Australia Dust Control Solutions Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

Australia Dust Control Solutions Market Summary:

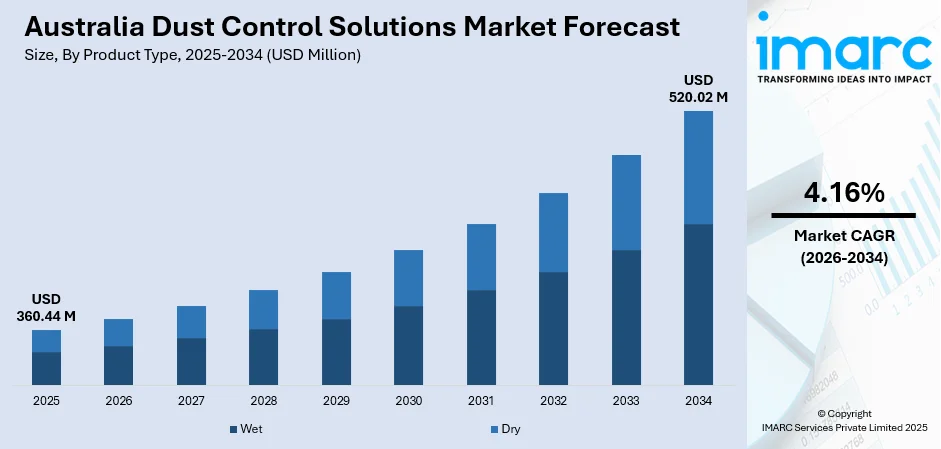

The Australia dust control solutions market size was valued at USD 360.44 Million in 2025 and is projected to reach USD 520.02 Million by 2034, growing at a compound annual growth rate of 4.16% from 2026-2034.

The Australia dust control solutions market is experiencing steady growth as industries increasingly prioritize occupational health protection and environmental compliance. Stringent regulatory frameworks governing crystalline silica exposure are compelling businesses to adopt advanced dust suppression technologies across mining, construction, and manufacturing operations. Growing awareness of respiratory hazards, combined with expanding infrastructure development and resource extraction activities, is driving investment in specialized dust management systems. Technological advancements in automated monitoring, sustainable chemical formulations, and real-time data analytics are reshaping operational approaches and strengthening the Australia dust control solutions market share.

Key Takeaways and Insights:

- By Product Type: Wet dust control solutions dominate the market with a 60% share in 2025, driven by their superior efficiency in capturing fine particulates and widespread application across mining operations, construction sites, and industrial processing facilities.

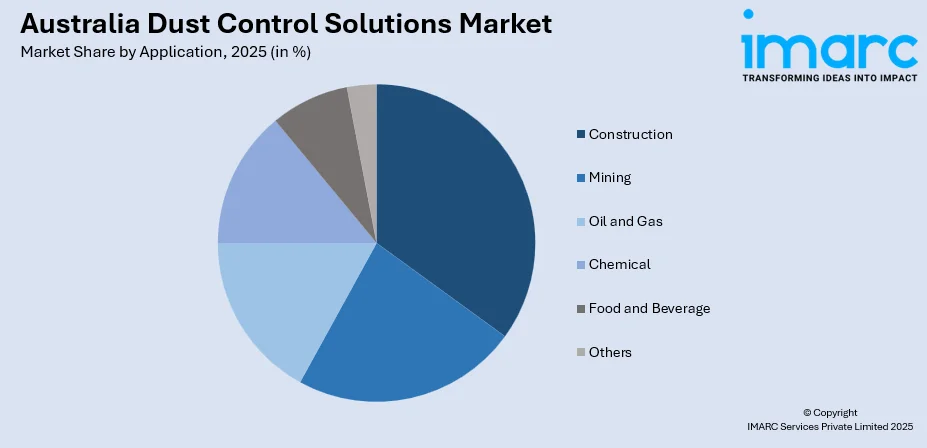

- By Application: Construction holds the largest market share at 32% in 2025, propelled by extensive infrastructure development projects, regulatory mandates for silica dust control, and growing emphasis on worker safety during building and demolition activities.

- Key Players: The Australia dust control solutions market features a competitive landscape with established manufacturers and specialized regional providers offering comprehensive solutions ranging from wet suppression systems to automated monitoring technologies.

