Australia Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033

Australia Cryptocurrency Market Size and Share:

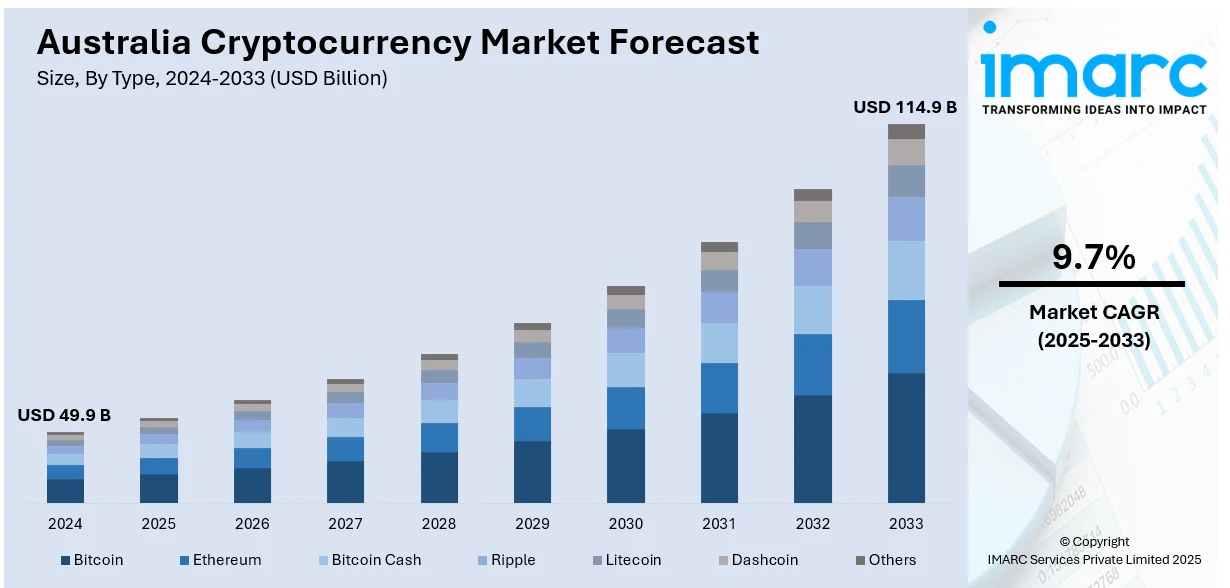

The Australia cryptocurrency market size reached USD 49.9 Billion in 2024. The market is projected to reach USD 114.9 Billion by 2033, exhibiting a growth rate (CAGR) of 9.7% during 2025-2033. Regulatory clarity, growing institutional adoption, innovation in blockchain technology, retail investor interest, and increasing acceptance of digital assets for payments are some of the factors propelling the growth of the market. Additionally, government policies, economic conditions, and global market trends significantly impact market dynamics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 49.9 Billion |

| Market Forecast in 2033 | USD 114.9 Billion |

| Market Growth Rate 2025-2033 | 9.7% |

Key Trends of Australia Cryptocurrency Market:

Growth of Cryptocurrency Platforms

The Australian cryptocurrency market is seeing increased interest from international exchanges expanding into the region. With a focus on regulatory compliance, these platforms are offering services such as spot trading to cater to the growing demand from local crypto users. The introduction of new platforms highlights the increasing integration of digital currencies into Australia's financial landscape. These exchanges are working to meet local regulations, ensuring secure and transparent trading experiences. As the market matures, additional services are expected to be introduced, further supporting the needs of Australia's crypto-savvy audience and driving continued growth in the sector. The entry of global players signals a promising future for the Australian cryptocurrency industry. For example, WhiteBIT, Europe's largest cryptocurrency exchange, has expanded into Australia, launching its platform in December 2024. The exchange is registered with AUSTRAC as a Digital Currency Exchange Provider and Independent Remitter Dealer. WhiteBIT aims to engage Australia's crypto-savvy audience, offering spot trading initially, with plans to introduce additional services compliant with local regulations.

