Australia Cosmetic Surgery Market Size, Share, Trends and Forecast by Procedure, Gender, Age Group, End User, and Region, 2026-2034

Australia Cosmetic Surgery Market Overview:

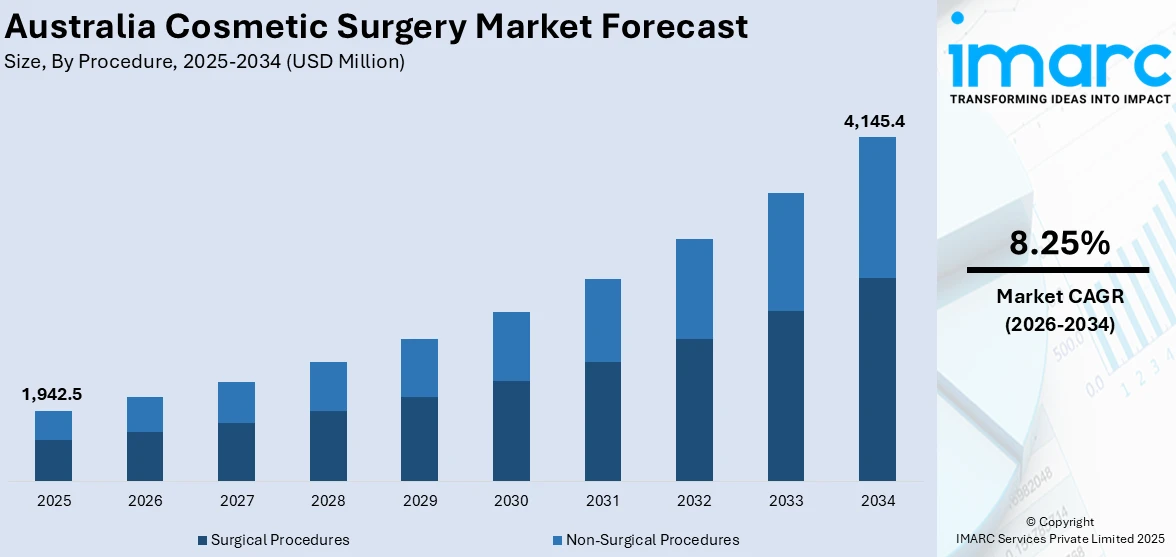

The Australia cosmetic surgery market size reached USD 1,942.5 Million in 2025. Looking forward, the market is expected to reach USD 4,145.4 Million by 2034, exhibiting a growth rate (CAGR) of 8.25% during 2026-2034. The market is experiencing significant growth due to the rising social media influence, increasing acceptance among younger demographics, technological advancements in non-invasive procedures, and a growing aging population seeking aesthetic enhancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,942.5 Million |

| Market Forecast in 2034 | USD 4,145.4 Million |

| Market Growth Rate 2026-2034 | 8.25% |

Key Trends of Australia Cosmetic Surgery Market:

Social Media Influence and Digital Beauty Standards

Social media platforms like Instagram, TikTok, and Snapchat have significantly shaped how Australians, particularly younger generations, view beauty. The constant exposure to edited, filtered, and curated images fosters unrealistic beauty ideals, increasing dissatisfaction with one's natural appearance. Because influencers and celebrities constantly promote aesthetic enhancements, the public sees these procedures as becoming more common while making them appear achievable. Additionally, the rise of dating apps and the gig economy has made appearance a social and professional asset, further encouraging individuals to invest in their looks, thus driving the Australia cosmetic surgery market demand. As online image and identity grow in importance, aesthetic treatments have become a tool for self-presentation and confidence. This digital environment continues to be a powerful driver of cosmetic procedure demand.

To get more information on this market, Request Sample

Innovation in Non-Invasive and Minimally Invasive Treatments

The cosmetic surgery market in Australia has experienced a revolution through developments in aesthetic technology, especially in procedures that minimize invasiveness. Different aesthetic treatments, including dermal fillers along with laser resurfacing and chemical peels, and cryolipolysis (fat freezing), are available in wider markets to meet consumer demands for small but fast results with few risks and short recovery requirements. These procedures are especially attractive to working professionals and busy individuals who cannot afford extended recovery periods. The growing trust in safe, medically approved devices and products, along with clinics offering specialized treatments, has made these solutions more mainstream. Many Australians are now prioritizing "natural enhancement" over dramatic surgical results, and non-invasive options meet this demand perfectly, which is creating a positive Australia cosmetic surgery market outlook. With ongoing innovation and competitive pricing, these treatments continue to expand their reach and accessibility across all age groups, making them a major growth engine for the cosmetic industry.

