Australia Cosmetics and Personal Care Market Report by Product Type (Personal Care Products, Cosmetics/Make-up Products), Distribution Channel (Specialist Stores, Supermarkets/Hypermarkets, Convenience Stores, Online Retail Channels, and Others), and Region 2025-2033

Australia Cosmetics and Personal Care Market Size and Share:

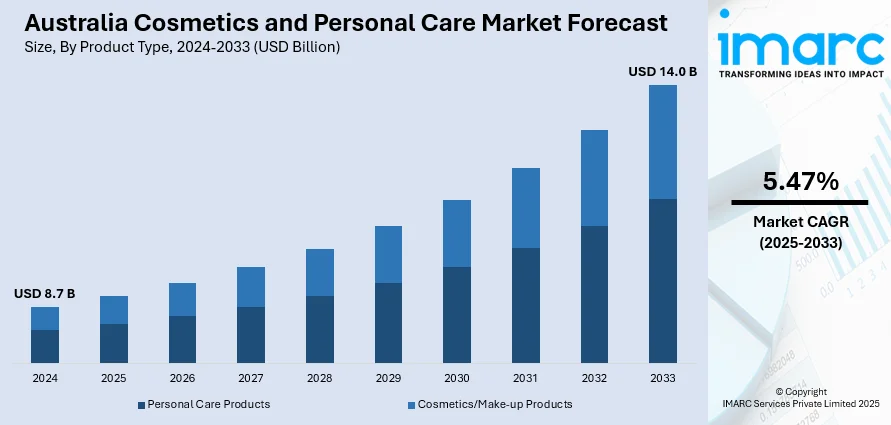

The Australia cosmetics and personal care market size reached USD 8.7 Billion in 2024. Looking forward, the market is expected to reach USD 14.0 Billion by 2033, exhibiting a growth rate (CAGR) of 5.47% during 2025-2033. The market is experiencing steady growth driven by increasing consumer awareness regarding ingredient safety and sustainability, considerable growth in e-commerce and digital channels enhancing shopping convenience, and the rising demand for men’s grooming products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.7 Billion |

| Market Forecast in 2033 | USD 14.0 Billion |

| Market Growth Rate 2025-2033 | 5.47% |

Key Trends of Australia Cosmetics and Personal Care Market:

Increasing consumer awareness about ingredients and sustainability

The Australian cosmetics and personal care market is driven by heightened consumer awareness regarding product ingredients and sustainability efforts. Consumers are increasingly concerned about the potential health risks of synthetic chemicals, leading to greater demand for ethical, natural, organic, and cruelty-free products. This shift in consumer preference compels companies to reformulate their offerings, ensuring they exclude harmful substances and adopt environmentally responsible practices, reflecting the growing priority on sustainability and health-conscious choices. Apart from sustainability issues, the escalating consumer inclination toward environmental responsibility through recyclable packaging, smaller carbon footprints, or raw materials sourced ethically.

To get more information of this market, Request Sample

Expansion of e-commerce and digital channels

A considerable rise in e-commerce and digital channels is significantly augmenting the market. This can be supported by the development of online shopping platforms and digital marketing strategies encouraging consumers of beauty products purchase through these digital channels for convenience, wider variety, and customized shopping experiences. The COVID-19 pandemic has accelerated this transition, with technological innovations such as augmented reality for virtual try-ons and personalized recommendations enhancing online shopping. Consequently, traditional retailers have embraced omnichannel strategies, blending online and offline experiences to meet changing consumer expectations. This trend is fostering market expansion at a time when e-commerce and digital platforms are intensifying competition, pushing companies to continuously innovate their business strategies, and further contributing to the growth of Australia cosmetics and personal care market share growth.

Rising demand for men’s grooming products

Increasing preference for personal grooming by men is becoming a key driver in the market. The traditionally female-consumer-dominated market has been witnessing a shift toward an increase in male grooming products. Shifting social norms and the increasing emphasis on appearance and self-care are fueling demand for male grooming products. In response, brands are expanding their portfolios to include a wider range of offerings, such as skincare, haircare, and shaving products, tailored specifically for male consumers. Additionally, the increasing importance of social media and digital content further increases the visibility of trends in male grooming and affects consumer preferences. Companies are responding by actively innovating and expanding their product lines to meet the evolving demands of male consumers. As a result, the male grooming segment is emerging as one of the most dynamic and competitive areas in the market.

