Australia Debt Collection Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2025-2033

Australia Debt Collection Software Market Overview:

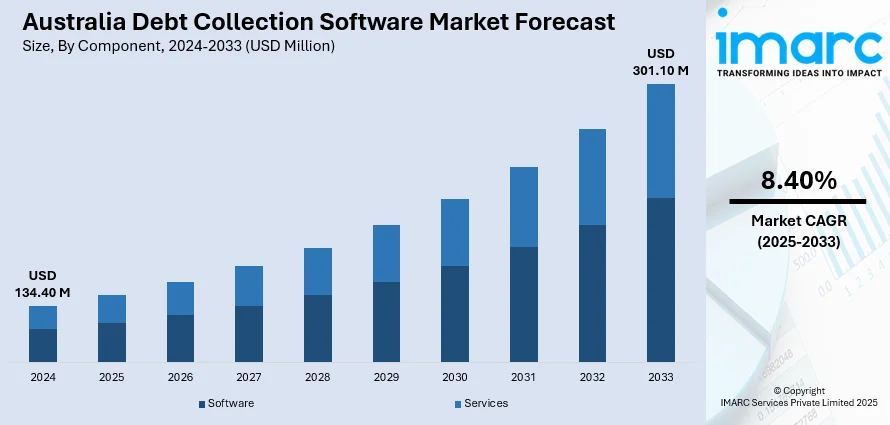

The Australia debt collection software market size reached USD 134.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 301.10 Million by 2033, exhibiting a growth rate (CAGR) of 8.40% during 2025-2033. The market is driven by various factors, such as the escalating need for automation in debt recovery processes to enhance efficiency and reduce errors, the rising volumes of outstanding debts necessitating effective management solutions, and the integration of advanced technologies like artificial intelligence and machine learning to optimize collection strategies and improve debtor engagement.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 134.40 Million |

| Market Forecast in 2033 | USD 301.10 Million |

| Market Growth Rate 2025-2033 | 8.40% |

Australia Debt Collection Software Market Trends:

Increasing Digital Transformation Across Financial Services Sector

Among the major drivers propelling the need for debt collection software in Australia is the widespread digitalization happening across the country's financial services industry. Banks, credit unions, and lending institutions are extensively facing pressure to rationalize processes, minimize manual interventions, and enhance recovery rates. In reaction, they are more and more turning to cloud-based and AI-driven debt collection platforms to automate and maximize their collections process. The move toward digital-first infrastructure is not solely about operational efficiency—it also attends to regulatory compliance and consumer protection requirements. Next-generation software capabilities include real-time analytics, simple integration with CRM systems, multi-channel communication functionalities, and sophisticated audit trails. These capabilities make it possible for lenders to treat delinquent customers more gracefully and actively, reducing default rates and building more effective customer relationships. In addition, the Australian Prudential Regulation Authority (APRA) and other financial institutions promote transparency and accountability, which can be better guaranteed by digital systems.

To get more information on this market, Request Sample

Rising Household Debt and Consumer Credit Dependency

Another factor propelling the market is the growing household debt and greater dependency on consumer credit in Australia. Australian households have seen ten years of continuously rising debt levels—especially in credit cards, personal loans, and buy-now-pay-later (BNPL) programs. This pattern has seriously raised the demand for more effective and scalable debt recovery tools across various industries, including retail, healthcare, utilities, and telecommunication. With economic uncertainties persisting sustained by inflationary trends, increasing interest rates, and a volatile residential housing market a higher number of consumers are failing to meet their repayment commitments. Companies, correspondingly, encounter difficulties managing accounts receivable and sustaining cash flow. These have led even large corporations as well as SMEs to implement sophisticated debt recovery software to monitor outstanding payments, risk-score for prioritization purposes, and utilize more effective recovery tactics. In industries such as BNPL and consumer finance, where repayment habits tend to be volatile, the role of intelligent and adaptive collection tools cannot be overemphasized. With the use of automation and predictive analytics, companies can reduce losses and ensure financial stability.

Australia Debt Collection Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, and end user.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

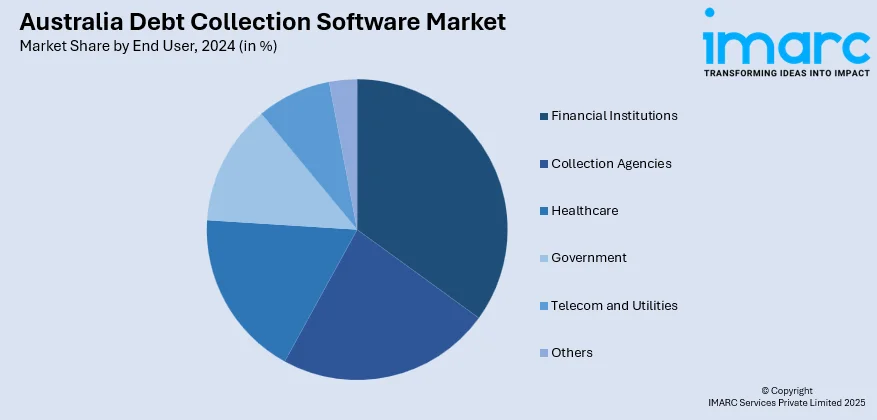

End User Insights:

- Financial Institutions

- Collection Agencies

- Healthcare

- Government

- Telecom and Utilities

- Others

A detailed breakup and analysis of the market based on the end users have also been provided in the report. This includes financial institutions, collection agencies, healthcare, government, telecom and utilities, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Debt Collection Software Market News:

- September 2024: InDebted, an Australian fintech firm, raised USD 41 million in Series C funding to enhance its AI-driven debt collection services and expand into new markets. Specializing in debt collection software, InDebted leverages machine learning to personalize collection journeys.

- June 2024: The Australian government proposed legislation requiring buy-now-pay-later (BNPL) companies to conduct credit checks on borrowers, aligning them with traditional credit providers. By enforcing stricter lending standards, the legislation is expected to impact the debt collection software market, as BNPL firms may need to adopt more robust systems to manage credit assessments and collections effectively.

Australia Debt Collection Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Users Covered | Financial Institutions, Collection Agencies, Healthcare, Government, Telecom and Utilities, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia debt collection software market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia debt collection software market on the basis of component?

- What is the breakup of the Australia debt collection software market on the basis of deployment mode?

- What is the breakup of the Australia debt collection software market on the basis of organization size?

- What is the breakup of the Australia debt collection software market on the basis of end user?

- What are the various stages in the value chain of the Australia debt collection software market?

- What are the key driving factors and challenges in the Australia debt collection software?

- What is the structure of the Australia debt collection software market and who are the key players?

- What is the degree of competition in the Australia debt collection software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia debt collection software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia debt collection software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia debt collection software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)