Aging Population and Anti-Aging Demand

Australia has a steadily aging population, with a significant portion entering their 40s, 50s, and beyond—prime ages for age-related cosmetic concerns. As people age, issues like wrinkles, sagging skin, volume loss, and pigmentation become more prominent, leading many to seek aesthetic treatments. However, rather than opting for drastic surgical facelifts, many Australians prefer less invasive options like Botox, fillers, and skin-tightening technologies that offer rejuvenation without a drastic change or long recovery. Older Australians are also becoming more financially secure, health-conscious, and proactive in maintaining their appearance. For many, looking youthful is linked to remaining competitive in the workplace or maintaining confidence in personal relationships. This mature demographic values subtle, safe, and effective treatments, and they tend to be loyal, long-term clients for aesthetic clinics. Their growing demand for anti-aging solutions significantly contributes to the Australian cosmetic surgery market share.

Growth Drivers of Australia Cosmetic Surgery Market:

Impact of Weight-Loss Medications and Post-Treatment Aesthetic Needs

The widespread use of GLP-1 medications such as Ozempic and Wegovy for rapid weight loss has significantly contributed to the demand for cosmetic surgery in Australia. While these drugs help patients reduce body fat, they often result in excess skin and facial volume loss, particularly among middle-aged and older users. This outcome has led to a rise in procedures like facelifts, neck lifts, tummy tucks, and body contouring to restore tightness and shape. Clinics have responded by offering customized post-weight-loss treatment packages. As more Australians adopt medical weight-loss solutions, the need for complementary cosmetic procedures is expected to rise, positioning this trend as a major driver of the Australia cosmetic surgery market.

Rise in Medical Tourism Within and Into Australia

Australia’s reputation for high-quality healthcare, skilled cosmetic surgeons, and modern clinic infrastructure has made it a growing hub for cosmetic medical tourism. Patients from neighboring countries and domestic travelers from regional areas often visit metropolitan clinics known for advanced surgical techniques and international accreditations. Compared to countries like the U.S. or the U.K., Australia offers competitively priced services with comparable safety and care standards. Additionally, state-of-the-art recovery accommodations and bundled service packages enhance the patient experience. This intra- and inter-regional medical tourism trend contributes to the consistent growth of the market, especially in urban hubs like Sydney, Melbourne, and Brisbane. As global mobility increases post-pandemic, Australia’s cosmetic surgery sector is set to benefit further.

Improved Regulatory Oversight and Professional Accreditation

The Australian government and medical boards have introduced stricter regulations and professional standards to improve safety in the cosmetic surgery sector. According to the Australia cosmetic surgery market analysis, requirements such as surgeon accreditation, clinic licensing, and transparent patient consent processes have enhanced public trust in aesthetic procedures. This regulatory clarity distinguishes reputable practitioners from unqualified operators, improving consumer confidence and willingness to undergo procedures. Education campaigns and legal changes, like the recent crackdown on misleading advertising and inappropriate marketing tactics, have also ensured that patients receive accurate information. As safety becomes a stronger determinant of choice, patients are more likely to seek cosmetic surgery from certified professionals, thereby contributing to the market’s long-term growth and structural maturity.

Australia Cosmetic Surgery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on procedure, gender, age group, and end user.

Procedure Insights:

- Surgical Procedures

- Breast Augmentation

- Liposuction

- Eyelid Surgery

- Abdominoplasty

- Rhinoplasty

- Others

- Non-Surgical Procedures

- Botulinum Toxin

- Hyaluronic Acid

- Hair Removal

- Nonsurgical Fat Reduction

- Photo Rejuvenation

- Others

The report has provided a detailed breakup and analysis of the market based on the procedure. This includes surgical procedures (breast augmentation, liposuction, eyelid surgery, abdominoplasty, rhinoplasty, and others) and non-surgical procedures (botulinum toxin, hyaluronic acid, hair removal, nonsurgical fat reduction, photo rejuvenation, and others).

Gender Insights:

- Female

- Male

A detailed breakup and analysis of the market based on gender have also been provided in the report. This includes female and male.

Age Group Insights:

- 13 to 29

- 30 to 54

- 55 and Above

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 13 to 29, 30 to 54, and 55 and above.

