Australia E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Region, 2026-2034

Australia E-Invoicing Market Size and Growth:

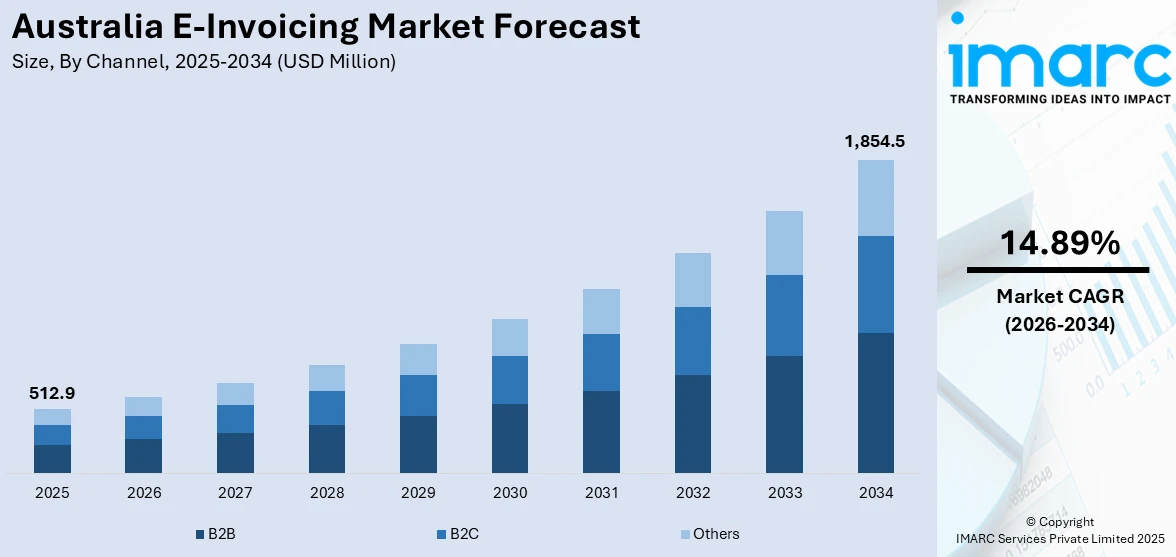

The Australia e-invoicing market size reached USD 512.9 Million in 2025. Looking forward, the market is expected to reach USD 1,854.5 Million by 2034, exhibiting a growth rate (CAGR) of 14.89% during 2026-2034. The adoption of e-invoicing in Australia is driven by government mandates, including federal agency compliance by 2024, and ATO-backed Peppol standards. Businesses seek cost savings, faster payments, and reduced errors, while AI and automation enhance efficiency. SME adoption and digital transformation trends are further expanding the Australia e-invoicing market share, supported by cloud-based solutions and real-time processing benefits.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 512.9 Million |

| Market Forecast in 2034 | USD 1,854.5 Million |

| Market Growth Rate 2026-2034 | 14.89% |

Key Trends of Australia E-Invoicing Market:

Increasing Focus on Cybersecurity and Fraud Prevention in E-Invoicing

As e-invoicing adoption grows in Australia, businesses and regulators are prioritizing cybersecurity to combat invoice fraud and data breaches. Australia witnessed 47 million data breaches in 2024, equating to one breach every second, ranking it as the 11th most affected country globally. Thus, the breach density was 1,785 incidents per 1,000 residents. This rise in e-invoice fraud presents major challenges for the e-invoicing industry, highlighting the need for stronger data governance and privacy practices to protect sensitive financial information. The shift to digital transactions has exposed vulnerabilities, prompting stricter security measures such as multi-factor authentication, blockchain verification, and encryption protocols. The Australian Cyber Security Centre (ACSC) has issued guidelines to safeguard e-invoicing systems, particularly for SMEs that may lack robust IT infrastructure. Additionally, Peppol’s secure network and digital identity frameworks help mitigate risks. Companies are investing in fraud detection tools powered by AI to flag suspicious transactions in real time. With rising cyber threats, businesses are adopting advanced security solutions, driving the Australia e-invoicing market growth.

