Australia Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Australia Duty-Free and Travel Retail Market Size and Share:

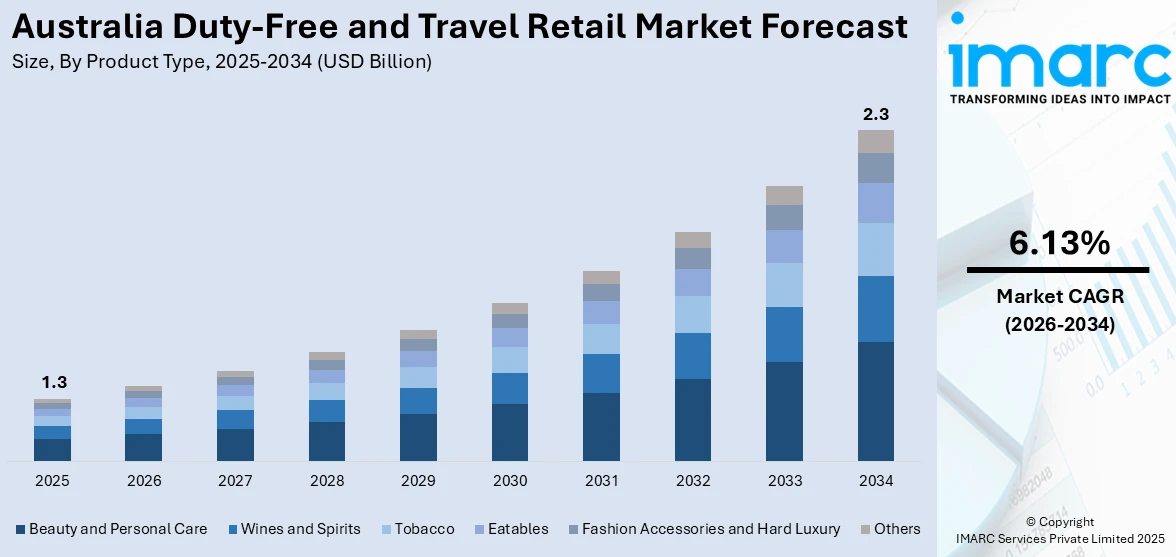

The Australia duty-free and travel retail market size reached USD 1.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.3 Billion by 2034, exhibiting a growth rate (CAGR) of 6.13% during 2026-2034. The market is experiencing significant growth driven by rising international tourism, increasing demand for luxury products, and digital transformation. Moreover, enhanced airport retail spaces, premium brand offerings, and sustainability trends are shaping market growth, ensuring a competitive and dynamic retail landscape.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.3 Billion |

| Market Forecast in 2034 | USD 2.3 Billion |

| Market Growth Rate 2026-2034 | 6.13% |

Australia Duty-Free and Travel Retail Market Trends:

Rising International Travel

The rising international travel is a major catalyst for the expansion of Australia’s duty-free and travel retail sector. As global mobility rebounds, particularly in the Asia-Pacific region, airports, seaports, and border crossings across Australia are witnessing a surge in foot traffic. This uptick is directly contributing to Australia duty-free and travel retail market growth, with increased spending by both inbound tourists and outbound Australian travelers. According to the report published by Tourism Research Australia, international tourism in Australia is recovering, with 7.6 million trips recorded in 2024, reaching 88% of pre-COVID levels. Total spending was $48.9 billion, up 8% from 2019. Key markets included New Zealand (1.3 million trips, $2.1 billion) and China (829,000 trips, $8.1 billion). Key international airports like Sydney, Melbourne, and Brisbane are upgrading retail infrastructure to accommodate this demand, introducing premium brands, local specialties, and tech-enabled shopping experiences. Additionally, the resumption of cruise tourism and regional travel corridors is further expanding the customer base beyond traditional air travel. Retailers are tailoring product assortments and promotions to suit diverse traveler profiles, driving higher conversion rates. This steady rise in tourism is translating into a stronger Australia duty-free and travel retail market share, particularly among airport-based outlets.

