Australia Data Center Rack Market Size, Share, Trends and Forecast by Type, Rack Units, Rack Size, Frame Size, Frame Design, Service, Application, End User, and Region, 2025-2033

Australia Data Center Rack Market Size and Share:

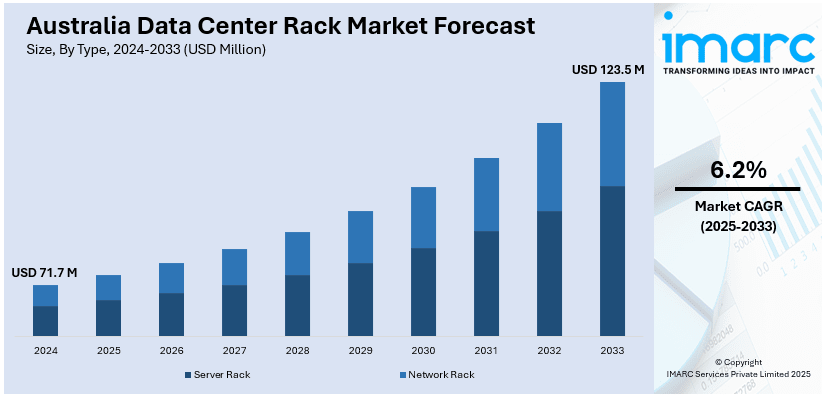

The Australia data center rack market size was valued at USD 71.7 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 123.5 Million by 2033, exhibiting a CAGR of 6.2% from 2025-2033. The Australia data center rack market share is expanding, driven by the increasing adoption of cloud computing, energy efficiency, several sustainability initiatives, demands for high-performance computing, edge computing expansion, digital transformation, and the growing usage of prefabricated modules for scalable, efficient data center solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 71.7 Million |

| Market Forecast in 2033 | USD 123.5 Million |

| Market Growth Rate (2025-2033) | 6.2% |

The market in Australia is majorly influenced by the increased data consumption, and the need for efficient IT infrastructure. Also, with the increased adoption of cloud computing across industries, businesses need racks to house their growing workloads that are scalable and highly performing. For instance, on October 10, 2024, 4Cabling, one of the leading providers of data center infrastructure, launched its latest range of server racks and network cabinets to support the rapidly expanding data center industry in Australia. t offers quarter, half, and full racks with suitable offerings for various industries, including IT, telecommunications, and government sectors.

To get more information on this market, Request Sample

The growing interest in edge computing to reduce latency and make data more accessible is driving demand for compact, modular racks that support edge deployments. For example, on October 16, 2024, Dell Technologies launched some next-generation artificial intelligence (AI) hardware solutions with enhanced demands in data center systems. The product lines entail Integrated Rack 7000 (IR7000) aimed at high-density computing. Also, liquid cooling and PowerEdge XE9712 server co-designed by Dell and NVIDIA to be built with large-scale AI workload systems. Moreover, the increasing digital transformation among enterprises is forcing companies to invest in advanced data center solutions, such as modern rack systems that improve efficiency in operations.

Australia Data Center Rack Market Trends:

Emphasis on Energy Efficiency and Green Data Center Practices

The growing demand for green data centers that can reduce carbon footprints using energy-efficient racks is offering a favorable Australia data center rack market outlook. According to the International Energy Agency, data centers are expected to consume more than 800 TWh annually by 2026, which would be more than double the consumption in 2022 and this affects the corporate net-zero targets. Renewable sources of energy need to be integrated into data center operations to meet sustainability goals. Thus, energy efficiency has become one of the major concerns for data center operations in Australia. Data center racks are evolving with more features supporting energy-efficient operation, such as advanced airflow management, intelligent cooling systems, and PDUs with real-time monitoring capabilities. This trend aligns with the broader moves to constrain carbon footprints, wherein several organizations are investing in racks that minimize energy wastage. Government incentives and regulations promoting sustainable practices further boost the adoption of eco-friendly rack solutions and facilitate growth in the market.

