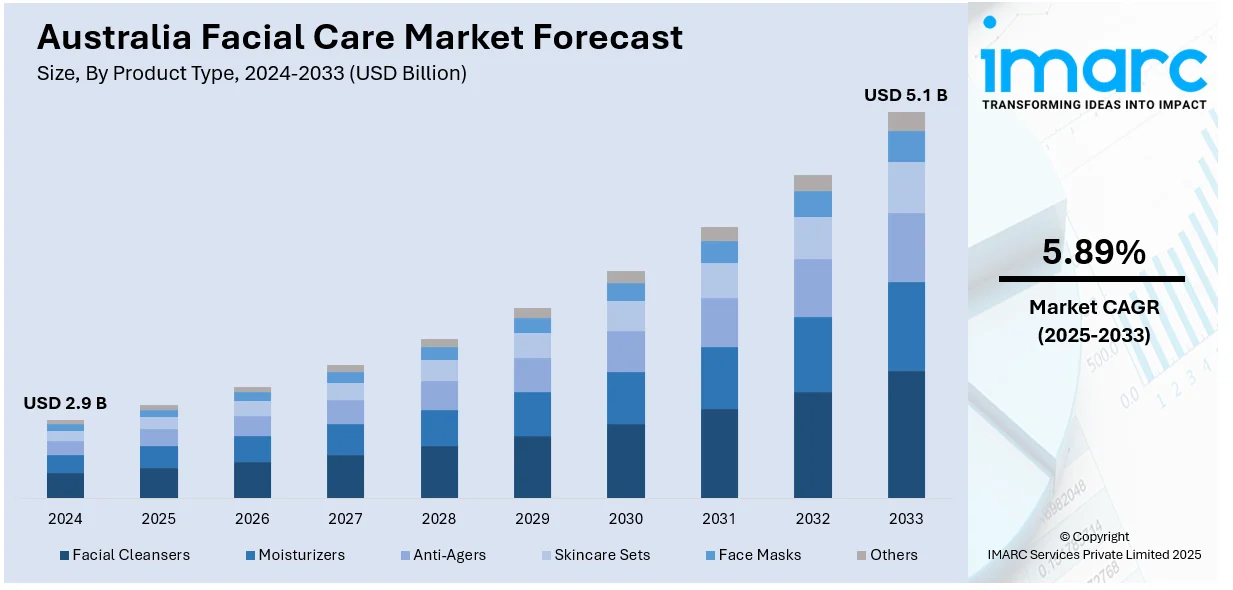

Australia Facial Care Market Report by Product Type (Facial Cleansers, Moisturizers, Anti-Agers, Skincare Sets, Face Masks, and Others), Ingredient (Chemical, Natural), Gender (Male, Female, Unisex), Distribution Channel (Supermarkets and Hypermarkets, Beauty Parlors and Salons, Multi Branded Retail Stores, Online, Exclusive Retail Stores, and Others), and Region 2025-2033

Australia Facial Care Market Size and Share:

The Australia facial care market size reached USD 2.9 Billion in 2024. Looking forward, the market is expected to reach USD 5.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.89% during 2025-2033. The market is being driven by the rising demand for facial care to prevent skin damage, increasing demand for natural and organic products, and the wide availability of facial care products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.9 Billion |

|

Market Forecast in 2033

|

USD 5.1 Billion |

| Market Growth Rate 2025-2033 | 5.89% |

Facial care comprises a wide range of facial care products, such as moisturizers, anti-agers, face masks, cleansers, toners, scrubs or exfoliators, oils, face wash, and serums, that enhance the skin appearance. It is suitable for sensitive and allergy-prone skin and restores firmness and texture while reducing blemishes and scars. It offers nourished skin by providing vitamins and minerals, benefits in cleansing the face, and has increased shelf life. It also increases the amount of collagen and prevents loss of elasticity in the skin. It assists in treating acne, rash, and pigmentation, maintaining healthy skin, preventing ultraviolet (UV) rays and sun burn, and decreasing the signs of aging, wrinkles, and dark spots. Besides this, it aids in protecting the skin from environmental damage like pollution. According to the Australia facial care market forecast, the demand for facial care will grow significantly due to its benefits such as visible pores reduction and protection from bacteria and allergies.

