Australia Engineering Plastics Market Size, Share, Trends and Forecast by Type, Performance Parameter, Application, and Region, 2025-2033

Australia Engineering Plastics Market Overview:

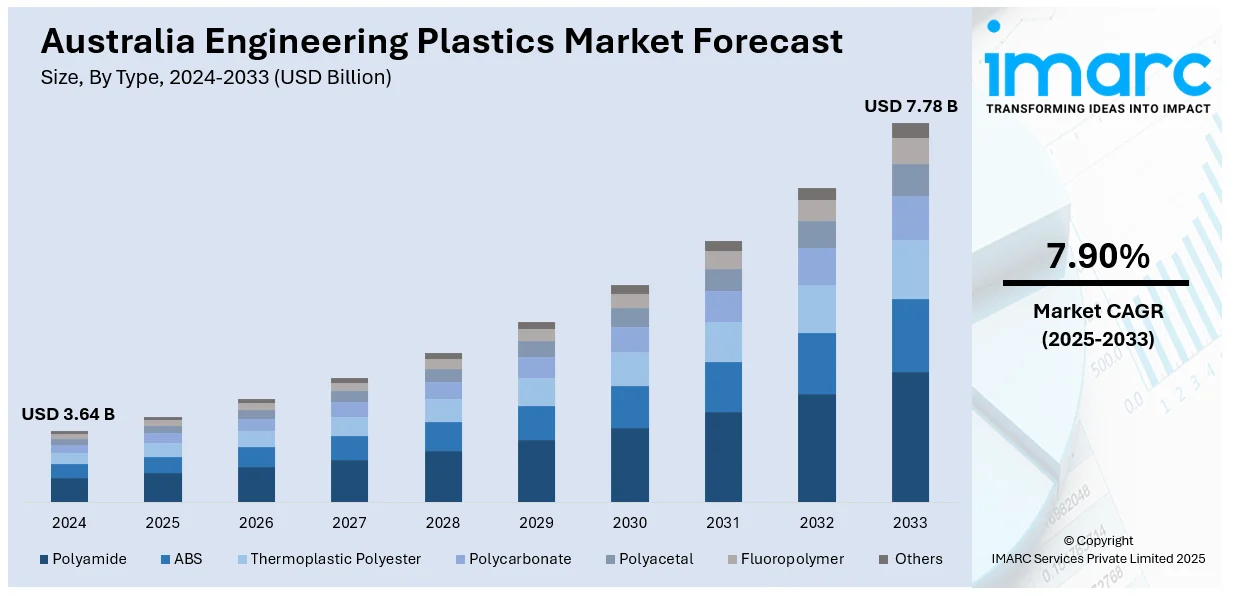

The Australia engineering plastics market size reached USD 3.64 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.78 Billion by 2033, exhibiting a growth rate (CAGR) of 7.90% during 2025-2033. The market is driven by rising demand in automotive, electronics, and construction sectors, along with advancements in lightweight, high-performance materials. Increasing emphasis on sustainable manufacturing, government support for local production, and the growing shift toward electric vehicles further fuel the Australia engineering plastics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.64 Billion |

| Market Forecast in 2033 | USD 7.78 Billion |

| Market Growth Rate 2025-2033 | 7.90% |

Australia Engineering Plastics Market Trends:

Shift Towards High-Performance Thermoplastics in Electric Mobility Applications

Australia’s transition towards electric mobility is fostering a notable shift in the engineering plastics landscape, particularly toward high-performance thermoplastics (HPTs). For instance, according to data from the EVC and public sources, around 114,000 new battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold in Australia in 2024, exceeding the previous record of over 98,000 units sold in 2023. Of the total in 2024, approximately 91,000 were BEVs and 23,000 were PHEVs. These materials have higher thermal resistance, mechanical integrity, and chemical stability than metals and are well-suited for parts in electric vehicle (EV) batteries, powertrain systems, and electronic control units. With more people driving electric vehicles, driven by federal incentives and tighter emissions standards, automakers are relying more on HPTs to take the place of conventional metals, which lightens the vehicle and makes it more energy-efficient. In addition, the localization of EV component production has created demand for high-performance polymers that satisfy the particular performance standards needed in extreme Australian climatic conditions. This trend represents a definite shift away from commodity plastics towards more advanced materials that enable innovation and longevity in next-generation transportation solutions.

To get more information on this market, Request Sample

Emphasis on Sustainable and Recyclable Engineering Plastics

Environmental sustainability is becoming a central theme in the Australia engineering plastics market growth, with manufacturers and end-users prioritizing recyclable and bio-based plastic solutions. Regulatory frameworks promoting circular economy practices are accelerating the shift toward engineering plastics derived from renewable resources or featuring improved recyclability. This is especially evident in packaging, automotive interiors, and consumer goods manufacturing, where sustainability metrics are now closely integrated into material selection processes. For instance, an April 2025 CSIRO study reported a 39% drop in plastic debris on Australian beaches over the last decade, crediting bottle deposit schemes as a key contributor. The findings stress the need for ongoing improvements in sustainable waste management and recyclability. This aligns with rising demand for recyclable, bio-based engineering plastics and supports circular economy goals in sectors like packaging and consumer goods. Companies are increasingly investing in R&D to develop high-performance recycled engineering plastics that retain mechanical integrity while reducing environmental impact. Furthermore, collaboration between industry bodies and government agencies is fostering the development of standardization protocols and certification schemes, thereby encouraging broader market acceptance and ensuring long-term viability of sustainable plastics across key industrial sectors.

