Australia Dog Food Market Size, Share, Trends and Forecast by Product Type, Pricing Type, Ingredient Type, Distribution Channel, and Region, 2025-2033

Australia Dog Food Market Size and Share:

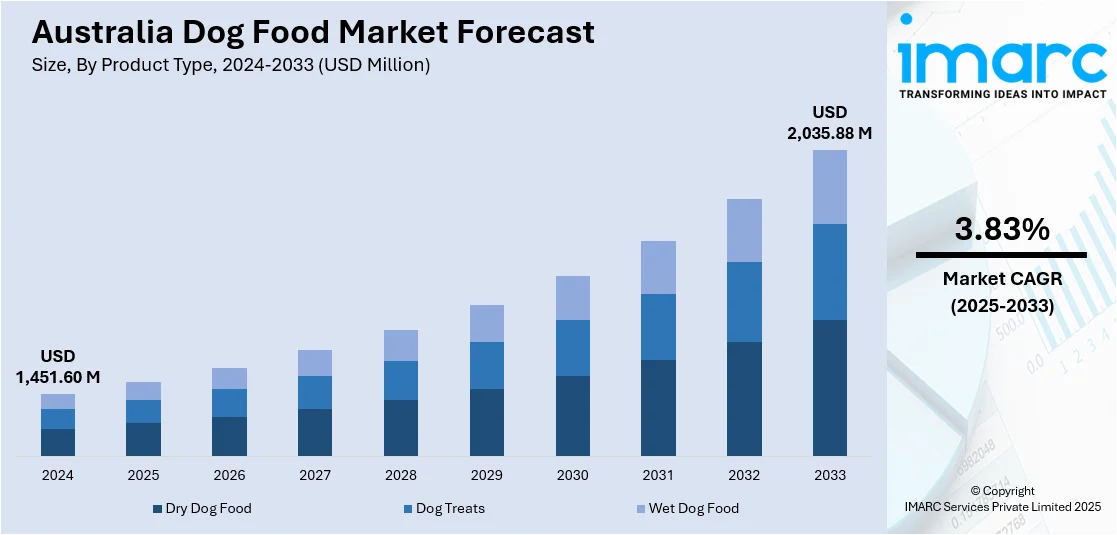

The Australia dog food market size reached USD 1,451.60 Million in 2024. Looking forward, the market is expected to reach USD 2,035.88 Million by 2033, exhibiting a growth rate (CAGR) of 3.83% during 2025-2033. The market is being driven by rising pet humanization trends, elevating demand for premium and health-focused products, growing adoption of e-commerce platforms, and innovations in sustainable and alternative protein sources, all contributing to a dynamic shift in consumer preferences and purchasing behaviors across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,451.60 Million |

| Market Forecast in 2033 | USD 2,035.88 Million |

| Market Growth Rate 2025-2033 | 3.83% |

Key Trends of Australia Dog Food Market:

Pet Humanization Trends and Shift Toward Product Premiumization

In Australia, pets are no longer perceived as animals, but also as core members of family groups. This shifting attitude is having a profound impact on purchasing habits, with buyers prepared to pay more for products of higher quality that offer quantifiable health advantages, richer taste, and sustainable sourcing. Pet owners are pushing for ingredient transparency, with demand for natural, grain-free, organic, and nutrient-dense recipes growing. Sales of premium dry kibbles, gourmet canned foods, raw diets, and freeze-dried equivalents have all surged significantly. Australian pet food manufacturers are meeting this demand with differentiated product ranges, focusing on wellness features such as joint health, skin well-being, digestive care, and age-related diets (e.g., puppy, adult, senior diets). Functional additives such as probiotics, omega-3 fatty acids, and emerging proteins (e.g., kangaroo, duck, salmon) are also increasing in popularity, which further assist in increasing the Australia dog food market share.