To get more information of this market, Request Sample

Key Trends of Australia Facial Care Market:

Rising Demand for Organic and Natural Products

In Australia, there is a growing consumer preference for organic and natural skincare products, with most Australians opting for skincare items that incorporate natural ingredients. This shift is primarily due to increased awareness about the health benefits associated with organic products and the desire to avoid synthetic chemicals in skincare. As consumers become more educated about the ingredients in their skincare products and their potential impacts on health and the environment, there is a noticeable move toward products that are free from parabens, sulfates, and other harmful chemicals. This trend is significantly influencing the skin care industry, encouraging brands to develop and market facial care products that meet these natural and organic criteria. Furthermore, the market is dedicated to clean, green beauty solutions that cater to health-conscious consumers looking to maintain skin health with minimal environmental impact, which is increasing the Australia facial care market share.

Increase in Disposable Income

There has been a notable increase in the average weekly household income in Australia. Additionally, the rising disposable income enables consumers to allocate more funds toward premium skincare products. Moreover, with more financial flexibility, Australians are investing in high-quality facial care items that promise better results and often come with higher price tags. The trend is driven by a growing consumer perception that premium products offer superior formulations, enhanced effectiveness, and often, more ethical sourcing and manufacturing practices. As a result, the market is witnessing a rising demand for luxury skincare products that offer these added benefits, underscoring how economic factors influence consumer buying habits, thereby providing a positive Australia facial care market outlook.

Rising Popularity of Sunscreen-Infused Skincare

The high exposure to ultraviolet (UV) radiation in Australia, is identified by the Australian Radiation Protection and Nuclear Safety Agency (ARPANSA) as among the highest in the world, there is an increasing demand for skincare products with built-in SPF protection. This need is critical as Australians seek ways to protect their skin from the harmful effects of UV rays, including skin aging and cancer. Moreover, sunscreen-infused skincare products, such as moisturizers with SPF, have witnessed a significant annual growth rate. These products offer a dual benefit as they hydrate the skin and provide necessary sun protection. Along with this, the convenience of combining sun protection with daily skincare routines is appealing to consumers looking to streamline their beauty practices while ensuring they are shielded from the sun’s damaging rays. This growing awareness about the importance of UV protection has led to an expansion in the range of facial care items that include sunscreen, thus influencing the growth of Australia facial care market demand.

Growth Drivers of Australia Facial Care Market:

Climate and high UV Exposure

Australia's harsh sun exposure and distinctive climatic conditions contribute significantly towards driving growth in the facial care industry. With amongst the highest UV radiation intensity on the globe, Australian consumers are extremely aware of skin injury, premature ageing, and risk of skin cancer. This has increased the relevance of daily facial care routines that include SPF protection, moisturizing, and after-sun repair. Consequently, sunscreens for the face, anti-pigmentation creams, and barrier-restoring creams are some of the most popular skincare products. Further, the changing weather conditions in the nation—ranging from dry heat in the interior states to sea-coast moisture—lead customers to desire specially formulated skincare products for their surroundings. Domestic players have taken this cue and come up with products adapted to these weather conditions using local ingredients such as Kakadu plum, tea tree oil, and eucalyptus. This consciousness drives consumer behavior and spurs new product development innovation, further propelling market expansion across a variety of facial care categories.

Increased Demand for Locally Produced and Plant-Based Products

According to the Australia facial care market analysis, a robust cultural predisposition toward wellness, sustainability, and health is pushing consumers toward facial care that is organic, natural, and domestic. With increased awareness about the safety of ingredients, consumers are rejecting synthetic additives and opting for plant-based, cruelty-free, and environmentally friendly alternatives. The rich biodiversity of Australia presents a distinctive edge in this market, with indigenous botanicals such as finger lime, quandong, and macadamia oil becoming signature ingredients in a lot of skincare products. Local businesses are keeping up with the trend by emphasizing sustainable sourcing, minimal processing, and clean-label transparency, which gains immense traction among environmentally and socially aware consumers. In addition, Australian consumers prefer to patronize locally based businesses, particularly those that share values of authenticity and sustainability. This generates ongoing momentum for the local facial care market, facilitating rapid scale-up for local brands.

