Australia Drilling Equipment Market Size, Share, Trends and Forecast by Type, Category, Power Source, Mount Type, Distribution Channel, End-Use, and Region, 2025-2033

Australia Drilling Equipment Market Size and Share:

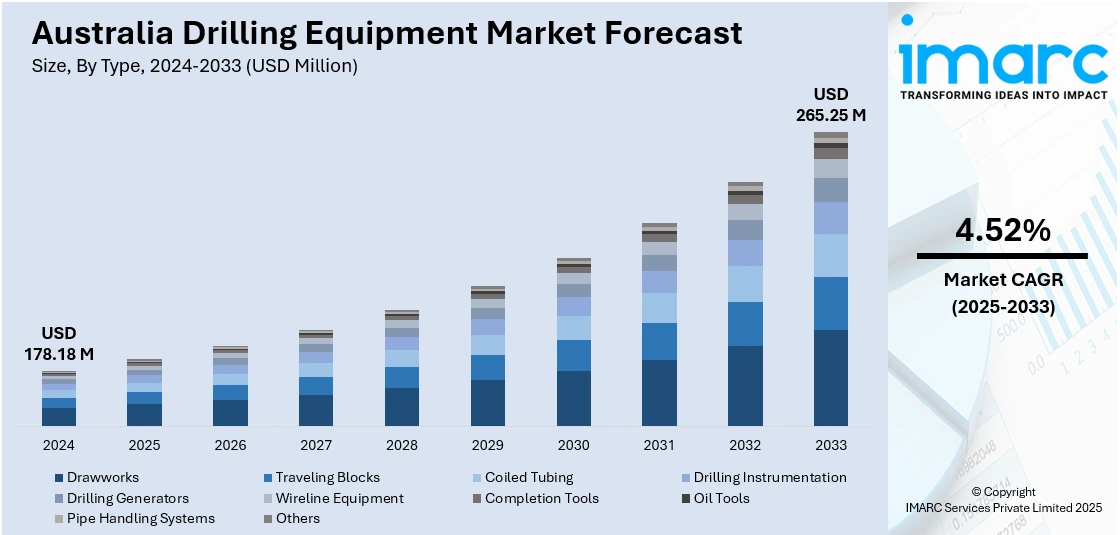

The Australia drilling equipment market size reached USD 178.18 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 265.25 Million by 2033, exhibiting a growth rate (CAGR) of 4.52% during 2025-2033. The market is driven by increasing demand from the mining and exploration sectors, as Australia's rich mineral deposits continue to fuel expansion in resource extraction. Technological advancements in drilling machinery, such as automation and real-time monitoring, significantly enhance operational efficiency and safety, fueling the market. Government-led initiatives supporting infrastructure development and energy security projects further create opportunities for drilling companies, augmenting the Australia drilling equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 178.18 Million |

| Market Forecast in 2033 | USD 265.25 Million |

| Market Growth Rate 2025-2033 | 4.52% |

Key Trends of Australia Drilling Equipment Market:

Rising Demand in Mining and Exploration

The market for drilling equipment in Australia is significantly driven by the high profile of the country in the natural resource extraction and mining sectors. With Australia being among the world's top exporters of minerals like coal, iron ore, and gold, the demand for effective and sophisticated equipment for drilling is increasing. Mining activities need strong and resilient equipment to access deep ore deposits, and businesses are making investments in technologies such as automation, artificial intelligence, and advanced sensor systems to optimize operational efficiency and minimize downtime. For instance, Fervo Energy’s geothermal drilling campaign demonstrated sustained drilling rates of 70 feet per hour with a 60% reduction in drilling time, show examples of the improvements made to drilling efficiency by recent technologies, even in difficult areas. High-performance drilling methods using technology are gaining importance for mining companies in Australia. Besides, the Australian government’s active work to promote resources has led to more exploration attempts. While working towards meeting the environment standards, mining businesses are beginning to incorporate more green technologies. As a result, the growing resource extraction industry and advanced drilling technology lead to greater demand for drilling equipment which boosts the Australia drilling equipment market growth.

