Australia Digital OOH Advertising Market Size, Share, Trends and Forecast by Format Type, Application, End Use Industry, and Region, 2026-2034

Australia Digital OOH Advertising Market Overview:

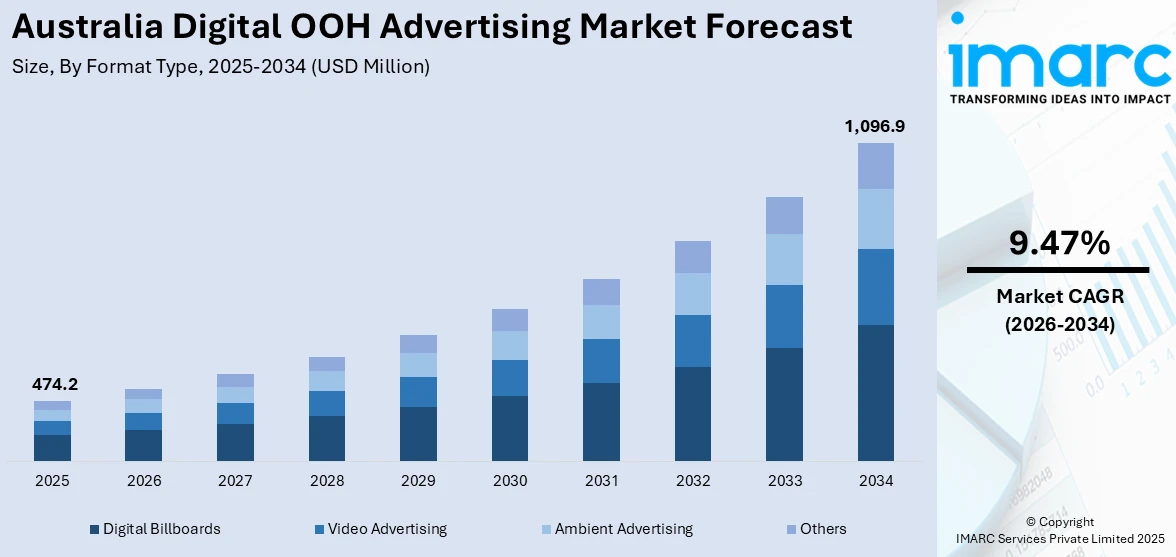

The Australia digital OOH advertising market size reached USD 474.2 Million in 2025. Looking forward, the market is expected to reach USD 1,096.9 Million by 2034, exhibiting a growth rate (CAGR) of 9.47% during 2026-2034. The rising smartphone penetration, advancements in display technology, growing demand for targeted advertising, government investments in smart city projects, higher consumer engagement with digital content, and the shift from traditional to digital media are some of the major factors augmenting Australia digital OOH advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 474.2 Million |

| Market Forecast in 2034 | USD 1,096.9 Million |

| Market Growth Rate 2026-2034 | 9.47% |

Key Trends of Australia Digital OOH Advertising Market:

Expansion of Digital Screens in Urban and Transit Environments

The extensive rollout of digital screens in high-traffic urban areas and transit systems is positively impacting the Australia digital OOH advertising market outlook. Industry reports reveal that every month, 78% of Australians report they see and notice outdoor advertising, while 74% state they encounter a billboard every day. These figures underscore the growing effectiveness and visibility of DOOH campaigns, driven in part by the strategic placement and increasing density of digital screens in daily commuting and shopping environments. Major cities such as Sydney, Melbourne, and Brisbane are seeing an increase in digital billboard placements on roadside locations, shopping malls, airports, railway stations, and bus stops. The growth enables advertisers to target big, mobile audiences with powerful, high-definition screens that enable dynamic content and dayparted messaging. At transit points, digital screens are optimally placed to catch commuter attention, giving advertisers repeated daily impressions and reinforcing message retention. Media businesses are leveraging live data feeds to present contextually relevant advertisements, such as flight information, public service announcements, or live event promotions, thereby engaging viewers. Facial detection and footfall analytics integration also help in improved campaign measurement. With government backing for smart infrastructure and digital transformation, the spread of DOOH assets across public spaces is likely to persist, providing brands with a wide canvas for immersive and interactive campaigns across urban Australia.

To get more information on this market Request Sample

Rising Smartphone Penetration

The growing penetration of smartphones in Australia is providing a boost to Australia digital OOH advertising market growth. According to an industry report, over 90% of Australians own a smartphone; thereby, mobile connectivity is now deeply embedded in daily routines, offering advertisers new channels to interact with consumers. This trend is making DOOH campaigns more interactive and responsive, frequently connecting digital signage with mobile engagement through QR codes, NFC, augmented reality experiences, or location-based services. Smartphones are both a source of data and a response mechanism, enabling advertisers to monitor consumer movement, analyze behavior, and retarget individuals with targeted content. In addition, the convergence of mobile and DOOH platforms enables cross-channel marketing, where messages communicated through digital billboards can be supported by mobile alerts, social media promotions, or in-app offers. This multi-touchpoint approach maximizes campaign reach, recall, and ROI. The increasing use of mobile devices in urban living guarantees that DOOH advertising can increasingly tap into real-time data and contextual triggers to deliver more compelling, seamless brand experiences.

