Australia E-Waste Recycling Market Size, Share, Trends and Forecast by Material, Source, and Region, 2025-2033

Australia E-Waste Recycling Overview:

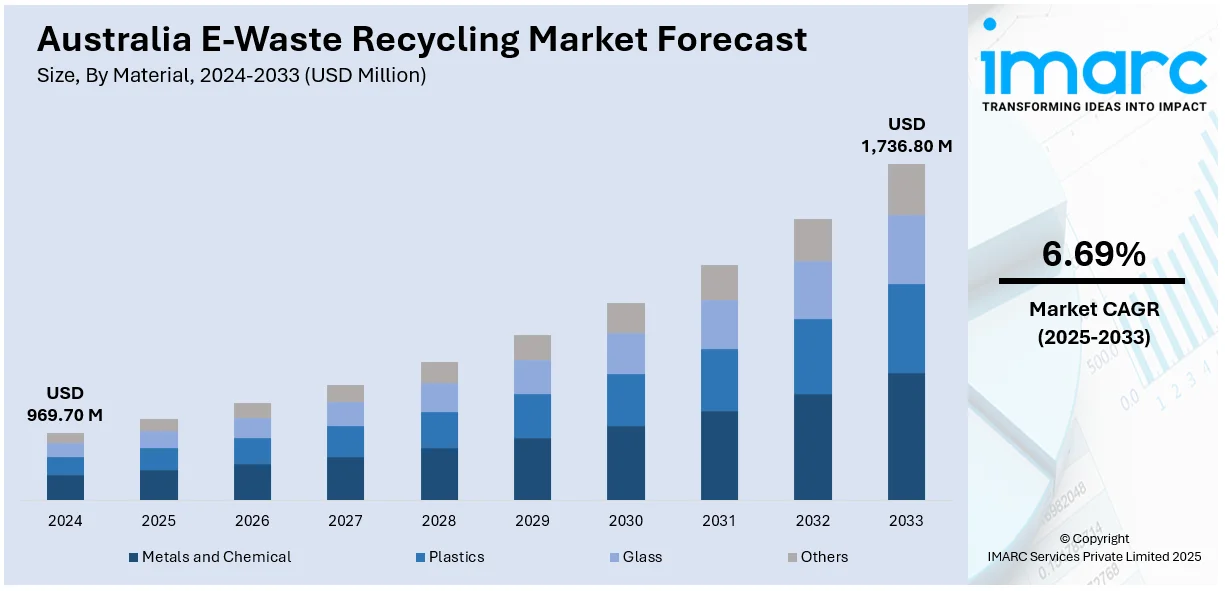

The Australia E-Waste Recycling Market size reached USD 969.70 Million in 2024. Looking forward, the market is expected to reach USD 1,736.80 Million by 2033, exhibiting a growth rate (CAGR) of 6.69% during 2025-2033. The growth is spurred by the greater consumption of electronic devices, greater government regulation for responsible disposal, and greater environmental consciousness among consumers. Advancements in recycling technologies enhance efficiency and material recovery and increasing concerns about resource scarcity propel circular economy tendencies. Furthermore, policies on extended producer responsibility compel manufacturers to accept responsibility for managing the product end-of-life, further fueling recycling efforts supporting the Australia e-waste recycling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 969.70 Million |

| Market Forecast in 2033 | USD 1,736.80 Million |

| Market Growth Rate 2025-2033 | 6.69% |

Key Trends of Australia E-Waste Recycling Market:

Expansion of Producer Responsibility Regulations

The Australian government is strengthening regulations with Extended Producer Responsibility (EPR) policies that obligate manufacturers to take control of their products' entire life cycle. EPR calls for companies to develop electronics that can be recyclable and ensures end-of-life disposal in a responsible manner. These policies, by placing accountability with producers, enhance sustainable product design and recycling practices, curbing e-waste pollution. This also promotes innovation in recyclable material and green packaging, enabling the production of cleaner products. Increasing producer responsibility enables industry practice to integrate with Australia's environmental objectives and creates a greener economy. This compels manufacturers to take a significant role in reducing the increasing e-waste menace, making them produce products with reduced environmental footprint and sustaining effective recycling mechanisms. All in all, EPR policies play a central role in minimizing landfill waste, saving resources, and promoting circular economy values in Australia's electronics industry.

