Australia Cookware Market Size, Share, Trends and Forecast by Type, Product, Material, Application, Distribution Channel, and Region, 2025-2033

Australia Cookware Market Overview:

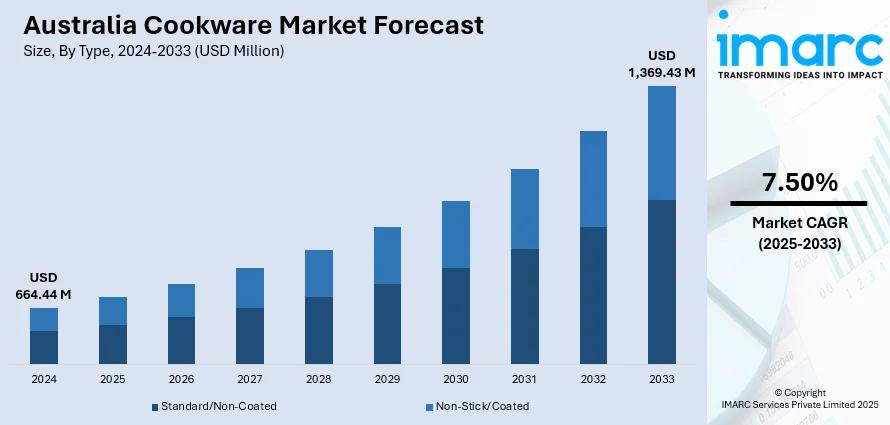

The Australia cookware market size reached USD 664.44 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,369.43 Million by 2033, exhibiting a growth rate (CAGR) of 7.50% during 2025-2033. The market is driven by rising interest in home cooking, and demand for premium, durable cookware. The increasing consumer preference for non-stick, eco-friendly, and induction-compatible options. Expanding online retail, cooking shows, and influencer trends further support market momentum, positively influencing the Australia cookware market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 664.44 Million |

| Market Forecast in 2033 | USD 1,369.43 Million |

| Market Growth Rate 2025-2033 | 7.50% |

Australia Cookware Market Trends:

Rising Interest in Home Cooking and Culinary Lifestyles

The Australians are turning to home cooking as both a need and a hobby, responding to the lifestyle trends, cost saving, and healthy eating. Preparing meals at home provides better control over the ingredients and portion sizes, aligning with wellness goals. Additionally, culinary experimentation has grown popular, with people trying global cuisines and advanced techniques. This shift has driven demand for diverse and high-quality cookware, such as woks, cast iron pans, and specialty baking tools. Cooking shows, YouTube tutorials, and social media influencers further fuel this interest by inspiring consumers to upgrade their kitchens. As a result, many households are investing in versatile, stylish, and performance-oriented cookware that supports both everyday meals and more elaborate cooking experiences.

To get more information on this market, Request Sample

Health and Sustainability Awareness

Health-conscious Australians are increasingly selective about the materials used in cookware, seeking products that are non-toxic, PFOA-free, and made from sustainable or recyclable materials. This trend aligns with growing national concerns about personal health and environmental impact. Consumers are turning to stainless steel, ceramic, and cast iron options, which are perceived as safer and more eco-friendly. At the same time, there's heightened demand for non-stick cookware that supports low-oil cooking. This preference is particularly intense among low and middle-income consumers who value a healthy lifestyle. That drive toward sustainability also cuts out people’s desire for more enduring products, and that translates to an increase in premium and durable cookware. Companies responding to them with greener packaging and eco-labels are building trust among consumers, thus dictating purchase choices within the market.

Growth of Online and Multi-channel Retailing

The expansion of e-commerce and multi-channel retail in Australia has made cookware more accessible than ever. Online platforms provide consumers with the ease of exploring, comparing, and buying from a wide variety of brands and price ranges. Features such as customer reviews, product videos, and influencer endorsements influence buying behavior and support brand discovery. Hybrid retail models, combining brick-and-mortar presence with strong online offerings, allow customers to research digitally and purchase in-store or vice versa. Flash sales, holiday promotions, and free shipping further stimulate demand. Retailers are also targeting niche segments with curated cookware collections and exclusive online launches. This digital shift enables even smaller or emerging cookware brands to compete effectively, fueling the Australia cookware market growth.