To get more information on this market, Request Sample

The Australia dust control solutions market is advancing as government regulations, industry best practices, and technological innovations converge to address airborne particulate management challenges. The implementation of stricter workplace exposure standards from September 2024, which extended crystalline silica protections to over 600,000 workers across construction, mining, and manufacturing sectors, has accelerated adoption of advanced dust suppression systems. Companies are increasingly deploying IoT-enabled monitoring solutions, automated dosing units, and environmentally sustainable chemical formulations to achieve compliance while optimizing operational efficiency. Major infrastructure initiatives, including transport projects and renewable energy developments, continue to create substantial demand for specialized dust control equipment and services across the nation.

Australia Dust Control Solutions Market Trends:

Adoption of Intelligent and Automated Dust Control Technologies

The Australian dust control market is rapidly embracing automated and intelligent technologies to enhance efficiency and regulatory compliance. Industries are deploying Internet of Things sensors, real-time monitoring systems, and automated dust suppressants to precisely control airborne particulate matter. In line with this, the Australia internet of things (IoT) market is projected to reach USD 92.6 Billion by 2033, exhibiting a growth rate (CAGR) of 13.15% during 2025-2033. These systems enable immediate adjustments to control measures based on environmental conditions, optimizing resource utilization while minimizing human error. The integration of satellite communication modules and Bluetooth-enabled instrumentation allows remote management and data-driven decision-making, supporting the Australia dust control solutions market growth.

Development of Sustainable and Eco-Friendly Dust Suppression Solutions

Environmental sustainability has become a central focus in Australia's dust control industry, with manufacturers developing non-toxic, biodegradable dust suppression products. Polymer-based formulations are gaining traction as they offer superior dust binding capabilities while meeting stringent environmental regulations. These sustainable solutions reduce water consumption compared to traditional methods and minimize chemical runoff into surrounding ecosystems. The shift toward green technologies reflects growing corporate environmental responsibility commitments and consumer preferences for ecologically sound operational practices across mining and construction sectors. For instance, in February 2023, Global Road Technology (GRT), a prominent provider of engineering solutions, revealed a new collaboration with TotalEnergies Marketing Australia, a subsidiary of TotalEnergies SE, under which it will serve as the company’s exclusive distributor. Through this alliance, TotalEnergies will deliver a range of advanced, eco-friendly dust control products engineered to strengthen soil and prevent the release of airborne particulate matter across mining operations.

Integration of Advanced Data Analytics and Digital Monitoring

Australian industries are leveraging advanced data analytics and digital monitoring capabilities to revolutionize dust management practices. Drones equipped with high-resolution cameras and sensors capture aerial data on dust dispersion patterns, while automated ground-based sensors provide continuous air quality feedback. Real-time reporting enables immediate corrective actions when particulate levels exceed regulatory thresholds. The adoption of cloud-based solutions facilitates comprehensive data analysis, predictive maintenance scheduling, and performance benchmarking across multiple operational sites throughout the country.

Market Outlook 2026-2034:

The Australia dust control solutions market is positioned for sustained expansion as regulatory requirements intensify and technological innovations continue to reshape operational capabilities. Growing investments in mining, construction, and infrastructure development will drive demand for advanced suppression systems and monitoring technologies. The market generated a revenue of USD 360.44 Million in 2025 and is projected to reach a revenue of USD 520.02 Million by 2034, growing at a compound annual growth rate of 4.16% from 2026-2034.

Australia Dust Control Solutions Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Wet |

60% |

| Application | Construction |

32% |

Product Type Insights:

- Wet

- Wet Scrubbers

- Wet Electrostatic Precipitators (WEPS)

- Dry

- Bag Dust Collectors

- Cyclone Dust Collectors

- Electrostatic Dust Collectors

- Vacuum Dust Collectors

- Others

Wet dust control solutions dominate the Australia dust control solutions market with a 60% share in 2025.

Wet dust suppression systems have established market leadership due to their exceptional efficiency in capturing fine and respirable particles across diverse industrial applications. These systems utilize water-based technologies including high-pressure spray systems, misting cannons, and foam-based suppressants to effectively bind airborne particulates at their source. The mining sector particularly favors wet solutions for controlling dust generated during ore processing, material handling, and transportation operations, where immediate particle capture prevents worker exposure and environmental dispersion.

Advanced wet electrostatic precipitators are gaining prominence for treating sub-micron particulates, aerosols, and industrial fumes requiring specialized filtration approaches. Recent innovations include water conditioning modules requiring zero maintenance over extended service periods and automated dosing systems that optimize product distribution while reducing water consumption. In September 2025, EnviroMist delivered high-pressure dust suppression systems for BHP's Western Ridge mine project, featuring upgraded compressors, Bluetooth-enabled instrumentation, and comprehensive water pressure booster units meeting stringent technical requirements.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Construction

- Mining

- Oil and Gas

- Chemical

- Food and Beverage

- Others

Construction leads the Australia dust control solutions market with a 32% share in 2025.