Growth Drivers of Australia Cosmetics and Personal Care Market:

Tourism and International Promotion of Australian Beauty

According to the Australia cosmetics and personal care market analysis, tourism makes a special contribution to growth in the market, especially by exposing local beauty products internationally. Foreign visitors, particularly from Europe and Asia commonly look for Australian-produced skincare and wellness products as souvenirs or presents, increasing retail sales in urban centers and tourist destinations. The pure, green perception of Australian attractiveness combined with the high standard of manufacturing in Australia appeals significantly to tourists. Consequently, numerous Australian brands have developed travel-sized product lines and constructed marketing campaigns aimed at inbound tourists. The visibility of the products among foreign tourists has also stimulated organic demand abroad, generating export expansion and international brand presence. With Australia's beauty and tourism sectors in conjunction, there is a constant feedback loop that facilitates local innovation, raises brand stature, and generates new market possibilities across domestic borders.

Wellness Lifestyle and Skin Health Focus

The increasing incorporation of wellness and self-care into daily habits has had a profound impact on the path of Australia's personal care and cosmetics industry. Skincare, grooming, and cosmetic products are increasingly being seen as integral parts of overall health and wellness by consumers. This trend is particularly evident in Australia, where an outdoor lifestyle coupled with a high UV rating has turned skin protection and rejuvenating care into a top concern. Multifunctional benefits are popular in products—like sunscreens that offer anti-aging properties or moisturizers that contain vitamins and probiotics—because consumers value skin health as much as aesthetics. "Skinimalism" is also in high demand, compelling people to simplify their routine with fewer, better products that help maintain the natural barrier function of the skin. This trend has contributed to the success of local dermo cosmetic brands and pharmacies that concentrate on evidence-based, mild formulations. As health and wellness converge with beauty, the Australia cosmetics and personal care market demand is also well-poised to expand, particularly among consumers who seek safe, efficient, and health-oriented personal care products.

Growing demand for Ethical and Cruelty-Free Products

A significant and emerging driver in the cosmetics and personal care market in Australia is consumer demand for products that are both ethically made and cruelty-free. Australian consumers are more and more seeking to purchase from brands that reflect values including animal welfare, fair trade, and sustainable production. This is especially clear through the popularity of "cruelty-free," "vegan," and "carbon-neutral" markings on product packaging. Consumers, particularly younger consumers, proactively seek brand ethicality and decide to purchase based on openness and responsibility. Australia's robust regulatory environment and educated public debate have motivated numerous local businesses to promote ethical sourcing, compostable packaging, and green supply chains as standard business practices. Social media campaigning and beauty influencers in Australia also frequently highlight ethically aware brands, bringing such preferences into the mainstream. With growing awareness, brands that incorporate social and environmental responsibility into their DNA are being preferred more, and it is these brands that gain customer loyalty and sustainable growth in the personal care and cosmetic industry.

Australia Cosmetics and Personal Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Personal Care Products

- Hair Care Products

- Shampoo

- Conditioner

- Others

- Skin Care Products

- Facial Care Products

- Body Care Products

- Lip Care Products

- Bath and Shower

- Shower Gels

- Soaps

- Others

- Oral Care

- Toothbrushes

- Toothpaste

- Mouthwashes and Rinses

- Others

- Men's Grooming Products

- Deodorants and Antiperspirants

- Hair Care Products

- Cosmetics/Make-up Products

- Facial Cosmetics

- Eye Cosmetic Products

- Lip and Nail Make-up Products

- Hair Styling and Coloring Products

The report has provided a detailed breakup and analysis of the market based on the product type. This includes personal care products [(hair care products {shampoo, conditioner, others}, skin care products {facial care products, body care products, lip care products}, bath and shower {shower gels, soaps, others}, oral care {toothbrushes, toothpaste, mouthwashes and rinses, others}, men's grooming products and deodorants and antiperspirants)] and cosmetics/make-up products [facial cosmetics, eye cosmetic products, lip and nail make-up products, and hair styling and coloring products].

