Australia Energy as a Service Market Size, Share, Trends and Forecast by Service Type, End User, and Region, 2025-2033

Australia Energy as a Service Market Overview:

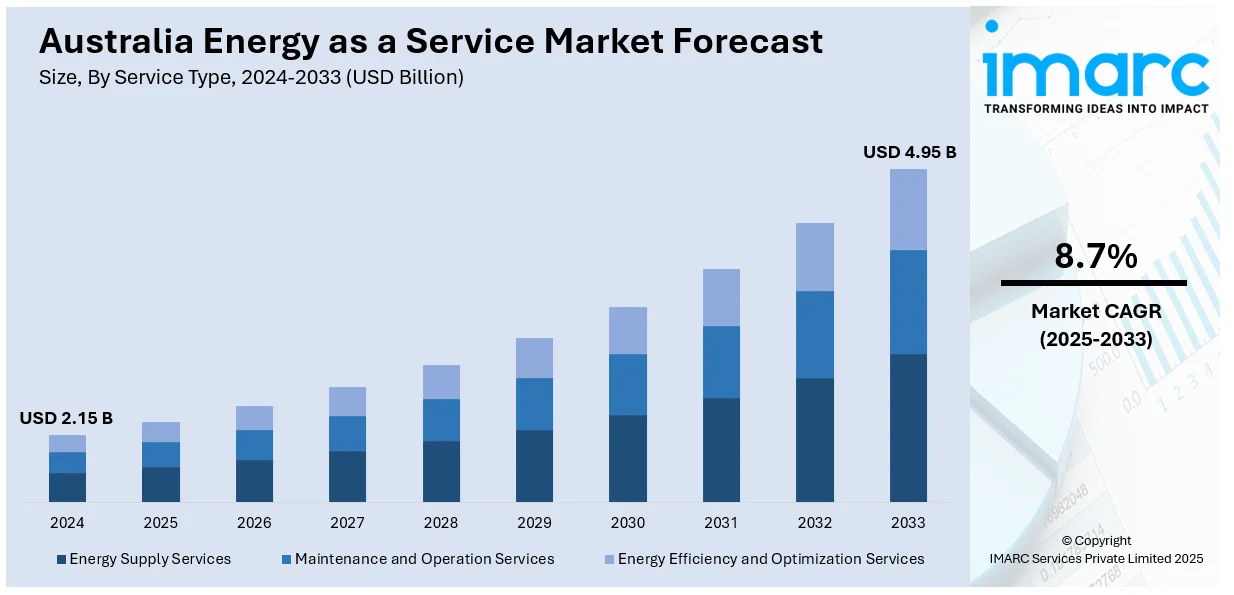

The Australia energy as a service market size reached USD 2.15 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.95 Billion by 2033, exhibiting a growth rate (CAGR) of 8.7% during 2025-2033. Rising energy costs, demand for decentralized energy solutions, increased adoption of renewable energy, government incentives, and the need for energy efficiency are some of the factors contributing to Australia energy as a service market share. Businesses seek flexible, subscription-based models to reduce carbon emissions and optimize energy management.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 4.95 Billion |

| Market Growth Rate 2025-2033 | 8.7% |

Australia Energy as a Service Market Trends:

Shift toward Integrated Clean Power Solutions

Australia is witnessing a growing focus on service-based clean energy infrastructure, combining solar generation with battery storage and smart control systems. These setups allow for flexible power delivery and advanced energy management, supporting both grid stability and decarbonization goals. The inclusion of energy trading capabilities further enables users to actively participate in power markets, reinforcing the shift from traditional supply models to performance-oriented offerings. This approach emphasizes delivering reliable, scalable, and cleaner electricity services without full ownership of physical assets. It aligns with broader efforts to reduce emissions while enhancing resilience in regional grids, particularly in areas like Queensland where renewable potential and strategic partnerships are driving innovation in how energy is produced, stored, and utilized. These factors are intensifying the Australia energy as a service market growth. For example, in January 2025, Sojitz Corporation, in partnership with CS Energy and Nippon Koei, announced a renewable energy and battery storage project in Queensland. The initiative includes integrated control systems and energy management, enabling flexible power delivery. By combining solar generation with storage and energy trading functions, the project reflects an energy as a service model aimed at enhancing grid reliability and supporting decarbonization through service-based clean energy infrastructure.