Rising Adoption of High-Density Computing Racks

High-density computing racks are gaining popularity in Australia with the emerging usage of applications in artificial intelligence (AI), machine learning (ML), and big data analytics. These workloads require racks with powerful high-computational-need server support and associated heat density. To tackle these concerns, manufacturers develop racks fitted with enhanced cooling technologies, such as liquid cooling or advanced thermal management systems. For example, Schneider Electric launched artificial intelligence (AI) driven data center solutions to face energy and sustainability challenges due to the growing demand for AI systems on December 6, 2024. In collaboration with NVIDIA, they launched a liquid-cooled, high-density artificial intelligence (AI) cluster reference design that can support up to 132 kW per rack in a data center. Besides this, Schneider Electric introduced the Galaxy VXL uninterruptible power supply, a compact, high-density UPS designed specifically for artificial intelligence (AI) and other heavy workloads. The rising need to consolidate the infrastructure of IT is increasing the adoption of these racks, as it maximizes space usage without compromise in terms of performance and reliability. This trend is notable in the finance, healthcare, and telecommunications sectors.

Increasing Demand for Prefabricated Data Center Modules

The growing preference for prefabricated data center modules to meet the rising demand for scalable and energy-efficient solutions is reshaping the Australian data center rack market. These modules, pre-engineered and factory-assembled, enable rapid deployment and customization to suit specific operational needs. Prefabs are gaining traction due to their ability to support high-density computing environments and integrate advanced cooling technologies. For instance, on November 27, 2024, DXN confirmed the completion of the factory acceptance test for a prefabricated data center module to be deployed at Stanmore Resources Limited's South Walker Creek mine in Queensland, Australia. The $1.2 million contract was awarded in February 2024. This trend aligns with the market's focus on reducing construction times, operational costs, and environmental impact. As per the Australia data center rack market forecast, companies are using prefabs for cloud computing, edge deployments, and artificial intelligence (AI) workloads, which makes them a critical component in Australia's rapidly expanding data center infrastructure landscape.

Australia Data Center Rack Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia data center rack market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, rack units, rack size, frame size, frame design, service, application, and end user.

Analysis by Type:

- Server Rack

- Network Rack

Server racks are critical within the Australian data center rack market because they ensure organized accommodation for servers, thereby leading to efficient space utilization as well as system stability. Server racks house critical IT equipment while supporting cable management and enhanced cooling capabilities. The increasing deployment of cloud computing and virtualization has led to a boost in demand for server racks due to businesses requiring reliable, scalable infrastructure to support their fast-growing data storage and processing requirements.

Network racks are key players in the Australian data center market, as they host network switches, routers, and cabling systems. They are designed to enhance the placement of network equipment to ensure easy access and proper airflow management. As enterprises expand their digital infrastructure, network racks take center stage for streamlined connectivity and high performance. The rapid deployment of the internet of things (IoT) and high-speed networks further emphasizes the need for network racks in today's data center configurations.

Analysis by Rack Units:

- Small

- Medium

- Large

The smaller rack units play an important role in the Australian data center rack market. They are suitable for small businesses that have lower infrastructure needs. These compact-sized ones are ideal for small firms, edge computing, or remote locations. They help save space and lower the cost of deployment for business entities that require efficient ways to house their essential servers, networking devices, or other storage systems.

Medium rack units cater to mid-sized companies and organizations that require a moderate amount of IT infrastructure. They strike a balance between capacity and footprint, making them suitable for companies that are expanding their operations. These racks accommodate different hardware configurations and help ensure optimal resource allocation while minimizing cooling. In light of growing digitalization and hybrid IT models, medium rack units are becoming more relevant in the Australian data center landscape.

Large rack units play the core role in massive data centers, which often involve huge IT systems and corporate infrastructure. They form very high-density solutions that would fit multiple servers and more storage and networking components on a single frame. Design-wise, they can give out great performance when huge computing operations are expected of them. Hyperscale data centers and cloud providers are increasing in Australia as huge computing resources are being developed.

