Australia Data Governance Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Business Function, Application, End Use Industry, and Region, 2025-2033

Australia Data Governance Market Overview:

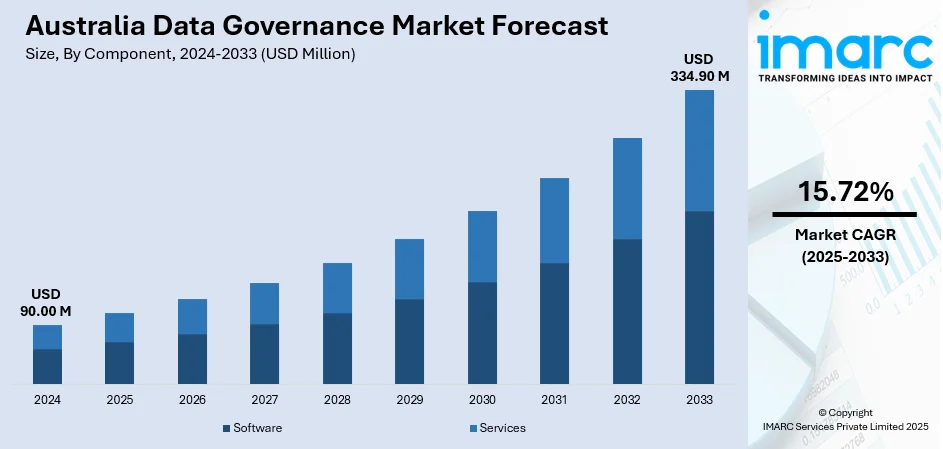

The Australia data governance market size reached USD 90.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 334.90 Million by 2033, exhibiting a growth rate (CAGR) of 15.72% during 2025-2033. The market is growing due to rising demand for data sovereignty, secure cloud infrastructure, and responsible AI use. Government policies, local data centers, and structured investment plans are driving compliance, transparency, and digital maturity across public and private sector operations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 90.00 Million |

| Market Forecast in 2033 | USD 334.90 Million |

| Market Growth Rate 2025-2033 | 15.72% |

Australia Data Governance Market Trends:

Strengthening Data Sovereignty Measures

Australia is steadily reinforcing its commitment to data sovereignty, especially in the face of rising concerns around data privacy and regulatory compliance. Businesses operating in cloud-based environments are increasingly expected to maintain full control over where and how their data is stored. This growing need for secure, region-specific data storage has become a defining feature of the data governance market. It ensures that critical business and customer information remains within Australian borders, meeting local regulatory expectations and improving public trust in digital services. Organizations now prioritize solutions that align with local security standards and demonstrate compliance with jurisdiction-specific governance frameworks. The importance of secure data infrastructure became more evident in October 2024 when Obsidian Security launched its new AWS-based data center in Sydney. This facility gave Australian businesses the ability to store sensitive SaaS data within national boundaries while adopting modern security tools. The initiative supported the country’s strategic push to maintain digital sovereignty and reduce reliance on offshore data services. By meeting residency requirements and reinforcing trust, this development strengthened the market for enterprise data governance solutions and drove wider adoption of localized infrastructure. It also underscored the role of security-focused innovation in shaping Australia’s evolving digital compliance ecosystem.

To get more information on this market, Request Sample

Institutional Push for Ethical Technology

Australia’s data governance industry is increasingly influenced by the public sector’s structured push for ethical and transparent technology use. Government bodies are actively developing policies to manage emerging technologies such as artificial intelligence, recognizing the growing need for safe integration into public services. These efforts are directed at building digital maturity, creating long-term investment pathways, and promoting responsible innovation. With public confidence tied to how transparently government agencies handle data, establishing clear policy frameworks has become essential. This shift also enables agencies to align innovation with consistent national standards while reducing implementation risks. In February 2025, the Australian Government released the 2024 Implementation Plan under its Data and Digital Strategy. The plan emphasized responsible AI deployment and introduced mandatory digital investment planning for all agencies, beginning July 2025. As part of this initiative, the Government evaluated a large-scale AI trial involving over 5,000 staff across 60 agencies and began developing AI assurance frameworks. These actions reflected a national-level push to guide digital transformation while protecting public interest. This policy-led model of governance has strengthened Australia’s position in data stewardship, encouraging coordinated oversight, improved accountability, and increased strategic alignment across sectors all contributing to a more mature and future-focused data governance market.

