Australia Edge Data Center Market Size, Share, Trends and Forecast by Component, Facility Size, Vertical, and Region, 2026-2034

Australia Edge Data Center Market Overview:

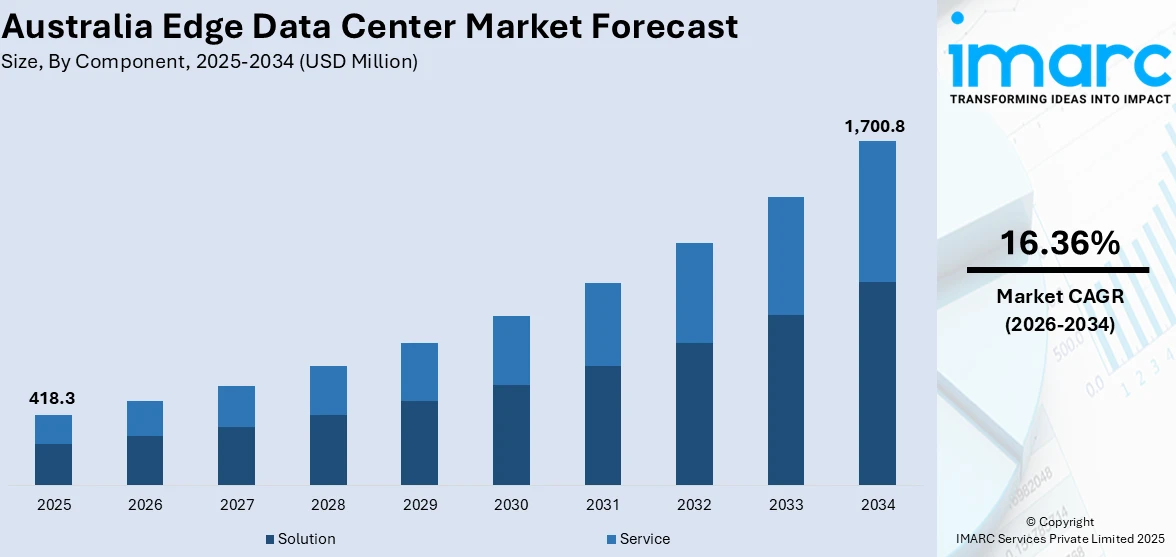

The Australia edge data center market size reached USD 418.3 Million in 2025. Looking forward, the market is expected to reach USD 1,700.8 Million by 2034, exhibiting a growth rate (CAGR) of 16.36% during 2026-2034. Surging low-latency demand, increasing fifth-generation (5G) network deployment, and hybrid cloud deployment are major factors propelling the market growth. Besides this, data sovereignty regulation compliance, growth in Internet of Things (IoT) adoption, and smart city project creation are also stimulating the market growth. Furthermore, remote industrial digitalization, expansion in content delivery networks (CDNs), mobile data traffic growth, heightened cybersecurity requirements, and government-funded digital infrastructure initiatives are further boosting the Australia edge data center market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 418.3 Million |

| Market Forecast in 2034 | USD 1,700.8 Million |

| Market Growth Rate 2026-2034 | 16.36% |

Key Trends of Australia Edge Data Center Market:

Low-Latency Demand for Real-Time Applications

The market is being driven by the rising demand for ultra-low latency to support real-time digital services. As users spend more time using applications like online gaming, video conferencing, and live coverage of events, service providers are compelled to maintain data travel times as minimal as possible. Centralized data centers tend to introduce delays that compromise the performance of such applications. Edge data centers allow for data processing close to its source, which significantly reduces latency and improves the end-user experience. For those places where there is high geographic dispersal, this matters a lot because centralized systems are unable to maintain sustained performance. Moreover, the demand is also prominent from companies that implement real-time analytics, such as retail, logistics, and financial services, which is fueling the Australia edge data center market growth.