Analysis by Rack Size:

- 36U

- 42U

- 45U

- 47U

- 48U

- 51U

- Others

The 36U rack size is significant in the Australian data center rack market, especially for small and medium-sized enterprises. It provides a compact yet efficient solution for housing IT equipment such as servers, storage devices, and networking hardware. Its smaller footprint makes it ideal for edge computing and co-location facilities. Businesses with limited space and moderate infrastructure need to benefit greatly from this versatile and space-saving rack size.

The 42U rack size is the most preferred in the Australian data center market because it provides a good balance between capacity and usability. It supports almost all types of equipment, including servers, switches, and power distribution units, and hence is ideal for mid-sized and large data centers. This size is highly flexible, allowing for enough space to scale up IT infrastructure while still maintaining efficient cooling and cable management systems.

The 45U rack size is critical for high-density data center environments in Australia, mainly utilized by large enterprises and hyperscale facilities. It offers more capacity than smaller racks, making it ideal for operations that require a lot of IT equipment. The increased height allows for better utilization of floor space and supports advanced cooling technologies. The 45U rack size is becoming more crucial for scalability and efficiency as companies grow their digital operations.

Analysis by Frame Size:

- 19 Inch

- Others

The 19-inch size is a standard in the Australian data center rack market for general compatibility and versatility. This size accommodates different IT equipment, such as servers, networking devices, and storage units. Its universally acceptable design ensures smooth integration of such racks across different industries and their manufacturers, making this product a favorite for optimal housing of equipment with effective space utilization. The 19-inch frame is, therefore, important to create optimal layouts in data centers through minimal space usage.

Analysis by Frame Design:

- Open Frame

- Enclosed

- Customized

Open frame racks are crucial in the Australian data center market, mainly in areas where accessibility and airflow are of utmost importance. The racks' low cost eases the installation process and enables access for simple maintenance. They are also frequently applied in areas with strong cooling systems and secure areas. They are great for small-scale setups and industrial-specific applications where efficiency and simplicity will be prioritized instead of enclosure.

Enclosed racks form a very important segment of the market by offering protection against physical impacts and environmental effects on equipment. They protect devices against such impacts, dust, and changes in temperature. Most data centers for corporate and colocation, where the environment and the cabling are organized and controlled, use enclosed racks. They support advanced cooling arrangements. This will ensure the reliable running of equipment in dense implementations.

Customized racks are a crucial product in the market, as they provide specialized infrastructure. Businesses that have specific IT infrastructures and have customized designs for the optimum use of space, specific cooling requirements, or just aesthetic considerations will opt for customized racks. They solve industry-specific issues that cater to non-standard equipment sizes and configurations. Their flexibility and adaptability make them valuable for enterprises that place significant importance on bespoke solutions in their quest to meet evolving operational demands.

Analysis by Service:

- Consulting Services

- Installation and Support Services

- Professional Services

Consulting services are crucial in the market, offering businesses expert guidance on selecting and deploying rack systems. These services help organizations optimize their infrastructure, considering factors like scalability, energy efficiency, and cooling requirements. Consultants provide tailored solutions aligned with business objectives, enabling informed decisions that enhance operational performance and cost-effectiveness in data center management.

Installation and support services are important in the market. Installation services ensure easy deployment of rack systems and proper ongoing maintenance. Such services may include the setting up of equipment, cable management, and integration with existing infrastructure. Support services ensure uninterrupted operations and handle issues related to hardware malfunctions and upgrades. Effective installation and support services help ensure system efficiency and avoid data center downtime.

Professional services in the market involve a complete design-to-deployment and performance-optimization set of solutions. The solution will cover demanding requirements such as customized configuration and compliance with industry standards. Professional service providers help businesses implement innovative technologies, improve system robustness, and prepare infrastructure for future growth strategies.

