Australia Customer Data Platform Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Application, Vertical, and Region, 2025-2033

Australia Customer Data Platform Market Overview:

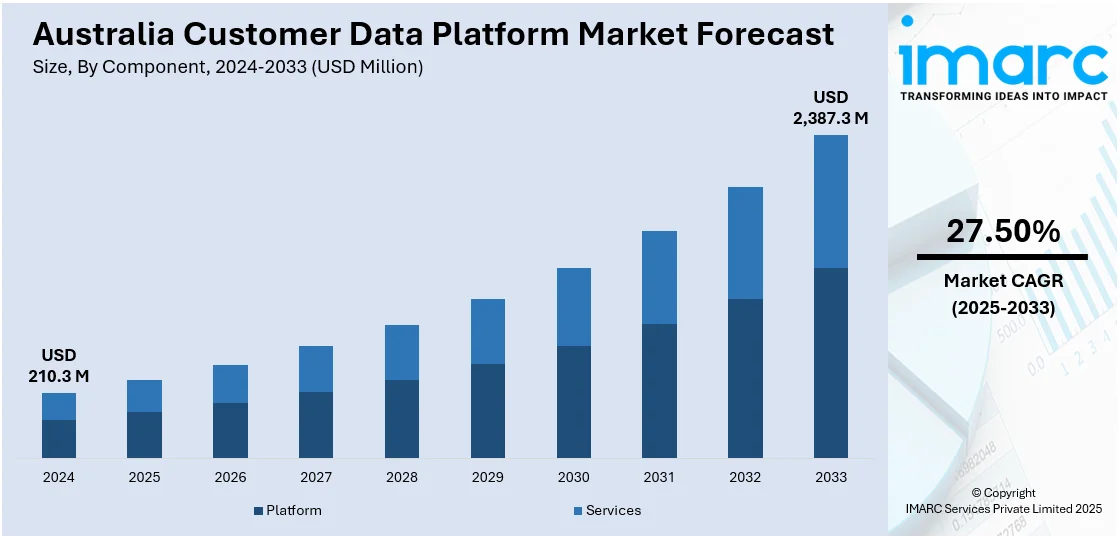

The Australia customer data platform market size reached USD 210.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,387.3 Million by 2033, exhibiting a growth rate (CAGR) of 27.50% during 2025-2033. The rising digital adoption across sectors, growing demand for personalized customer experiences, increased investments in AI-driven marketing tools, and stringent data privacy regulations are driving the adoption of customer data platforms in Australia, as businesses seek centralized, real-time insights to improve targeting, retention, and compliance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 210.3 Million |

| Market Forecast in 2033 | USD 2,387.3 Million |

| Market Growth Rate 2025-2033 | 27.50% |

Australia Customer Data Platform Market Trends:

Growing Demand for Personalized Customer Experiences

Personalization is a strategic priority for Australian brands seeking to differentiate themselves in saturated markets and improve conversion rates across digital channels. Customer data platforms play a central role in this effort by enabling the delivery of individualized content, offers, and services based on real-time behavioral insights. Businesses are increasingly utilizing CDP to integrate online and offline data sources, which is positively impacting Australia customer data platform market outlook. CDP integrates browsing behavior, purchase history, and customer support records, into a unified customer profile. This consolidation enables hyper-personalized engagement across various touchpoints such as websites, mobile applications, email campaigns, call centers, and physical retail environments. According to an industry report, 66% of Australian consumers indicated they would stop engaging with a brand if their experience lacked personalization, while 88% expressed loyalty to brands that consistently deliver personalized interactions. These expectations are further compelling businesses to invest in CDPs that can operationalize real-time insights and automate tailored messaging at scale, which is augmenting Australia customer data platform market share. Moreover, CDPs enable brands to respond quickly to changing preferences, adapt messaging based on contextual triggers, and ensure consistency across channels. This is resulting in an increased platform adoption among marketing and customer experience teams that are under pressure to demonstrate measurable returns on personalization initiatives.