To get more information on this market, Request Sample

Rise in E-commerce and Digital Pet Retailing

Another significant driver in the Australian dog food market is the rapid expansion of e-commerce and digital retail platforms, which have transformed the manner in which Australians purchase pet food. The emergence of online marketplaces, subscription services, and direct-to-consumer (DTC) pet food brands has significantly expanded access, convenience, and personalization for pet owners nationwide, particularly in remote or underserved regions. Post-pandemic consumer habits have remained skewed heavily towards digital platforms. Australian consumers now anticipate the same convenience and frictionless user experience when purchasing dog food as they would with other household products. This encompasses simple navigation, flexible payment options, auto-replenishment capabilities, same-day or next-day delivery, and mobile app compatibility. Furthermore, e-commerce websites provide price comparison, reading product reviews, and browsing niche products not generally available in physical stores. The digital revolution has also enabled smaller, niche, and independent brands to reach the consumer market without needing to use traditional retail distribution channels. Social media and influencer marketing are being used by many startups to target younger, technology-using pet owners, which further contributes significantly to the Australia dog food market demand.

Growth Drivers of Australia Dog Food Market:

Urban Lifestyle Changes and Need for Convenient Feeding Solutions

Australia's rising urban lifestyle is greatly influencing dog food purchasing trends. With more Australians residing in apartments or small urban homes—especially in Sydney, Melbourne, and Brisbane, there is increasing demand for dog food solutions that provide convenience and nutrition. Busy pet owners are relying on ready-to-eat meals, portioned packages, and long-shelf-life foods that save time in meal preparation without sacrificing quality. Wet food packets, freeze-dried meals, and air-dried kibble are becoming increasingly popular due to convenience and storage advantages. Pet parents also seek food that is appropriate for small or indoor breeds and tend to opt for foods that promote digestive health and odor reduction. The convenience move also manifests in packaging innovations such as resealable packaging bags and single-serve packaging. This lifestyle-driven demand in the region’s expanding urban population is driving innovation and diversification in the dog food market, rendering convenience as a key Australia dog food market growth driver.

Focus on Local Sourcing and Regional Premiumization

Australia's fertile agricultural industry and high demand for quality food safety standards have influenced consumer attitudes about local sourcing and premium ingredients in pet food. Pet owners increasingly prefer products that prominently emphasize locally sourced grains, meats, and fish, believing Australian-made dictates higher nutrition and less processing. Such regional loyalty not only benefits home-grown pet food companies but also separates products from non-domestic imports. Consumers in urban and regional markets frequently align their purchases with brands that align with local farmers or emphasize Australian origin. The dynamics stimulate manufacturers to upgrade ingredient choice, endorsing grass-fed lamb from New South Wales, sustainably caught fish from Tasmania, or kangaroo meat from remote areas. It is as much about perceived quality as it is ethical and environmental congruence, as brands place a strong focus on pastoral agricultural practices and traceability all the way back to Australian land. This emphasis on local sourcing and premium positioning is a major contributor to driving the Australian dog food industry forward.

Specialized Diets and Vet-Approved Products on the Rise

According to the Australia dog food market analysis, more pet owners are looking for specialized diets to meet the distinct health requirements of their dogs. From treating food allergies to maintaining joint health or helping to control weight, these functional foods are gaining ground on veterinary clinic shelves and retail stores. The trend is especially prevalent in a nation such as Australia, where routine vet visits and preventative care are entrenched aspects of pet ownership. Products recommended or prescribed by veterinarians like prescription kibble to address renal problems or limited-ingredient diets, are being relied upon by owners who seek targeted solutions. The option to find breed-specific and life-stage-specific formulations has also increased, making pet parents make better-informed decisions. With dogs living longer and their health needs becoming more intricate, this shift toward scientific, health-based formulations has a pivotal position in the market. The close association between pet food options and veterinary treatments is an exceptionally strong driver of growth in the dog food market in Australia.

Australia Dog Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, pricing type, ingredient type, and distribution channel.

Product Type Insights:

- Dry Dog Food

- Dog Treats

- Wet Dog Food

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dry dog food, dog treats, and wet dog food.

Pricing Type Insights:

- Mass Products

- Premium Products

A detailed breakup and analysis of the market based on the pricing type have also been provided in the report. This includes mass products and premium products.

Ingredient Type Insights:

- Animal Derived

- Plant Derived

The report has provided a detailed breakup and analysis of the market based on the ingredient type. This includes animal derived and plant derived.

