Australia Digital Video Content Market Size, Share, Trends and Forecast by Business Model, Type, Device, and Region, 2025-2033

Australia Digital Video Content Market Size and Share:

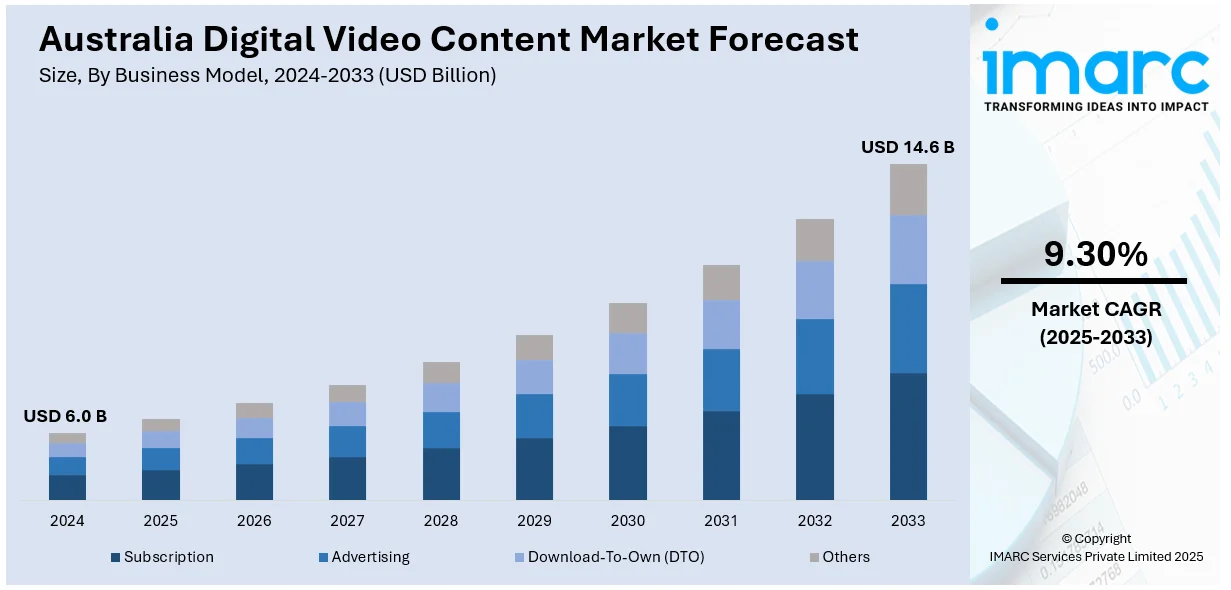

The Australia digital video content market size reached USD 6.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.6 Billion by 2033, exhibiting a growth rate (CAGR) of 9.30% during 2025-2033. The rising internet penetration, increasing smartphone adoption, growing demand for streaming services, expanding 5G networks, rising consumer preference for on-demand content, advancements in artificial intelligence (AI) driven content recommendations, increasing investment in original productions, and the growing influence of social media platforms are some of the major factors augmenting the Australia digital video content market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.0 Billion |

| Market Forecast in 2033 | USD 14.6 Billion |

| Market Growth Rate 2025-2033 | 9.30% |

Australia Digital Video Content Market Trends:

Extending Subscription-Based Streaming Services

The market is witnessing a significant rise in subscription-based streaming services, driven by the increasing requirement for high-quality, on-demand content. The proliferation of global platforms, such as Netflix, Disney+, and Amazon Prime Video, alongside local players is intensifying competition. Consumers are shifting away from traditional cable television in favor of personalized, ad-free viewing experiences supported by artificial intelligence (AI) driven content recommendations. In addition to this, the availability of diverse content libraries, including international blockbusters, original productions, and localized content, is further facilitating the Australia digital video content market growth. Moreover, the introduction of bundled service offerings, partnerships with telecom providers, and aggressive pricing strategies are enhancing user retention and acquisition. According to an industry report, 5G subscriptions are predicted to account for 86% of all mobile subscriptions by 2029 in Australia. The growing penetration of 5G networks is improving streaming quality, reducing buffering issues, and enabling 4K and HDR content consumption. As a result, streaming services are investing heavily in content production and exclusive licensing deals to differentiate themselves in a highly competitive market. This trend underscores a fundamental shift in consumer entertainment preferences, reshaping Australia's digital video landscape.