To get more information on this market Request Sample

Integration of AI and Automation in E-Invoicing Solutions

Artificial intelligence (AI) and automation are transforming Australia’s e-invoicing market by enhancing accuracy and efficiency. A research report from the IMARC Group indicates that the artificial intelligence market in Australia was valued at USD 2,072.7 Million in 2024. It is projected to grow to USD 7,761.0 Million by 2033, reflecting a compound annual growth rate (CAGR) of 15.17% from 2025 to 2033. Businesses are leveraging AI-powered tools to automate invoice data extraction, validation, and matching, reducing manual intervention. Machine learning algorithms improve over time, minimizing discrepancies and fraud risks while ensuring compliance with tax regulations. Cloud-based e-invoicing platforms with AI capabilities are gaining traction, offering real-time analytics and predictive cash flow insights. Thus, this is creating a positive Australia e-invoicing market outlook. Additionally, robotic process automation (RPA) is being used to streamline approval workflows, accelerating payment cycles. As Australian enterprises prioritize digital transformation, the demand for intelligent e-invoicing solutions is rising. This trend is particularly beneficial for industries with high invoice volumes, such as retail, logistics, and healthcare, where automation drives significant cost savings and operational efficiency.

Growth Drivers of Australia E-Invoicing Market:

SME Cost & Efficiency Benefits

Small and medium-sized enterprises (SMEs) in Australia stand to gain significant financial and operational benefits from adopting e-invoicing. Businesses handling dozens to hundreds of invoices each month can eliminate time-consuming manual data entry, reduce administrative workload, and minimize the risk of human errors. According to research by Deloitte and SAP, SMEs can potentially save up to A$40,000 per year by transitioning to e-invoicing platforms. Such cost savings are based on speed of processing, use of less paper, and cheaper labor. Besides its cost effectiveness, a digital invoice also offers a more structured system of record-keeping and reconciliation, which increases audit-readiness and financial transparency. Consequently, the use of e-invoicing by SMEs is becoming not only a technological modernization option, but it is a strategic step towards the long-term efficiency of the company operation.

Faster Payment Cycles & Cash Flow

One of the most impactful advantages of e-invoicing is the acceleration of payment cycles and improvement in overall cash flow management, which is driving the Australia e-invoicing market analysis. With the use of standardized digital formats and real-time invoice delivery, businesses experience quicker processing and fewer disputes caused by data mismatches or lost documents. Government policies, such as the mandated five-day payment terms for federal agencies, further enhance the speed of transactions. Faster receivables mean businesses have quicker access to funds, allowing them to reinvest in operations, pay suppliers on time, and maintain healthier financial liquidity. This predictability in cash inflow also reduces the need for short-term financing. Across the supply chain, such improvements foster stronger relationships and greater trust between buyers and suppliers, contributing to a more stable and efficient business environment.

Standardized Interoperability via Peppol

The adoption of the Pan-European Public Procurement Online (Peppol) framework in Australia has been a game-changer for digital invoicing, enabling seamless and standardized communication between different accounting and ERP systems. Peppol’s interoperable infrastructure ensures that e-invoices can be securely exchanged between trading partners, regardless of the software platforms they use. This eliminates the need for manual uploads or duplicate data entry and reduces errors caused by incompatible formats. Businesses across sectors, ranging from SMEs to large enterprises, benefit from consistent and reliable document exchange, which streamlines workflows and enhances compliance. As more organizations connect to the Peppol network, network effects increase, driving broader adoption and efficiency gains across industries. Ultimately, Peppol’s structured ecosystem provides a foundation for scalable, secure, and future-proof e-invoicing implementation in Australia.

Opportunities of Australia E-Invoicing Market:

Integration into Broader Digital Procurement Systems

As Peppol compliance becomes a foundational requirement in Australia’s digital invoicing landscape, businesses are recognizing the potential to expand e-invoicing into more comprehensive digital procurement processes. By embedding e-invoicing as a core communication layer, companies can streamline their entire procure-to-pay lifecycle, from purchase orders and invoicing to payment and reconciliation. This integration supports greater automation, real-time visibility, and seamless data flow between buyers and suppliers. It also enhances compatibility with ERP and procurement platforms, reducing manual intervention and ensuring data accuracy across operations. Organizations benefit from improved efficiency, cost savings, and compliance. As more enterprises move toward fully digital supply chains, e-invoicing becomes not just a standalone solution but a vital enabler of end-to-end digital transformation in procurement and financial management.

SME Participation in Larger Supply Chains

E-invoicing serves as a gateway for small and medium-sized enterprises (SMEs) to engage more effectively with large corporations and government buyers. By enabling the secure and standardized exchange of invoices, it eliminates the need for manual paperwork, simplifies compliance, and improves the reliability of transactions. According to the Australia e-invoicing market analysis, this allows SMEs to meet the procurement requirements of larger organizations and integrate into their supply chains with ease. Participating in digital trade networks enhances the competitiveness of small businesses by improving visibility, reducing administrative costs, and increasing their chances of securing new contracts or public tenders. As government and enterprise buyers increasingly mandate e-invoicing, SMEs that adopt the technology early gain a strategic advantage, improving their access to high-value business opportunities and strengthening their long-term market positioning.

