Australia Customer Relationship Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Application, Industry Vertical, and Region, 2025-2033

Australia Customer Relationship Management Market Overview:

The Australia customer relationship management market size reached USD 1.97 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.01 Billion by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. The increasing digital transformation across industries, rising demand for customer-centric strategies, expanding cloud adoption, and the integration of AI and data analytics to enhance customer insights, streamline operations, and improve personalized customer engagement across businesses of all sizes are among the key factors strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.97 Billion |

| Market Forecast in 2033 | USD 5.01 Billion |

| Market Growth Rate 2025-2033 | 9.80% |

Australia Customer Relationship Management Market Trends:

Integration of AI and Predictive Analytics for Enhanced Customer Engagement

A major trend driving the Australian CRM market is the integration of AI and predictive analytics to enhance customer experiences and operational efficiency. AI-powered CRM tools are automating routine tasks, analyzing customer behavior, and forecasting trends to improve satisfaction and loyalty. Features such as chatbots, virtual assistants, and intelligent lead scoring enable Australian businesses to provide personalized, real-time interactions, while predictive analytics helps identify sales opportunities and reduce customer churn by analyzing purchasing patterns and sentiment. In response, CRM vendors like Zoho, HubSpot, and Microsoft Dynamics 365 are expanding their AI integrations, while startups are also emerging with AI-first CRM solutions specifically designed for Australia’s SME sector.

To get more information on this market, Request Sample

Cloud-Based CRM Adoption Accelerated by Remote Work and SME Digitization

The accelerated adoption of cloud-based CRM platforms is another key trend transforming the CRM market in Australia. Driven by the rise of remote work, SME digitization, and the demand for cost-effective, scalable solutions, cloud CRM systems provide flexibility, easy third-party tool integration, and real-time customer data access from any location. In Australia, small and medium-sized enterprises (SMEs) are increasingly turning to cloud CRM solutions like Salesforce Essentials, Zoho CRM, and HubSpot to streamline operations and enhance customer relationships without the burden of on-premise systems. This shift is further supported by government initiatives such as the Digital Solutions Program by the Australian Small Business Advisory Services (ASBAS), which aids small businesses in adopting cloud CRM platforms and driving digital transformation.

Australia Customer Relationship Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, application, and industry vertical.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

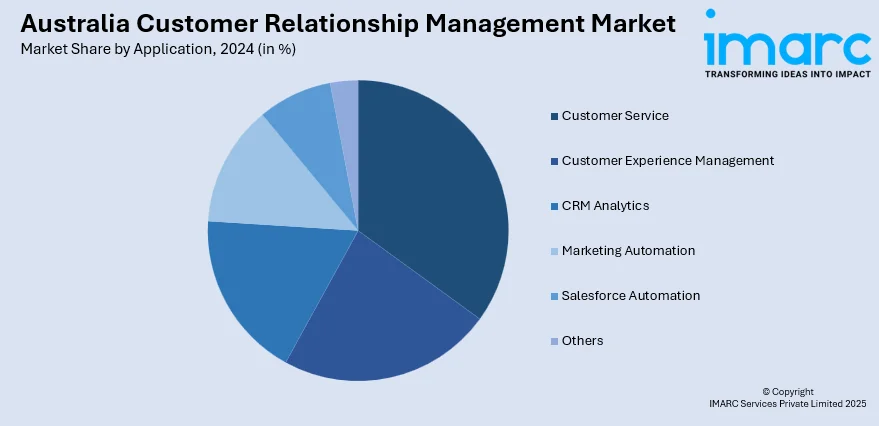

Application Insights:

- Customer Service

- Customer Experience Management

- CRM Analytics

- Marketing Automation

- Salesforce Automation

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes customer service, customer experience management, CRM analytics, marketing automation, salesforce automation, and others.

Industry Vertical Insights:

- BFSI

- Retail

- Healthcare

- IT and Telecom

- Discrete Manufacturing

- Government and Education

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, retail, healthcare, IT and telecom, discrete manufacturing, government and education, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Customer Relationship Management Market News:

- October 2024: Thryv Holdings acquired Keap, a CRM and marketing automation platform for small and medium-sized businesses (SMBs), in a strategic move to enhance its SaaS offerings. This acquisition expands Thryv’s presence in key international markets, including Australia, enabling SMBs to leverage integrated tools for customer relationship management, marketing automation, and sales optimization.

- March 2024: Accenture's marketing division, Accenture Song, acquired The Lumery, an Australian marketing technology consultancy. This move aims to enhance Accenture's capabilities in delivering personalized customer experiences across various touchpoints in the Australian market.

Australia Customer Relationship Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Applications Covered | Customer Service, Customer Experience Management, CRM Analytics, Marketing Automation, Salesforce Automation, Others |

| Industry Verticals Covered | BFSI, Retail, Healthcare, IT and Telecom, Discrete Manufacturing, Government and Education, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia customer relationship management market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia customer relationship management market on the basis of component?

- What is the breakup of the Australia customer relationship management market on the basis of deployment mode?

- What is the breakup of the Australia customer relationship management market on the basis of organization size?

- What is the breakup of the Australia customer relationship management market on the basis of application?

- What is the breakup of the Australia customer relationship management market on the basis of industry vertical?

- What is the breakup of the Australia customer relationship management market on the basis of region?

- What are the various stages in the value chain of the Australia customer relationship management market?

- What are the key driving factors and challenges in the Australia customer relationship management market?

- What is the structure of the Australia customer relationship management market and who are the key players?

- What is the degree of competition in the Australia customer relationship management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia customer relationship management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia customer relationship management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia customer relationship management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)