To get more information on this market Request Sample

5G Rollout and Enhanced Mobile Connectivity

The deployment of 5G networks across Australia is also acting as a major catalyst for the growth of edge data centers. In 2024, 5G networks have been rolled out to approximately 85% of Australia's population, with an aim to reach over 95% by mid-2025. The rollout covers over 200 cities and over 3,000 suburbs, from major cities to the regions. It is more powerful and faster, and this is quite in line with the potential of edge infrastructure. Moreover, there is a matching need to develop local data processing capacity to unlock the full potential of the technology. Edge data centers offset the burden on central cloud infrastructure and enable real-time processing for applications such as augmented reality, autonomous vehicles, and smart city infrastructures. The combined power of 5G and edge computing allows companies to roll out high-performance services without the issue of latency, especially in areas of high mobile traffic. In addition to this, greater use of mobile devices and data usage in metropolitan and suburban regions creates an immediate demand for localized high-speed infrastructure.

Hybrid Cloud Adoption with Local Compliance Needs

The shift toward hybrid cloud infrastructures is another factor escalating the Australia edge data center market demand. The majority of organizations are combining public cloud services with regional private infrastructure to address flexibility, cost, and control requirements. However, industries such as healthcare, banking, and government require adherence to rigorous data residency and privacy regulations. Edge data centers offer a practical answer by facilitating local data processing without sacrificing integration into broader cloud plans. This ensures sensitive information stays within country borders, as mandated by law and regulation. Furthermore, organizations are finding that edge solutions enhance operational resilience by reducing dependence on far-flung, centralized servers. With hybrid cloud becoming increasingly mainstream, particularly with medium to large-sized enterprises, regional edge infrastructure is in increasing demand. The facilities provide the scalability and performance required while enabling organizations to stay compliant with Australia's changing digital governance requirements.

Growth Drivers of Australia Edge Data Center Market:

Rising AI and Machine Learning Workloads

The growing deployment of artificial intelligence (AI) and machine learning (ML) applications across industries is a key driver for edge data center development in Australia. Sectors such as healthcare, retail, agriculture, and mining increasingly rely on real-time data analysis and localized processing, which edge data centers can deliver efficiently. By bringing computation closer to the source, these centers reduce bandwidth consumption, enhance responsiveness, and support the scale required for AI models. Edge infrastructure also supports privacy-sensitive AI applications, as data can be processed locally without moving to central clouds. As businesses continue to adopt AI to gain competitive advantages, the demand for scalable, low-latency edge data centers capable of handling high-performance workloads is expected to rise significantly across Australia.

Decentralization of IT Infrastructure in Remote and Regional Areas

Australia’s vast geography and the need for reliable digital infrastructure outside metropolitan hubs are fueling demand for edge data centers in remote and regional areas. Traditional centralized data centers located in major cities cannot always deliver the low-latency, high-availability services required by businesses and consumers in rural regions. Edge facilities bring processing power closer to the end users, improving performance and supporting applications like telehealth, online education, remote work, and smart agriculture. According to the Australia edge data center market analysis, government investments in regional connectivity and digital inclusion further support this decentralization. By enhancing digital equity and enabling advanced services in underserved areas, the spread of edge data centers is becoming a crucial enabler of inclusive technological growth across Australia.

Sustainability and Energy Efficiency Initiatives

Environmental concerns and Australia’s commitment to reducing carbon emissions are pushing data infrastructure providers to adopt greener solutions. Edge data centers, with their smaller footprints and localized architecture, can be designed for optimal energy use and integration with renewable energy sources. Many operators are focusing on innovations such as liquid cooling, modular systems, and AI-based energy management to lower operational costs and environmental impact. Additionally, Australia's climate policies and industry standards encourage the adoption of sustainable practices, creating incentives for building eco-friendly edge facilities. As enterprises and governments prioritize green IT, edge data centers offer a more sustainable alternative to large hyperscale centers, driving their adoption in line with environmental, social, and governance (ESG) goals.

Australia Edge Data Center Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, facility size, and vertical.

Component Insights:

- Solution

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and service.

Facility Size Insights:

- Small and Medium Facility

- Large Facility

The report has provided a detailed breakup and analysis of the market based on the facility size. This includes small and medium facility and large facility.

