Australia Data Center Power Market Report by Component (Solution, Services), Size (Mid-Size Data Center, Enterprise Data Center, Large Data Center), Vertical (BFSI, Telecommunication and IT, Energy, Manufacturing, and Others), and Region 2026-2034

Australia Data Center Power Market Size and Share:

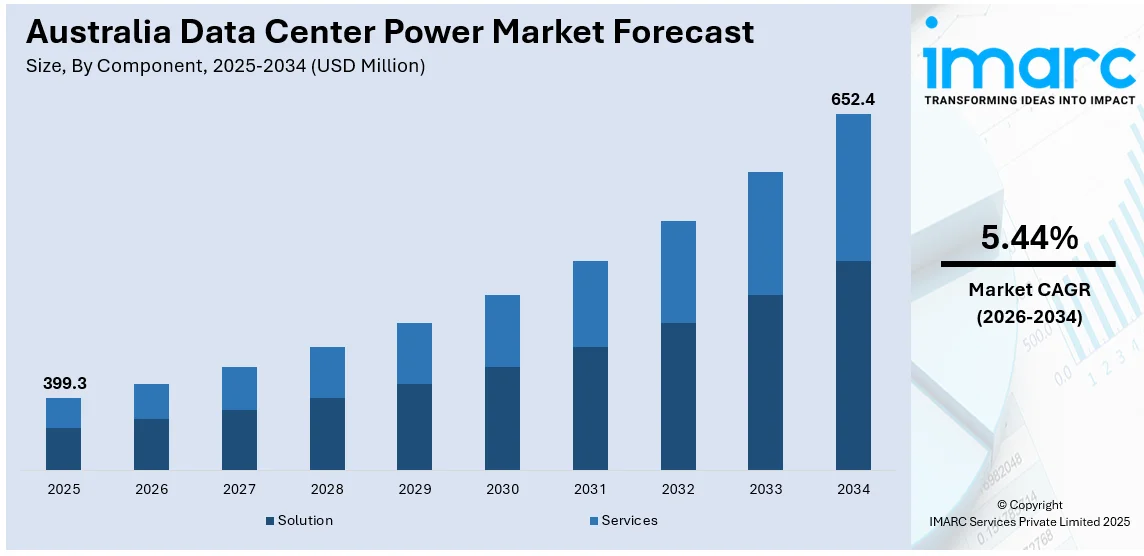

The Australia data center power market size reached USD 399.3 Million in 2025. Looking forward, the market is projected to reach USD 652.4 Million by 2034, exhibiting a growth rate (CAGR) of 5.44% during 2026-2034. Increasing digitalization, rising cloud computing adoption, advancements in the Internet of Things (IoT) and big data analytics, availability of government incentives, surging data sovereignty concerns, growth in edge computing, burgeoning demand for colocation services, and advancements in artificial intelligence (AI) technologies are some of the factors stimulating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 399.3 Million |

| Market Forecast in 2034 | USD 652.4 Million |

| Market Growth Rate 2026-2034 | 5.44% |

Key Trends of Australia Data Center Power Market:

Increasing Digitalization Across Industries

The rapid digitization of Australian industries is driving an increasing demand for data center power solutions, making it a key factor in the market's growth. Another crucial factor is the digital transformation efforts across umpteen sectors, including finance, healthcare and retail are soaring data capacity needs. In line with this, enterprises are steadily moving operations into digital platforms, which has further surged the need for data storage. Moreover, this new trend in digital business models is associated with a rise in the establishment of data centers to store massive volumes of information, which is further accelerating the market growth.

To get more information on this market Request Sample

Rise in Cloud Computing Adoption

The increasing use of cloud computing is one the key factors providing a considerable thrust to the market growth. This can be attributed to organizations efforts to move their information technology (IT) infrastructure to the cloud in order to avail cost savings, scalability, and added flexibility. Ports from several industries require greater data center infrastructure to hold and operate the enormous amounts of information created, which is further stimulating to the market growth. Moreover, the growing product adoption by small and medium enterprises (SMEs) to reduce the initial investment in IT capital is another factor facilitating the Australia data center power market growth.

Advancements in IoT and Big Data Analytics

Advancements in the Internet of Things (IoT) and big data analytics are significantly driving the demand for data center power solutions in Australia. IoT devices generate massive amounts of data that need to be processed, stored, and analyzed in real-time to deliver actionable insights. This surge in data generation is increasing the need for data centers that are not only capable of handling vast data volumes but also equipped with high-performance computing resources to process complex analytics workloads. Additionally, the growth of big data analytics is leading organizations to store more data to gain competitive advantages through predictive analytics, machine learning, and artificial intelligence.

Growth Drivers of Australia Data Center Power Market:

Rapid Expansion of Data Centers

Australia is experiencing significant growth in the construction of hyperscale and colocation data centers, driven by the rising demand for digital storage and processing capabilities. This surge is leading to major investments in power infrastructure to accommodate increasing operational loads and ensure reliable energy supply. Both enterprises and cloud service providers are focusing on scalable solutions such as modular power systems and smart grids to manage heightened compute density. Urban areas like Sydney and Melbourne are emerging as vital centers for data center development, heightening the need for strong, energy-efficient power solutions. This ongoing growth is expected to greatly influence infrastructure planning and investment approaches across the industry, thereby enhancing the Australia data center power market share in the upcoming years.