To get more information on this market, Request Sample

Adoption of Advanced Recycling Technologies

Australia is embracing cutting-edge technologies at a rapid pace; by 2024, over 35% of businesses will have automated processes and artificial intelligence (AI) in place, particularly in technology, manufacturing, and finance industries. This trend is now extending to e-waste recycling, where AI-powered robotic sorting systems are being adopted with increasing frequency. Such innovations allow for quicker, more accurate separation of valuable material from electronic trash, enhancing precious metal recovery and minimizing damage to the environment. Through the incorporation of these innovative solutions, the recycling sector is better positioned to handle the increasing quantity of e-waste while achieving sustainability targets. Automation also saves on manpower and improves safety in recycling plants. All in all, this transition to more intelligent, technology-based processing is a strong demonstration of Australia's determination to update waste management and foster a circular economy to sustain the future.

Growth of the Refurbished Electronics Market

The Australia e-waste recycling market demand is rapidly growing as consumers look for affordable, sustainable alternatives to new devices. Refurbishing involves repairing and upgrading used electronics, extending their life and reducing e-waste sent to landfill. This practice supports a circular economy by lowering demand for new manufacturing, conserving resources, and reducing environmental impact. It also increases consumer awareness about sustainability and encourages responsible consumption habits. As more businesses focus on refurbishment, they help divert large amounts of e-waste from traditional recycling streams, easing pressure on waste management systems. Overall, the rise of refurbished electronics complements recycling efforts, promoting sustainability and resource efficiency in Australia’s technology sector, while providing cost-effective options for consumers and contributing to Australia e-waste recycling market growth.

Growth Drivers of Australia E-Waste Recycling Market:

Expanding Consumer Electronics Adoption and Reduced Product Lifespan

One of the key drivers of Australia's e-waste recycling market growth is the increased number of electronic goods entering homes and enterprises, as well as the decreased lifespan of products. Australians are among the world's most avid adopters of digital technology, frequently replacing smartphones, laptops, home media systems, and smart devices. This high device turnover creates a constant flow of obsolete electronics, so there is demand for sound and convenient recycling options. In addition, repeated product upgrades due to software obsolescence, promotional cycles, and new-tech trends result in consumers prematurely discarding functional electronics. This type of behavior is most evident in big cities such as Melbourne, Sydney, and Brisbane, where smart home connections and digital lifestyles are most widespread. The increasing role electronics are playing in everyday life, from wearable health monitors to connected household kitchen appliances, continues to drive the e-waste market for effective collection, refurbishment, and material recovery systems to manage a varied and growing waste stream.

Public Consciousness, Circular Economy Culture, and Business Involvement

Growing consumer awareness for environmental responsibility and the circular economy culture is driving growth in Australia's e‑waste recycling industry. Australians produce far more electronic waste per capita compared to the world average, which has created increasing public pressure for improved recovery activities. In response to this, consumer-oriented programs of reuse and refurbishment services have become visible, particularly in high population hubs such as Sydney, Melbourne, Brisbane and Perth. Entrepreneurs are refurbishing gadgets for schools, charities, and second-hand stores, balancing affordability with sustainability. On the business front, investor pressure and ESG commitments of ASX-listed businesses are compelling demand for structured e-waste management strategies instead of bundling electronics into mixed waste contracts. More corporates are now looking for verified recycling partners that can prove material recovery, reclamation of rare metals, and compliance with regulations. This coming together of ecosystems- public, community-based refurbishers, and corporate ESG requirements, is a strong demand driver for formal e‑waste recycling and reuse facilities across Australia.

Education Sector and Institutional Waste Management Reforms

According to the Australia e-waste recycling market analysis, another significant driver of growth in the industry is the growing emphasis on institutional waste reform across institutions and government agencies, most notably in schools and universities as well as public agencies. Schools, universities, and TAFEs nationwide constantly refresh their IT capabilities, creating substantial amounts of obsolescent equipment in the form of computers, projectors, printers, and networking devices. These organizations come under increasing pressure to prove environmentally sustainable waste management practices, and this has prompted many to implement formal e-waste collection schemes or collaborate with approved recyclers. Government ministries and local government are also aligning with procurement policies that demand responsible end-of-life processing of electronic assets. These institutional customers tend to deal with e-waste recyclers that provide data destruction, asset tracking, and comprehensive compliance reporting, which are features especially significant in public sector contracts. The trend toward environmentally conscious waste management in the government and education markets is fueling steady demand for structured e-waste management services, stimulating new capital and innovation in the overall recycling industry.