End User Insights:

Access the comprehensive market breakdown Request Sample

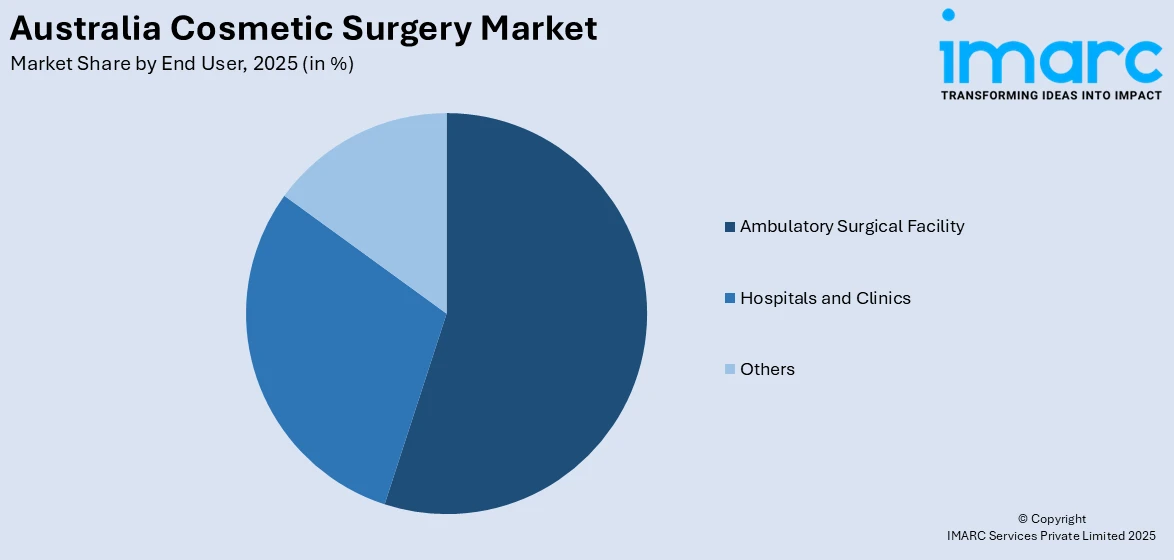

- Ambulatory Surgical Facility

- Hospitals and Clinics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes ambulatory surgical facility, hospitals and clinics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cosmetic Surgery Market News:

- In March 2025, Hydrinity revealed its collaboration with Device Consulting to introduce its US-based skincare brand to the Australian market. Under this partnership, Device Consulting will distribute Hydrinity’s product line through a network of plastic surgeons, dermatologists, and general practitioners who focus on cosmetic treatments and aesthetic care.

- In February 2024, practitioners claim that a sudden emphasis on advertising regulations pertaining to cosmetic injectables essentially silences their companies and restricts the amount of information potential patients can learn about their treatment. A letter of clarification detailing changes to the way services are advertised was delivered to the cosmetic beauty industry by the Therapeutic Goods Administration (TGA) in January.

- In December 2023, the Australian Commission on Safety and Quality in Health Care, represented by the Hon Mark Butler MP, Minister for Health and Aged Care, introduced the Cosmetic Surgery Standards to strengthen public safety. These standards are fully developed and available for immediate implementation.

- In April 2023, the Medical Board of Australia (MBA) and the Australian Health Practitioner Regulation Agency (Ahpra) released new practice standards today, and doctors who undertake cosmetic surgery have three months to update their advertising to comply with the stricter regulations.

Australia Cosmetic Surgery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Procedures Covered |

|

| Gender Covered | Female, Male |

| Age Groups Covered | 13 to 29, 30 to 54, 55 and Above |

| End Users Covered | Ambulatory Surgical Facility, Hospitals and Clinics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cosmetic surgery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cosmetic surgery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cosmetic surgery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cosmetic surgery market in Australia was valued at USD 1,942.5 Million in 2025.

The Australia cosmetic surgery market is projected to exhibit a CAGR of 8.25% during 2026-2034.

The Australia cosmetic surgery market is projected to reach a value of USD 4,145.4 Million by 2034.

Growth in Australia’s cosmetic surgery market is driven by rising demand for post-weight-loss procedures due to GLP-1 drugs, increasing popularity of minimally invasive treatments like Botox and fillers, and improved regulatory standards that boost public confidence and expand access to safe, high-quality aesthetic care.

Key trends in the Australia cosmetic surgery market include a growing preference for natural-looking results, rising demand for skin-tightening procedures post-weight loss, and increased popularity of non-surgical “tweakments” like fillers and Botox. These trends reflect evolving beauty standards, health-driven motivations, and the desire for low-downtime aesthetic solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)