To get more information on this market, Request Sample

Government Initiatives and Infrastructure Development

The Australian government plays an instrumental role in the growth of the drilling equipment market by supporting infrastructure projects and resource development initiatives. In recent years, there has been an emphasis on increasing infrastructure development, particularly in remote and regional areas, which often require drilling for natural resource extraction, water supply, and energy projects. Government investments in large-scale infrastructure projects, such as roads, utilities, and ports, create significant opportunities for drilling companies to supply the necessary machinery. Additionally, the government’s push towards energy security, including investments in renewable energy sources like geothermal and geothermal exploration, is further expanding the scope of drilling activities. Public-private partnerships also help fund infrastructure projects that require high-quality drilling solutions. On March 31, 2025, SLB was awarded a major drilling contract by Woodside Energy for the ultra-deepwater Trion development project offshore Mexico. The contract involves delivering 18 ultra-deepwater wells with an integrated services approach, utilizing AI-enabled drilling capabilities to enhance operational efficiency and well quality. Services are set to begin in early 2026, with first production targeted for 2028, further solidifying SLB's position in ultra-deepwater drilling. As these initiatives continue to unfold, drilling companies are better positioned to capitalize on the opportunities arising from both public and private sector investments, further solidifying their position in the market. The government's active role in infrastructure development is a clear and influential driver in propelling the demand for drilling equipment in Australia.

Technological Advancements and Equipment Modernization

The rapid technological advancement and modernization of drilling machinery are significantly boosting the Australia drilling equipment market demand. Companies are now investing massively in next-generation equipment using automation, artificial intelligence, and real-time data analytics. These kinds of innovations are meant to improve the precision of drilling performance while controlling operational costs. Drilling safety can be enhanced, especially in remote or hazardous environments. Smart drilling rigs are also emerging with IoT sensors and autonomous control systems that help in predictive maintenance and reduction of downtime. Also being pursued is the use of digital twin technology to model drilling activities and maximize performance. This transition towards high-tech, high-efficiency equipment not only revolutionizes operational processes but also provides businesses with a competitive advantage in a world that needs sustainability, productivity, and responsiveness.

Growth Factors of Australia Drilling Equipment Market:

Rising Disposable Incomes and Affluent Consumer Base

Australia’s growing economy has led to a surge in disposable incomes, especially among high-net-worth individuals and urban professionals. This financial independence is driving demand for luxury cars that provide greater comfort, prestige, and the latest features. Buyers are increasingly perceiving luxury cars as lifestyle declarations and investments in the long term. Metropolitan cities such as Sydney and Melbourne are experiencing a surge in luxury car showrooms and experiential retail outlets, raising brand awareness. Additionally, the growing entrepreneurial class and technology-educated millennials are favoring premium cars that align with their success and goals. This trend is encouraging global luxury car brands to introduce exclusive models and personalized services tailored to Australian preferences.

Technological Advancements and Innovation

Luxury car manufacturers are integrating advanced technologies to enhance the driving experience, safety, and connectivity. Features such as adaptive cruise control, AI-powered infotainment systems, autonomous driving capabilities, and enhanced suspension systems are becoming standard in high-end vehicles. Australian consumers are particularly drawn to innovations that combine performance with convenience and sustainability. The integration of smart features and digital interfaces aligns with the tech-forward lifestyle of modern buyers. According to the Australia drilling equipment market analysis, luxury brands are investing in research and development (R&D) to offer unique driving experiences, such as augmented reality dashboards and biometric access. These innovations not only differentiate luxury vehicles from standard models but also justify their premium pricing.

Shift Toward Electric and Hybrid Luxury Vehicles

Environmental consciousness and government incentives are accelerating the adoption of electric and hybrid luxury cars in Australia. Brands like BMW, Tesla, and Mercedes-Benz are expanding their EV portfolios, offering high-performance models that align with sustainability goals. Consumers are increasingly seeking zero-emission vehicles without compromising on luxury, performance, or design. The Australian government’s support through tax benefits and infrastructure development, such as EV charging stations, is further encouraging this shift. Luxury EVs are also perceived as futuristic and innovative, appealing to environmentally aware, tech-savvy buyers. This transition is reshaping the competitive landscape, prompting traditional automakers to prioritize green technologies in their luxury offerings.

Australia Drilling Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, category, power source, mount type, distribution channel, and end-use.

Type Insights:

- Drawworks

- Traveling Blocks

- Coiled Tubing

- Drilling Instrumentation

- Drilling Generators

- Wireline Equipment

- Completion Tools

- Oil Tools

- Pipe Handling Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes drawworks, traveling blocks, coiled tubing, drilling instrumentation, drilling generators, wireline equipment, completion tools, oil tools, pipe handling systems, and others.

Category Insights:

- Automatic

- Manual

The report has provided a detailed breakup and analysis of the market based on the category. This includes automatic and manual.

