Australia Edtech Hardware Market Size, Share, Trends and Forecast by Sector, End User, and Region, 2025-2033

Australia Edtech Hardware Market Size and Share:

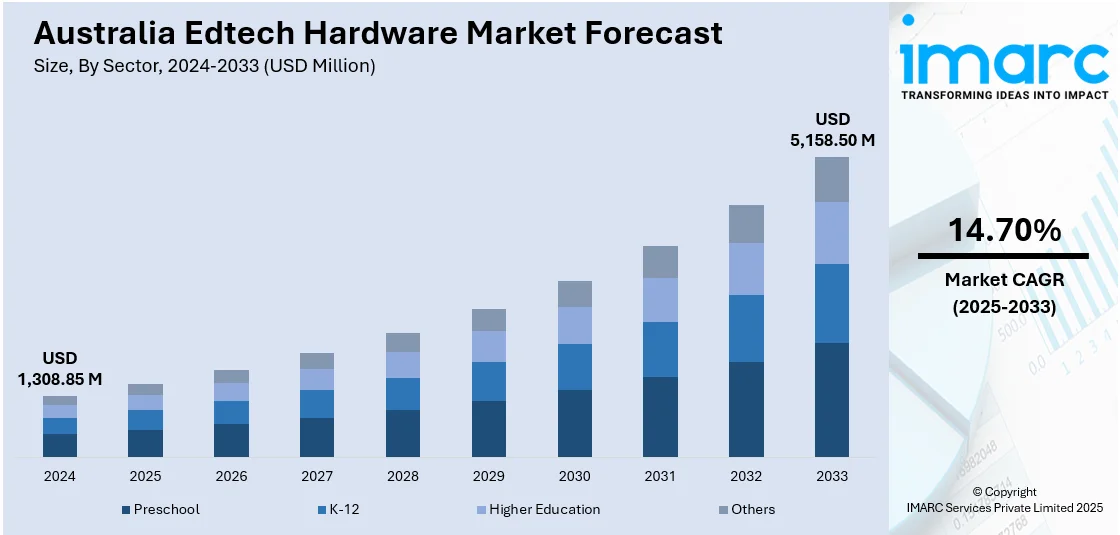

The Australia edtech hardware market size reached USD 1,308.85 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,158.50 Million by 2033, exhibiting a growth rate (CAGR) of 14.70% during 2025-2033. The market is driven by structured government support through digital education funding, institutional commitment to modernizing learning infrastructure, and vendor innovation tailored to regional needs. Increasing reliance on blended formats is pushing hardware to the center of instructional design, demanding robust device ecosystems and in turn fueling the market. Product localization and integrated service offerings are raising buyer confidence, further augmenting the Australia edtech hardware market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,308.85 Million |

| Market Forecast in 2033 | USD 5,158.50 Million |

| Market Growth Rate 2025-2033 | 14.70% |

Australia Edtech Hardware Market Trends:

Government Investment and Policy Support

Federal and state governments across Australia have steadily increased investment in digital infrastructure for education. This includes funding for device procurement, smart classrooms, and network upgrades in public schools. Programs such as the National School Reform Agreement and various state-level digital literacy initiatives have laid the groundwork for hardware adoption. Additionally, procurement frameworks have been streamlined to allow faster onboarding of approved technology vendors, creating a more accessible market entry pathway. On August 21, 2024, EQT announced its investment in Compass, a Melbourne-based K-12 SaaS education company, to support its growth and innovation in education software solutions. With over 3,000 schools and 4 million users, Compass is enhancing its platform with a focus on analytics, learning, assessment, and timetabling, helping schools transition to cloud-based management systems. EQT's investment aims to accelerate Compass' expansion, including international growth, further M&A opportunities, and talent acquisition. These collaborations are critical in supporting indigenous communities, where hardware tools serve not only as educational aids but also as cultural bridges. The emphasis on STEM education, combined with grants targeting technological adoption in K-12 and tertiary institutions, creates sustained demand for reliable devices and peripherals. Supportive regulation, clear procurement frameworks, and targeted funding continue to accelerate the adoption of connected learning devices. This trend remains a significant force behind Australia edtech hardware market growth.