Sustainability and Environmental Impact

The shift from traditional paper-based invoicing to digital formats plays a critical role in supporting Australia’s environmental and sustainability objectives. E-invoicing significantly reduces the need for physical materials such as paper, ink, and envelopes, as well as energy-intensive storage and transportation processes. By cutting down on paper usage and associated waste, organizations lower their carbon footprint and contribute to more sustainable business operations. Additionally, digital record-keeping improves audit readiness and reduces the space and resources needed for storing financial documents. This transition aligns with corporate ESG (Environmental, Social, and Governance) goals and meets the growing expectations of regulators, investors, and consumers who prioritize environmentally responsible practices. As sustainability becomes a key competitive factor, e-invoicing presents a clear opportunity to align digital transformation with climate-conscious operations.

Challenges of Australia E-Invoicing Market:

Low Awareness and Misunderstandings

A major barrier to e-invoicing adoption in Australia is the widespread confusion surrounding what it entails. Many businesses, especially small and medium-sized enterprises and some accounting professionals, mistakenly assume that sending a PDF invoice via email qualifies as e-invoicing. This misconception stems from a limited understanding of Peppol’s structured, machine-readable invoice format and the secure, automated delivery process it uses. As a result, the significant advantages of e-invoicing, such as real-time processing, reduced errors, and seamless integration, are often overlooked. The lack of targeted educational campaigns and user-friendly resources has further slowed adoption. Until this knowledge gap is addressed, especially among SMEs and sole traders, the full potential of e-invoicing to transform Australia’s business ecosystem will remain underutilized, despite government backing and available infrastructure.

Integration Complexity & Resistance to Change

For many organizations, implementing e-invoicing requires adjustments to their existing financial systems, ERP platforms, or accounting workflows. This often involves technical upgrades, data mapping, and staff training—tasks that can be seen as costly or disruptive in the short term. As a result, some businesses are reluctant to move away from familiar manual or semi-digital processes, even when aware of the long-term benefits of automation. Resistance is particularly strong in companies with legacy systems or limited IT resources. Inadequate change management, concerns over downtime, and uncertainty about system compatibility can further deter adoption. To overcome this, clearer migration pathways, stronger support from solution providers, and increased awareness of return on investment are needed to ease the transition and foster greater confidence in digital invoicing solutions.

Coverage Gaps Across Public and Private Sectors

Despite federal mandates requiring e-invoicing adoption among Australian government agencies, uptake remains uneven across both the public and private sectors. While some state agencies and large enterprises have embraced the technology, many suppliers and trading partners have yet to come on board. A key issue is the lack of consistent e-invoicing requirements for private sector businesses, leading to a fragmented landscape. Additionally, inadequate onboarding efforts, particularly for small suppliers, limit participation and reduce the efficiency of the broader e-invoicing ecosystem. This lack of critical mass weakens the network effect, slowing down the realization of widespread benefits such as faster payments and improved transparency. Bridging these gaps requires coordinated policy efforts, incentives for private adoption, and streamlined support mechanisms to ensure inclusive and scalable implementation.

Government Initiatives of Australia E-Invoicing Market:

Federal Mandates for Government Agencies

The Australian federal government has taken a proactive stance by mandating e-invoicing adoption across its agencies, aiming to lead by example in digital transformation. All federal departments are required to be capable of receiving e-invoices via the Peppol network, with deadlines already in place. This top-down enforcement ensures public sector compliance and is intended to encourage similar action in state governments and the private sector. These mandates help create a foundational user base and stimulate demand from suppliers, especially small businesses seeking faster payment cycles. By embedding e-invoicing as a standard practice within its operations, the federal government strengthens the legitimacy and visibility of the initiative, reinforcing its broader digital economy strategy and setting the tone for wider national adoption.

Regulatory Support & Funding Allocation

To accelerate e-invoicing adoption, Australian authorities have introduced supportive regulatory measures and allocated targeted funding. Key reforms simplify compliance obligations, reduce reporting burdens, and encourage businesses to shift from paper to digital systems. Government-backed incentives and budget provisions have been directed toward helping small and medium-sized enterprises upgrade or integrate e-invoicing technology into their operations. Public awareness campaigns and pilot programs have also been implemented to ease the transition. These initiatives not only lower the financial and technical barriers to entry but also help standardize practices across industries. By coupling regulation with funding and support, the government aims to ensure a more inclusive rollout, ultimately fostering a digitally connected economy that enhances efficiency, reduces fraud, and supports long-term business growth.

