Australia Digital Asset Management Market Size, Share, Trends and Forecast by Type, Component, Application, Deployment, Organization Size, End-Use Sector, and Region, 2025-2033

Australia Digital Asset Management Market Size and Growth:

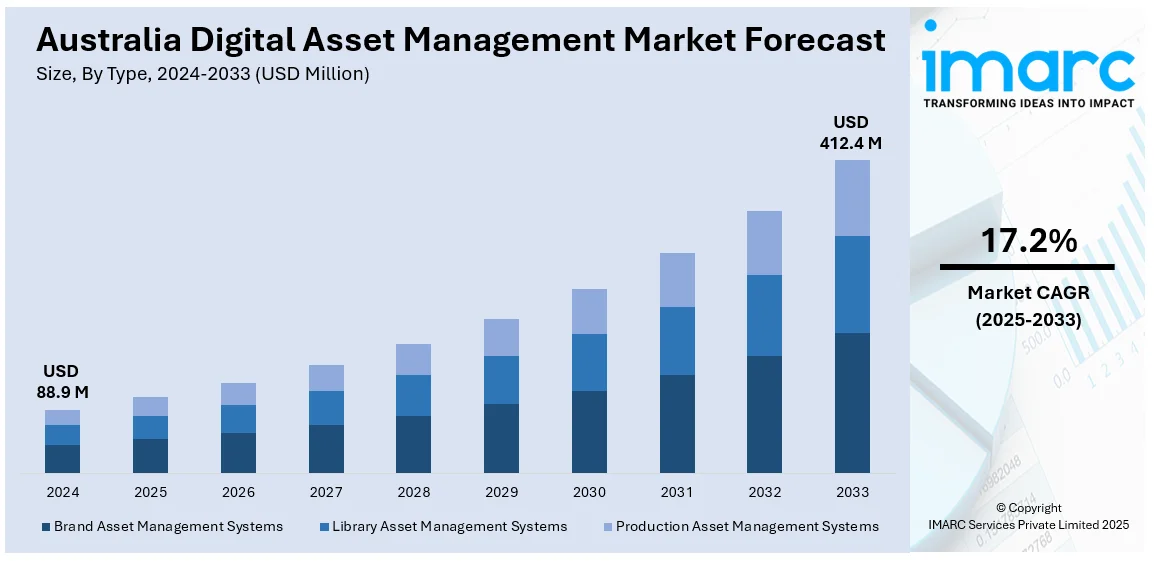

The Australia digital asset management market size reached USD 88.9 Million in 2024. Looking forward, the market is expected to reach USD 412.4 Million by 2033, exhibiting a growth rate (CAGR) of 17.2% during 2025-2033. The increasing digitization across industries, growing demand for centralized data management, rising adoption of cloud-based solutions, expanding e-commerce sector, heightened focus on brand consistency, regulatory compliance requirements, the rise in remote work, and the need for efficient content collaboration, scalability, and data security are some of the factors augmenting Australia digital asset management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 88.9 Million |

| Market Forecast in 2033 | USD 412.4 Million |

| Market Growth Rate 2025-2033 | 17.2% |

Key Trends of Australia Digital Asset Management Market:

The rise in Remote Work and Hybrid Workforce Models

The widespread shift to remote work and hybrid workforce models is greatly influencing the adoption and facilitating the Australia digital asset management market growth. As workforces grow more distributed, the dependence on centralized digital infrastructure is growing greatly. According to an industry report, 37% of Australians worked remotely at least once a week in 2023, while 45% of the workforce followed a hybrid work model. This shift emphasizes the necessity of safe, cloud-based systems where teams can access, organize, and manage digital assets across different locations in real time. In this regard, DAM platforms are becoming indispensable tools for Australian organizations that want to ensure operational continuity and content consistency across departments. These platforms facilitate remote collaboration by allowing users to automate workflows, approve processes, and have strict version control, which is essential in marketing, media, and corporate communications. Australian businesses across sectors, from creative agencies to educational institutions, are increasingly moving to DAM solutions to address issues of asset accessibility, miscommunication, and dispersed storage systems. Also, as businesses adopt flexible working patterns in the long term, investment in scalable, cloud-based DAM infrastructure is increasing. This development also fuels innovation in user interface design, mobile accessibility, and collaboration features within DAM systems. By enabling streamlined content management among remote teams, DAM systems have become critical parts of Australia's digital workplace strategy.

