Australia Endoscopy Devices Market Size, Share, Trends and Forecast by Type, Application, End Use, and Region, 2025-2033

Australia Endoscopy Devices Market Overview:

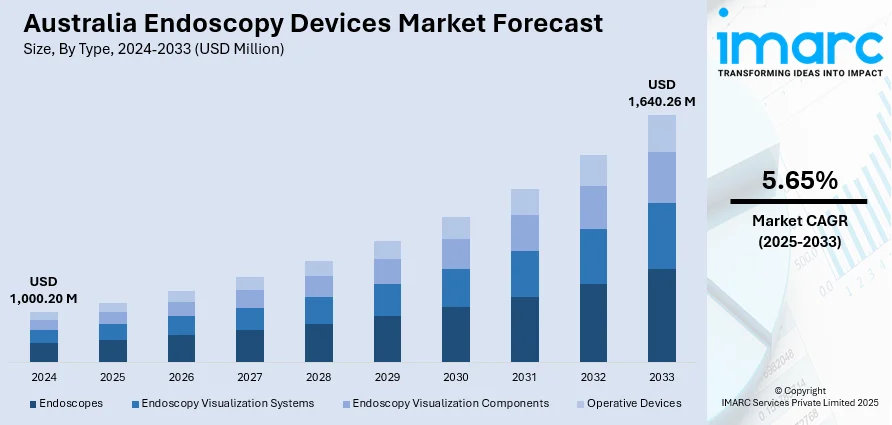

The Australia endoscopy devices market size reached USD 1,000.20 Million in 2024. Looking forward, the market is projected to reach USD 1,640.26 Million by 2033, exhibiting a growth rate (CAGR) of 5.65% during 2025-2033. The market is experiencing strong growth due to advances in medical technology and an increasing demand for minimally invasive surgeries. Growing healthcare awareness and emphasis on cost-saving treatments are adding momentum to the market. The increasing proportion of elderly people and the rising incidence of chronic conditions are also driving demand for endoscopic treatments. Consequently, Australia Endoscopy Devices market share is likely to keep changing according to these trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,000.20 Million |

| Market Forecast in 2033 | USD 1,640.26 Million |

| Market Growth Rate 2025-2033 | 5.65% |

Key Trends of Australia Endoscopy Devices Market:

Rising Prevalence of Gastrointestinal and Chronic Diseases

Australia is experiencing a rising incidence of gastrointestinal disorders and chronic conditions, notably colorectal cancer, which is projected to be the fourth most commonly diagnosed cancer in 2024 with an estimated 15,542 new cases. This growing burden significantly fuels demand for endoscopic procedures, particularly colonoscopies, which are essential for early detection and monitoring. Lifestyle-related illnesses such as obesity and acid reflux are also on the rise, prompting increased use of minimally invasive diagnostic tools. In tandem with an increasingly aged population and increased rates of chronic disease, hospitals and clinics are investing proactively in new endoscopy technologies to advance diagnostic precision and patient outcomes. National programs such as the Bowel Cancer Screening Program reinforce the trend by advocating regular screening and preventive care, driving adoption of endoscopic products throughout urban locations and regional health networks.

To get more information on this market, Request Sample

Technological Advancements in Endoscopic Equipment

The Australia endoscopy devices market is experiencing significant growth due to rapid technological innovation. Advances such as high-definition (HD) imaging, three-dimensional (3D) visualization, robotic-assisted endoscopy, and AI-powered diagnostics enhance the precision, safety, and efficacy of procedures. These developments allow earlier detection of abnormalities, reduced recovery time, and minimally invasive interventions, which are increasingly preferred by both patients and healthcare providers. To stay on the cutting edge of surgical care, Australian hospitals and specialized clinics are using these state-of-the-art instruments. Further propelling the Australia endoscopy devices market growth and the country's competitiveness in the global endoscopic diagnostics and treatment are further driven by ongoing collaborations between medical device companies and research institutions. These partnerships promote the local development and integration of advanced technologies.

Government Healthcare Support and Infrastructure Investment

The Australian government's sustained investment in healthcare infrastructure and early diagnosis policies is a key driver of the endoscopy devices market. Programs like Medicare and the National Bowel Cancer Screening Program (NBCSP) subsidize endoscopic procedures, improving accessibility and encouraging early detection. In 2024 alone, approximately 7,265 individuals aged 50–74 is projected to be diagnosed with bowel cancer, accounting for about 47% of all cases—highlighting the importance of screening initiatives. Public hospital funding supports the adoption of advanced surgical and diagnostic equipment, including modern endoscopy technologies. Additionally, regional and rural health programs are expanding access to care through mobile and tele-endoscopy services. These coordinated government efforts are increasing procedural volumes and creating a supportive environment for medical device companies to introduce and scale innovative endoscopic solutions across Australia.

Growth Drivers of Australia Endoscopy Devices Market:

Shift Toward Minimally Invasive Procedures

The increasing preference among patients for minimally invasive options is profoundly affecting the endoscopy devices market in Australia. Techniques such as laparoscopic and endoscopic procedures provide numerous benefits, including reduced surgical trauma, shorter hospitalization durations, quicker recovery times, and fewer postoperative complications. Healthcare providers and hospitals are progressively adopting advanced endoscopic technologies to fulfill patient demands and enhance treatment outcomes. This trend is bolstered by innovations in flexible scopes, high-definition imaging, and robotic-assisted endoscopy, which all improve procedural accuracy. As patients lean toward less invasive methods for both diagnostic and therapeutic purposes, the demand for cutting-edge endoscopy devices is on the rise, escalating the Australia endoscopy devices market demand.

