Australia Edible Oil Market Size, Share, Trends and Forecast by Product Type, Nature, Distribution Channel, End Use, and Region, 2026-2034

Australia Edible Oil Market Overview:

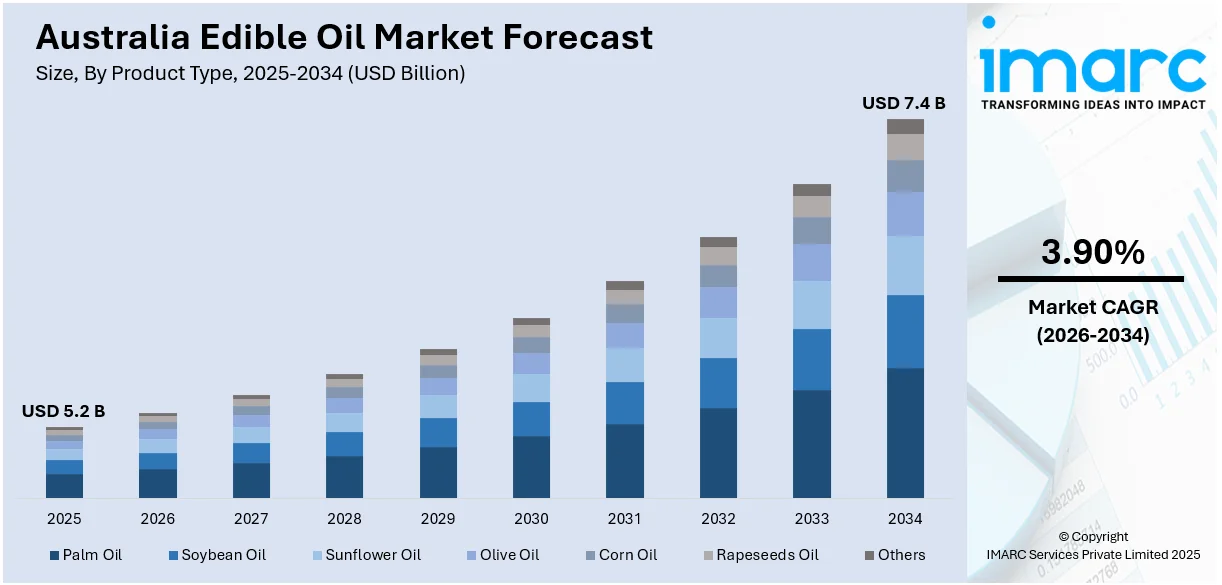

The Australia edible oil market size reached USD 5.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.4 Billion by 2034, exhibiting a growth rate (CAGR) of 3.90% during 2026-2034. The market is driven by increasing health-consciousness, leading to higher demand for healthier oils like olive and canola. The rise of plant-based diets fuels interest in alternative oils, while sustainability concerns push for ethically sourced, and eco-friendly options which is supporting the Australia edible oil market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.2 Billion |

| Market Forecast in 2034 | USD 7.4 Billion |

| Market Growth Rate 2026-2034 | 3.90% |

Australia Edible Oil Market Trends:

Growing Demand for Healthier Edible Oils

Australian consumer preference is moving towards healthier edible oils as awareness about nutrition and wellness increases. Edible oils that are rich in unsaturated fats, including olive, avocado, and canola oil, are experiencing growing demand due to their perceived health benefits. This trend is complemented by nutritional guidelines recommending lowering the intake of saturated fats. Also, enriched edible oils containing Omega-3 and plant sterols are picking pace as consumers look for functional foods. Clean-label trends have influenced manufacturers to focus on purity and natural processing. This has encouraged retailers to increase organic and cold-pressed oil offerings targeting health-aware consumers looking for sourcing and production transparency further supporting the Australia edible oil market outlook.

To get more information on this market Request Sample

Rising Popularity of Plant-Based and Alternative Oils

The increasing adoption of plant-based diets is driving the Australia edible oil market share. As of 2024, about 5% of Australians follow a vegan diet, a 2% rise from the previous year, while 21% identify as 'meat reducers,' reflecting a shift toward plant-based choices. This trend fuels interest in oils derived from nuts, seeds, and algae, offering sustainable options for health-conscious consumers. Coconut, flaxseed, and hemp seed oils are becoming increasingly popular for their nutritional value and adaptability in cooking and body care. The development in food technology also favors algae-based oils, which are high in essential fatty acids and have lesser environmental footprints. Consumers are increasingly concerned with the source of ethically obtained, minimally processed products, forcing brands to develop and create greener edible oil substitutes.

Sustainability and Ethical Sourcing Initiatives

Sustainability issues are redefining the Australian edible oil industry as consumers and regulatory agencies prioritize ethical sourcing and environmental stewardship. Consumer demand for palm oil substitutes and sustainably certified products is on the increase, prompting companies to ensure responsible supply chain operations. Certifications like Roundtable on Sustainable Palm Oil (RSPO) and organic certification drive purchasing behavior, as consumers favor transparent and environmentally friendly brands. Moreover, local sourcing is also picking up pace as consumers favor locally made oils to minimize carbon footprints. In response, brands are enhancing traceability, adopting eco-friendly packaging, and investing in regenerative farming practices to create a more sustainable supply chain.