To get more information on this market, Request Sample

Expanding E-Commerce Sector Driving Demand for Scalable Content Solutions

The rapid expansion of Australia's e-commerce sector is creating a substantial demand for digital asset management systems capable of handling high volumes of product-related content. According to an industry report, the e-commerce market in Australia is projected to reach USD 1,568.60 Billion by 2033, growing at a CAGR of 12.70% from 2025 to 2033. This impressive growth trajectory is driving online retailers to leverage increasingly rich media, such as high-resolution images, product videos, 360-degree product views, and interactive content, to capture customer attention and enhance the online shopping experience. Managing these digital assets across multiple sales channels, marketplaces, and marketing platforms requires sophisticated DAM capabilities. Therefore, Australian businesses are adopting DAM solutions to centralize product content, ensure brand consistency, and accelerate time-to-market for new listings and campaigns. The integration of DAM with e-commerce platforms, such as Shopify, Magento, and BigCommerce, allows for dynamic content updates and real-time asset deployment, which also positively influences the Australia digital asset management market outlook. Moreover, DAM systems help automate metadata tagging and enforce content usage rights, reducing the risk of errors and legal issues. As consumer expectations for personalized and visually engaging online shopping experiences grow, DAM platforms are playing a crucial role in supporting content scalability and operational agility for Australian e-commerce businesses of all sizes.

Growth Drivers of Australia Digital Asset Management Market:

Digital Transformation Across Industries

The accelerated rate of digitalization among Australian businesses is a key driver of the market for digital asset management (DAM). As more businesses digitize their activities, there is a greater need for products that are capable of handling large amounts of multimedia content, ranging from photos and videos to documents and marketing materials. DAM systems offer central storage that makes it easy to organize and retrieve, as well as maintain brand consistency over various channels. They also facilitate real-time collaboration, making it possible for remote teams to work together seamlessly on content. By simplifying workflows and eliminating inefficiencies, DAM systems have a direct impact on increased productivity. As companies lead with digital-first strategies to compete, the need for powerful DAM platforms expands, and they become a staple within contemporary enterprise environments.

AI and Machine Learning Integration

Artificial intelligence (AI) and machine learning (ML) are transforming the usability of digital asset management software in Australia. Cutting-edge AI-based features like automated tagging, intelligent classification, and predictive analytics assist organizations in managing large and intricate datasets in an effective manner. Such technologies improve searchability, allowing users to find appropriate files within a fraction of a second through intelligent metadata detection and contextual insights. Personalization is also another key advantage, where AI-driven systems can suggest assets based on user preference and project requirements, enhancing marketing and customer engagement strategies. Machine learning algorithms consistently enhance precision by adapting to usage behaviors, further automating workflows. With companies handling more and more digital assets, the combination of AI and ML turns DAM platforms into highly advanced, intelligent tools that ensure maximum efficiency and scalability.

Focus on Regulatory Compliance

The growing importance of regulatory compliance and data privacy is fueling the Australia digital asset management market demand. With stringent laws such as the Privacy Act and sector-specific data protection regulations, organizations are under pressure to manage and store digital content responsibly. DAM platforms provide structured frameworks to ensure compliance by maintaining detailed audit trails, version control, and secure user access management. These features minimize risks associated with unauthorized usage, data breaches, and non-compliance penalties. Additionally, DAM solutions enhance transparency, allowing businesses to monitor how digital assets are created, distributed, and archived. For industries such as finance, healthcare, and government, where compliance is critical, DAM systems offer the assurance of data integrity and regulatory alignment, thereby strengthening trust and organizational accountability.