Opportunities of Australia E-Waste Recycling Market:

Growth into New Emerging Waste Streams and Product Categories

Perhaps the biggest opportunity in Australia's e-waste recycling sector is growing into new streams of electronic and electrical waste not yet addressed by national programs. Although the existing demand is mainly for televisions, computers, and IT peripherals, there is a growing need for recycling services for emerging waste streams such as small appliances, smart home appliances, electric vehicle parts, and wearables. With the increased use of Internet of Things (IoT) devices and smart devices in Australian homes, the industry will be able to gain from the establishment of systems to handle their end-of-life in a responsible manner. Moreover, the projected expansion of electric cars and solar power storage systems will generate future demand for lithium-ion battery and other advanced component safe recovery and recycling. Firms that develop the ability to safely dismantle and process these new forms of e-waste, especially with procedures suited to Australian safety and environmental requirements, are in a strong position to capture new revenue streams and achieve early market leadership.

Expanding Rural and Remote Services to Bridge Accessibility Gaps

The country's singular geography, with its long distances and scattered population beyond the large cities, offers a chance to close a long-standing gap in e-waste recycling accessibility. Oftentimes, regional and remote communities have uncertain infrastructure for appropriate e-waste disposal, so they stockpile, illegally dump, or send it to landfill. Having scalable and mobile e-waste collection schemes, for example, pop-up collections, depot collaborations with local authorities, or mobile recycling facilities, can assist in bridging the service gap. It is specifically required in mining communities, Aboriginal groups, and agricultural areas where electronic hardware is intensively utilized but there are limited end-of-life options. By investing in local logistics networks and online platforms to manage pickups, recyclers can unlock value in underserved markets while serving national sustainability objectives. In addition, collaboration with local authorities and Indigenous organizations to provide culturally sensitive and community-driven recycling solutions generates long-term social and economic returns, broadening the market while addressing equity in access to environmental services.

Recovery of Valuable Materials for Local Manufacturing Supply

Australia has an expanding potential to reinforce its homegrown supply chain by reclaiming useful material from e-waste and cycling it back into local production. As global demand continues to rise and supply uncertainty for strategic minerals such as cobalt, lithium, and rare earths intensifies, recycling e-waste domestically offers a real second tier of supply for these strategic metals. Australian university- and start-up-driven innovations have shown the potential for recovering high-value metals from waste electronics, which can decrease reliance on imports and the environmental impact of virgin resource mining. This provides synergy with Australia's efforts at advanced manufacturing and clean energy technologies, where critical minerals are crucial inputs. For instance, materials retrieved from recycled batteries, solar panels, and computing devices might be utilized in domestic manufacturing of energy storage units, electric vehicle parts, or new electronics. Taking advantage of this prospect entails synchronizing recycling activities with the needs of industry, encouraging closed-loop production systems, and collaborating public-private partnerships to scale up material recovery commercialization.

Government Initiatives of Australia E-Waste Recycling Market:

Federal Schemes and National Stewardship Schemes

Australia's e-waste recycling industry is heavily driven by federal-level policies that offer core framework and policy guidance. The Australian Government's National Waste Policy lays out the country's resource recovery goals, with a particular emphasis on product stewardship and diverting e-waste from landfills. The nation's first of its kind, the National Television and Computer Recycling Scheme (NTCRS), mandates that importers and manufacturers pay for the collection and recycling of specific types of e-waste so that customers can return these items without restriction. This has provided a secure recycling system for everyday electronic products and encouraged companies to make their products more recyclable. The federal government also collaborates with states and territories to consider extending the scheme to new classes of products such as solar panels, batteries, and small appliances. Aside from stimulating market activity, these measures provide investment in new technologies and infrastructure specific to Australia's distinctive environmental and geographic settings.

State Legislation and Landfill Bans

State governments around Australia have moved decisively to enhance e-waste recycling by enacting local laws and enforcement policies. Victoria has moved furthest, implementing a wide-ranging e-waste landfill ban covering all electronic products irrespective of size or type. This legislation prompts councils and companies to provide specific e-waste drop-off centers and promote responsible disposal practices. South Australia, a pioneer in waste policy for many years, has also introduced bans to guarantee electronic items are kept out of general waste streams. Bans provide a strong regulatory incentive that encourages the construction of local collection networks and facilities for processing e-waste. State grants and strategic plans in New South Wales and Western Australia are constructing the infrastructure to handle rising amounts of e-waste. By customizing policy to local settings, states can respond to varied challenges like transportation, accessibility, and contamination, thus enhancing the overall efficacy of e-waste recycling programs in Australia.