To get more information on this market, Request Sample

Institutional Digitization and Learning Model Transformation

Australian schools and universities are rapidly transitioning from traditional methods toward blended and remote learning formats. This shift demands dependable, scalable hardware solutions capable of supporting interactive applications, cloud-based tools, and video content. Institutions are updating legacy systems to ensure compatibility with newer educational platforms, which is driving the replacement cycle for classroom hardware. Tertiary institutions, in particular, are adopting modular tech solutions that integrate with lecture capture systems, virtual labs, and collaboration tools, making devices more central to day-to-day learning. Budget allocations are increasingly tied to long-term digital strategies, ensuring continuity in procurement and infrastructure refresh cycles. Primary and secondary schools are also investing in rugged, student-friendly devices that can handle daily wear and tear, particularly in shared-device environments. On May 1, 2025, the Australian Islamic College (AIC) partnered with IXL Learning to streamline personalized learning across its six schools, serving 5,500 students, through a unified platform for assessments, curriculum, and reporting. This shift towards integrated edtech solutions signals growing demand for compatible hardware like tablets, laptops, and interactive displays in schools across Australia to support these platforms. As educational institutions increasingly adopt such technology, the need for reliable and efficient hardware in the Australian edtech market is expected to rise. Public-private partnerships are also gaining traction, especially in regional and remote areas where access to quality education depends on reliable tech-enabled delivery. Equally relevant is the push for secure and manageable ecosystems, with many institutions opting for centralized device management solutions. IT administrators in education are prioritizing platforms that enable remote troubleshooting, user tracking, and compliance monitoring.

Australia Edtech Hardware Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on sector and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

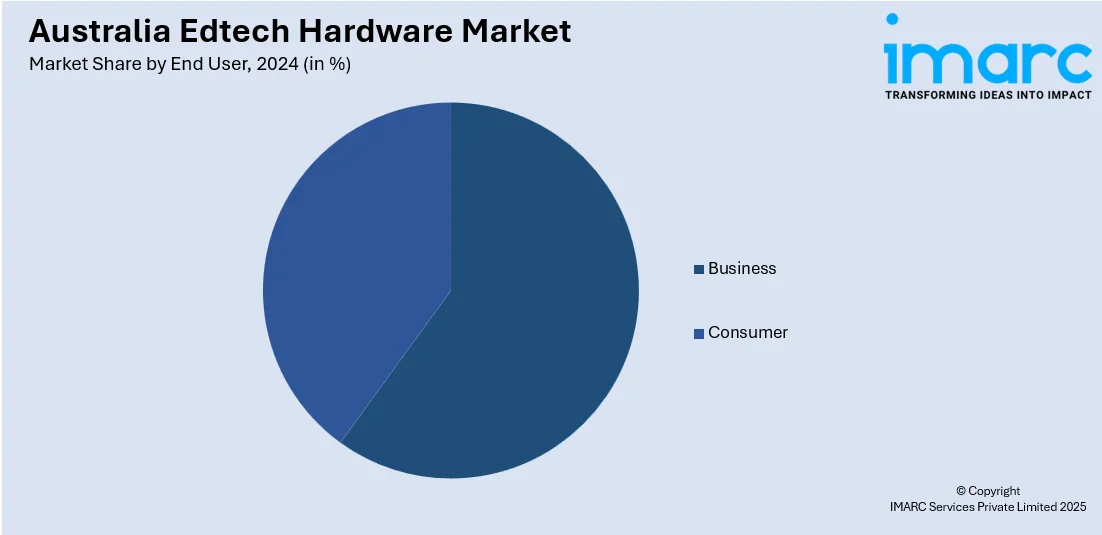

End User Insights:

- Business

- Consumer

The report has provided a detailed breakup and analysis of the market based on the end user. This includes business and consumer.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Edtech Hardware Market News:

- On January 24, 2025, HEX, an edtech company, acquired Sydney-based EntryLevel to expand its reach and tackle the global skills and employability gap. This acquisition aligns with HEX's vision to incorporate AI literacy into its programs, preparing students for a rapidly evolving workforce. The merger will leverage both companies' strengths, with HEX aiming to enhance its educational offerings and deliver world-class, cross-disciplinary learning solutions globally.

Australia Edtech Hardware Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| End Users Covered | Business, Consumer |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia edtech hardware market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia edtech hardware market on the basis of sector?

- What is the breakup of the Australia edtech hardware market on the basis of end user?

- What is the breakup of the Australia edtech hardware market on the basis of region?

- What are the various stages in the value chain of the Australia edtech hardware market?

- What are the key driving factors and challenges in the Australia edtech hardware market?

- What is the structure of the Australia edtech hardware market and who are the key players?

- What is the degree of competition in the Australia edtech hardware market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia edtech hardware market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia edtech hardware market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia edtech hardware industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)