Australia Electric Actuators Market Size, Share, Trends and Forecast by Type, End-User, and Region, 2025-2033

Australia Electric Actuators Market Overview:

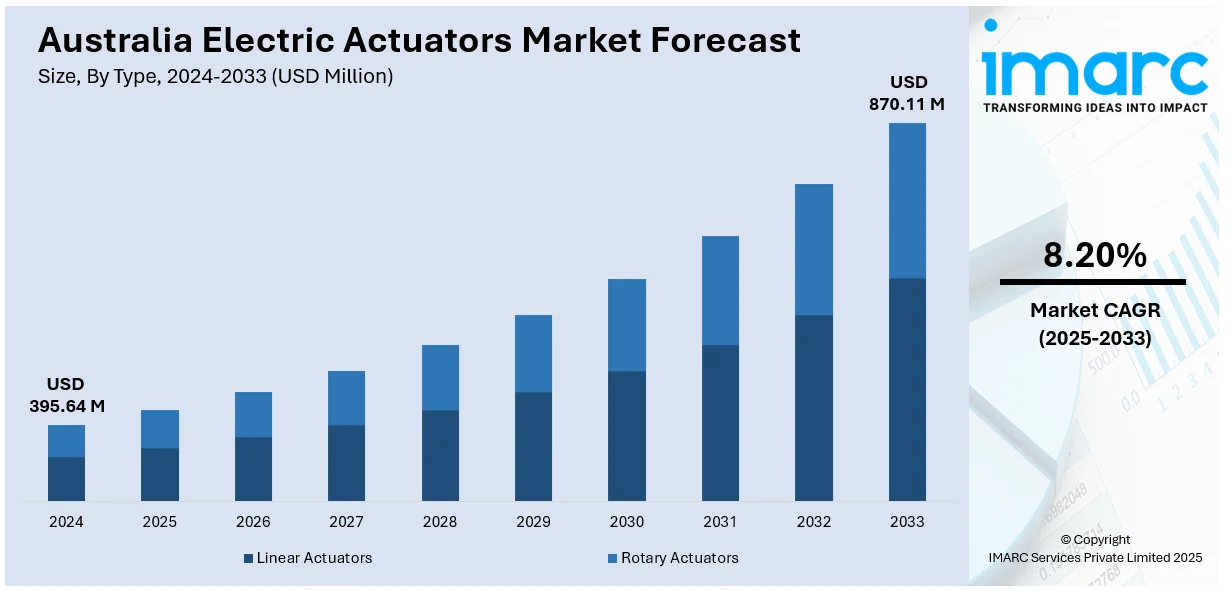

The Australia electric actuators market size reached USD 395.64 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 870.11 Million by 2033, exhibiting a growth rate (CAGR) of 8.20% during 2025-2033. The demand is fueled by growing need for automation, energy efficiency, and accuracy in industrial uses. The expansion of the manufacturing industry, along with environmental regulations, is driving the use of electric actuators. Further, the emphasis on green technologies is promoting demand for electric actuators in industries like mining, oil & gas, and water treatment, supporting the Australia electric actuators market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 395.64 Million |

| Market Forecast in 2033 | USD 870.11 Million |

| Market Growth Rate 2025-2033 | 8.20% |

Australia Electric Actuators Market Trends:

Adoption of Automation Across Industries

The implementation of automation technologies across industries is a dominant factor driving the growth of Australia electric actuators market. Since industries want to streamline operations, increase productivity, and reduce errors caused by human intervention, there has been higher demand for reliable and accurate control systems. For instance, as per industry reports, in 2024, 35% of Australian businesses adopted AI or automation, with large firms showing a 60% adoption rate versus 20% in SMEs. AI spending grew 20%, reaching $3.5 billion, supported by $124 million in government funding. Electric actuators are crucial components in automated systems, enabling accurate positioning and efficient control in applications such as robotics, assembly lines, and process industries. Not only does automation enhance efficiency, but it also lowers operational expenses, thus enhancing the adoption of electric actuators. In addition, as manufacturers adopt smart technologies, the interconnectivity of electric actuators with IoT and digital control systems is making them more desirable. The trend will continue to boost the demand for electric actuators in different industrial applications, thus enhancing the overall market.