To get more information on this market, Request Sample

Rise of Subscription-Based Community Energy Models

Australia’s local energy landscape is seeing greater adoption of shared storage systems that allow households to store and access solar power without owning a battery. A subscription-based approach is enabling residents to tap into communal battery infrastructure, optimizing the use of excess solar generation and reducing strain on the grid. This model supports more efficient energy distribution while providing flexibility and cost savings for users. By decoupling storage ownership from energy access, the market is moving toward service-oriented delivery frameworks that align with clean energy goals. These offerings also enhance grid stability by smoothing demand fluctuations and increasing local energy resilience, especially in suburban communities aiming to scale solar integration through practical, service-driven solutions. For instance, in August 2024, Ausgrid launched its energy storage as a service offering with the activation of a community battery in Cabarita, New South Wales. The system enables residents to store excess solar energy and draw from shared battery capacity. This subscription-based model supports grid stability and promotes efficient energy use, reflecting a key shift toward service-based energy delivery in Australia’s local energy networks.

Australia Energy as a Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type and end user.

Service Type Insights:

- Energy Supply Services

- Maintenance and Operation Services

- Energy Efficiency and Optimization Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes energy supply services, maintenance and operation services, and energy efficiency and optimization services.

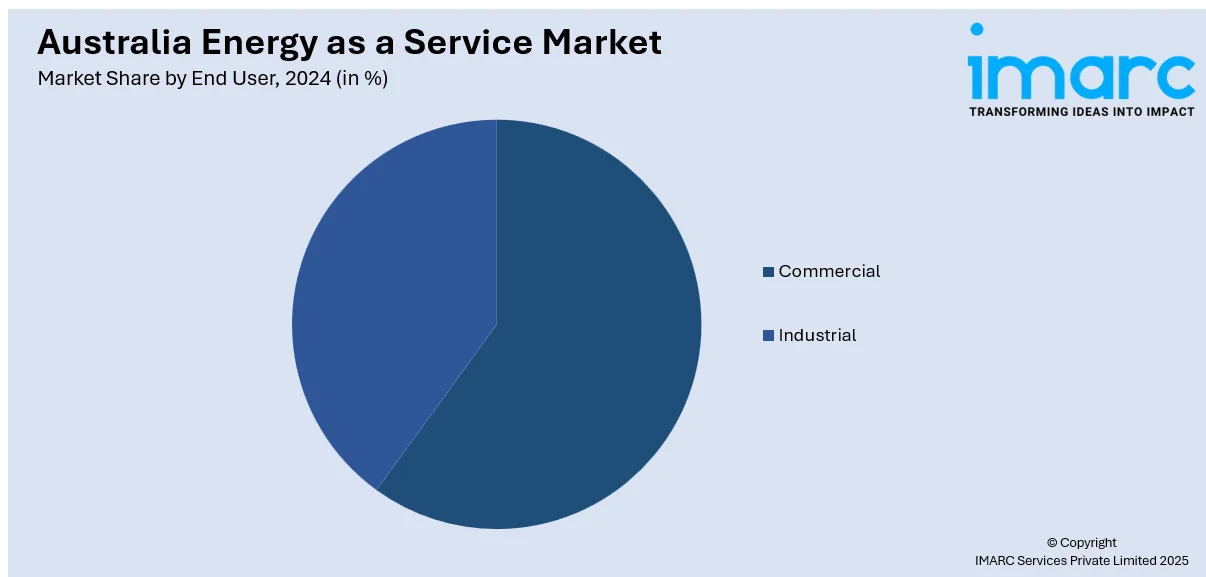

End User Insights:

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes commercial and industrial.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Energy as a Service Market News:

- In April 2025, Wärtsilä announced its plans to deliver one of Australia’s first DC-coupled energy storage projects, combining solar PV and battery storage with integrated controls. The project includes a long-term service agreement that ensures performance optimization and operational support. This aligns with the energy as a service model by enabling renewable energy providers to offer storage-backed power solutions with guaranteed uptime and efficiency, supporting grid stability and clean energy transition.

Australia Energy as a Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Energy Supply Services, Maintenance and Operation Services, Energy Efficiency and Optimization Services |

| End Users Covered | Commercial, Industrial |

| Regions Covered | Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia energy as a service market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia energy as a service market on the basis of service type?

- What is the breakup of the Australia energy as a service market on the basis of end user?

- What is the breakup of the Australia energy as a service market on the basis of region?

- What are the various stages in the value chain of the Australia energy as a service market?

- What are the key driving factors and challenges in the Australia energy as a service market?

- What is the structure of the Australia energy as a service market and who are the key players?

- What is the degree of competition in the Australia energy as a service market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia energy as a service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia energy as a service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia energy as a service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)