Australia E-Cigarette Market Size, Share, Trends and Forecast by Product, Flavor, Mode of Operation, Distribution Channel, and Region, 2026-2034

Australia E-Cigarette Market Overview:

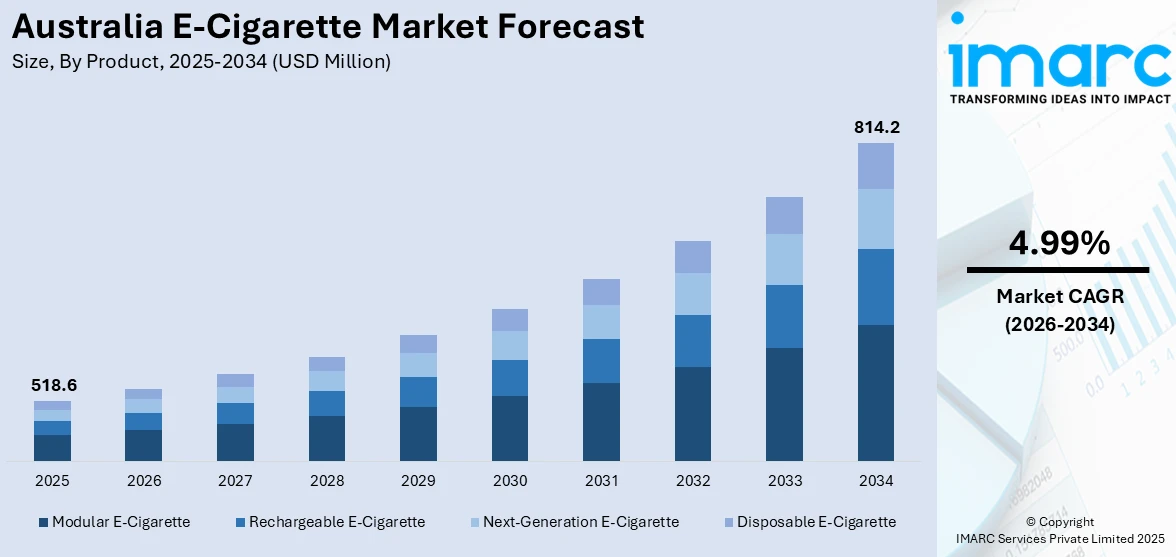

The Australia e-cigarette market size reached USD 518.6 Million in 2025. Looking forward, the market is expected to reach USD 814.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.99% during 2026-2034. The market share is expanding, driven by the rising impact of social media platforms wherein vaping is being promoted by influencers and celebrities, along with the increasing implementation of government regulations regarding tobacco control.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 518.6 Million |

| Market Forecast in 2034 | USD 814.2 Million |

| Market Growth Rate 2026-2034 | 4.99% |

Key Trends of Australia E-Cigarette Market:

Growing impact of social media

The increasing influence of social media platforms is offering a favorable Australia e-cigarette market outlook. With the rising number of social media users, the demand for e-cigarette is high. According to the DataReportal, in January 2024, Australia had 20.80 million social media users, representing 78.3% of the overall population. Digital media platforms are filled with content wherein vaping is shown as trendy and fun. Young people especially are exposed to influencers and peers who show off sleek vape devices and cool tricks, making vaping look appealing and socially acceptable. Many brands and sellers also employ social media channels, sometimes through indirect promotion, to advertise their items to a younger audience. Hashtags, viral challenges, and aesthetic e-cigarette videos help spread awareness and curiosity about vaping. The constant presence of vaping content online acts like marketing, especially when it comes from relatable figures or influencers. This kind of exposure encourages experimentation and drives demand, particularly among teenagers and young adults. As social media continues to shape trends and impact behavior, the e-cigarette market in Australia is moving forward. With the constant visibility and glamorization of vaping online, for many, it becomes something they want to try just to fit in or be part of the trend.