Australia Cookware Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, material, application, and distribution channel.

Type Insights:

- Standard/Non-Coated

- Non-Stick/Coated

- Teflon (PTFE) Coated

- Ceramic Coated

- Enamel Coated

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes standard/non-coated, and non-stick/coated (Teflon (PTFE) coated, ceramic coated, enamel coated, and others).

Product Insights:

- Pots and Pans

- Pressure Cooker

- Cooking Racks

- Cooking Tools

- Bakeware

- Microware Cookware

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes pots and pans, pressure cookers, cooking racks, cooking tools, bakeware, and microware cookware.

Material Insights:

- Stainless Steel

- Carbon Steel

- Cast Iron

- Aluminum

- Glass

- Stoneware

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes stainless steel, carbon steel, cast iron, aluminum, glass, stoneware, and others.

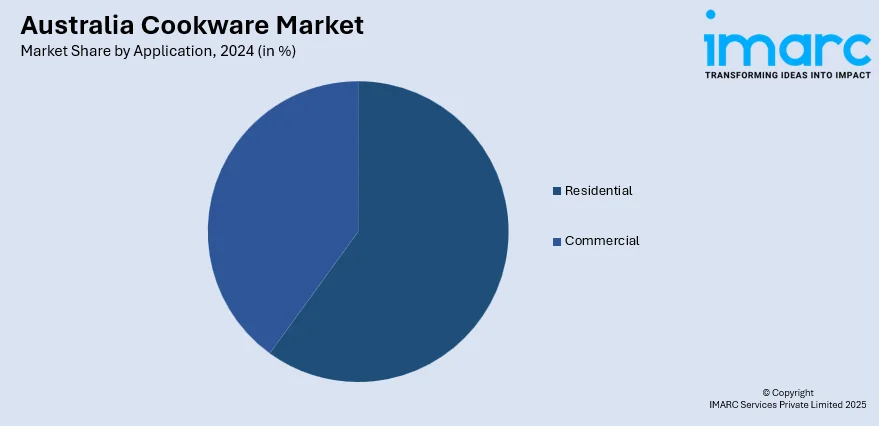

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Distribution Channel Insights:

- Supermarket/Hypermarket

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarket/hypermarket, specialty stores, online, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cookware Market News:

- In October 2023, American cookware manufacturer Our Place launched a line of environment-friendly and toxin-free cookware in the Australian market. The fundamental tenet of the business is around the notion that cooking at home can bring people together and strengthen bonds over meals. The company, which was founded by women and immigrants, claims to place a strong emphasis on inclusivity and cultural diversity.

Australia Cookware Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Products Covered | Pots And Pans, Pressure Cookers, Cooking Racks, Cooking Tools, Bakeware, Microware Cookware |

| Materials Covered | Stainless Steel, Carbon Steel, Cast Iron, Aluminum, Glass, Stoneware, Others |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Supermarket/Hypermarket, Specialty Stores, Online, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia cookware market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia cookware market on the basis of type?

- What is the breakup of the Australia cookware market on the basis of product?

- What is the breakup of the Australia cookware market on the basis of material?

- What is the breakup of the Australia cookware market on the basis of application?

- What is the breakup of the Australia cookware market on the basis of distribution channel?

- What is the breakup of the Australia cookware market on the basis of region?

- What are the various stages in the value chain of the Australia cookware market?

- What are the key driving factors and challenges in the Australia cookware market?

- What is the structure of the Australia cookware market and who are the key players?

- What is the degree of competition in the Australia cookware market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cookware market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cookware market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cookware industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)