The construction sector drives significant demand for dust control solutions as major infrastructure projects, urban development initiatives, and building renovation activities generate substantial airborne particulates. Regulatory requirements implemented from September 2024 classify processing of crystalline silica substances as high-risk construction work, mandating Safe Work Method Statements and detailed silica risk control plans. These regulations extend protection to activities involving cutting, grinding, trimming, and drilling of concrete, bricks, tiles, and natural stone products commonly encountered on construction sites.

Australia's robust pipeline of infrastructure development projects creates sustained demand for specialized dust suppression equipment and services. Major initiatives including Sydney Metro West, Western Sydney International Airport, Melbourne Metro Tunnel, and renewable energy zone developments require comprehensive dust management strategies throughout construction phases. In November 2024, Global Soil Systems completed over 400 hectares of dust suppression across multiple project sites, demonstrating the scale of dust control operations required for large infrastructure developments and the industry's capacity for rapid deployment.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Demand for dust control solutions in ACT and NSW is fueled by extensive infrastructure development, expanding urban construction, and strict regulatory enforcement on workplace air quality. Growing tunnelling, road upgrades, and commercial projects require effective dust suppression to meet safety standards. Increasing environmental monitoring by authorities and community pressure to reduce particulate emissions around high-density urban zones also encourages adoption of advanced suppression technologies and compliance-focused dust management systems.

In Victoria and Tasmania, rapid transport infrastructure upgrades, industrial expansion, and landscaping activities strongly support dust control adoption. Stricter environmental compliance frameworks drive industries to use efficient suppression technologies across construction, mining support services, and waste-handling sites. Demand is further strengthened by rising public scrutiny of air quality in densely populated areas, encouraging investment in sustainable dust control solutions. Industrial maintenance programs, roadworks, and port-related operations also contribute to consistent market growth.

Queensland’s dust control market is primarily driven by its large mining footprint, extensive quarrying operations, and ongoing infrastructure development. High dust-generating activities such as coal handling, metal ore processing, and large-scale construction projects increase the need for suppression systems. Compliance with strict occupational health and environmental standards further motivates companies to invest in advanced dust management technologies. Growing renewable energy projects and industrial expansion in regional areas also boost dust control requirements.

In the Northern Territory and South Australia, widespread mining, oil and gas operations, and remote-area construction create substantial demand for dust suppression solutions. Harsh climatic conditions, including dry winds and arid landscapes, exacerbate particulate emissions, making dust control essential. Regulatory oversight on worker safety and environmental protection encourages companies to adopt advanced mitigation systems. Growth in infrastructure, logistics hubs, and exploration activities further supports market expansion across both regions.

Western Australia’s dust control market is driven by its extensive mining sector, large-scale mineral processing activities, and ongoing infrastructure investments. High dust emissions from iron ore operations, port handling facilities, and heavy construction necessitate robust suppression technologies. Environmental compliance requirements and corporate sustainability commitments push industries toward efficient and eco-friendly dust control methods. Continuous expansion of mining projects and increased regulatory monitoring further strengthen market demand across the region.

Market Dynamics:

Growth Drivers:

Why is the Australia Dust Control Solutions Market Growing?

Stringent Environmental and Workplace Safety Regulations

Australia's regulatory framework governing airborne particulate exposure has intensified substantially, compelling industries to invest in advanced dust control systems. Work Health and Safety regulations implemented from September 2024 extended crystalline silica protections to approximately 600,000 workers across construction, civil tunnelling, quarrying, mining, and road maintenance sectors. These regulations mandate controlled processing of all materials containing at least one percent crystalline silica, comprehensive risk assessments, silica risk control plans, air monitoring requirements, and mandatory worker training programs. Businesses face significant penalties for non-compliance, including work stoppages and regulatory enforcement actions when safety protocols are inadequate. The national ban on engineered stone benchtops from July 2024, along with import restrictions from January 2025, demonstrates the government's commitment to eliminating high-risk silica exposure sources and protecting worker health.

Expanding Mining and Construction Activities

Australia's resource extraction and infrastructure development sectors continue driving substantial demand for specialized dust control equipment and services. The mining industry generates significant quantities of particulate matter during extraction, processing, and transportation operations, requiring comprehensive site-wide dust management strategies. Major mining companies are implementing advanced suppression technologies across haul roads, processing plants, stockpiles, and port facilities to protect workers and surrounding communities. Infrastructure development initiatives across the nation, including transport networks, renewable energy installations, and urban construction projects, continue to expand, supported by the Australia construction market expected to reach USD 588 Billion by 2033, growing at a 4.30% CAGR from 2025–2033. This sustained build-out creates continuous demand for effective dust suppression solutions. The concentration of mining activities in regions like Western Australia and Queensland further necessitates specialized approaches tailored to arid environmental conditions where dust dispersion challenges are particularly acute.