Australia Edible Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type, nature, distribution channel, and end use.

Product Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Olive Oil

- Corn Oil

- Rapeseeds Oil

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes palm oil, soybean oil, sunflower oil, olive oil, corn oil, rapeseeds oil, and others.

Nature Insights:

- Organic

- Conventional

A detailed breakup and analysis of the market based on the nature have also been provided in the report. This includes organic, and conventional.

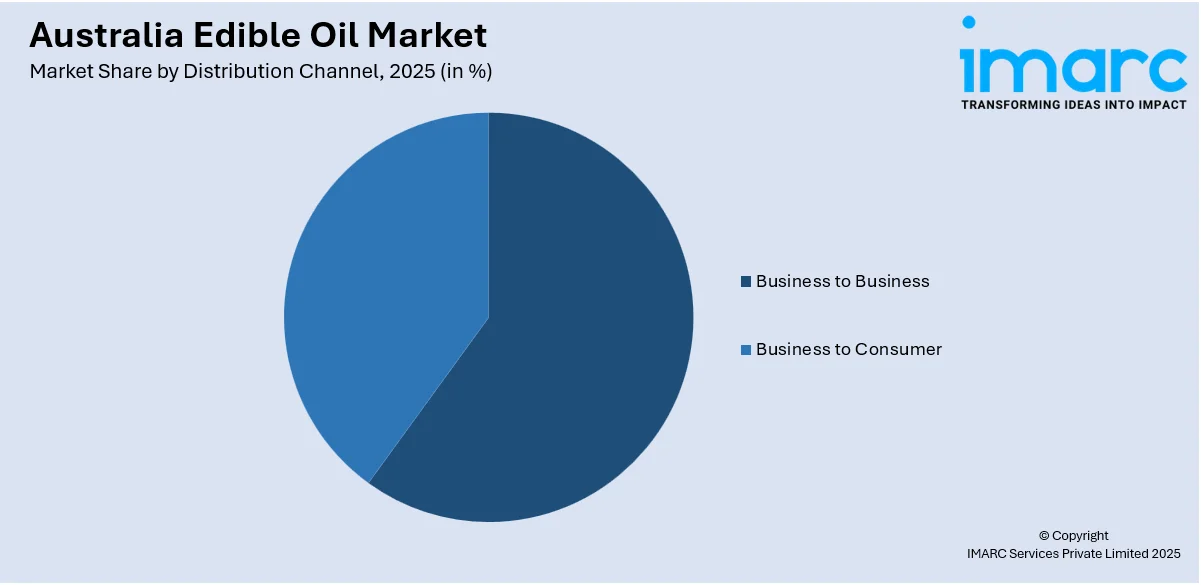

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Business to Business

- Business to Consumer

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes business to business, and business to consumer.

End Use Insights:

- Industrial

- Food Service

- Retail

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes industrial, food service, and retail.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Edible Oil Market News:

- In March 2024, Australian Oilseed Investments (AOI) and EDOC Acquisitions Corporation merged in a US$190M deal to form Australian Oilseeds Holdings (AOH), creating an oilseed giant in the Asia-Pacific region. The merger will expand AOI's crushing capacity to 160,000 tonnes, positioning AOH as the largest cold-pressed oil and meal producer. AOI’s director Gary Seaton will lead AOH as CEO and chair, focusing on non-GMO, chemical-free feed ingredients for the food supply chain.

- In February 2024, Cargill launched the SustainConnect programme in Australia to meet the growing demand for sustainable canola. The initiative supports local farmers by offering financial incentives for adopting sustainable practices, such as nutrient management and reduced tillage, to enhance soil health and reduce emissions. Partnering with Regrow, Cargill will measure and verify carbon outcomes using advanced data and remote sensing to drive sustainability in agriculture.

Australia Edible Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Olive Oil, Corn Oil, Rapeseeds Oil, Others |

| Natures Covered | Organic, Conventional |

| Distribution Channels Covered | Business to Business, Business to Consumer |

| End Uses Covered | Industrial, Food Service, Retail |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia edible oil market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia edible oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia edible oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia edible oil market was valued at USD 5.2 Billion in 2025.

The Australia edible oil market is projected to exhibit a CAGR of 3.90% during 2026-2034, reaching a value of USD 7.4 Billion by 2034.

The Australia edible oil market is driven by rising health awareness, growing demand for plant-based and heart-healthy oils, and increasing multicultural culinary influences. Expanding food processing industries and changing dietary habits also support growth. Innovation in cold-pressed and organic oils attracting health-conscious consumers, is further boosting both retail and foodservice sector demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)