Digital Engagement and Personalization

Another principal driving force behind the expansion of the facial care market is the digital revolution within the Australian beauty and skincare space. Consumers are interacting with brands on social media platforms, with beauty influencers, and online through e-commerce channels more today than ever before. It has enabled smaller, niche brands to create online communities of committed followers and access domestic and global markets without the necessity for widespread physical stores. In addition, Australian consumers increasingly look for tailored skincare solutions. Brands are utilizing digital platforms like skin quizzes, AI analysis, and virtual consultations to provide personal product suggestions based on skin type, issues, and lifestyle. This degree of personalization has been particularly attractive to tech-savvy younger consumers who appreciate bespoke solutions and ease. The digital-first strategy also supports Australia's geographically diverse population, enabling even users in remote locations to access high-end skincare items and professional advice. Hence, this digital transformation is broadening consumer access, engagement, and loyalty throughout the facial care space.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia facial care market report, along with forecasts at the regional levels from 2025-2033. Our report has categorized the market based on product type, ingredient, gender and distribution channel.

Product Type Insights:

- Facial Cleansers

- Moisturizers

- Anti-Agers

- Skincare Sets

- Face Masks

- Others

The report has provided a detailed breakup and analysis of the Australia facial care market based on the product type. This includes facial cleansers, moisturizers, anti-agers, skincare sets, face masks, and others. According to the report, facial cleansers represented the largest segment.

Ingredient Insights:

- Chemical

- Natural

A detailed breakup and analysis of the Australia facial care market based on the ingredient has also been provided in the report. This includes chemical and natural. According to the report, chemical accounted for the largest market share.

Gender Insights:

- Male

- Female

- Unisex

A detailed breakup and analysis of the Australia facial care market based on the gender has also been provided in the report. This includes male, female, and unisex.