To get more information on this market Request Sample

Rising execution of government initiatives

The increasing execution of government initiatives is fueling the Australia e-cigarette market growth. As the government tightens regulations around traditional smoking and promotes harm reduction, more people look at e-cigarettes as an alternative. These efforts include public health campaigns, restrictions on tobacco cigarette advertising, and support for quitting smoking, which all help to shift attention towards vaping items. The government’s actions regarding tobacco control are impelling the market growth. There is also a rising interest in research and discussions around regulated access to e-cigarettes for smokers trying to quit, which is creating more awareness. In line with this, changes in import laws and stricter product standards mean only certain kinds of items can legally enter the market, leading to more demand for high-quality approved options. Moreover, high taxation on traditional cigarettes has led some people to seek substitutes like e-cigarettes. The government’s focus on lowering smoking and improving public health is positively influencing the market, especially among adult smokers looking for alternatives. In March 2024, the Government of Australia launched the Excise Tariff Amendment (Tobacco) Bill 2024 and Customs Tariff Amendment (Tobacco) Bill 2024 to increase taxation on tobacco items by 5% annually for 3 years alongside standard indexation. The aim was to lower tobacco usage by raising duty rates on tobacco products and promote a reduction in smoking among the Australian public.

Growth Factors of Australia E-Cigarette Market:

Government Policies and Regulatory Changes

The primary contributing growth factor for the Australian e-cigarette market is derived from a shift in regulatory environments that, though strict, have influenced consumer attitudes and adaptation within the industry. Australia has among the most stringent nicotine e-cigarette regulations in the world, mandating the use of a valid prescription for the acquisition of nicotine-infused vapes. Despite these restrictions, the market keeps on growing, helped along by regulatory clarity that has prompted businesses to invest in compliant products and prescription-based retail channels. Telehealth providers and local pharmacies have increasingly entered into partnerships with licensed vape distributors, providing a legal channel for adult smokers looking for harm-reduction alternatives. Furthermore, shifts in enforcement have resulted in higher levels of debate surrounding policy reform, with various states calling for more equitable approaches that consider vaping's potential as a tool for smoking cessation. Such dynamics render Australia's regulatory landscape a distinctive driver—both stimulus and challenge—for expansion within the e-cigarette market.

Health Awareness and Move Away from Traditional Smoking

According to the Australia e-cigarette market analysis, increased health awareness and anti-smoking campaigns have played a major role in the growth of e-cigarettes in the region. Public health campaigns sponsored by the government and grass-roots movements have made more people aware of the risks of conventional smoking among young adults and middle-aged groups. This has created a booming market for e-cigarettes, which are commonly seen as less risky than conventional smoking. Though skepticism continues to exist in medical communities, part of the public views vaping as a step-down process to be used for leaving smoking behind. In Australia's major cities such as Sydney and Melbourne, the popularity of smoke-free living is fueling the transition towards vaping. The impact of overseas research and the increasing number of Australian health professionals advising on e-cigarettes under controlled conditions have also played a role in altering perceptions. This health-conscious attitude, along with greater exposure to prescription-based vaping products, continues to spur consumers to try e-cigarettes as a smoking cessation aid, creating more space for the market to grow.

Impact of Online Sales and Youth Culture

The online marketplace and youth-oriented lifestyle trends are also significant reasons for the escalating Australia e-cigarette market demand. Despite regulatory barriers, internet sites have proved a ready source for nicotine and non-nicotine vape products, with most users heading to overseas sites offering products for sale for Australian buyers. Moreover, vaping's cultural impact—hitched to fashion, media influence, and lifestyle branding—has captured the attention of younger populations in urban centers and regional communities. Such consumers who are brought up online and have instant access to the world, perceive vaping as a smoking substitute as well as a lifestyle. Such appeal is also furthered by flavored e-liquids and slim, minimalist e-pipes. These cultural and online influences, specifically molded by the tech-savvy and trend-seeking populace of Australia, keep driving market demand and expansion.

