Australia Construction Scaffolding Market Size, Share, Trends and Forecast by Type, Material, Application, End-User, and Region, 2025-2033

Australia Construction Scaffolding Market Overview:

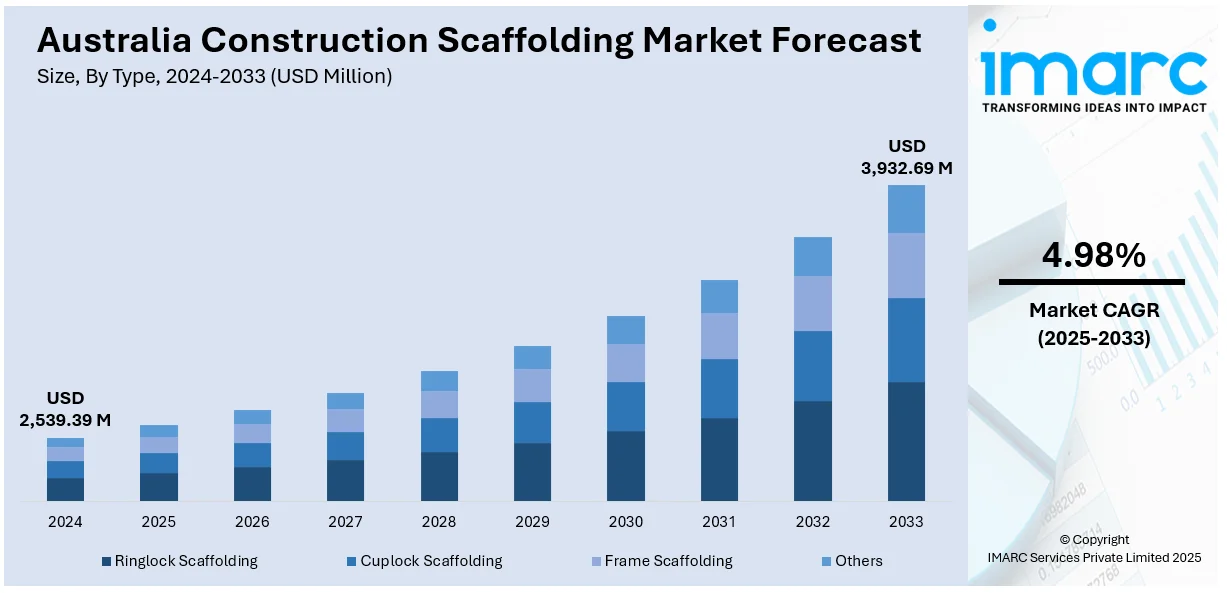

The Australia construction scaffolding market size reached USD 2,539.39 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,932.69 Million by 2033, exhibiting a growth rate (CAGR) of 4.98% during 2025-2033. The market is fueled by urbanization at a fast rate and rising infrastructure development, which demands safe and efficient access solutions. Stringent government safety requirements force the adoption of certified and quality scaffolding systems, which fuels market growth. Advances in technology like light-weight materials and module designs enhance assembly efficiency and worker protection. Moreover, increased construction activity, particularly in the commercial and residential industries, drives demand for robust and flexible scaffolding, further driving Australia construction scaffolding market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,539.39 Million |

| Market Forecast in 2033 | USD 3,932.69 Million |

| Market Growth Rate 2025-2033 | 4.98% |

Australia Construction Scaffolding Market Trends:

Growing Construction Industry

Australia's thriving construction industry is largely propelling the growth in the scaffolding market. Transport infrastructure building reached a record $51 billion during 2023–24, with $33 billion going towards roads and bridges and $16 billion to railways. This growth, combined with high-speed urbanization, commercial and residential builds, and government spending on infrastructure, is driving demand for secure and efficient scaffolding solutions. High-rise building further increases the demand for complex scaffolding systems that accommodate intricate structures. With increased construction activity, the demand for temporary support structures that ensure worker safety and project efficiency also increases. The growth in the industry is also driving innovation, with the use of modular, lightweight, and strong scaffolding materials that are specifically designed to meet diverse project demands. Therefore, the growing construction horizon is propelling the scaffolding industry by way of higher rentals, sales, and maintenance activities, further aiding the Australia construction scaffolding market growth.

To get more information on this market, Request Sample

Technological Advancements and Innovations

Technological advancements in scaffolding design and materials are a major market force in Australia. Lightweight aluminum scaffolding, modular systems, and rapid assembly components are advances that have increased efficiency and lowered labor costs on the construction site. Higher load-bearing and flexibility capabilities in advanced designs accommodate varied construction specifications, such as high-rise and complex infrastructure projects. Integration of advanced technologies such as digital tools like BIM (Building Information Modeling) facilitates planning scaffold installations more accurately, reducing downtime and risk. In addition, corrosion-resistant materials increase equipment durability, lowering maintenance costs. The innovations also improve working conditions since they facilitate stability and inspection more easily. With construction companies focusing on safety and speed, advanced scaffolding technologies boost market growth and competition differentiation.

Safety Regulations and Standards

Strict occupational health and safety regulations in Australia are a key driver of the scaffolding market, enforcing high standards to protect workers at height. SafeWork NSW’s 2024 “Scaff Safe in Construction” initiative revealed major compliance gaps—37% of sites had incomplete scaffold decks, 39% lacked proper handrails or mid-rails, and 27% lacked written confirmation of compliance from a qualified person. These findings highlight the need for certified, high-quality scaffolding systems that meet Australian standards. To reduce accidents and liabilities, construction companies are compelled to invest in equipment with greater stability, load capacity, and ease of assembly. Ongoing audits, inspections, and mandatory training further reinforce this demand, encouraging the professional and safe use of scaffolding. As safety awareness increases, so does the market need for compliant and reliable scaffolding solutions, fueling steady growth across rental, sales, and maintenance services.