Community Partnerships and Local Government Engagement

It is local government that applies e-waste recycling initiatives on the ground, mediating between national policy and community action. Australian councils are establishing permanent e-waste drop-off centers, commonly situated within transfer stations and resource recovery centers. In areas such as the Northern Rivers in New South Wales or the Gippsland region in Victoria, the local councils have collaborated with not-for-profits and social enterprises to provide innovative collection and refurbishment initiatives. Such joint ventures not only enhance recycling yields but also create jobs and training opportunities within the local community. Additionally, a few local councils are piloting mobile collection facilities in order to serve remote communities and enhance easy recycling services. In addition, local government-led public education campaigns play an important role in modifying consumers' attitudes, particularly in communities where illegal dumping or casual disposal has been prevalent. The grassroots activities make the national e-waste recycling system more effective by instilling community participation, accessibility, and compliance at the local level.

Challenges of Australia E-Waste Recycling Market:

Geographic Dispersion and Logistics Limitations

Its extensive geography and sparse population in areas away from the larger urban areas are perhaps the most urgent of all challenges Australia's e-waste recycling industry faces. Australia's remote villages, mining towns, and country regions tend to have limited or no access to e-waste collection points or processing centers, making logistics costly and complicated. Shipping gathered e-waste from these areas to recycling facilities, commonly placed in coastal metropolises such as Melbourne, Sydney, or Brisbane, increases operational expenses and detracts from the environmental advantages of recycling. These logistical challenges are also compounded by restricted road access, extensive travel distance, and seasonal climatic conditions that could interfere with collection schedules. Whereas densely populated countries can be served by centralized recycling for broad populations, Australia's market calls for decentralized or mobile recycling solutions, which are still underdeveloped. This deficiency acts as a hindrance to scaling up the recycling coverage nationwide and delays making services uniformly available. It calls for focused investment in infrastructure and creative collection frameworks appropriate for regional and remote Australian landscapes.

Inconsistent Regulations and Policy Gaps

Australia's federated political environment generates inconsistency in the implementation of e-waste recycling policy, threatening market expansion and consistent compliance. Whereas states such as Victoria have established straightforward e-waste landfill bans and allocated special funding to support infrastructure investment, other states fall behind or impose weaker regulations. The patchwork nature of the laws hinders national recyclers and manufacturers in complying, particularly when they operate across state borders. In addition, most product categories like household appliances, power tools, and IoT devices, for instance, are not included under national programs yet, leaving a gap in responsibility and restricting the amount of e-waste being sufficiently processed. The disjointed regulatory landscape impacts consumer education and behavior as well, with contrasting expectations and services between territories. Unless there is a harmonized approach across all states and territories, including consistent enforcement and broader product coverage, Australia's e-waste recycling market can't be optimally developed, and the development is uneven in different parts of the country.

Limited Recycling Technology and Processing Capacity

Even with increased demand for e-waste recycling, Australia continues to experience difficulties due to limited local processing capacity and dependence on international markets for some high-value material recovery. Most of the nation's current facilities are geared toward coarse dismantling and material segregation, frequently not having the capacity to recover precious metals or rare earth elements with the needed efficiency to allow operations to be economically feasible. Consequently, valuable parts end up being exported for final processing, subjecting the system to global market risks and regulatory threats. In addition, the fast pace of changes in electronic devices from phones to solar panels requires continuously upgraded recycling technology, which lags in many facilities. This technology gap restricts the processing of various e-waste locally and leads to lower recovery yields and greater contamination. Financing the latest recycling technology, including hydrometallurgical extraction or artificial intelligence-based sorting machines, is low, especially in non-major cities. Without corresponding advances in processing capacity, the sector could stagnate, even as rising amounts of electronic waste flow into the system.

Australia E-Waste Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material and source.

Material Insights:

- Metals and Chemical

- Plastics

- Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes metals and chemical, plastics, glass, and others.