Opportunities of Australia Digital Asset Management Market:

Cloud-First Adoption

The growing shift toward cloud-first strategies in Australia presents a significant opportunity for digital asset management (DAM) vendors. Organizations are increasingly prioritizing cloud deployment models due to their flexibility, scalability, and cost-efficiency. Unlike traditional on-premise systems, cloud-based DAM solutions allow businesses of all sizes to access, share, and manage content seamlessly from any location. This is particularly beneficial for enterprises with geographically dispersed teams, as it ensures real-time collaboration and faster decision-making. Cloud platforms also reduce infrastructure expenses while offering automatic updates, improved security, and integration with other digital tools. As companies adopt cloud ecosystems to drive digital transformation, the demand for robust, adaptable, and subscription-based DAM offerings is expected to rise, creating long-term opportunities for vendors and service providers.

Integration with Emerging Technologies

Integrating digital asset management platforms with emerging technologies offers a transformative opportunity for the Australian market. Blockchain integration, for example, can provide enhanced security and authentication of digital assets, reducing risks of copyright infringement or unauthorized usage. Similarly, the adoption of augmented reality (AR) and virtual reality (VR) expands DAM use cases, particularly in marketing, retail, and entertainment, where immersive experiences are becoming essential for customer engagement. According to the Australia digital asset management market analysis, these integrations enable businesses to go beyond basic content storage, creating dynamic and interactive applications that enhance brand visibility. By aligning DAM systems with cutting-edge technologies, vendors can broaden their market reach, attract innovation-driven clients, and position their solutions as strategic tools in industries undergoing digital reinvention.

Sector-Specific Solutions

Another major opportunity lies in offering industry-specific DAM solutions tailored to the unique needs of different sectors. For instance, the healthcare industry requires secure management of patient records and medical imagery, while the education sector relies heavily on digital learning materials and content libraries. The media and entertainment industries demand tools that can handle vast volumes of high-resolution images, videos, and creative assets with efficiency. By providing vertical-focused solutions that address these specialized requirements, vendors can deliver greater value and build stronger customer loyalty. This approach not only enhances user adoption but also creates niche markets with reduced competition. Developing sector-driven DAM platforms enables providers to diversify revenue streams and capitalize on Australia’s growing demand for customized digital solutions.

Challenges of Australia Digital Asset Management Market:

High Implementation Costs

One of the most significant challenges facing the adoption of digital asset management (DAM) platforms in Australia is the high implementation cost. Many small and mid-sized enterprises (SMEs) operate under tight budgets, making it difficult to allocate large capital for advanced digital solutions. DAM platforms often involve expenses related to software licensing, customization, employee training, and ongoing maintenance, which can add up substantially. While larger enterprises may absorb these costs due to broader operational needs, smaller businesses struggle to justify such investments against immediate returns. This financial barrier slows down widespread adoption, particularly in industries where profit margins are thin. To overcome this challenge, vendors must focus on offering flexible pricing models, subscription-based services, and scalable solutions tailored for SMEs.

Complex Integration Issues

Another key challenge for the Australian DAM market is the complexity involved in integrating these platforms with existing enterprise systems. Many organizations already use software such as enterprise resource planning (ERP), customer relationship management (CRM), and other digital tools that are essential to daily operations. Integrating DAM into these ecosystems often requires significant technical expertise, additional resources, and extensive testing to ensure seamless compatibility. Misalignment can lead to operational disruptions, data silos, or duplicated processes, undermining efficiency instead of enhancing it. Smaller firms without dedicated IT teams may find the process particularly overwhelming. This complexity often discourages adoption, highlighting the need for vendors to develop DAM platforms with pre-built integrations, APIs, and simplified deployment processes to ease integration challenges.

Data Security Concerns

Despite the benefits of DAM platforms, data security remains a major concern for Australian organizations. Businesses increasingly rely on cloud-based environments for content storage, but this raises fears of potential vulnerabilities, unauthorized access, and cyberattacks. With sensitive digital assets such as intellectual property, customer data, or creative files at stake, even minor breaches can result in reputational damage and financial loss. Industries like healthcare, finance, and government, where compliance is critical, are particularly cautious about adopting cloud-based DAM systems without robust security assurances. While many platforms offer encryption, multi-factor authentication, and access control, skepticism remains around evolving cyber threats. Addressing these concerns requires continuous investment in cybersecurity features, transparent compliance with regulations, and clear vendor accountability to build customer confidence.