Australia Data Governance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, business function, application, and end use industry.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Mode Insights:

- Cloud-Based

- On-Premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

Organization Size Insights:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises (SMEs) and large enterprises.

Business Function Insights:

- Operation and IT

- Legal

- Finance

- Others

A detailed breakup and analysis of the market based on the business function have also been provided in the report. This includes operation and IT, legal, finance, and others.

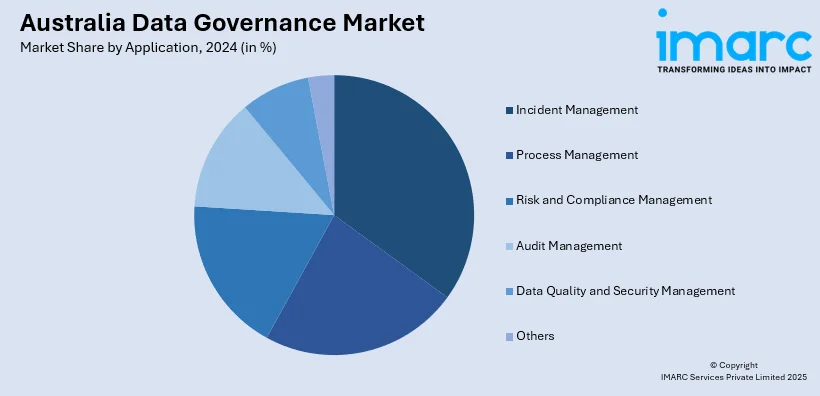

Application Insights:

- Incident Management

- Process Management

- Risk and Compliance Management

- Audit Management

- Data Quality and Security Management

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes incident management, process management, risk and compliance management, audit management, data quality and security management, and others.

End Use Industry Insights:

- IT and Telecom

- Healthcare

- Retail

- Defense

- BFSI

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes IT and telecom, healthcare, retail, defense, BFSI, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Data Governance Market News:

- December 2024: The Australian Government launched AusDevPortal, a data-driven transparency platform powered by IATI standards. This initiative improved public access to official development data, reinforcing Australia’s data governance framework and promoting accountability, accuracy, and trust in the management of international aid information.

- October 2024: Vanta expanded its presence in Australia with a new data centre in Sydney and support for CPS 234 and Essential Eight frameworks. This strengthened the country’s data governance market by enhancing local compliance capabilities, improving data residency options, and streamlining cybersecurity management.

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | Cloud-Based, On-Premises |

| Organization Sizes Covered | Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| Business Functions Covered | Operation and IT, Legal, Finance, Others |

| Applications Covered | Incident Management, Process Management, Risk and Compliance Management, Audit Management, Data Quality and Security Management, Others |

| End User Industries Covered | IT and Telecom, Healthcare, Retail, Defense, BFSI, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia data governance market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia data governance market on the basis of component?

- What is the breakup of the Australia data governance market on the basis of deployment mode?

- What is the breakup of the Australia data governance market on the basis of organization size?

- What is the breakup of the Australia data governance market on the basis of business function?

- What is the breakup of the Australia data governance market on the basis of application?

- What is the breakup of the Australia data governance market on the basis of end use industry?

- What is the breakup of the Australia data governance market on the basis of region?

- What are the various stages in the value chain of the Australia data governance market?

- What are the key driving factors and challenges in the Australia data governance market?

- What is the structure of the Australia data governance market and who are the key players?

- What is the degree of competition in the Australia data governance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia data governance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia data governance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia data governance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)