Australia Docking Station Market Size, Share, Trends and Forecast by Type, Technology, Application, Distribution Channel, and Region, 2025-2033

Australia Docking Station Market Overview:

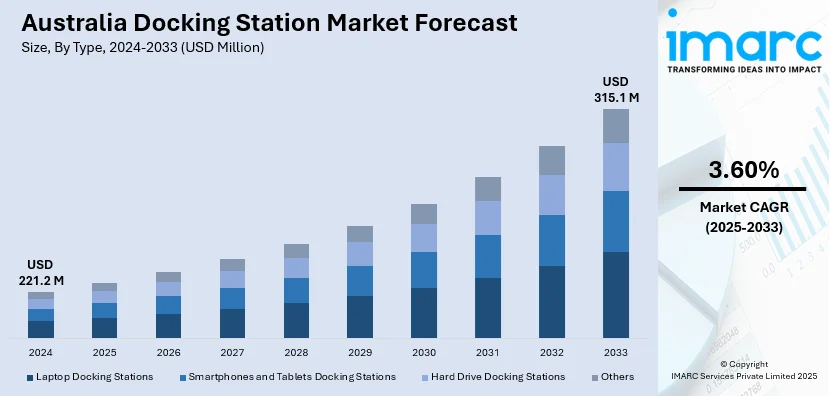

The Australia docking station market size reached USD 221.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 315.1 Million by 2033, exhibiting a growth rate (CAGR) of 3.60% during 2025-2033. The market is driven by rising remote work adoption, increasing laptop and tablet usage, surging demand for multi-device connectivity, ongoing technological advancements, growing bring your own device (BYOD) trends, expanding gaming setups, and rising need for efficient workspace organization.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 221.2 Million |

| Market Forecast in 2033 | USD 315.1 Million |

| Market Growth Rate 2025-2033 | 3.60% |

Australia Docking Station Market Trends:

Surge in Remote Work and BYOD Policies

The surging adoption of remote work and BYOD policies is significantly boosting the Australia docking station market share. In addition to this, workplace connectivity solutions are becoming essential due to rising employee usage of home offices and their personal devices to perform professional tasks. Moreover, docking stations help users increase their productivity through multiple peripheral connections between laptops tablets and smartphones, thus improving workspace efficiency. Besides this, the current workplace flexibility wave aligns with the global trend toward flexible work arrangements because employees need setups that smoothly shift between office and home-based work. For example, in 2024, Targus released the USB4 Triple Video Docking Station in Australia, offering up to 100W power delivery and support for triple 4K displays, meeting the evolving needs of hybrid professionals. Furthermore, docking stations serve as core components in today's modern work environments, as they deliver practical utility, addressing the developing requirements of Australian employees.

To get more information on this market, Request Sample

Technological Advancements and USB-C Adoption

The Australia docking station market growth is expanding, as manufacturers have adopted the universal serial bus (USB)-C port across multiple devices. In line with this, modern manufacturers and consumers choose USB-C because it delivers data transfer combined with power delivery and video output capabilities through one unified connector. Concurrently, the market evolution has also triggered the docking station development of multiple device-compatible models covering ultrabooks, tablets, and smartphones. In confluence with this, the implementation of high-speed data transfer features and multiple display support, along with charging capabilities, matches the growing need for efficient work arrangements. For instance, in 2024, Belkin launched its USB-C 11-in-1 Pro GaN Dock 150W in Australia, offering high-speed connectivity, power delivery, and multi-device support, fueling demand for compact, performance-oriented workstations. Additionally, the rising demand from Australian companies and users to upgrade their technology systems drives the growth of specialized docking systems that mirror global trends for a unified connection solution, thereby enhancing the Australia docking station market outlook.

Australia Docking Station Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, technology, application, and distribution channel.

Type Insights:

- Laptop Docking Stations

- Smartphones and Tablets Docking Stations

- Hard Drive Docking Stations

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes laptop docking stations, smartphones and tablets docking stations, hard drive docking stations, and others.

Technology Insights:

- Wired Docks

- Wireless Docks

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes wired docks and wireless docks.

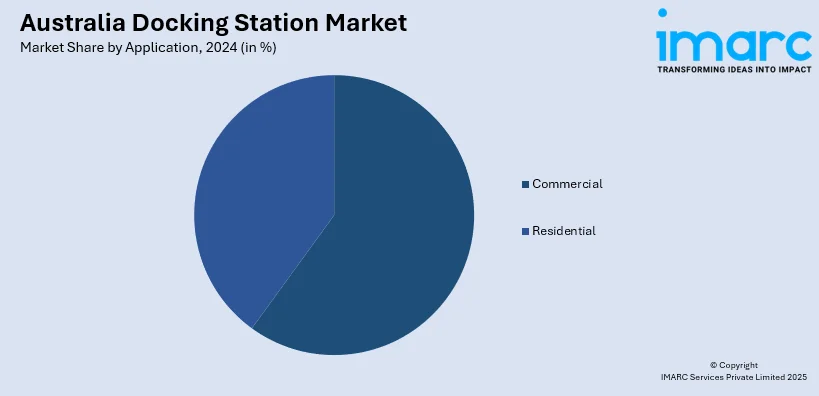

Application Insights:

- Commercial

- Residential

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial and residential.

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Docking Station Market News:

- In March 2025, Kensington released the SD5000T5 EQ, a Thunderbolt 5 docking station supporting triple 4K displays, enhancing productivity for users requiring multiple high-resolution monitors. This product caters to professionals seeking advanced multi-display setups, thereby expanding the market for high-end docking stations.

- In October 2024, Cable Matters introduced a next-generation Thunderbolt™ 5 docking station, offering up to 120 Gbps bandwidth, three times more than Thunderbolt 4, enabling ultra-fast data transfers and superior display experiences. By delivering cutting-edge speed and compatibility, this innovation meets the increasing demand for high-performance docking solutions in professional and creative sectors.

Australia Docking Station Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Laptop Docking Stations, Smartphones and Tablets Docking Stations, Hard Drive Docking Stations, Others |

| Technologies Covered | Wired Docks, Wireless Docks |

| Applications Covered | Commercial, Residential |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia docking station market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia docking station market on the basis of type?

- What is the breakup of the Australia docking station market on the basis of technology?

- What is the breakup of the Australia docking station market on the basis of application?

- What is the breakup of the Australia docking station market on the basis of distribution channel?

- What is the breakup of the Australia docking station market on the basis of region?

- What are the various stages in the value chain of the Australia docking station market?

- What are the key driving factors and challenges in the Australia docking station?

- What is the structure of the Australia docking station market and who are the key players?

- What is the degree of competition in the Australia docking station market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia docking station market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia docking station market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia docking station industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)