Government Initiatives of Australia Digital Asset Management Market:

Digital Economy Strategy

The Australian government’s Digital Economy Strategy plays a vital role in fostering the growth of advanced technologies, including digital asset management (DAM) platforms. By promoting widespread digital adoption, the strategy encourages businesses across sectors to modernize their operations and invest in innovative tools that drive efficiency. The policy framework supports industries in transitioning to digital-first models, highlighting the importance of secure content management, collaboration, and data-driven decision-making. As organizations align with these national objectives, the demand for DAM solutions naturally increases, particularly among enterprises managing large volumes of digital assets. This initiative not only strengthens Australia’s global competitiveness but also creates a supportive ecosystem where DAM technologies are viewed as essential components of corporate digital transformation.

Support for Cloud and Cybersecurity

Government initiatives aimed at strengthening cloud infrastructure and enhancing cybersecurity are creating a reliable foundation for digital asset management (DAM) adoption in Australia. Public funding and supportive policies ensure that businesses have access to secure, scalable, and modern digital environments that can accommodate advanced platforms. Since DAM often involves managing sensitive or high-value assets, robust cybersecurity measures are critical in building trust among organizations, especially in industries such as healthcare, finance, and government. By encouraging the adoption of secure cloud services, the government ensures businesses can embrace DAM without compromising on data protection. These measures provide companies with the confidence that their assets are safe, enabling greater reliance on cloud-based DAM solutions and driving overall market growth.

Encouragement of Innovation and SMEs

The Australian government actively promotes innovation and supports small and medium-sized enterprises (SMEs) through grants, subsidies, and digital adoption programs. These initiatives create opportunities for startups and smaller firms to access advanced technologies, including digital asset management (DAM) platforms, which they might otherwise find financially challenging to implement. By lowering barriers to entry, such programs foster innovation, efficiency, and competitiveness in the SME sector, which forms a large part of the national economy. Government-backed resources and training also enable SMEs to upskill their workforce, making them better equipped to handle digital transformation. As a result, these initiatives not only accelerate DAM adoption among smaller players but also contribute to building a more digitally resilient and competitive economy.

Australia Digital Asset Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, component, application, deployment, organization size, and end-use sector.

Type Insights:

- Brand Asset Management Systems

- Library Asset Management Systems

- Production Asset Management Systems

The report has provided a detailed breakup and analysis of the market based on the type. This includes brand asset management systems, library asset management systems, and production asset management systems.

Component Insights:

- Solution

- Services

- Consulting

- System Integration

- Support and Maintenance

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes solution and services (consulting, system integration, and support and maintenance).