Regulatory Landscape of Australia E-Cigarette Market:

Prescription-Based Nicotine Regulation

Australia has established one of the most distinctive regulatory frameworks for e-cigarettes in the world, particularly regarding the use of nicotine-containing products. Unlike many countries where nicotine vapes can be purchased over the counter, Australia mandates a medical prescription to legally access nicotine e-cigarettes. This policy is upheld under the Therapeutic Goods Administration (TGA), where importation, sale, and marketing of nicotine vaping products are regulated as therapeutic goods. The objective is to place vaping on a medically supervised platform for quitting smoking rather than consumer lifestyle. Australian consumers have to get their prescribed medication from registered health professionals and can procure their products from registered pharmacies or approved online sources. Though intended to limit youth access and outlaw unregulated use, however, this system has also facilitated heightened surveillance of illegal imports and grey-market sales. The model of prescription, though restrictive, differentiates Australia and establishes a highly controlled but specialized channel for legal access to vaping products.

Federal-State Inconsistencies and Enforcement Complications

The regulatory environment of e-cigarettes in Australia is also complicated by the inconsistencies between federal legislation and state or territory-level enforcement. Whereas the federal government, in the Australian Border Force and the TGA, regulates imports and national health policy, retail sales, public use, and criminalization of possession without prescription are within state jurisdictions. Queensland and Western Australia have long enforced stricter local regulation, such as prohibition on retail sale of non-nicotine e-cigarettes, despite federal permission. These jurisdictional inconsistencies usually lead to confusion among retailers and consumers, with enforcement significantly varying by location. Adding to the problem is the ubiquity of black-market vaping products, many of which skirt regulatory control through online sourcing or unregulated distribution channels. State governments have ramped up compliance efforts, such as raids and fines, but enforcement continues to be resource-draining and decentralized. This federal-state incongruity highlights the nuance of Australia's regulatory system and the necessity for clearer, coordinated national policy.

Continuing Reform and Public Health Disputes

Australia's regulatory environment continues to change, driven by public health controversies, interest group pressure, and global studies on the harms and benefits of vaping. On the one hand, public health officials support tight controls to avoid youth adoption and restrict recreational consumption, citing growing concern about flavored e-cigarette products and black-market sales. Harm reduction activists, on the other hand, urge a more balanced strategy, referencing research showing that regulated access to nicotine e-cigarettes can assist long-term smokers in quitting. The debate has resulted in policy reviews and proposals for debate on improving the model of prescription or instituting wider access under tight retail control. Submissions to parliamentary inquiries by the public and changing research results continue to fuel debate within the Department of Health and amongst state lawmakers. Moreover, the global policy trends' impact—whether it is the United Kingdom's more liberal approach or New Zealand's retail-oriented one—are leading Australian policymakers to rethink long-term strategies. These ever-evolving debates guarantee that regulation is a unifying force determining Australia's e-cigarette market future.

Australia E-Cigarette Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product, flavor, mode of operation, and distribution channel.

Product Insights:

- Modular E-Cigarette

- Rechargeable E-Cigarette

- Next-Generation E-Cigarette

- Disposable E-Cigarette

The report has provided a detailed breakup and analysis of the market based on the product. This includes modular e-cigarette, rechargeable e-cigarette, next-generation e-cigarette, and disposable e-cigarette.

Flavor Insights:

- Tobacco

- Botanical

- Fruit

- Sweet

- Beverage

- Others

A detailed breakup and analysis of the market based on the flavor have also been provided in the report. This includes tobacco, botanical, fruit, sweet, beverage, and others.

Mode of Operation Insights:

- Automatic E-Cigarette

- Manual E-Cigarette

The report has provided a detailed breakup and analysis of the market based on the mode of operation. This includes automatic e-cigarette and manual e-cigarette.