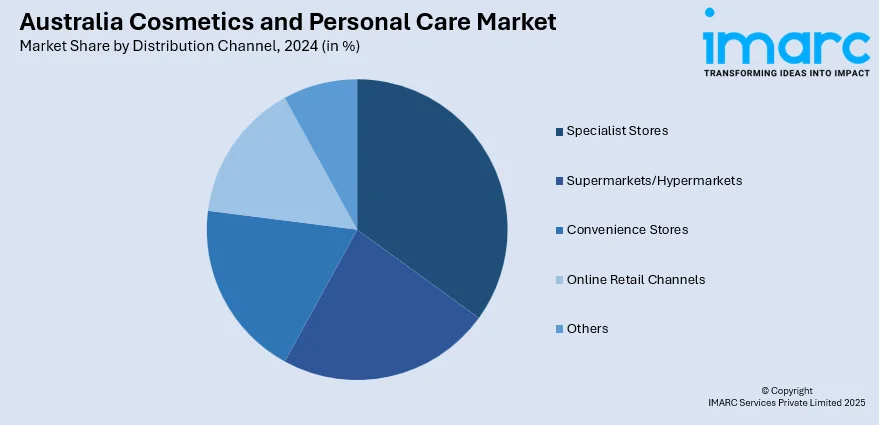

Distribution Channel Insights:

- Specialist Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail Channels

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialist stores, supermarkets/hypermarkets, convenience stores, online retail channels and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Aesop

- Alpha-H Skincare Australia

- Edible Beauty Australia

- Estée Lauder Inc

- INIKA Organic Australia

- MAAEMO Organic

- MECCA Brands

- Natio

- O&M Australia

- Sodashi Pty Ltd

- The Body Shop International Limited

Australia Cosmetics and Personal Care Market News:

- March 25, 2024: Medipledge, a premium skincare brand, has launched in Australia with a focus on post-cosmetic treatment skin barrier restoration, particularly for Asian type IV skin. The brand's products are backed by advanced formulas and extensive clinical testing, utilizing ingredients such as PDRN, GP4G, and Centella asiatica extract. Several clinical trials demonstrate the effectiveness of their products, positioning Medipledge as a specialized brand in post-cosmetic treatment skincare.

- In March 2025, Hydrinity revealed a collaboration with Device Consulting, allowing the US skin care brand to enter the Australian market. Device Consulting intends to market the line through plastic surgeons, dermatologists, and general practitioners focused on cosmetic treatments.

- In June 2025, Kagome Australia began providing cold-pressed tomato seed oil to the cosmetics sector, signifying a novel application for by-products from its tomato processing activities. Kagome, located in Echuca, Victoria, is currently manufacturing tomato seed oil for application in cosmetic items including moisturizers, facial scrubs, and sunscreen. The oil is derived from tomato seeds that remain after the company’s extensive processing activities, which process more than 200,000 tons of tomatoes annually. Kagome has implemented powder drying and cold-pressing technologies to maximize recovery from its by-product stream, with intentions to process all tomato waste by 2027. The company is manufacturing tomato skin powder for incorporation in pet food.

- In February 2025, the Australian skincare and cosmetics brand MCoBeauty, known for its ‘dupe’ culture, declared that it is now completely owned by billionaire Dennis Bastas’ DBG Group—valuing the brand at US$1 Billion, as reported. This comes after DBG's initial 50 percent ownership in 2022 and highlights MCoBeauty's swift growth in both Australia and the US.

Australia Cosmetics and Personal Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Specialist Stores, Supermarkets/Hypermarkets, Convenience Stores, Online Retail Channels, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Aesop, Alpha-H Skincare Australia, Edible Beauty Australia, Estée Lauder Inc, INIKA Organic Australia, MAAEMO Organic, MECCA Brands, Natio, O&M Australia, Sodashi Pty Ltd, The Body Shop International Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cosmetics and personal care market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cosmetics and personal care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cosmetics and personal care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia cosmetics and personal care market was valued at USD 8.7 Billion in 2024.

The Australia cosmetics and personal care market is projected to exhibit a CAGR of 5.47% during 2025-2033.

The Australia cosmetics and personal care market is expected to reach a value of USD 14.0 Billion by 2033.

The Australia cosmetics and personal care market is driven by demand for natural ingredients, wellness-focused routines, and ethically produced products. Consumers prefer local brands using native botanicals and cruelty-free formulations. Aling with this, a strong focus on skin health, sun protection, and sustainable packaging further fuels market growth, especially among environmentally conscious shoppers.

The Australia cosmetics and personal care market trends highlight a surge in native botanical ingredients, minimalistic skincare routines, and multifunctional wellness products. Brands are also embracing eco-friendly packaging and waterless formulations while tapping into digital personalization tools like virtual skincare consultations. The popularity of clean beauty and ethically sourced lines continues to expand the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)