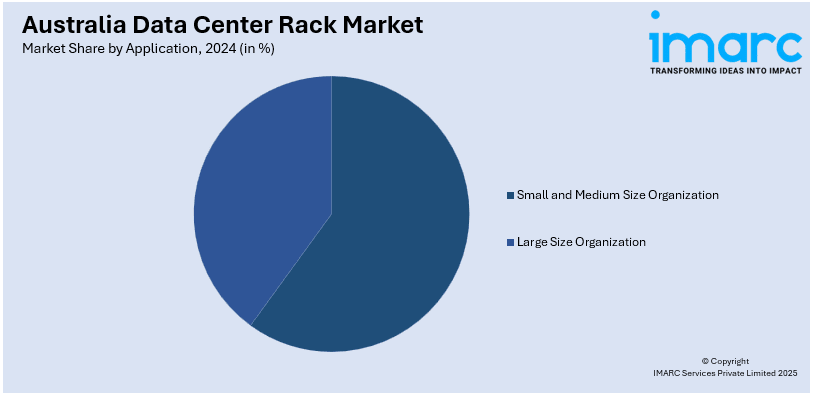

Analysis by Application:

- Small and Medium Size Organization

- Large Size Organization

Small and medium-sized organizations in the Australian data center rack market require compact and cost-effective solutions for their IT infrastructure. They need scalable and energy-efficient solutions within space and budget constraints. Data center racks designed for this segment will have optimized layouts for servers and networking equipment, allowing businesses to grow and adopt cloud-based technologies without compromising operational efficiency.

Large Australian data center rack organizations demand rack systems that provide high-density and robust power for massive IT infrastructure arrangements. They look for products that have scalable features along with enhanced cooling and added security measures to ensure the operational efficiency of mission-critical applications. Large-scale deployment racks support the management of equipment effectively and allow proper integration into complex systems; therefore, these organizations maintain up-to-date racks when digital transformation is rapidly carried out.

Analysis by End User:

- IT and Telecom

- BFSI

- Public Sector

- Healthcare

- Retail

- Manufacturing

- Media Entertainment

- Others

The IT and telecom sector forms a significant end user in the Australian data center rack market due to the increased demand for scalable and high-density rack solutions. IT and telecom sectors require highly reliable racks to house the servers, switches, and storage used for handling big data, ensuring seamless connectivity. The advancement of cloud computing, 5G networks, and digital services has led to the IT and telecom sectors heavily relying on advanced rack systems for operational efficiency.

The BFSI (Banking, Financial Services, and Insurance) sector is significant for the Australian data center rack market. Requiring strong and reliable infrastructure to handle sensitive financial information. These companies demand racks that provide strong security, effective cooling, and structured cabling. With increasing online transactions and regulatory compliance needs, the BFSI sector invests in advanced rack systems for data protection and to enable high-performance IT operations.

The public sector plays an integral part in Australia data center rack market, with a focus on the robust and scalable solution management of government data and services. Data center racks in this sector focus on critical applications like citizen services, national security, and public infrastructure. Increasing digitization and the adoption of e-governance require reliable racks that allow secure and uninterrupted operations within the public sector.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory and New South Wales are the most critical regions in the data center rack market due to the high concentration of government facilities, corporate headquarters, and financial institutions. These areas require sophisticated rack systems for hosting critical IT infrastructure. With significant investments in digital transformation and cloud services, Australia Capital Territory and New South Wales continue to lead the data center expansion and innovation in Australia.

Victoria, especially Melbourne, is a major hub for the data center rack market due to its thriving tech ecosystem and diversified industries. Tasmania supports this with growing interest in green data centers using its renewable energy resources. The demand for efficient and sustainable rack solutions is growing in these regions, which aligns with business needs and environmental goals, making them integral to the market's growth.

Queensland is emerging as an important contributor to the Australian data center rack market, driven by its growing tech industry and regional businesses. There is an increased demand in Brisbane and other cities for racks that scale and are reliable. The state's focus on disaster recovery and edge computing solutions also enhances the adoption of advanced rack systems to support critical infrastructure and remote operations.