AI and High-Density Workloads

The rising integration of AI, big data analytics, and high-performance computing is contributing to elevated power density per rack in Australian data centers. The implementation of GPUs and other cutting-edge hardware requires more power and efficient distribution systems capable of managing these intensive workloads reliably. This trend is pushing forward the adoption of innovative energy solutions such as liquid cooling, intelligent power management, and systems for real-time monitoring. Consequently, operators are focusing on scalable, high-efficiency infrastructure to support next-generation workloads without sacrificing uptime. These advancements are directly impacting infrastructure decisions, underlining the increasing Australia data center power market demand for high-performance, future-ready power systems.

Increasing Focus on Uptime & Reliability

Maintaining uninterrupted uptime is a primary concern for data center operators in Australia, particularly given the critical nature of digital services for businesses. With organizations seeking 99.999% availability, data centers are making substantial investments in resilient power infrastructure such as dual power feeds, N+1 redundancy, and sophisticated UPS systems. These improvements ensure compliance with strict service-level agreements and reduce risks associated with grid instability or equipment failure. The industry is also embracing predictive maintenance and real-time monitoring technologies to minimize downtime risks. This strategic emphasis on operational continuity and reliability is significantly influencing infrastructure strategies according to Australia data center power market analysis.

Australia Data Center Power Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, size, and vertical.

Component Insights:

- Solution

- UPS Systems

- Generators

- Power Distribution Solutions

- PDU

- Switchgear

- Critical Power Distribution

- Transfer Switches

- Remote Power Panels

- Others

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution [UPS systems, generators, and power distribution solutions (PDU, switchgear, critical power distribution, transfer switches, remote power panels, and others)] and services.

Size Insights:

- Mid-Size Data Center

- Enterprise Data Center

- Large Data Center

A detailed breakup and analysis of the market based on the size have also been provided in the report. This includes mid-size data center, enterprise data center, and large data center.

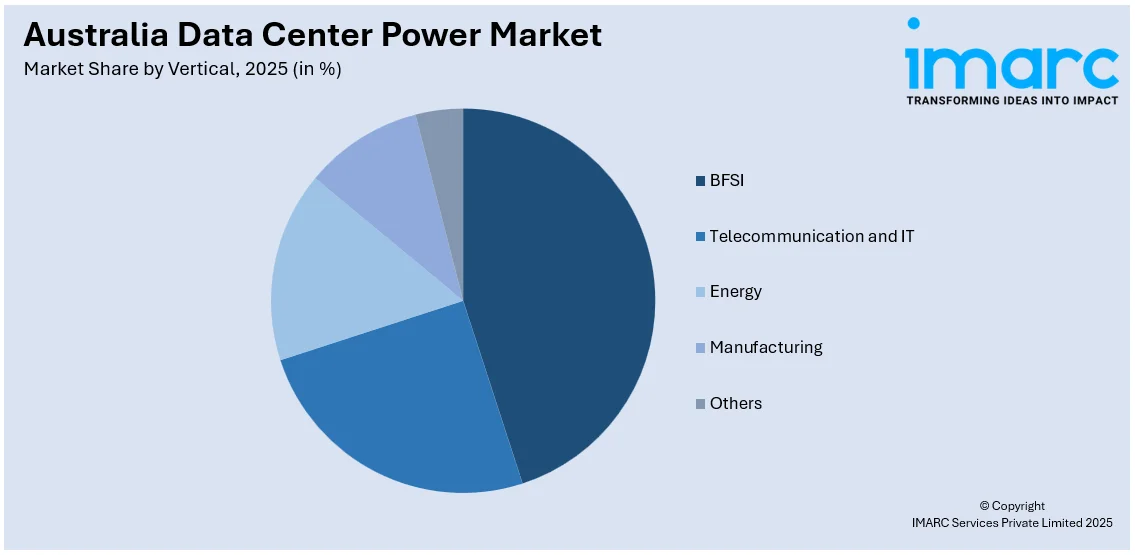

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Telecommunication and IT

- Energy

- Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes BFSI, telecommunication and IT, energy, manufacturing, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Data Center Power Market News:

- In 2024, NEXTDC launched its new D1 data center in Darwin, Northern Territory, marking a significant expansion of its footprint in Australia. The $80 million facility is designed to support up to 7MW of IT load and accommodate around 1,000 racks. This center aims to boost the region's digital economy by providing critical infrastructure for cloud computing, data analytics, and other digital services.

- In 2024, Global Switch filed plans to expand its Ultimo data center in Sydney, Australia, by adding 47 MW of capacity. This expansion will significantly increase the site's total power to meet the growing demand for data storage and cloud services. The development reflects the rising need for robust data center infrastructure in Australia, driven by digital transformation and increased cloud adoption across various sectors.

Australia Data Center Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Sizes Covered | Mid-Size Data Center, Enterprise Data Center, Large Data Center |

| Verticals Covered | BFSI, Telecommunication and IT, Energy, Manufacturing, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia data center power market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia data center power market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia data center power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The data center power market in Australia was valued at USD 399.3 Million in 2025.

The Australia data center power market is projected to exhibit a compound annual growth rate (CAGR) of 5.44% during 2026-2034.

The Australia data center power market is expected to reach a value of USD 652.4 Million by 2034.

The Australia data center power market is witnessing a rise in demand for energy-efficient systems, smart power monitoring tools, and modular infrastructure. There is a growing shift toward renewable integration, liquid cooling technologies, and hybrid on-grid/off-grid backup solutions to optimize energy usage and meet sustainability targets.

Key growth drivers include rising cloud adoption, increasing data localization regulations, and the rapid expansion of digital services. The need for high-density computing and AI-driven workloads is pushing demand for scalable and resilient power infrastructure, while strong investments in hyperscale and edge data centers are accelerating power capacity upgrades.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)