To get more information on this market, Request Sample

Growth of Local Content Production and Regional Storytelling

The increasing consumer demand for culturally relevant narratives and government incentives supporting domestic media industries is encouraging local content and positively impacting the Australia digital video content market outlook. Furthermore, streaming platforms and broadcasters are prioritizing Australian-made films, series, and documentaries to cater to local audiences and comply with emerging content regulations. The success of locally produced shows on global platforms demonstrates the market's appetite for authentic regional storytelling. Apart from this, the implementation of government funding initiatives, such as Screen Australia's investment programs, is bolstering content creation by supporting independent filmmakers and production houses. According to an industry report, Netflix spent more than AUSD 1 Billion on Australian and Australian-related Netflix series and movies for four years (2019–2023), underscoring the growing demand for local content in the market. Global streaming platforms are increasingly recognizing the value of Australian productions in attracting both regional and international audiences, leading to a surge in co-productions and exclusive licensing agreements. In line with this, continual advancements in production technology, including virtual production and artificial intelligence (AI) driven editing, are further enhancing the efficiency and quality of content creation. This trend reflects a broader shift toward content localization, which is also strengthening Australia's position in the global digital entertainment industry.

Australia Digital Video Content Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on business model, type, and device.

Business Model Insights:

- Subscription

- Advertising

- Download-To-Own (DTO)

- Others

The report has provided a detailed breakup and analysis of the market based on the business model. This includes subscription, advertising, download-to-own (DTO), and others.

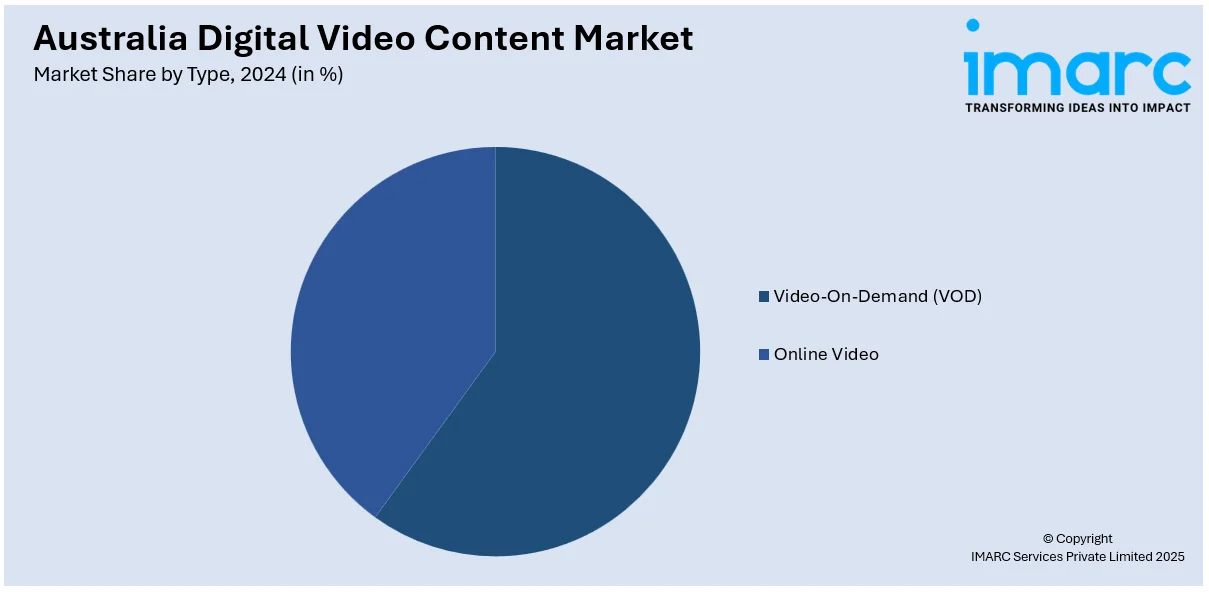

Type Insights:

- Video-On-Demand (VOD)

- Online Video

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes video-on-demand (VOD) and online video.

Device Insights:

- Laptop

- PC

- Mobile

- Others

The report has provided a detailed breakup and analysis of the market based on the device. This includes laptop, PC, mobile, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Digital Video Content Market News:

- March 31, 2025, Warner Bros discovery declared that its streaming service, Max, would begin in Australia. The platform offers a comprehensive library of HBO series, Warner Bros. films, and Max Originals, including titles such as "The Last of Us," "House of the Dragon," and the "Harry Potter" franchise. Subscription plans are competitively priced, with the Basic plan at AUSD 7.99 per month, Standard at AUSD 11.99 per month, and Premium at AUSD 17.99 per month.

Australia Digital Video Content Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Models Covered | Subscription, Advertising, Download-To-Own (DTO), Others |

| Types Covered | Video-On-Demand (VOD), Online Video |

| Devices Covered | Laptop, PC, Mobile, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia digital video content market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia digital video content market on the basis of business model?

- What is the breakup of the Australia digital video content market on the basis of type?

- What is the breakup of the Australia digital video content market on the basis of device?

- What is the breakup of the Australia digital video content market on the basis of region?

- What are the various stages in the value chain of the Australia digital video content market?

- What are the key driving factors and challenges in the Australia digital video content market?

- What is the structure of the Australia digital video content market and who are the key players?

- What is the degree of competition in the Australia digital video content market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia digital video content market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia digital video content market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia digital video content industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)