Growth Drivers of Australia Digital OOH Advertising Market:

Technological Advancements and Infrastructure Development

Rapid development of display technologies backed by significant infrastructure development is among the main drivers of Australia's digital out-of-home (DOOH) advertising market growth. There has been a sharp rise in the installation of digital high-resolution screens in major urban locations including Sydney, Melbourne, and Brisbane. These screens have features such as dynamic content refreshes, programmatic ad purchases, and mobile device integration, all of which increase the flexibility and efficacy of advertising campaigns. Additionally, the nation's continued infrastructure investment in smart cities, including public transit locations and business districts, offers prime space for digital signage. This technology-based culture provides a desirable platform for advertisers wishing to reach customers with striking visual, timely, and context-specific messages. The transition from the use of conventional static billboards to dynamic digital media is making it easier to communicate in real time, enabling brands to maximize the relevance of messages to consumers' immediate context and actions.

Emerging Urbanization and Growing Consumer Mobility

Australia's urbanization and increased consumer mobility are major forces driving the Australia digital OOH advertising market demand. As more individuals reside in urban areas and travel increasingly longer distances on a daily basis, effective advertisement advertisers have a bigger and more active audience to reach. The use of electronic billboards in transportation systems like trains, buses, and tram stations grabs commuters' attention during rush hours. Furthermore, Australians' hectic lifestyles translate into their dependence on visual messages in public places, so digital signage is an effective platform to achieve brand exposure and interaction. This trend is further supported by the tourism industry of the country, where digital advertising in tourist spots and airport locations effectively covers a wide range of audiences. Advertisers are taking advantage of these changes by using location-based and time-based campaigns that appeal to locals as well as tourists, increasing the overall effect of DOOH advertising.

Regulatory Support and Industry Cooperation

Policies of the government and industry cooperation in Australia are also supporting expansion in the market of digital OOH advertising. Different state and municipal authorities have come up with regulations that promote the utilization of digital signage while at the same time observing public safety and aesthetic standards. Such clarity in regulation facilitates the deployment of digital screens as well as spurs investment by eliminating delays caused by bureaucracy. In addition, cooperation among advertising agencies, technology suppliers, and outdoor media owners is propelling the market by advancing standardized measurement measures as well as programmatic buying platforms. Industry associations in Australia are proactively striving to improve transparency and accountability, thereby increasing advertiser trust in digital OOH as a powerful marketing medium. Furthermore, sustainability measures touting energy-saving digital screens cooperate with Australia's overall environmental agenda, drawing in businesses with corporate social responsibility focus. Together, these provide a conducive environment for innovation and long-term growth in the digital OOH industry.

Benefits of Australia Digital OOH Advertising Market:

Increased Engagement Through Dynamic and Contextual Content

One of the greatest advantages of digital out-of-home (DOOH) advertising in Australia is that it can provide dynamic, contextually targeted content with greater ability to engage the attention of audiences than static conventional advertising. Australian metropolitan cities such as Sydney and Melbourne are hotbeds of lively consumer activity, where residents are always in transit. Electronic billboards and screens enable advertisers to customize messages according to time of day, weather, and local events, thereby maximizing interaction. This flexibility allows content to be more in line with particular groups of people, be it rush hour commuters or shoppers in shopping precincts. Additionally, the interactive ability of most digital screens, which tend to interact with mobile devices via QR codes or augmented reality experiences, enhances consumer engagement even more, providing immersive brand experiences that translate to greater recall and conversion.

Wider Coverage and More Accurate Targeting

According to the Australia digital OOH advertising market analysis, the cultural diversity of the population and far-reaching urban-rural split make DOOH advertising especially useful for coverage of a wide and diverse audience. Digital screens are located in heavy-traffic areas like airports, shopping malls, transport hubs, and busy city streets, where brands can reach locals, visitors, and business travelers. One such special benefit in the Australian context is the combination of data analytics and location technologies, which enables advertisers to implement sharply targeted campaigns. Through the use of demographic, behavioral, and environmental information, marketers are able to tailor ad placements to target specific consumer groups more accurately. This ability decreases wasted impressions and maximizes campaign ROI. In addition, DOOH advertising integrates well with digital and mobile marketing initiatives, providing an effective multi-channel solution that enhances brand visibility and engagement across touchpoints.

Sustainability and Cost-Effectiveness in Advertising

The Australian consumer appreciates sustainability, and digital OOH advertising fits this philosophy by minimizing wastage of the print and stationary billboard type. As opposed to paper-based advertisement that needs to be constantly replaced, digital screens present a recyclable medium where messages can be changed instantly without extra material expenses. This minimizes the environmental footprint of street advertising in cities renowned for their green-based programs. Additionally, developments in power-efficient screen technologies assist in reducing the use of electricity, responding to issues surrounding carbon footprints. On a financial basis, digital OOH provides marketing entities with budget flexibility through real-time data adjustments and programmatic purchasing. This responsiveness promotes the ability to fine-tune campaigns using performance metrics to maximize cost-effectiveness and enable Australian companies of all sizes to get the most out of their ad spend while promoting environmental objectives.