Rising Integration of Engineering Plastics in Smart Infrastructure Projects

With Australia investing significantly in smart infrastructure development—particularly in transport, utilities, and telecommunications—the demand for engineering plastics with specialized electrical, thermal, and structural properties is growing. These materials are being used in components such as cable insulation, circuit housings, and protective enclosures for sensors and connectivity hardware. As urban centres expand and digital connectivity becomes more embedded in infrastructure projects, engineering plastics that offer lightweight, corrosion-resistant, and long-life performance are increasingly preferred over traditional materials. Additionally, the compatibility of advanced polymers with automation and 3D printing technologies enhances their value proposition in custom or large-scale infrastructure applications. This trend reflects the critical role of engineering plastics in enabling the integration of smart technologies into durable and future-ready public systems.

Australia Engineering Plastics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, performance parameter, and application.

Type Insights:

- Polyamide

- ABS

- Thermoplastic Polyester

- Polycarbonate

- Polyacetal

- Fluoropolymer

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes polyamide, ABS, thermoplastic polyester, polycarbonate, polyacetal, fluoropolymer, and others.

Performance Parameter Insights:

- High Performance

- Low Performance

The report has provided a detailed breakup and analysis of the market based on the performance parameter. This includes high performance and low performance.

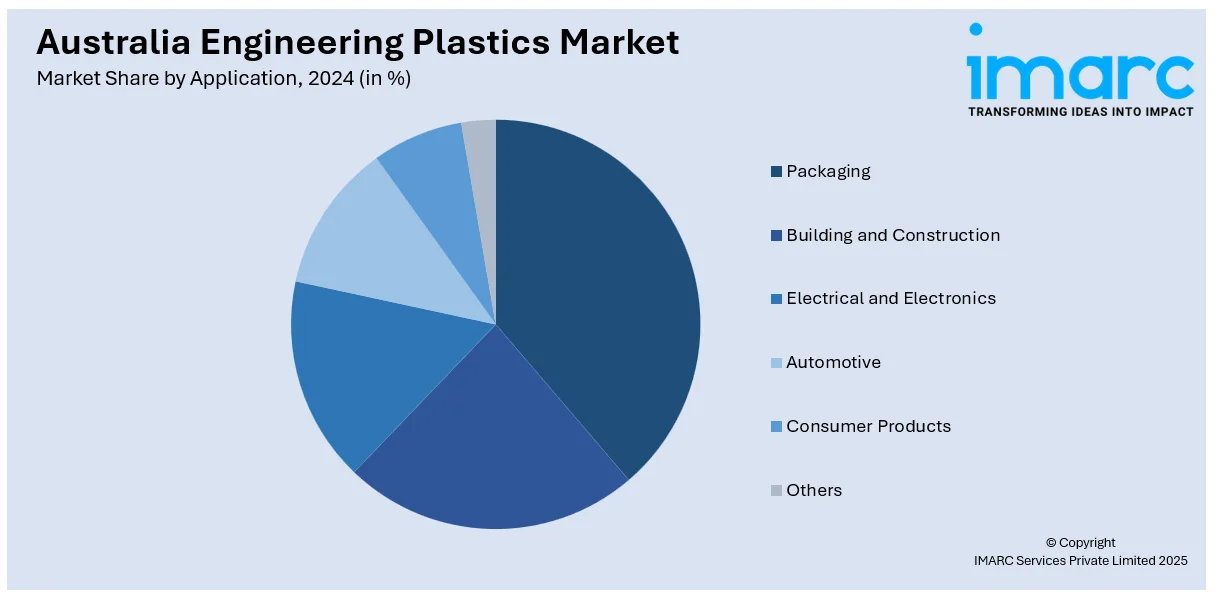

Application Insights:

- Packaging

- Building and Construction

- Electrical and Electronics

- Automotive

- Consumer Products

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes packaging, building and construction, electrical and electronics, automotive, consumer products, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Engineering Plastics Market News:

- In September 2024, CSIRO and Murdoch University launched the Bioplastics Innovation Hub, a collaboration aimed at developing 100% compostable, bio-derived plastics. The $8 million project focuses on creating plastic packaging that breaks down in compost, land, or water, helping tackle global plastic pollution. By working with industry partners, the Hub will promote the commercialization of bioplastics made from waste products like food industry by-products. This initiative aligns with Australia’s environmental goals, including reducing plastic waste and supporting a circular economy.

- In April 2025, Viva Energy and Cleanaway completed a pre-feasibility study for Australia’s first large-scale advanced soft plastics recycling facility. The project aims to convert soft plastics into food-grade materials through Cleanaway’s collection system and Viva Energy’s refining capabilities. The initiative aligns with Australia's planned Extended Producer Responsibility (EPR) scheme and packaging reforms, promoting circular economy goals. The collaboration highlights growing industry and government support for sustainable plastic waste solutions and infrastructure investment.

Australia Engineering Plastics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyamide, ABS, Thermoplastic Polyester, Polycarbonate, Polyacetal, Fluoropolymer, Others |

| Performance Parameters Covered | High Performance, Low Performance |

| Applications Covered | Packaging, Building and Construction, Electrical and Electronics, Automotive, Consumer Products, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia engineering plastics market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia engineering plastics market on the basis of type?

- What is the breakup of the Australia engineering plastics market on the basis of performance parameter?

- What is the breakup of the Australia engineering plastics market on the basis of application?

- What is the breakup of the Australia engineering plastics market on the basis of region?

- What are the various stages in the value chain of the Australia engineering plastics market?

- What are the key driving factors and challenges in the Australia engineering plastics market?

- What is the structure of the Australia engineering plastics market and who are the key players?

- What is the degree of competition in the Australia engineering plastics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia engineering plastics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia engineering plastics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia engineering plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)