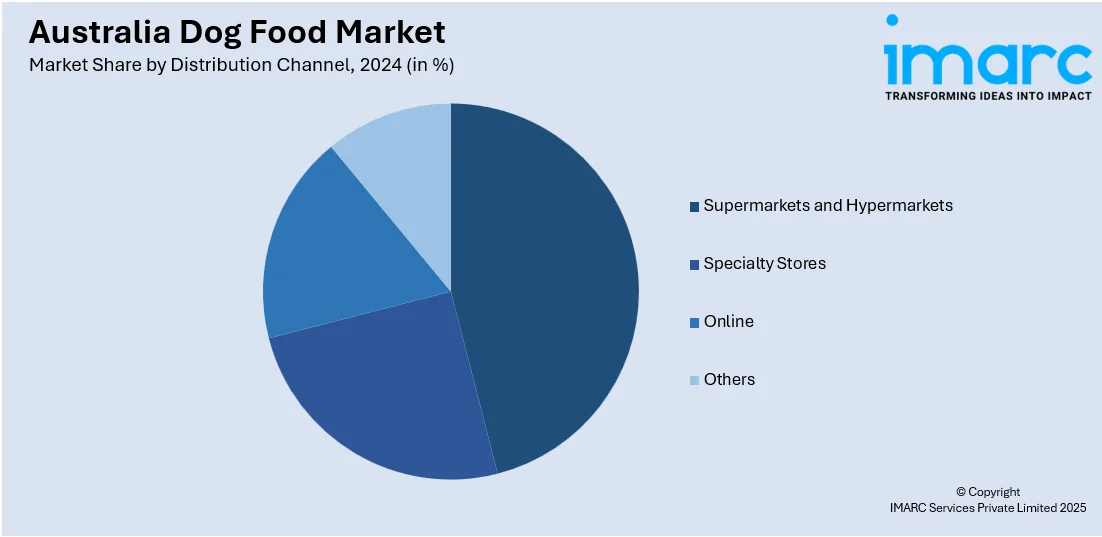

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Advance Pet

- Ivory Coat

- Lifewise

- Lyka Pet Food

- Masterpet Australia Pty Ltd

- Orijen

- Petzyo

- SavourLife Pty Ltd

- Vetalogica

Australia Dog Food Market News:

- February 2025: Colgate-Palmolive agreed to acquire Care TopCo Ltd., owner of Australia's Prime100 pet food brand, to expand its Hill’s Pet Nutrition division into the fresh dog food market. Prime100, based in Melbourne, offers both refrigerated and shelf-stable dog food products, and this acquisition aligns with Colgate-Palmolive's strategy to enhance its presence in the premium pet nutrition sector.

- November 2024: Scratch launched a line of raw and frozen dog food named Scratch Raw. Crafted at their Melbourne facility, it combines human-grade ingredients like beef chuck, salmon, kale, and sweet potatoes, blanched and frozen to preserve nutrients. The product includes a 'nutriblock', a cube of natural ingredients, to ensure complete nutrition without synthetic additives, offering a convenient, mess-free feeding solution.

- July 2024: Real Pet Food Co. introduced Australia's first dog food using black soldier fly (BSF) protein with its Billy + Margot Insect Single Protein + Superfoods line. This innovative product, sold exclusively at Petbarn stores and online, features BSF meal as the sole protein source, offering a sustainable and nutritious alternative for dogs.

Australia Dog Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dry Dog Food, Dog Treats, Wet Dog Food |

| Pricing Types Covered | Mass Products, Premium Products |

| Ingredient Types Covered | Animal Derived, Plant Derived |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Advance Pet, Ivory Coat, Lifewise, Lyka Pet Food, Masterpet Australia Pty Ltd, Orijen, Petzyo, SavourLife Pty Ltd, Vetalogica, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia dog food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia dog food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia dog food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia dog food market was valued at USD 1,451.60 Million in 2024.

The Australia dog food market is projected to exhibit a CAGR of 3.83% during 2025-2033.

The Australia dog food market is expected to reach a value of USD 2,035.88 Million by 2033.

The Australia dog food market is evolving with a clear shift toward premium, health-focused formulations. Grain-free, single-protein, and locally sourced options are rising in popularity, fueled by humanization trends. There is also increasing interest in functional diets for weight control, allergy care, and joint support, alongside growth in subscription-based e-commerce.

The Australia dog food market is driven by rising pet ownership, urban lifestyles, and increasing demand for premium, health-oriented products. Local sourcing, convenience, and vet-recommended diets further support growth. E-commerce expansion and the growing humanization of pets are encouraging innovation in ingredients, packaging, and personalized nutrition across the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)