Australia Facial Recognition Market Size, Share, Trends and Forecast by Component, Technology, Application, End Use Industry, and Region, 2025-2033

Australia Facial Recognition Market Overview:

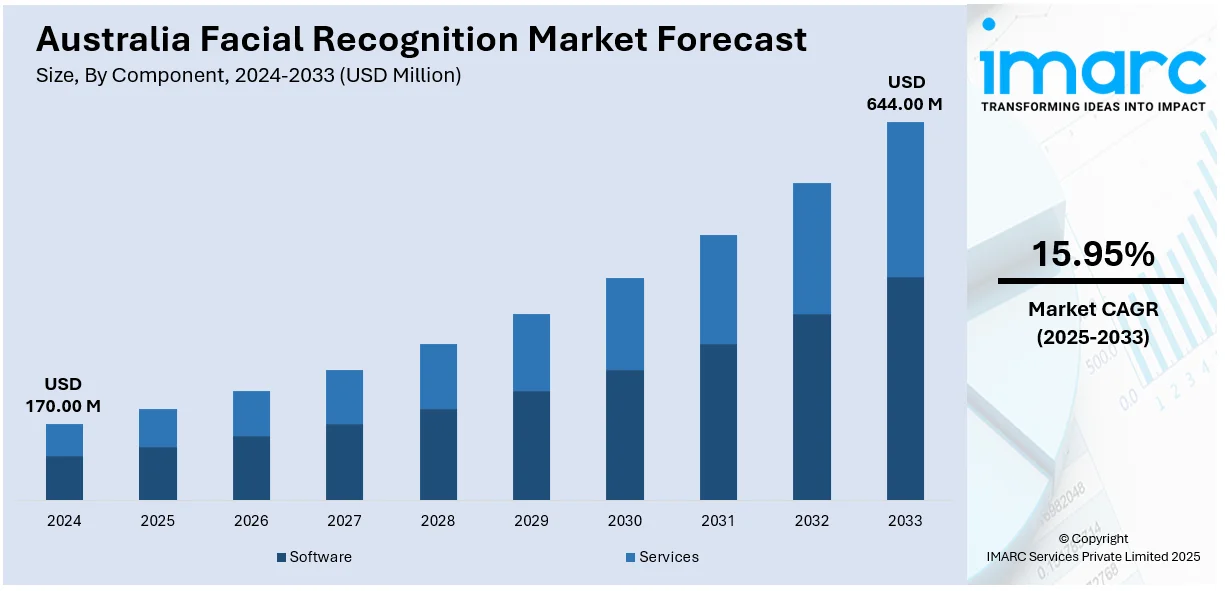

The Australia facial recognition market size reached USD 170.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 644.00 Million by 2033, exhibiting a growth rate (CAGR) of 15.95% during 2025-2033. Government investments in surveillance infrastructure, coupled with increased use in airports and border control, are accelerating the market growth. Retailers and banks are deploying facial authentication for fraud prevention and seamless customer experiences, which is fueling the market growth. Moreover, the shift toward contactless technology post-COVID-19, the emergence of local tech startups, integration with smart city projects, and trials in public transport are boosting the Australia facial recognition market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 170.00 Million |

| Market Forecast in 2033 | USD 644.00 Million |

| Market Growth Rate 2025-2033 | 15.95% |

Australia Facial Recognition Market Trends:

Rising Adoption in Law Enforcement and Surveillance

Australian law enforcement agencies are increasingly using facial recognition to improve public safety and streamline investigations. Police departments in several states have integrated the technology with existing camera networks to identify suspects, track criminal activity, and find missing persons. The ability to match live footage with existing criminal databases saves time and reduces manual effort during investigations. Facial recognition is also being tested for crowd monitoring at public events and in high-traffic zones. Concerns about misuse and privacy are being addressed through policy updates and stricter controls on data access. These efforts are helping build trust and allow for more responsible deployment. Furthermore, with strong government interest and the proven utility of facial analytics, this segment is expected to remain a major contributor to the Australia facial recognition market growth.

To get more information on this market, Request Sample

Biometric Use at Airports and Border Control

Facial recognition is gaining ground at major Australian airports as authorities aim to modernize border processing. Systems like SmartGates use facial scans to confirm traveler identities against passport photos, allowing quicker and more secure entry. This reduces the need for manual checks and cuts down waiting times, especially during peak travel seasons. The Australian Border Force has been expanding the rollout of such systems, with ongoing investments in next-generation biometric tools. Moreover, these upgrades are especially relevant in a post-COVID world, where contactless identity checks are seen as both safer and more efficient. Besides speeding up immigration clearance, the technology also improves security by making it harder to use fake or stolen documents, further propelling the market growth.

Facial Authentication in Retail and Banking

Retailers and banks in Australia are starting to adopt facial authentication to make customer verification faster and more secure. Banks are integrating facial recognition into apps and automated teller machine (ATMs) to reduce fraud and simplify login processes. Customers can approve transactions or access accounts just by scanning their face, which adds convenience and reduces reliance on passwords. In retail, the technology is being tested for personalized service, loyalty rewards, and even contactless payments. Additionally, stores are exploring facial tracking to understand shopping patterns and improve service. As digital payments become more common, the need for strong and user-friendly identity checks is rising. With more companies investing in digital tools, facial authentication is becoming a practical solution for both improving security and enhancing the customer experience across financial and retail environments.