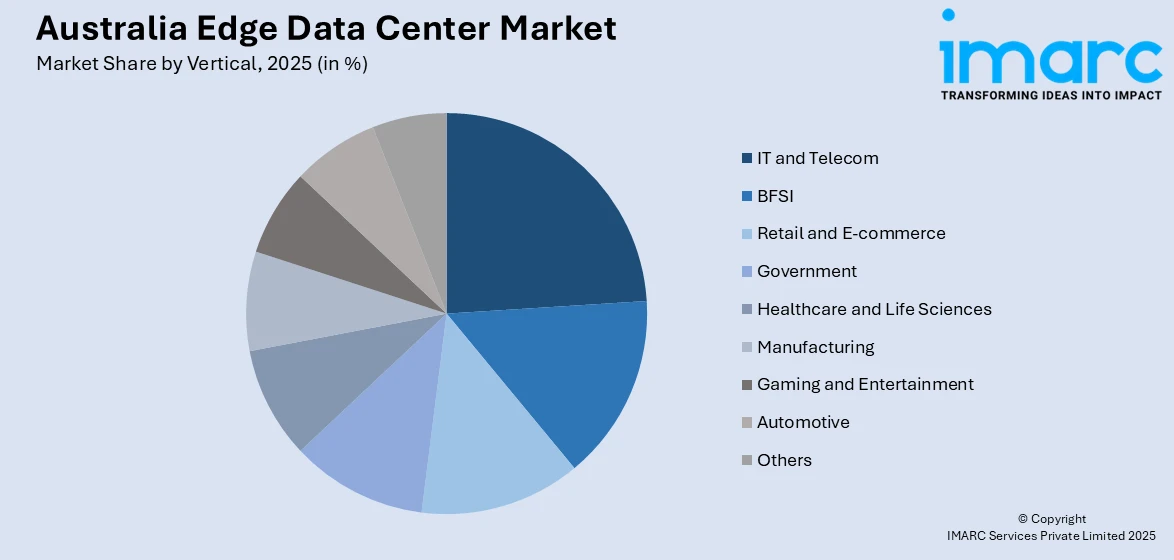

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- IT and Telecom

- BFSI

- Retail and E-commerce

- Government

- Healthcare and Life Sciences

- Manufacturing

- Gaming and Entertainment

- Automotive

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes IT and telecom, BFSI, retail and e-commerce, government, healthcare and life sciences, manufacturing, gaming and entertainment, automotive, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Edge Centres

- Leading Edge Data Centres Pty Ltd.

- Macquarie Technology Group

- Nextdc Ltd

- Zella DC

Australia Edge Data Center Market News:

- In April 2024, TPG Telecom and Optus entered into a USD 1.6 billion, 11-year network-sharing agreement. This deal allows TPG's Vodafone brand to extend its coverage from 400,000 to over 1 million square kilometers, reaching about 98.4% of the population. Optus benefits by accelerating its 5G rollout, particularly in regional areas.

- In June 2024, Equinix announced a USD 160 million investment (approx.) to expand its data centers in Sydney and Melbourne, adding 4,175 cabinets to meet growing demand for AI workloads and high-density computing infrastructure.

Australia Edge Data Center Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Service |

| Facility Sizes Covered | Small and Medium Facility, Large Facility |

| Verticals Covered | IT and Telecom, BFSI, Retail and E-Commerce, Government, Healthcare and Life Sciences, Manufacturing, Gaming and Entertainment, Automotive, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Edge Centres, Leading Edge Data Centres Pty Ltd., Macquarie Technology Group, Nextdc Ltd, Zella DC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia edge data center market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia edge data center market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia edge data center industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The edge data center market in Australia was valued at USD 418.3 Million in 2025.

The Australia edge data center market is projected to exhibit a CAGR of 16.36% during 2026-2034.

The Australia edge data center market is projected to reach a value of USD 1,700.8 Million by 2034.

Growth in Australia’s edge data center market is driven by rising low-latency demands from IoT and real-time apps, rapid 5G deployment across urban and regional areas, hybrid cloud adoption spurred by data sovereignty requirements in regulated industries, and significant AI and hyperscale investment supporting local compute needs.

Key trends in Australia’s edge data center market include growing demand for ultra-low latency to support IoT and real-time applications, rising use of hybrid cloud models, and increased focus on data sovereignty compliance across regulated sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)