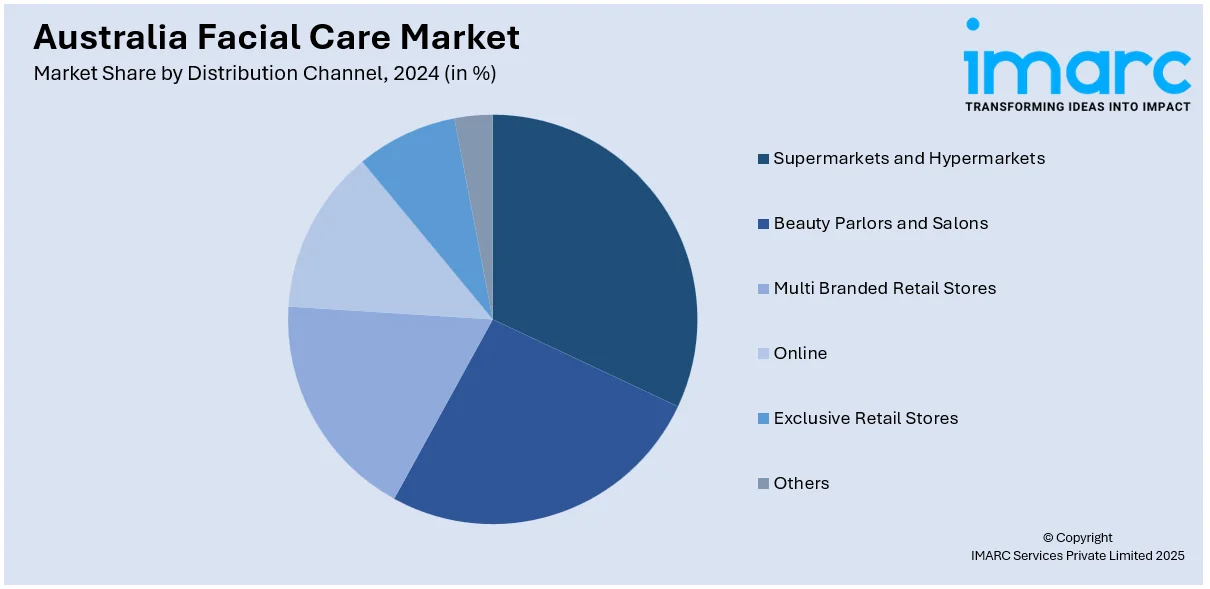

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Beauty Parlors and Salons

- Multi Branded Retail Stores

- Online

- Exclusive Retail Stores

- Others

A detailed breakup and analysis of the Australia facial care market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, beauty parlors and salons, multi branded retail stores, online, exclusive retail stores, and others.

Regional Insights:

- Western Australia

- New South Wales

- Queensland

- Victoria

- Rest of Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Australia, New South Wales, Queensland, Victoria, and Rest of Australia. According to the report, New South Wales was the largest market for Australia facial care. Some of the factors driving the New South Wales facial care market included the rising concern for overall appearance, increasing demand for toxin-free products, wide availability of facial care products, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the Australia facial care market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Beiersdorf AG

- Colgate-Palmolive Company

- Johnson & Johnson

- Kao Corporation

- L'Oreal S.A.

- Procter & Gamble

- Revlon Inc.

- The Estee Lauder Companies Inc

- Unilever PLC

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Australia Facial Care Market News:

- On 24 August 2023, the Beauty Health Company, the parent company of Hydrafacial declared an expansion of its collaboration with Sephora. It plans to offer Perk by Hydrafacial treatments in Sephora locations throughout Australia by year’s end. The recent expansion allows consumers across three continents to access in-store Perk by Hydrafacial treatments exclusively at Sephora. Perk offers a quick Hydrafacial experience that exfoliates and hydrates the skin, providing a smooth, radiant complexion in just minutes. It's ideal for makeup preparation, regular upkeep, or a swift boost.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Product Type, Ingredient, Gender, Distribution Channel, Region |

| Region Covered | Western Australia, New South Wales, Queensland, Victoria, Rest of Australia |

| Companies Covered | Beiersdorf AG, Colgate-Palmolive Company, Johnson & Johnson, Kao Corporation, L'Oreal S.A., Procter & Gamble, Revlon Inc., The Estee Lauder Companies Inc, and Unilever PLC. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia facial care market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia facial care market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia facial care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia facial care market was valued at USD 2.9 Billion in 2024.

We expect the Australia facial care market to exhibit a CAGR of 5.89% during 2025-2033.

The Australia facial care market is expected to reach a value of USD 5.1 Billion by 2033.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of facial care products across the nation.

The rising adoption of regular facial care regimes for maintaining healthy skin, along with the increasing consumer preference towards organic and natural skincare variants, is primarily driving the Australia facial care market.

The Australia facial skincare market is welcoming clean, natural ingredients and sun-savvy protection for its intense UV environment, coupled with personalized and streamlined "skinimalist" regimens. The acceleration of social commerce and influencer-led e-commerce, particularly through AR try-ons, drives online discovery. Subscription models and local natural players keep growing in popularity.

Based on the product type, the Australia facial care market has been segmented into facial cleansers, moisturizers, anti-agers, skincare sets, face masks, and others. Among these, facial cleansers currently hold the largest market share.

Based on the ingredient, the Australia facial care market can be bifurcated into chemical and natural. Currently, chemical ingredient accounts for the majority of the total market share.

On a regional level, the market has been classified into Western Australia, New South Wales, Queensland, Victoria, and rest of Australia, where New South Wales currently dominates the Australia facial care market.

Some of the major players in the Australia facial care market include Beiersdorf AG, Colgate-Palmolive Company, Johnson & Johnson, Kao Corporation, L'Oreal S.A., Procter & Gamble, Revlon Inc., The Estee Lauder Companies Inc, and Unilever PLC.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)