Australia Construction Scaffolding Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, material, application, and end-user.

Type Insights:

- Ringlock Scaffolding

- Cuplock Scaffolding

- Frame Scaffolding

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes ringlock scaffolding, cuplock scaffolding, frame scaffolding, and others.

Material Insights:

- Steel

- Aluminum

- Wood

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes steel, aluminum, and wood.

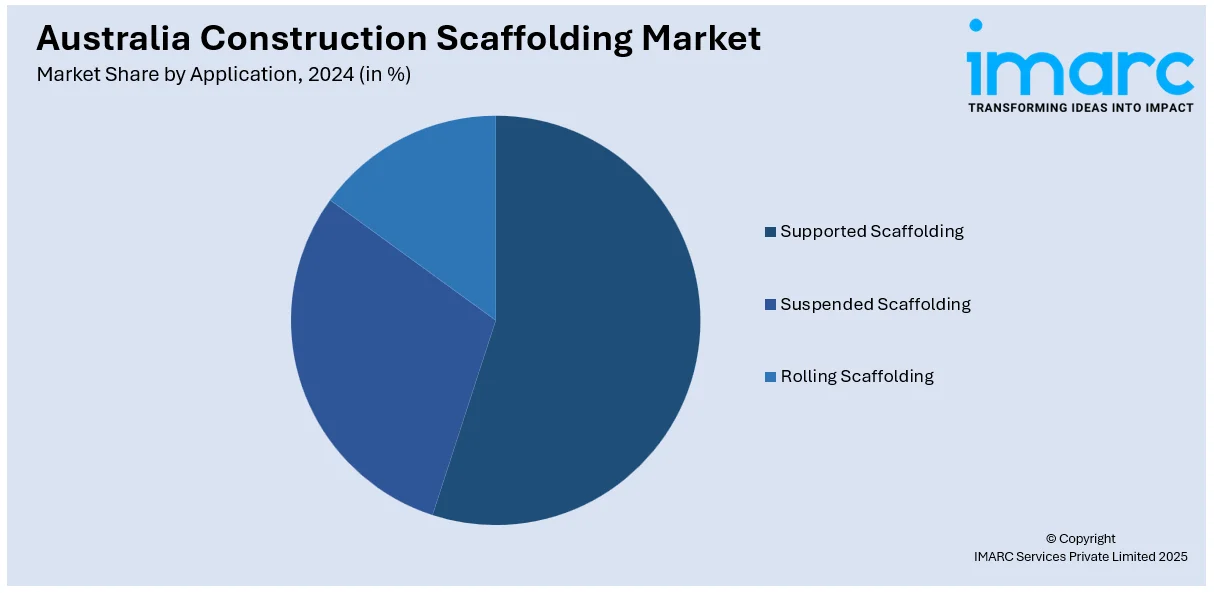

Application Insights:

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

The report has provided a detailed breakup and analysis of the market based on the application. This includes supported scaffolding, suspended scaffolding, and rolling scaffolding.

End-User Insights:

- Residential Building

- Commercial Building

- Industrial

- Oil and Gas Industry

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes residential building, commercial building, industrial, oil and gas industry, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Construction Scaffolding Market News:

- In January 2025, Alimak launched the updated STS 300 Scaffold Transportation System, now compatible with most ring lock scaffolds. Designed to boost productivity and safety, it allows two workers to install up to 300m² of scaffold per day. With a 300 kg payload, fast 17 m/min speed, and swivel-based loading, it streamlines vertical and horizontal transport. The STS 300 also features ergonomic design, ground-level loading, and is initially available in Europe.

- In October 2024, SafeWork NSW launched its “Scaff Safe 2024” blitz, targeting scaffold safety across construction sites, with a zero-tolerance approach to risks endangering workers’ lives. Falls from heights remain the top cause of fatalities, often due to unsafe, incomplete, or altered scaffolds. Inspectors will issue on-the-spot fines and ensure safety plans are in place. Newcastle leads in reducing scaffold-related incidents through stricter enforcement and safety awareness efforts.

Australia Construction Scaffolding Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ringlock Scaffolding, Cuplock Scaffolding, Frame Scaffolding, Others |

| Materials Covered | Steel, Aluminum, Wood |

| Applications Covered | Supported Scaffolding, Suspended Scaffolding, Rolling Scaffolding |

| End-Users Covered | Residential Building, Commercial Building, Industrial, Oil and Gas Industry, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia construction scaffolding market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia construction scaffolding market on the basis of type?

- What is the breakup of the Australia construction scaffolding market on the basis of material?

- What is the breakup of the Australia construction scaffolding market on the basis of application?

- What is the breakup of the Australia construction scaffolding market on the basis of end-user?

- What is the breakup of the Australia construction scaffolding market on the basis of region?

- What are the various stages in the value chain of the Australia construction scaffolding market?

- What are the key driving factors and challenges in the Australia construction scaffolding market?

- What is the structure of the Australia construction scaffolding market and who are the key players?

- What is the degree of competition in the Australia construction scaffolding market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia construction scaffolding market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia construction scaffolding market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia construction scaffolding industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)