Australia Electronic Toll Collection Market Size, Share, Trends and Forecast by Technology, System, Subsystem, Offering, Toll Charging, Application, and Region, 2025-2033

Australia Electronic Toll Collection Market Overview:

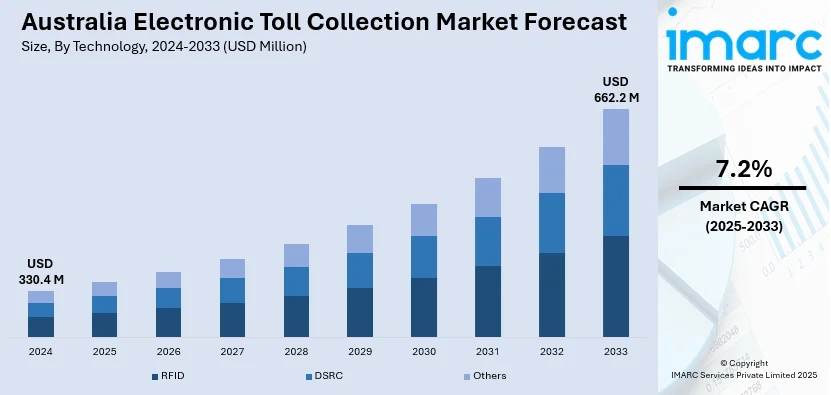

The Australia electronic toll collection market size reached USD 330.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 662.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.2% during 2025-2033. The market is driven by the increasing demand for efficient traffic management, smart city development, and the adoption of advanced technologies like RFID and DSRC. Government initiatives, rising vehicle numbers, and the need for seamless, contactless tolling experiences are further accelerating the transition to automated systems, promoting long-term market growth and enhanced commuter convenience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 330.4 Million |

| Market Forecast in 2033 | USD 662.2 Million |

| Market Growth Rate 2025-2033 | 7.2% |

Australia Electronic Toll Collection Market Trends:

Growing Adoption of RFID and DSRC Technologies

Australia's electronic toll collection (ETC) sector is in the process of a radical change with the implementation of cutting-edge technologies such as Radio Frequency Identification (RFID) and Dedicated Short Range Communication (DSRC). These technologies are increasing efficiency, precision, and delivering seamless, contactless transactions for travelers, lowering traffic congestion at toll stations. With increasing numbers of states and territories implementing RFID and DSRC systems, market penetration will continue to grow. Increased focus on smart cities and efforts to reduce traffic jams further drive the move towards autonomous, more efficient tolling technology. This optimistic Australia electronic toll collection market outlook was underscored at the Roads, Tolling & Technology 2024 conference hosted by ITS Australia, where leading industry players converged to discuss advancements in tolling technologies, drive new collaborations, and define the future of intelligent transport systems throughout the region. This portends long-term growth for Australia's ETC market, fueled by technology that improves operational efficiency and enhances the user experience.

To get more information on this market, Request Sample

Expanded integration with smart infrastructure

The conjoining of electronic toll collection (ETC) systems with smart infrastructure in Australia is a trend that is expected to propel the Australia electronic toll collection market growth. Smart infrastructure, including intelligent traffic management systems and connected vehicles, is being installed in all major cities and highways. The conjoining enables real-time tolling and analysis of traffic data, enhancing road management and cutting down on congestion. As urban areas and regions are still giving preference to technological upgrades in transport, the need for ETC systems compatible with such technologies is rising. Smart infrastructure growth not only increases toll efficiency but also maximizes traffic flow, lowers carbon emissions, and enhances safety. This trend is driving the expansion of the Australia electronic toll collection market, with considerable growth in market share as governments invest in smart road networks that utilize advanced tolling technologies.

Rise in Distance-Based and Time-Based Tolling Models

Australia is increasingly adopting dynamic tolling models, including distance-based and time-based tolling, which are defining the future of electronic toll collection systems. Distance-based tolling enables users to pay for the exact distance covered, ensuring fairness and flexibility, especially on long-distance roads. Time-of-day tolling, however, charges motorists on the basis of time of day, promoting usage of roads in off-peak hours and easing congestion. These dynamic tolling models are poised to play an important role in the expansion of the Australia electronic toll collection market share by providing more tailored tolling solutions. Moreover, operators of toll roads such as Transurban are embracing artificial intelligence for improving tolling collection processes. For example, AI solutions help bill cars whose e-tags are not scanned, lowering manual license plate image checking requirements by 40%. This shift toward dynamic tolling systems and AI-powered systems depicts a robust market trend for ETC solutions across Australia, where mass adoption would be seen throughout urban and rural regions, creating additional market expansion.