To get more information on this market, Request Sample

Energy Efficiency and Sustainability Initiatives

As Australia continues to prioritize sustainability and reduce carbon emissions, there is a growing emphasis on energy-efficient solutions. For instance, according to industry reports, Australia’s 2024 emissions projections show the country is on track to reduce greenhouse gas emissions by 42.6–42.7% below 2005 levels by 2030, exceeding its emissions budget of 4,377 Mt CO₂-e. Emissions are projected to decline in nearly all sectors, with electricity emissions halving by 2030. Australia electric actuators market share benefits from this energy transition. Electric actuators, compared to their pneumatic or hydraulic counterparts, offer improved energy efficiency and are increasingly being adopted in sectors where environmental considerations are paramount. Industries such as water treatment, mining, and manufacturing are transitioning to electric actuators due to their low energy consumption, long service life, and minimal maintenance requirements. This shift supports Australia’s broader sustainability goals while simultaneously enhancing operational efficiency. As the nation continues to invest in clean technologies, the demand for energy-efficient automation solutions, including electric actuators, is poised to rise significantly, thus supporting the Australia electric actuators market growth.

Australia Electric Actuators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and end-user.

Type Insights:

- Linear Actuators

- Rotary Actuators

The report has provided a detailed breakup and analysis of the market based on the type. This includes linear actuators and rotary actuators.

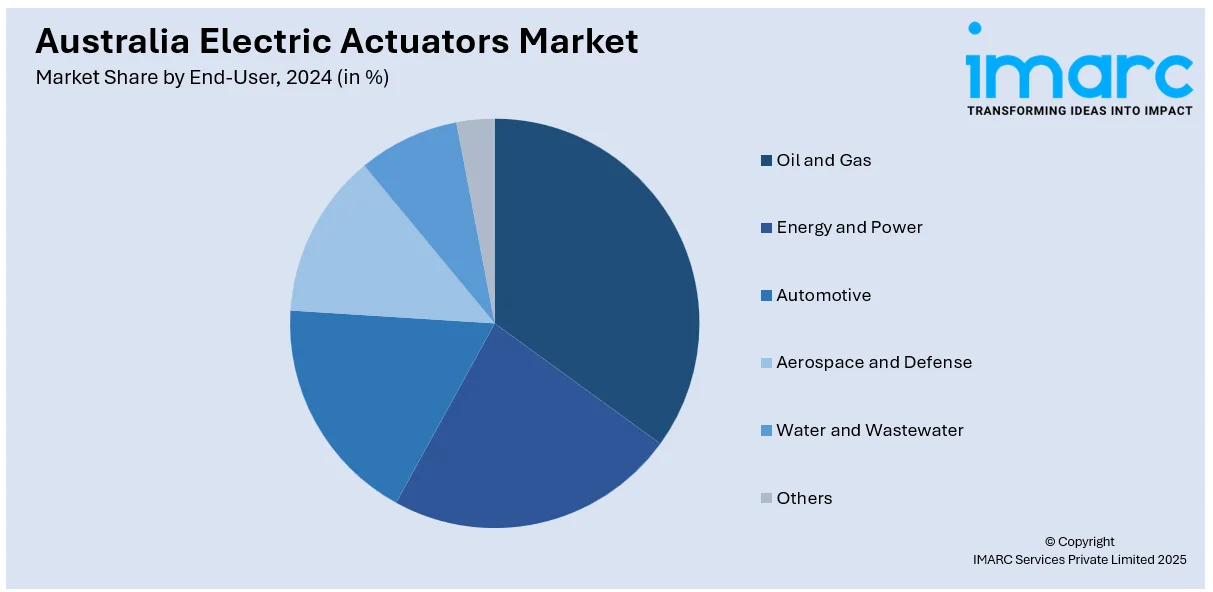

End-User Insights:

- Oil and Gas

- Energy and Power

- Automotive

- Aerospace and Defense

- Water and Wastewater

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes oil and gas, energy and power, automotive, aerospace and defense, water and wastewater, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Electric Actuators Market News:

- In June 2024, SMC Corporation launched the EQ electric actuator series in Australia, featuring integrated controllers to simplify automation and reduce emissions. The EQFS (slide-type) and EQY (rod-type) models offer compact design, easy setup, and energy-efficient operation, ideal where compressed air is unavailable. With up to 60% lower CO₂ emissions, the series enhances sustainability and productivity. Compatible with existing SMC actuators, it ensures easy retrofitting.

Australia Electric Actuators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Linear Actuators, Rotary Actuators |

| End-Users Covered | Oil and Gas, Energy and Power, Automotive, Aerospace and Defense, Water and Wastewater, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia electric actuators market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia electric actuators market on the basis of type?

- What is the breakup of the Australia electric actuators market on the basis of end-user?

- What is the breakup of the Australia electric actuators market on the basis of region?

- What are the various stages in the value chain of the Australia electric actuators market?

- What are the key driving factors and challenges in the Australia electric actuators market?

- What is the structure of the Australia electric actuators market and who are the key players?

- What is the degree of competition in the Australia electric actuators market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia electric actuators market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia electric actuators market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia electric actuators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)