Power Source Insights:

- Electric

- Non-Electric

The report has provided a detailed breakup and analysis of the market based on the power source. This includes electric and non-electric.

Mount Type Insights:

- Truck Mounted

- Trailer Mounted

The report has provided a detailed breakup and analysis of the market based on the mount type. This includes truck mounted and trailer mounted.

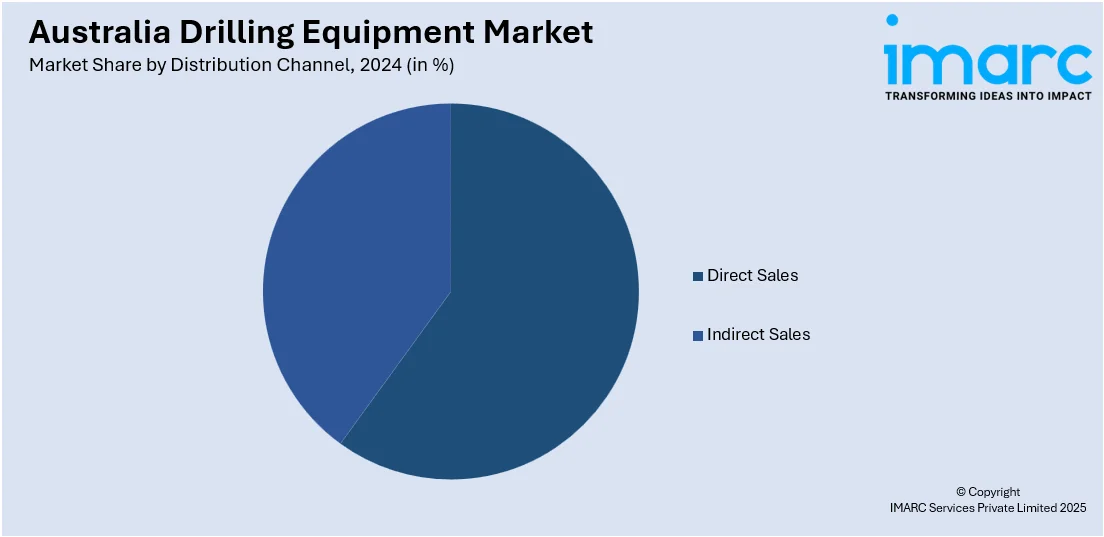

Distribution Channel Insights:

- Direct Sales

- Indirect Sales

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales and indirect sales.

End-Use Insights:

- Construction

- Oil and Gas

- Mining

- Water Management

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes construction, oil and gas, mining, water management, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Drilling Equipment Market News:

- On April 16, 2025, Epiroc won its largest-ever contract to supply Fortescue with a fleet of autonomous and electric-powered mining equipment for use at its iron ore mines in Western Australia. The contract, valued at MAUD 350 (SEK 2.2 billion), includes electric blasthole drill rigs, such as the Pit Viper 271 E and SmartROC D65 BE, which will help reduce carbon emissions by 90,000 tonnes annually. The autonomous machines will be operated remotely from Fortescue's Integrated Operations Centre in Perth, over 1,500 kilometers away, further enhancing productivity and safety.

Australia Drilling Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Drawworks, Traveling Blocks, Coiled Tubing, Drilling Instrumentation, Drilling Generators, Wireline Equipment, Completion Tools, Oil Tools, Pipe Handling Systems, Others |

| Categories Covered | Automatic, Manual |

| Power Sources Covered | Electric, Non-Electric |

| Mount Types Covered | Truck Mounted, Trailer Mounted |

| Distribution Channels Covered | Direct Sales, Indirect Sales |

| End-Uses Covered | Construction, Oil and Gas, Mining, Water Management, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia drilling equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia drilling equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia drilling equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The drilling equipment market in Australia was valued at USD 178.18 Million in 2024.

The Australia drilling equipment market is projected to exhibit a CAGR of 4.52% during 2025-2033.

The Australia drilling equipment market is expected to reach a value of USD 265.25 Million by 2033.

Australia’s drilling equipment market is driven by automation, AI integration, and real-time monitoring technologies. Rising demand from mining and energy sectors, especially deep resource extraction, is boosting innovation. Eco-friendly drilling practices and government-backed infrastructure projects are also shaping market trends.

Key growth drivers include Australia’s rich mineral reserves, increased exploration activities, and government support for infrastructure and energy security. Technological advancements in drilling machinery and rising demand from mining, oil, and gas sectors further propel market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)