To get more information on this market, Request Sample

Enhanced Tax Transparency

Governments in Australia are increasingly focusing on improving tax transparency in the cryptocurrency market. New measures are being introduced that require crypto asset intermediaries to report transactions to national tax authorities. This data will then be shared internationally, supporting global efforts to combat tax evasion and avoidance. By adopting international reporting frameworks, countries aim to strengthen financial transparency and align with global standards. These developments are expected to improve compliance within the cryptocurrency sector and ensure more accountability as regulators seek to integrate digital currencies into broader financial reporting systems. As the crypto market continues to grow, such initiatives are becoming essential in fostering trust and maintaining fair practices across borders. For instance, in November 2024, the Australian government introduced a consultation on enhancing tax transparency for cryptocurrency transactions. This follows the adoption of the OECD’s Crypto Asset Reporting Framework (CARF), which aims to combat tax evasion and avoidance. Crypto asset intermediaries in Australia would be required to report transactions to the Australian Taxation Office (ATO), which would share this data globally. The move supports international tax transparency and strengthens Australia’s commitment to global financial reporting standards.

Blockchain Innovations

Blockchain technology advancements are playing a pivotal role in the growth of the Australia cryptocurrency market. Innovations in blockchain are improving security through enhanced cryptographic techniques are making transactions more secure and transparent. Additionally, scalability solutions are allowing blockchain networks to handle a higher volume of transactions addressing previous limitations. These advancements are expanding the use cases for cryptocurrencies across various sectors including finance, supply chain, and healthcare. As these innovations continue to evolve, they contribute to the increasing adoption of cryptocurrency, thus fueling the Australia cryptocurrency market share and positioning it as a key player in the global crypto ecosystem.

Growth Drivers of Australia Cryptocurrency Market:

Increased Consumer Awareness and Adoption

The rising awareness of cryptocurrency among consumers is a major driver of the Australia cryptocurrency market. As more Australians become familiar with the benefits of digital currencies such as fast transactions, low fees, and decentralized finance adoption is rapidly increasing. Cryptocurrency exchanges and wallet providers are offering user-friendly platforms making it easier for people to buy, sell, and store digital assets. In addition to this, rising education through mass media and financial institutions about digital currencies further accelerates consumer interest driving market growth in Australia.

Innovative Digital Currency Use Cases

The expansion of uses of digital currencies in various sectors is the main growth driver of the Australian cryptocurrency market. As new applications evolve in areas like healthcare, supply chain, and gaming, digital currencies play more critical roles in safe data storage, transactions, and asset tracking. As businesses recognize the ability of digital currencies to make processes more efficient, cheaper, and transparent, the use of cryptocurrencies related to such applications is increasing. This innovation is contributing positively to the increasing Australia cryptocurrency market demand. Additionally, businesses are incorporating cryptocurrencies to make processes efficient, minimize fraud, and build more customer confidence. The use of digital currencies in entertainment and gaming is also growing, enabling quicker, borderless transactions. With more industries seeing the potential in digital currencies Australia's cryptocurrency market is ready for sustained growth, receiving varied investments and driving innovation.

Mainstream Integration and Acceptance

The increasing popularity of cryptocurrency among large companies and Australian financial institutions is a critical market driver. Some of the top Australian retailers and service providers have now started accepting digital currencies for payments, and consumers can now use cryptocurrencies for making day-to-day transactions. Also, the entry of established players in the crypto market, like banks providing crypto exchange services or crypto investment products, has greatly enhanced the credibility of cryptocurrencies. As more companies bring digital assets into their business models, the Australia cryptocurrency market continues to grow and gain strength, fueling greater mainstream adoption. As per the Australia cryptocurrency market analysis, this increasing mainstream acceptance will continue to grow as more businesses and financial institutions adopt digital currencies, contributing to further growth in the market and improving the sector's stability and legitimacy in the future years.

Australia Cryptocurrency Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, component, process, and application.

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others.

Component Insights:

- Hardware

- Software

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware and software.

Process Insights:

- Mining

- Transaction

The report has provided a detailed breakup and analysis of the market based on the process. This includes mining and transaction.