Australia Facial Recognition Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, technology, application, and end use industry.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Technology Insights:

- 2D Facial Recognition

- 3D Facial Recognition

- Facial Analytics

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes 2D facial recognition, 3D facial recognition, and facial analytics.

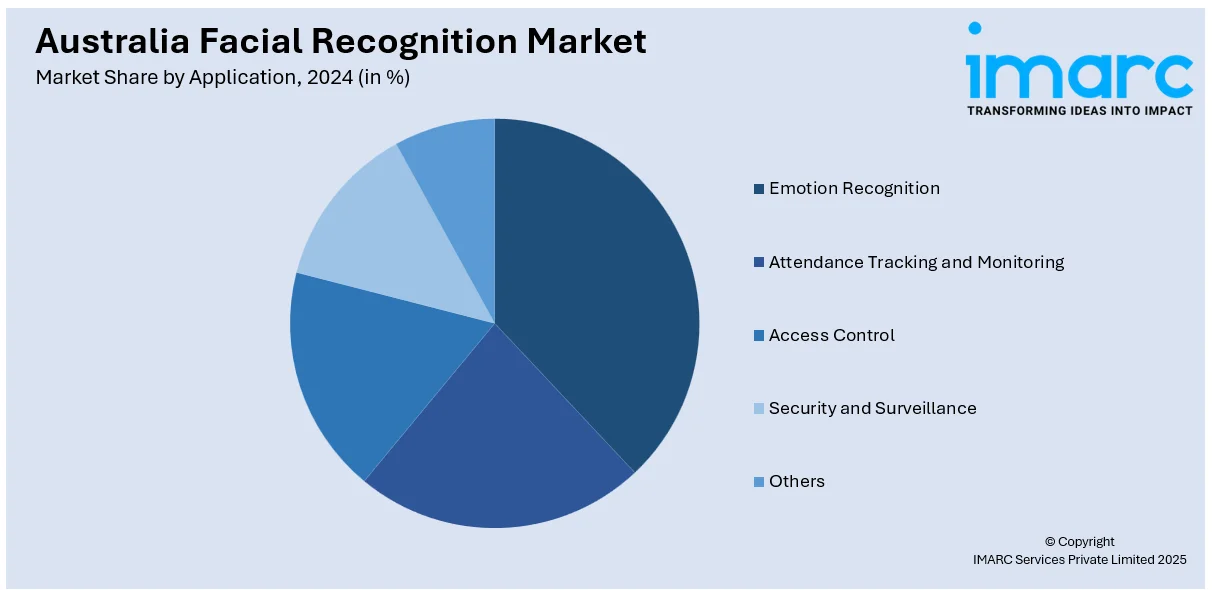

Application Insights:

- Emotion Recognition

- Attendance Tracking and Monitoring

- Access Control

- Security and Surveillance

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes emotion recognition, attendance tracking and monitoring, access control, security and surveillance, and others.

End Use Industry Insights:

- Retail and E-commerce

- BFSI

- Government and Defense

- Automotive and Transportation

- Media and Entertainment

- Healthcare

- Telecom and IT

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes retail and e-commerce, BFSI, government and defense, automotive and transportation, media and entertainment, healthcare, telecom and IT, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Facial Recognition Market News:

- In 2025, The New South Wales government launched a pilot program for an upgraded Digital Photo Card incorporating facial recognition technology. The initiative aims to enhance the NSW Digital ID and Wallet system, allowing users to verify their credentials via a "digital handshake" without handing over physical IDs.

- In 2024, The Australian Border Force reported successful trials of contactless border clearance technology using facial recognition at Sydney Airport. The initiative aims to phase out passport requirements by 2030, enhancing passenger flow efficiency and security through biometric screening.

Australia Facial Recognition Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Technologies Covered | 2D Facial Recognition, 3D Facial Recognition, Facial Analytics |

| Applications Covered | Emotion Recognition, Attendance Tracking and Monitoring, Access Control, Security and Surveillance, Others |

| End Use Industries Covered | Retail and E-commerce, BFSI, Government and Defense, Automotive and Transportation, Media and Entertainment, Healthcare, Telecom and IT, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia facial recognition market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia facial recognition market on the basis of component?

- What is the breakup of the Australia facial recognition market on the basis of technology?

- What is the breakup of the Australia facial recognition market on the basis of application?

- What is the breakup of the Australia facial recognition market on the basis of end use industry?

- What is the breakup of the Australia facial recognition market on the basis of region?

- What are the various stages in the value chain of the Australia facial recognition market?

- What are the key driving factors and challenges in the Australia facial recognition market?

- What is the structure of the Australia facial recognition market and who are the key players?

- What is the degree of competition in the Australia facial recognition market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia facial recognition market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia facial recognition market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia facial recognition industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)