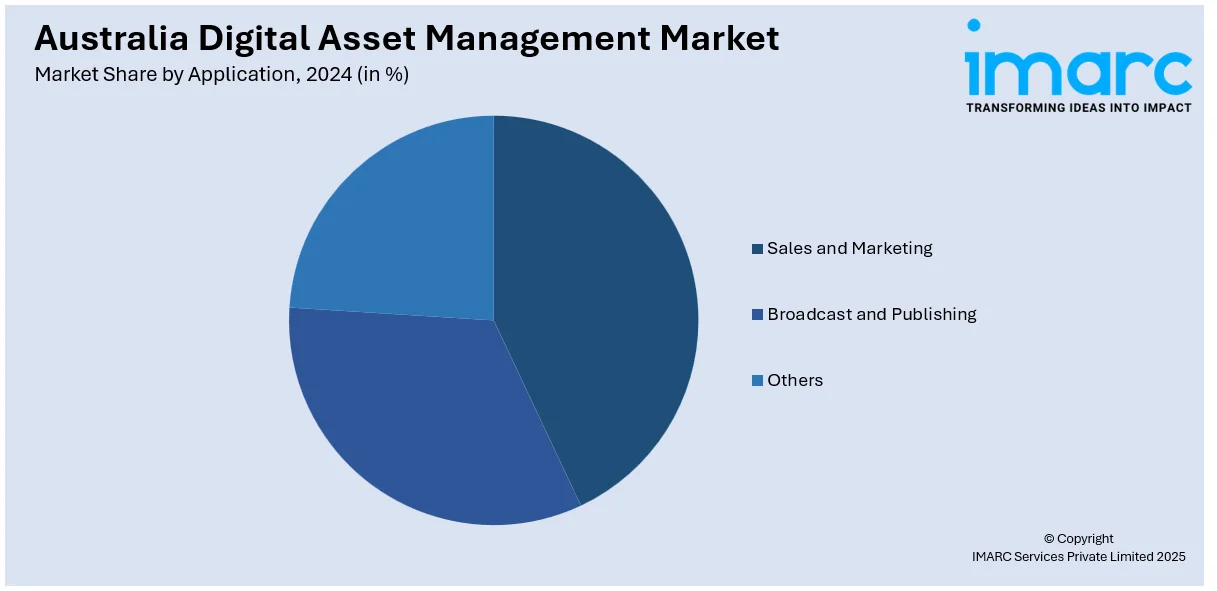

Application Insights:

- Sales and Marketing

- Broadcast and Publishing

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes sales and marketing, broadcast and publishing, and others.

Deployment Insights:

- On-premises

- Cloud

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes on-premises and cloud.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium-sized enterprises and large enterprises.

End-Use Sector Insights:

- Media and Entertainment

- Banking, Financial Services and Insurance (BFSI)

- Retail

- Manufacturing

- Healthcare and Life Sciences

- Education

- Travel and Tourism

- Others

A detailed breakup and analysis of the market based on the end-use sector have also been provided in the report. This includes media and entertainment, banking, financial services and insurance (BFSI), retail, manufacturing, healthcare and life sciences, education, travel and tourism, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Digital Asset Management Market News:

- On June 11, 2024, the Powerhouse Museum in Sydney, Australia, announced the selection of Arcitecta's Mediaflux as its new digital asset management solution. This decision aligns with Powerhouse's USD 1.3 Billion infrastructure renewal program aimed at enhancing the preservation and accessibility of its collection exceeding half a million objects. The implementation of Mediaflux is expected to transform the museum's curatorial processes and user experiences by providing a scalable, secure, and customizable data management platform.

- On December 6, 2024, the Sydney Opera House (SOH) issued a request for tender to implement a new Digital Asset Management (DAM) system. This initiative aims to centralize the storage and organization of the Opera House's digital media files, which are currently dispersed across various locations, including network drives, cloud storage, and physical carriers. The proposed contract is set for a five-year term, with options for two additional one-year extensions.

Australia Digital Asset Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Brand Asset Management Systems, Library Asset Management Systems, Production Asset Management Systems |

| Components Covered |

|

| Applications Covered | Sales and Marketing, Broadcast and Publishing, Others |

| Deployments Covered | On-premises, Cloud |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End-Use Sectors Covered | Media and Entertainment, Banking, Financial Services and Insurance (BFSI), Retail, Manufacturing, Healthcare and Life Sciences, Education, Travel and Tourism, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia digital asset management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia digital asset management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia digital asset management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital asset management market in Australia was valued at USD 88.9 Million in 2024.

The Australia digital asset management market is projected to exhibit a CAGR of 17.2% during 2025-2033.

The Australia digital asset management market is projected to reach a value of USD 412.4 Million by 2033.

The Australia digital asset management market is shaped by rising demand for cloud-based platforms, growing adoption of AI-driven analytics, and increasing need for secure data storage. Trends include integration with workflow automation, remote accessibility, and enhanced personalization to support businesses in managing large volumes of digital content efficiently and securely.

The growth of Australia’s digital asset management market is driven by expanding digital transformation initiatives, rising content creation across industries, and the need for centralized data management. Additionally, increasing cloud adoption, demand for cost-efficient solutions, and emphasis on data security and regulatory compliance are fueling widespread deployment of digital asset management systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)