Australia Digital OOH Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on format type, application, and end use industry.

Format Type Insights:

- Digital Billboards

- Video Advertising

- Ambient Advertising

- Others

The report has provided a detailed breakup and analysis of the market based on the format type. This includes digital billboards, video advertising, ambient advertising, and others.

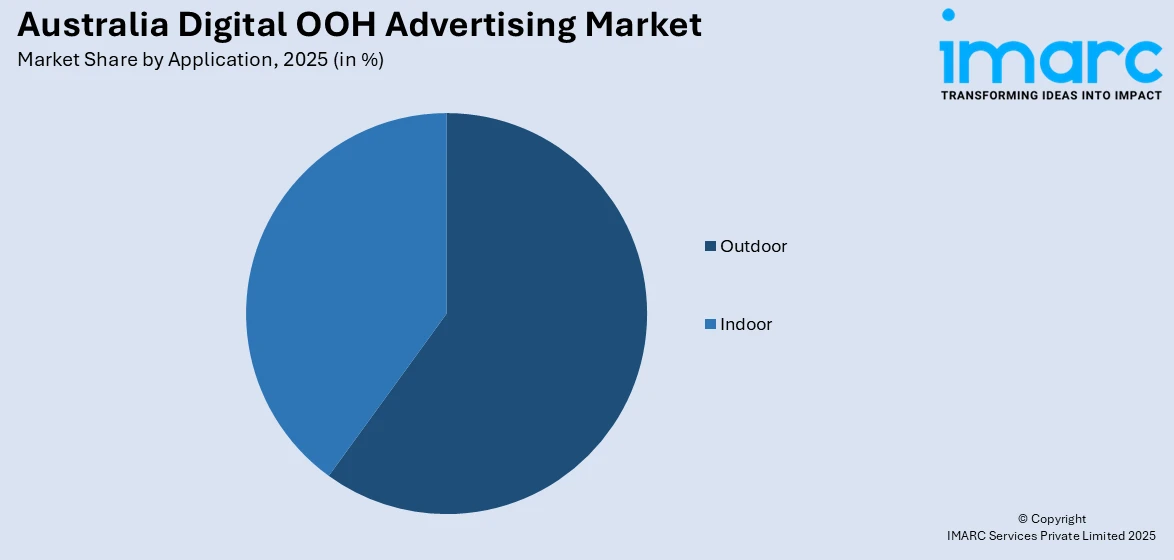

Application Insights:

Access the comprehensive market breakdown Request Sample

- Outdoor

- Indoor

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes outdoor and indoor.

End Use Industry Insights:

- Retail

- Recreation

- Banking

- Transportation

- Education

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes retail, recreation, banking, transportation, education, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Digital OOH Advertising Market News:

- On October 1, 2024, oOh!media and ANZ Falcon launched Australia's largest 3D OOH advertising campaign, deploying over 2,100 full-motion digital screens across retail, rail, fly, office, and study environments. The campaign highlights ANZ's fraud detection and prevention technology, emphasizing the bank's commitment to safeguarding customers from cyber threats. This initiative marks the first mass-reach, scalable 3D OOH campaign in Australia, showcasing the creative potential of 3D digital advertising at scale.

- On December 17, 2024, FRAMEN partnered with VIOOH to introduce advanced digital advertising screens in co-working spaces across Brisbane, Sydney, Perth, and Melbourne. The inaugural campaign featured Virgin Australia, aiming to engage professionals in high-traffic areas. This collaboration signifies a strategic move to enhance programmatic digital out-of-home advertising in Australia's major cities.

Australia Digital OOH Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Format Types Covered | Digital Billboards, Video Advertising, Ambient Advertising, Others |

| Applications Covered | Outdoor, Indoor |

| End Use Industries Covered | Retail, Recreation, Banking, Transportation, Education, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia digital OOH advertising market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia digital OOH advertising market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia digital OOH advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia digital OOH advertising market was valued at USD 474.2 Million in 2025.

The Australia digital OOH advertising market is projected to exhibit a CAGR of 9.47% during 2026-2034.

The Australia digital OOH advertising market is expected to reach a value of USD 1,096.9 Million by 2034.

The Australia digital OOH advertising market trends include increased use of programmatic advertising, real-time content customization, and integration with mobile technologies. Interactive digital displays and data-driven targeting are becoming standard. Additionally, there is a strong focus on sustainability with energy-efficient screens and eco-friendly practices , which is further shaping market evolution.

Key drivers of Australia digital OOH advertising market include growing urbanization, increased consumer mobility, and advancements in digital display technologies. Real-time data integration, audience targeting, and smart city initiatives are enhancing campaign effectiveness. Brands are leveraging dynamic content to engage consumers, further driving demand for innovative outdoor advertising solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)