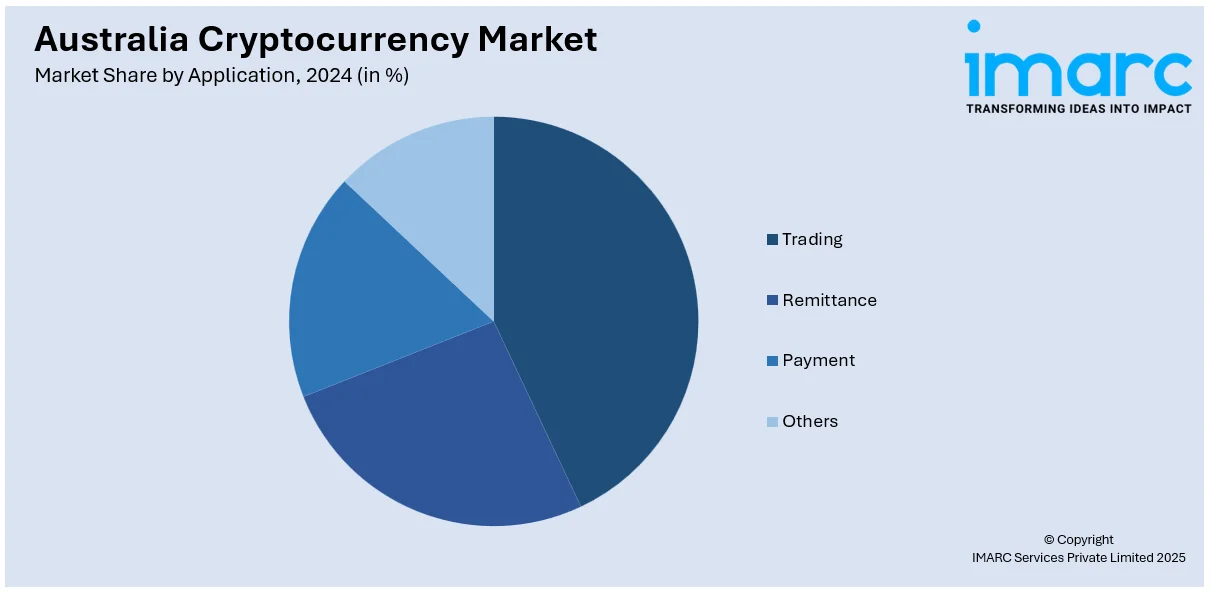

Application Insights:

- Trading

- Remittance

- Payment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes trading, remittance, payment, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cryptocurrency Market News:

- In December 2024, OKX launched its "Summer of Crypto" campaign in Australia, offering users a chance to earn USD 20 in Bitcoin after trading USD 20. The promotion targets Australian crypto traders and aims to increase engagement with OKX’s platform. This initiative is designed to attract both new and existing users, promoting more participation in crypto trading and investment. The exchange provides a wide range of crypto services while ensuring compliance with local regulations.

- In September 2024, the Reserve Bank of Australia and Treasury released a joint report on central bank digital currency (CBDC), outlining a three-year roadmap for future work on digital money in Australia. The report also highlights the potential benefits of wholesale CBDC for enhancing financial market efficiency, with Project Acacia set to explore tokenization and new settlement infrastructure.

Australia Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cryptocurrency market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cryptocurrency market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cryptocurrency industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cryptocurrency market in the Australia was valued at USD 49.9 Billion in 2024.

The Australia cryptocurrency market is projected to exhibit a compound annual growth rate (CAGR) of 9.7% during 2025-2033.

The Australia cryptocurrency market is expected to reach a value of USD 114.9 Billion by 2033.

Key trends in the Australia cryptocurrency market include the growth of cryptocurrency platforms, enhanced tax transparency with new reporting measures, and innovations in blockchain technology, which improve security, scalability, and broaden cryptocurrency use cases across industries like finance and healthcare.

Growth drivers of the Australia cryptocurrency market include increased consumer awareness, the rise of innovative digital currency applications in various sectors, and the mainstream integration of cryptocurrencies by businesses and financial institutions, enhancing adoption and credibility in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)