To get more information on this market Request Sample

Luxury and Premium Product Demand

The premiumization trend is reshaping the Australia duty-free and travel retail market, driven by increasing demand for luxury products such as high-end cosmetics, premium alcohol, and designer fashion. Asian travelers, particularly from China, South Korea and Japan, are key contributors to this trend as they seek exclusive and high-quality products during their travels. Global brands are expanding their presence in Australian duty-free stores, offering limited-edition items and personalized shopping experiences to attract affluent customers. Additionally, airport retailers are enhancing their luxury sections with immersive store designs, VIP lounges, and concierge services to cater to high-spending travelers. For instance, in August 2023, Heinemann Australia announced the launch of its first luxury resort wear brand, Camilla, in its duty-free store at Sydney Airport. The pop-up features the ‘Amore Mio’ collection, inspired by Italian summers, showcasing limited edition prints from a collaboration with The Leading Hotels of the World, with promotional activities running through October. The rise of digital engagement, including pre-order platforms and targeted promotions, is further fueling premium product sales. With continued growth in international travel and evolving consumer preferences, a strong Australia duty-free and travel retail market outlook is expected in the coming years.

Australia Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

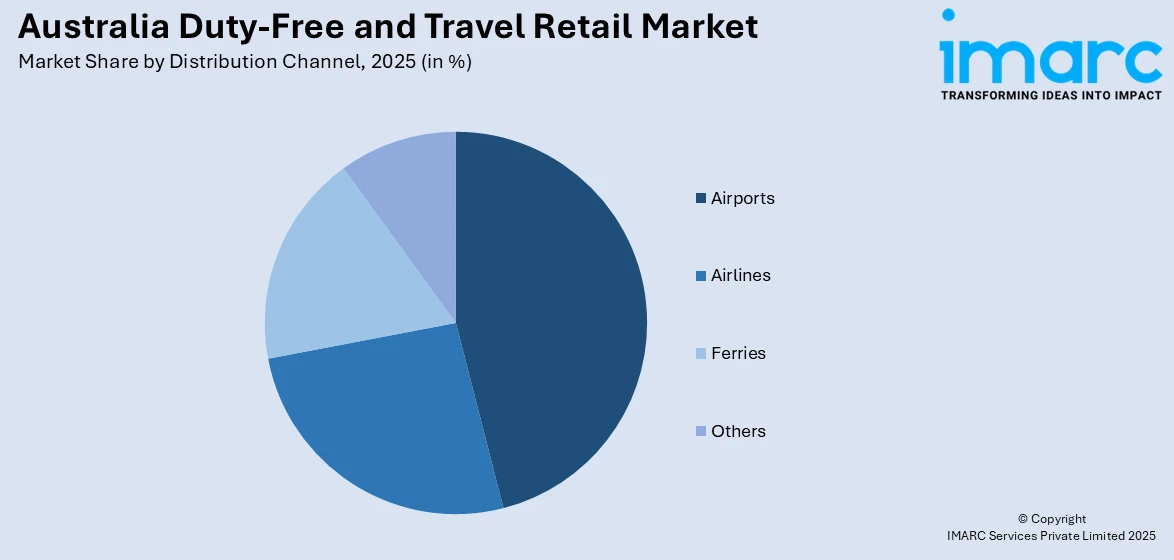

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Duty-Free and Travel Retail Market News:

- In July 2024, Molton Brown entered the Australian travel retail market in collaboration with Lotte Duty Free, debuting at their Sydney downtown store. The launch features iconic fragrances and new favorites, enhancing the brand's presence in Asia Pacific and focusing on sustainability and individuality to engage consumers effectively.

- In May 2024, Starward, the Melbourne-based whisky distiller, announced its partnership with Duty-Free Global to expand its travel retail presence. This collaboration aims to enhance distribution and brand awareness following Starward's recent success at the 2024 San Francisco World Spirits Competition, where it won multiple prestigious awards.

Australia Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia duty-free and travel retail market on the basis of product type?

- What is the breakup of the Australia duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the Australia duty-free and travel retail market on the basis of region?

- What are the various stages in the value chain of the Australia duty-free and travel retail market?

- What are the key driving factors and challenges in the Australia duty-free and travel retail market?

- What is the structure of the Australia duty-free and travel retail market and who are the key players?

- What is the degree of competition in the Australia duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia duty-free and travel retail market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)