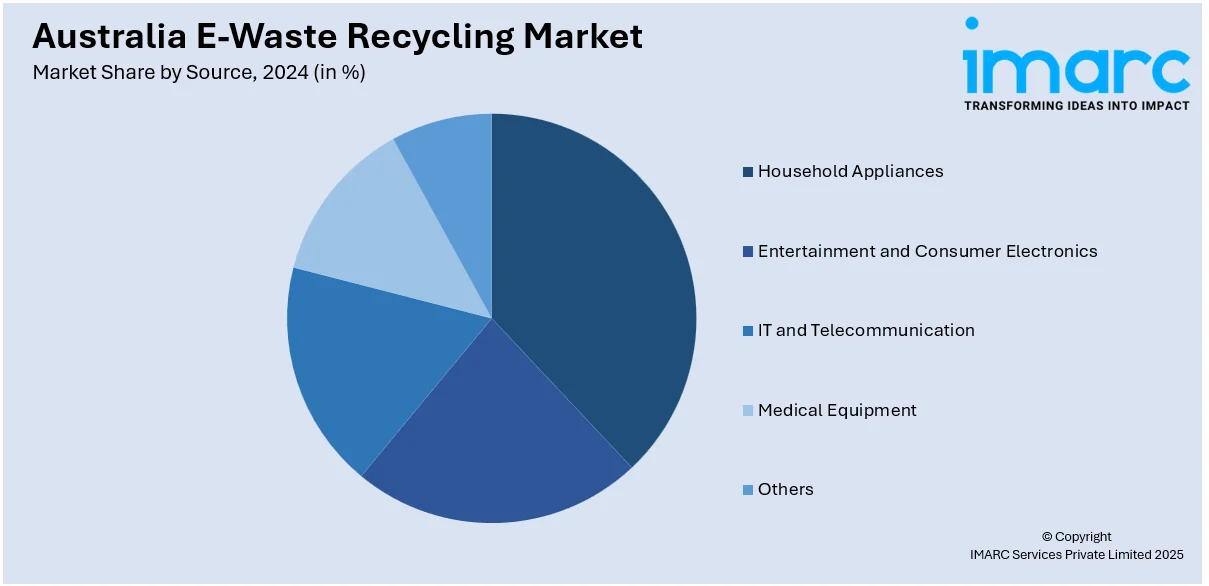

Source Insights:

- Household Appliances

- Entertainment and Consumer Electronics

- IT and Telecommunication

- Medical Equipment

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes household appliances, entertainment and consumer electronics, it and telecommunication, medical equipment, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia E-Waste Recycling Market News:

- In March 2025, A new UNSW-designed Plastics Filament MICROfactorie opened in Sydney, turning hard plastics from e-waste into 3D printing filament. Renew IT’s Lane Cove facility uses this tech to recycle discarded printer and computer plastics, reducing landfill waste. Australia’s e-waste, nearly three times the global average, is being tackled with this innovation, creating jobs and promoting sustainability by replacing imported petrochemical-based filament with recycled materials, supporting a circular economy.

- In March 2024, GreenBox Group, an Australian e-waste management firm, acquired RemarkIT, a New Zealand-based IT waste management and professional services company. Founded in 2000, GreenBox specializes in hardware configuration, data sanitization, recycling, and secure certification, while RemarkIT focuses on commissioning, decommissioning, and remarketing IT equipment. This acquisition strengthens GreenBox’s service offerings and expands its presence in the Australasian e-waste management market. Financial details were not disclosed.

Australia E-Waste Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Metals and Chemical, Plastics, Glass, Others |

| Sources Covered | Household Appliances, Entertainment and Consumer Electronics, IT and Telecommunication, Medical Equipment, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia e-waste recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia e-waste recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia e-waste recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia e-waste recycling market was valued at USD 969.70 Million in 2024.

The Australia e-waste recycling market is projected to exhibit a CAGR of 6.69% during 2025-2033.

The Australia e-waste recycling market is expected to reach a value of USD 1,736.80 Million by 2033.

The Australia e-waste recycling market is evolving with increased focus on circular economy practices, integration of advanced sorting technologies, and expansion of product stewardship schemes. Growing consumer awareness, government regulations, and innovations in battery and rare metal recovery are driving sustainable management of diverse electronic waste across urban and regional areas.

Rising electronic consumption, stricter government regulations, and growing environmental awareness are key drivers of the Australia e-waste recycling market. Increased product stewardship initiatives, technological advancements in material recovery, and expanding infrastructure in regional areas further propel the demand for efficient and responsible electronic waste management nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)