Peppol Authority and Interoperability Framework

Australia has designated the Australian Taxation Office (ATO) as the Peppol Authority, responsible for overseeing e-invoicing standards, accreditation of service providers, and ongoing governance. Under this framework, the Peppol interoperability model enables seamless invoice exchange between different business systems, regardless of software or provider. This uniformity simplifies integration for businesses of all sizes and promotes wide-scale adoption by eliminating compatibility concerns. The ATO ensures the integrity and reliability of the network while maintaining alignment with international standards. Additionally, the government has worked to harmonize Peppol with existing tax and regulatory requirements to make the transition as frictionless as possible. This structured, government-led approach ensures trust, consistency, and scalability across Australia’s e-invoicing ecosystem, supporting its long-term sustainability and international competitiveness.

Australia E-Invoicing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on channel, deployment type, and application.

Channel Insights:

- B2B

- B2C

- Others

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based and on-premises.

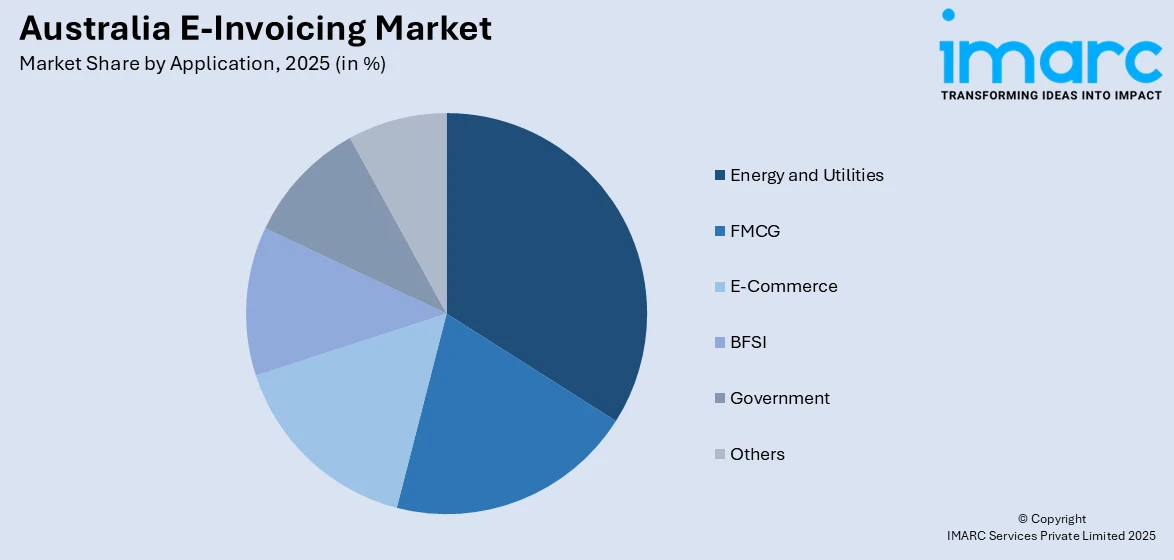

Application Insights:

Access the comprehensive market breakdown Request Sample

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes energy and utilities, FMCG, e-commerce, BFSI, government, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia E-Invoicing Market News:

- April 24, 2024: Airwallex, the leading Australian fintech born in 2015, announced the launch of its payment acceptance service in the USA, now supporting merchants in 35 countries with customized, multi-currency checkout and integrated invoice-linked payment methods. This development dramatically enhances cross-border e-invoicing capabilities for Australian businesses, enabling faster settlements within problematically low overhead member rates and greater global cash flow management.

Australia E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia e-invoicing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-invoicing market in Australia was valued at USD 512.9 Million in 2025.

The Australia e-invoicing market is projected to exhibit a CAGR of 14.89% during 2026-2034.

The Australia e-invoicing market is projected to reach a value of USD 1,854.5 Million by 2034.

Key trends in Australia’s e-invoicing market include the widespread adoption of the Peppol framework driven by government mandates, a strong push for automation to boost efficiency and reduce processing errors, and the growing emphasis on cybersecurity measures to protect invoice data from fraud and unauthorized access.

Key growth drivers of Australia’s e-invoicing market include strong government support through Peppol mandates and digital economy initiatives, significant cost and time efficiencies achieved through faster invoice processing, and enhanced cash flow management and transparency that improve business operations and strengthen supply chain performance across industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)