To get more information on this market, Request Sample

Rising Digital Adoption Across Sectors

Australian enterprises across industries, ranging from retail and banking to healthcare and telecommunications, are accelerating digital transformation initiatives, leading to the widespread adoption of customer data platforms. This trend is driven by an increasing reliance on digital channels for customer acquisition, engagement, and retention. According to industry reports, nearly 17.08 Million consumers in Australia used online purchasing platforms monthly in 2024, and these e-commerce consumers make up about 63.94% of the country’s 26.714 million population. The surge in e-commerce usage, coupled with the growing prevalence of mobile applications and integrated omnichannel experiences, has significantly increased the volume and complexity of customer data collected by businesses. CDPs are being deployed to manage this influx of data by consolidating fragmented sources and enabling the creation of unified customer profiles. This shift is also propelled by heightened competition in digital services and a growing emphasis on performance metrics such as lifetime value, churn rates, and engagement scores. As a result, CDPs are becoming core infrastructure components in digital maturity roadmaps. Additionally, government-backed initiatives promoting digital innovation and funding for tech adoption are encouraging mid-sized firms and public sector organizations to invest in scalable CDP solutions. The utility of CDPs in achieving both short-term campaign goals and long-term digital transformation outcomes is a key driver of Australia customer data platform market growth.

Australia Customer Data Platform Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, application, and vertical.

Component Insights:

- Platform

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes platform and services.

Deployment Mode Insights:

- Cloud -based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium-sized enterprises (SMEs).

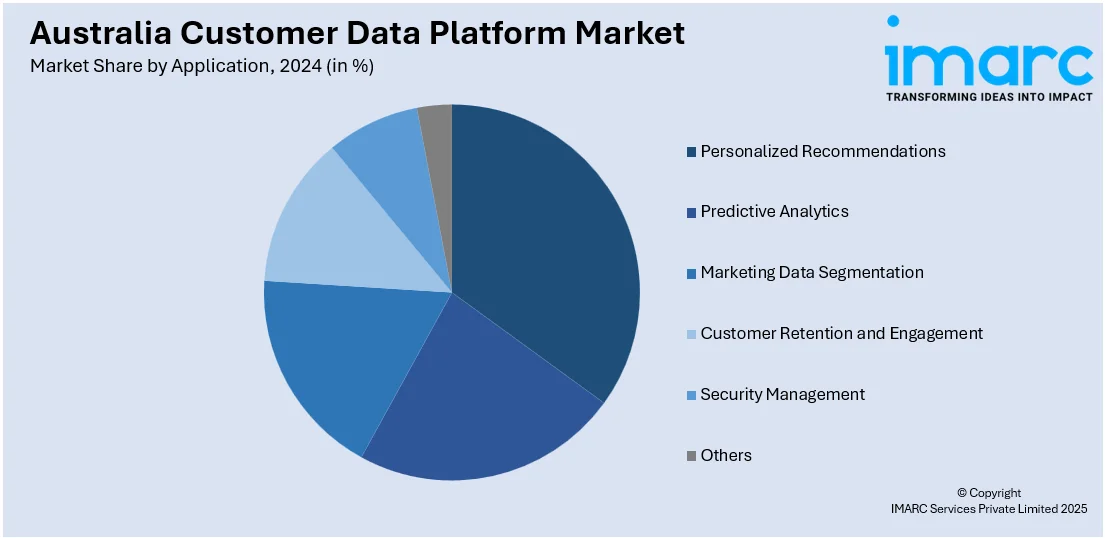

Application Insights:

- Personalized Recommendations

- Predictive Analytics

- Marketing Data Segmentation

- Customer Retention and Engagement

- Security Management

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes personalized recommendations, predictive analytics, marketing data segmentation, customer retention and engagement, security engagement, and others.

Vertical Insights:

- Retail and E-commerce

- BFSI

- Media and Entertainment

- IT and Telecommunications

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes retail and e-commerce, BFSI, media and entertainment, IT and telecommunications, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Customer Data Platform Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Platform, Services |

| Deployment Modes Covered | Cloud-based, On-premises |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises (SMEs) |

| Applications Covered | Personalized Recommendations, Predictive Analytics, Marketing Data Segmentation, Customer Retention and Engagement, Security Management, Others |

| Verticals Covered | Retail and E-commerce, BFSI, Media and Entertainment, IT and Telecommunications, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia customer data platform market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia customer data platform market on the basis of component?

- What is the breakup of the Australia customer data platform market on the basis of deployment mode?

- What is the breakup of the Australia customer data platform market on the basis of organization size?

- What is the breakup of the Australia customer data platform market on the basis of application?

- What is the breakup of the Australia customer data platform market on the basis of vertical?

- What is the breakup of the Australia customer data platform market on the basis of region?

- What are the various stages in the value chain of the Australia customer data platform market?

- What are the key driving factors and challenges in the Australia customer data platform market?

- What is the structure of the Australia customer data platform market and who are the key players?

- What is the degree of competition in the Australia customer data platform market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia customer data platform market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia customer data platform market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia customer data platform industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)