Rising Occupational Health Awareness and Industry Collaboration

Growing awareness of respiratory diseases linked to occupational dust exposure has elevated the priority of dust control investments across Australian industries. Documented cases of silicosis, coal workers' pneumoconiosis, and related lung conditions have prompted increased focus on preventive measures and health monitoring programs. Industry conferences, regulatory guidance, and collaborative initiatives are promoting best practices in dust suppression methodologies and exposure limit adherence. In April 2024, Global Road Technology and TotalEnergies Marketing Australia showcased their SMART Dosing Unit at the Queensland Mining Industry Health and Safety Conference, demonstrating industry commitment to innovative particulate pollution control solutions. The establishment of worker health registers and mandatory medical surveillance programs reinforces the importance of effective dust management systems in protecting long-term employee wellbeing.

Market Restraints:

What Challenges the Australia Dust Control Solutions Market is Facing?

High Initial Costs and Maintenance Requirements

Advanced dust control systems require substantial capital investment that may challenge smaller operators or businesses with limited financial resources. Sophisticated technologies incorporating IoT sensors, automated controls, and specialized chemical applications demand skilled personnel for operation and ongoing maintenance. These cost considerations can restrict widespread adoption, particularly among smaller mining operations and construction contractors operating on tight margins.

Technical Challenges with Specialized Dust Types

Certain dust types present unique technical challenges that existing control technologies may not adequately address. Combustible dust, hygroscopic particles, and highly reactive materials require specialized suppression approaches beyond standard wet or dry collection methods. Developing effective solutions for these specific particulate types necessitates ongoing research investment and customized engineering approaches that increase implementation complexity.

Water Scarcity and Resource Constraints in Arid Regions

Australia's arid climate conditions, particularly in major mining regions, create challenges for water-intensive dust suppression methods. Limited water availability in remote operational areas restricts the feasibility of traditional wet suppression approaches, driving demand for water-efficient alternatives. Balancing effective dust control with sustainable water management requires innovative solutions that minimize consumption while maintaining suppression effectiveness.

Competitive Landscape:

The Australia dust control solutions market exhibits a competitive landscape with established international manufacturers alongside specialized regional service providers. Companies are differentiating through technological innovation, sustainable product development, and comprehensive service offerings spanning equipment supply, installation, and maintenance. Strategic partnerships between technology providers and distribution networks are expanding market reach, while acquisitions consolidate capabilities across the value chain. Investment in research and development focuses on automated systems, water-efficient technologies, and environmentally responsible formulations. Market participants are emphasizing customized solutions tailored to specific industry requirements, with integrated approaches combining hardware, chemicals, and data analytics gaining prominence among resource sector clients.

Recent Developments:

- July 2025: Mideco launched the "Bat Booth," a compact personnel de-dusting system that uses low-pressure compressed air to safely remove up to 88% of respirable dust from workers' clothing in just 10 seconds, significantly reducing exposure risks in dusty industries globally.

- February 2025: RST Solutions, a specialist in fine particle management, has introduced a new product designed to help mining operations maintain optimal moisture levels for effective dust control while minimizing water use. Named DEM Hydroboost Pro, the solution enhances dust suppression for mined materials by reducing the risk of excessive watering and safeguarding material integrity, ensuring products arrive at their final destination in the same condition as when they were extracted.

Australia Dust Control Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Construction, Mining, Oil and Gas, Chemical, Food and Beverage, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia dust control solutions market size was valued at USD 360.44 Million in 2025.

The market is expected to grow at a compound annual growth rate of 4.16% from 2026-2034 to reach USD 520.02 Million by 2034.

Wet dust control solutions hold the largest market share at 60%, driven by superior particle capture efficiency, widespread adoption across mining and construction sectors, and effectiveness in treating fine respirable particulates through water-based suppression technologies.

Key factors driving the Australia dust control solutions market include stringent workplace safety regulations, expanding mining and construction activities, rising awareness of respiratory health hazards, technological advancements in automated monitoring systems, and growing demand for sustainable suppression solutions.

Major challenges include high initial investment costs for advanced systems, technical difficulties with specialized dust types, water scarcity in arid mining regions, maintenance requirements for sophisticated equipment, and the need for skilled personnel to operate automated technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)