Australia Electronic Toll Collection Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on technology, system, subsystem, offering, toll charging, and application.

Technology Insights:

- RFID

- DSRC

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes RFID, DSRC, and others.

System Insights:

- Transponder - or Tag-Based Toll Collection Systems

- Other Toll Collection Systems

A detailed breakup and analysis of the market based on the system have also been provided in the report. This includes transponder - or tag-based toll collection systems and other toll collection systems.

Subsystem Insights:

- Automated Vehicle Identification

- Automated Vehicle Classification

- Violation Enforcement System

- Transaction Processing

The report has provided a detailed breakup and analysis of the market based on the subsystem. This includes automated vehicle identification, automated vehicle classification, violation enforcement system and transaction processing.

Offering Insights:

- Hardware

- Back Office and Other Services

A detailed breakup and analysis of the market based on the offering have also been provided in the report. This includes hardware, and back office and other services.

Toll Charging Insights:

- Distance Based

- Point Based

- Time Based

- Perimeter Based

The report has provided a detailed breakup and analysis of the market based on the toll charging. This includes distance based, point based, time based, and perimeter based.

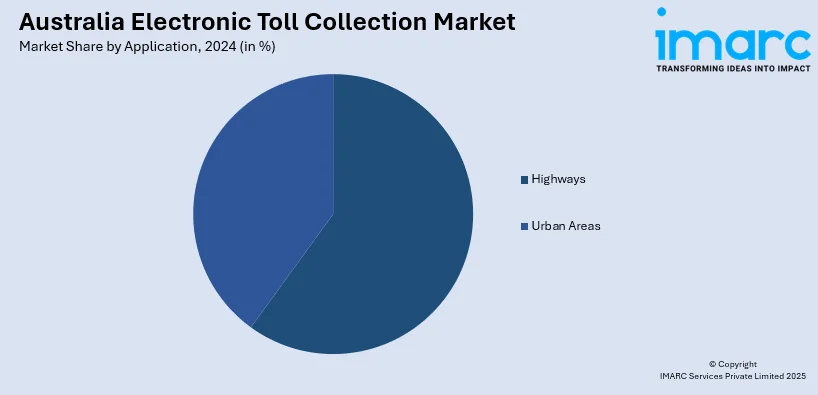

Application Insights:

- Highways

- Urban Areas

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes highways and urban areas.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Electronic Toll Collection Market News:

- In December 2024, where Q-Free signed its biggest roadside tolling system contract in Australia. This achievement underscores the growing need for sophisticated tolling systems in the region, with the contract involving the design, development, and deployment of a multi-lane free-flow tolling system on 37 gantries supplemented with a 12-year service and maintenance agreement.

Australia Electronic Toll Collection Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | RFID, DSRC, Others |

| Systems Covered | Transponder - or Tag-Based Toll Collection Systems, Other Toll Collection Systems |

| Subsystems Covered | Automated Vehicle Identification, Automated Vehicle Classification, Violation Enforcement System, Transaction Processing |

| Offerings Covered | Hardware, Back Office and Other Services |

| Toll Charging Covered | Distance Based, Point Based, Time Based, Perimeter Based |

| Applications Covered | Highways, Urban Areas |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia electronic toll collection market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia electronic toll collection market on the basis of technology?

- What is the breakup of the Australia electronic toll collection market on the basis of system?

- What is the breakup of the Australia electronic toll collection market on the basis of subsystem?

- What is the breakup of the Australia electronic toll collection market on the basis of offering?

- What is the breakup of the Australia electronic toll collection market on the basis of toll charging?

- What is the breakup of the Australia electronic toll collection market on the basis of application?

- What is the breakup of the Australia electronic toll collection market on the basis of region?

- What are the various stages in the value chain of the Australia electronic toll collection market?

- What are the key driving factors and challenges in the Australia electronic toll collection?

- What is the structure of the Australia electronic toll collection market and who are the key players?

- What is the degree of competition in the Australia electronic toll collection market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia electronic toll collection market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia electronic toll collection market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia electronic toll collection industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)