Increased Awareness and Screening Programs

Public health campaigns and initiatives promoting early detection of gastrointestinal, respiratory, and various chronic diseases are crucial in fostering the use of endoscopy devices in Australia. These awareness programs highlight the significance of preventive screenings and regular check-ups, motivating patients to undergo timely diagnostic procedures. In response, hospitals and diagnostic centers are investing in state-of-the-art endoscopic equipment that ensures efficient and precise detection. Greater understanding of the advantages of endoscopic procedures, along with endorsements from healthcare professionals, is markedly increasing patient engagement in screening programs. As a result, these initiatives are directly supporting market growth by generating consistent demand for endoscopy devices across urban and regional healthcare facilities.

Rising Medical Tourism

Australia’s advanced healthcare system and highly qualified medical personnel are drawing an increasing number of international patients seeking endoscopic procedures. Medical tourists are opting for Australia for complex gastrointestinal, respiratory, and minimally invasive surgeries due to the high treatment quality and exceptional patient care. This surge in international patients is prompting hospitals and clinics to broaden their endoscopic offerings, invest in advanced devices, and incorporate innovative technologies to cater to various procedural needs. Additionally, Australia’s reputation as a global healthcare hub enhances the use of high-performance endoscopy equipment. According to Australia endoscopy devices market analysis, this trend is leading to substantial growth in the sector.

Australia Endoscopy Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional for 2025-2033. Our report has categorized the market based on type, application, and end use.

Type Insights:

- Endoscopes

- Endoscopy Visualization Systems

- Endoscopy Visualization Components

- Operative Devices

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes endoscopes, endoscopy visualization systems, endoscopy visualization components, and operative devices.

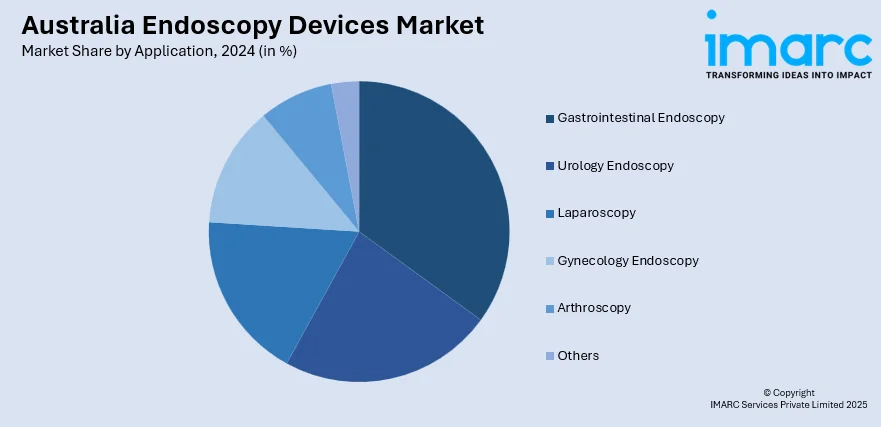

Application Insights:

- Gastrointestinal Endoscopy

- Urology Endoscopy

- Laparoscopy

- Gynecology Endoscopy

- Arthroscopy

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes gastrointestinal endoscopy, urology endoscopy, laparoscopy, gynecology endoscopy, arthroscopy, and others.

End Use Insights:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes hospitals and clinics, ambulatory surgical centers, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Endoscopy Devices Market News:

- In January 2025, Mediquip acquired Innovative Medical Solutions (WA), Austvet Endoscopy (VIC), and Bosco Medical Australia (QLD), strengthening its presence in the healthcare and veterinary sectors. The acquisitions enhance Mediquip’s product range, technical service capabilities, and nationwide support network. CEO Daniel Berndt emphasized the move as a major step in delivering greater clinical efficiencies, improved outcomes, and exceptional after-sales support across Australia.

- In September 2024, Olympus Australia launched “Sapphire,” its first flexible endoscope sterilisation facility in Melbourne. Part of the Olympus On-Demand program, Sapphire offers ready-to-use, sterilised endoscopes to hospitals, streamlining infection control and access to advanced technology. The facility supports improved healthcare delivery, especially in regional areas, and marks a significant investment in Victoria’s growing MedTech sector.

Australia Endoscopy Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Endoscopes, Endoscopy Visualization Systems, Endoscopy Visualization Components, Operative Devices |

| Applications Covered | Gastrointestinal Endoscopy, Urology Endoscopy, Laparoscopy, Gynecology Endoscopy, Arthroscopy, Others |

| End Uses Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia endoscopy devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia endoscopy devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia endoscopy devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The endoscopy devices market in Australia was valued at USD 1,000.20 Million in 2024.

The Australia endoscopy devices market is projected to exhibit a compound annual growth rate (CAGR) of 5.65% during 2025-2033.

The Australia endoscopy devices market is expected to reach a value of USD 1,640.26 Million by 2033.

Rising adoption of minimally invasive procedures, integration of high-definition imaging and robotic-assisted technologies, and increasing demand for flexible and portable endoscopy devices are shaping the market. Growth in outpatient and ambulatory care centers, along with tele-endoscopy solutions, is enhancing procedural efficiency and accessibility.

Growing prevalence of gastrointestinal and respiratory diseases, expansion of public health screening programs, and rising medical tourism are fueling market growth. Technological advancements, patient preference for faster recovery, and increasing investment by healthcare providers in advanced endoscopy equipment further drive demand and adoption across diagnostic and therapeutic applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)