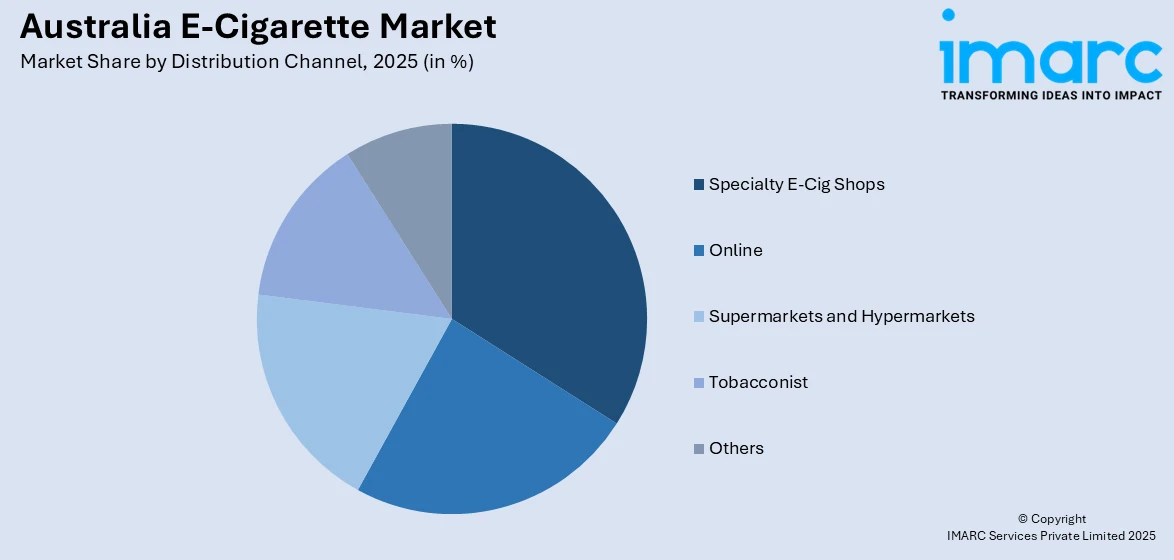

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Specialty E-Cig Shops

- Online

- Supermarkets and Hypermarkets

- Tobacconist

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialty e-cig shops, online, supermarkets and hypermarkets, tobacconist, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia E-Cigarette Market News:

- In August 2023, Vape Shark Australia unveiled its latest product, the Gunnpod Meta 4000 Puffs. One of the flavors introduced was Gunnpod Meta Peach Cocktail. It was the ideal choice for anyone seeking a refreshing and fruity taste in the e-cigarette. The delightful flavor of ripe peaches blended with refreshing menthol produced a pleasing and enjoyable sensation.

- In May 2025, the Coalition announced that it would modify the current rule that only allows pharmacies to sell vapes by allowing the sale of vapes in retail establishments, taxing these goods, and regulating the sector. The opposition's financial estimates indicate that the measure would increase the budget by USD 3.6 Billion over four years.

Australia E-Cigarette Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Modular E-Cigarette, Rechargeable E-Cigarette, Next-Generation E-Cigarette, Disposable E-Cigarette |

| Flavors Covered | Tobacco, Botanical, Fruit, Sweet, Beverage, Others |

| Modes of Operation Covered | Automatic E-Cigarette, Manual E-Cigarette |

| Distribution Channels Covered | Speciality E-Cig Shops, Online, Supermarkets and Hypermarkets, Tobacconist, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia e-cigarette market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia e-cigarette market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia e-cigarette industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia e-cigarette market was valued at USD 518.6 Million in 2025.

The Australia e-cigarette market is projected to exhibit a CAGR of 4.99% during 2026-2034.

The Australia e-cigarette market is expected to reach a value of USD 814.2 Million by 2034.

Major drivers in the Australia e-cigarette market are increasing health consciousness, the need for smoking cessation devices, and increasing demand among young adults. The prescription model promotes medically supervised use, while on-line accessibility and international product directions remain appealing to users who crave alternatives to conventional tobacco, irrespective of regulation controls and enforcement measures.

The major trend of the Australia e-cigarette industry is online consumer demand, fueled by the need for prescriptions that makes nicotine vapes more controlled and less popular in retail outlets. Moreover, government initiatives like campaigns and restrictions on tobacco and cigarette advertising, also contributes to the shift toward e-cigarette as an alternative.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)