The Northern Territory and South Australia operate in niches in the data center rack market with government projects and industrial activities. In these regions, racks suitable for remote locations with extreme conditions are emphasized. The South Australia renewable energy initiatives also enhance demand for green data center solutions. The Northern Territory focuses on connectivity improvements in support of its growing digital economy.

Western Australia is has a very robust mining, energy, and technology sector. Perth has become a major hub for data centers catering to these industries, with high-capacity racks for heavy data processing. With the right location for international connectivity, Western Australia has become a growing hotspot for data center infrastructure investments that fuel demand for advanced rack systems.

Competitive Landscape:

The Australian data center rack market is characterized by increasing competition, driven by the rapid expansion of data centers to meet growing demands for cloud computing, artificial intelligence (AI) workloads, and edge technologies. For instance, on June 21, 2024, Equinix announced the opening of its fourth data center in Osaka, Japan, designed to support hyperscale customers, alongside an AUD 240 million investment to expand its Australian operations, catering to the rising demand for AI infrastructure. Providers are focusing on advanced rack solutions that support high-density computing, energy efficiency, and modular designs to address scalability and sustainability needs. Regulatory pressures and rising energy costs are prompting innovation in airflow management, cooling technologies, and real-time monitoring capabilities, further intensifying competition among vendors. The dynamic environment positions Australia as a vital hub for advanced digital infrastructure.

The report provides a comprehensive analysis of the competitive landscape in the Australia data center rack market with detailed profiles of all major companies.

Latest News and Developments:

- January 30, 2024: Moveworks, Inc. announced the expansion of its regional data centers to Australia, complementing existing facilities in Europe and Canada. This initiative enhances compliance with local data residency regulations while providing customers with greater control over their data in delivering conversational artificial intelligence (AI) solutions. The move underscores Moveworks' commitment to global growth and addressing evolving privacy requirements for businesses worldwide.

- October 18, 2024: NextDC announced plans for a 550MW data center campus in Sydney, Australia, following its AUD 353 million acquisition of a 258,000 sqm site in Eastern Creek. Known as S7, the project aims to more than double the company's data center capacity in Sydney. This development is part of NextDC's broader expansion strategy, which includes 20 data centers across Australia and sites under evaluation in Asia.

- October 2024: 4Cabling, a top supplier of data center infrastructure, has recently unveiled its newest series of server racks and network cabinets aimed at assisting the swiftly growing data center sector in Australia.

- April 2024: Goodman announced the starting of a new data center, Project Pluto in Sydney. The secretary’s environmental assessment requirements (SEARs) layout revealed the position of 18 data halls, 600 racks per hall, and a density of almost 12kW per rack.

- August 2024: NextDC revealed a new Darwin data center in the Northern Territory which will have 1,000 racks and support up to 7MW of IT load.

Australia Data Center Rack Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Server Rack, Network Rack |

| Rack Units Covered | Small, Medium, Large |

| Rack Sizes Covered | 36U, 42U, 45U, 47U, 48U, 51U, Others |

| Frame Sizes Covered | 19 Inch, Others |

| Frame Designs Covered | Open Frame, Enclosed, Customized |

| Services Covered | Consulting Services, Installation and Support Services, Professional Services |

| Applications Covered | Small and Medium Size Organization, Large Size Organization |

| End Users Covered | IT and Telecom, BFSI, Public Sector, Healthcare, Retail, Manufacturing, Media Entertainment, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia data center rack market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia data center rack market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia data center rack industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A data center rack is a physical structure, typically made of steel or aluminum, designed to house servers, networking equipment, cables, and power systems. These racks optimize space, cooling, and cable management, supporting applications in cloud computing, telecommunications, and IT infrastructure.

The Australia data center rack market was valued at USD 71.7 Million in 2024.

IMARC estimates the Australia data center rack market to exhibit a CAGR of 6.2% during 2025-2033.

The key drivers of the Australian data center rack market include the rapid adoption of cloud computing, 5G rollout, increased demand for big data and artificial intelligence (AI) infrastructure, and investments in hyperscale and edge data centers. Rising data traffic and compliance with data residency regulations further propel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)