Australia Fast Food Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034

Australia Fast Food Market Size and Share:

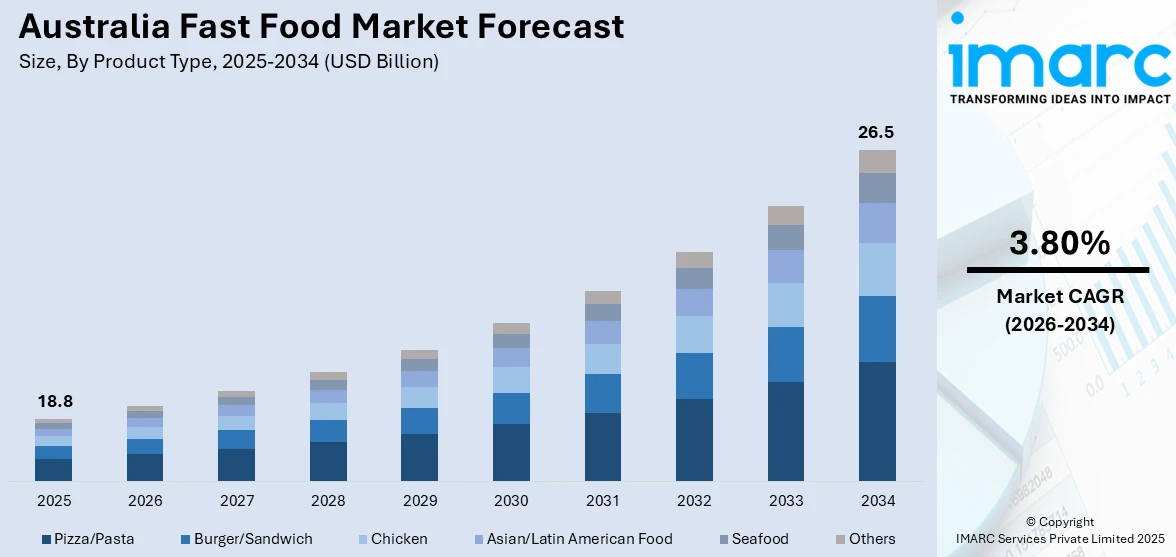

The Australia fast food market size reached USD 18.8 Billion in 2025. Looking forward, the market is expected to reach USD 26.5 Billion by 2034, exhibiting a growth rate (CAGR) of 3.80% during 2026-2034. The market is fueled by convenience, increasing disposable income, and demand for culinary diversity, with intense competition among international chains and domestic brands competing to accommodate health-conscious trends and digital ordering options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 18.8 Billion |

| Market Forecast in 2034 | USD 26.5 Billion |

| Market Growth Rate 2026-2034 | 3.80% |

Key Trends of Australia Fast Food Market:

Rise of Health-Conscious Menu Offerings

Changes in customer trends are forcing fast food operators in Australia to branch out beyond typical indulgent choices. An increasing focus on health-oriented products like plant-based options, low-carb wraps, grilled protein options, and gluten-free foods is gaining strength across the stores. This move appeals to a rising base of health-conscious customers who are looking for quick, convenient meals without sacrificing nutritional values. Demand for ingredient sourcing transparency and nutritional labeling is also impacting product development. For example, in January 2025, Wendy’s opened its first Australian store in Surfer’s Paradise, offering U.S. favorites like the Baconator and Spicy Chicken Sandwich, using 100% Australian-sourced beef and chicken, targeting 200 outlets by 2034. Further, while convenience and flavor continue to be major drivers, nutritional value is now a concurrent factor influencing menu innovation. Australia fast food market outlook indicates this nutritional shift will be a major contributor to segment growth. Brands embracing cleaner labels and functional ingredients are aligning themselves with long-term trends in consumer behavior, which is moving toward more sustainable, wellness-focused food consumption patterns.

To get more information on this market Request Sample

Growth of App-Based Ordering and Delivery

Digital disruption continues to reshape customer engagement with Australia fast food. A shift towards mobile app and integrated delivery platform growth has optimized the customer experience, minimizing ordering, payment, and customization friction. These platforms provide customized promotions, loyalty schemes, and instant order tracking, enhancing convenience while driving repeat use. Rising reliance on app-based interfaces captures wider technological embedding in food service, especially since younger cohorts want minimal physical engagement. This pattern also serves to enhance operational effectiveness, facilitating better order processing accuracy and more comprehensive data analytics in menu planning. Australia fast food market growth is also increasingly enabled by digital ecosystem embedding in metropolitan as well as suburban areas. As contactless delivery becomes routine and artificial intelligence (AI) driven recommendations pick up steam, digital ordering will continue to be the backbone of consumer interaction in the industry, building more intimate customer-brand relationships, and contributing to the Australia fast food market demand.

Expansion of Global Cuisines in Fast Casual Formats

Australian shoppers are showing increasing interest in globally inspired food experiences, which are driving the proliferation of diverse cuisines in fast food markets. Flavors from Asia and Latin America, such as Korean fried chicken, Mexican street food, and Japanese rice bowls, are making inroads in popular, affordable, fast casual formats. They marry speed with freshness and customization and appeal to a multicultural consumer base. Menu innovation highly draws inspiration from street food formats, adapted to fast service models. For instance, in August 2024, Domino's Australia launched its innovative "Pizza Dogs" range, which includes kransky-style sausages topped with crisped pizza dough, mozzarella, and tomato sauce, as a demonstration of the brand's ongoing focus on innovative fast-food products. Moreover, diversification not only broadens consumer appeal but also makes menus dynamic and responsive. Australia fast food market share captures this trend towards fusion formats and cultural cross-over dishes that address demand for variety and novelty. As the demand for international flavors boosts, the industry is reacting by incorporating strong, authentic flavors into daily meals, further increasing the appeal of quick-service restaurants (QSRs) beyond the usual fare.

Growth Drivers of Australia Fast Food Market:

Growing Need for Personalization and Customization

Australian fast food customers are demonstrating a high appetite for customization and requesting meals that are tailored to their personal tastes, dietary requirements, and lifestyle. This desire for personalization cuts across age groups, and yet more so with millennials and Gen Z customers, who desire control of ingredients, portion sizes, and add-ons. Australian fast food outlets have retaliated by introducing build-your-own products, where customers can choose bases, meats, sauces, and add-ons to their liking. Diet diversity in Australia also drives the trend, with consumers seeking gluten-free, dairy-free, or keto versions of fast food. Ordering customization via mobile apps or in-store kiosks increases customer satisfaction and loyalty. Customization also addresses consumers' need for healthier and more open eating, providing them with greater authority over nutritional values without compromising convenience or taste.

Influence of Ethical and Environmental Concerns

According to the Australia fast food market analysis, consumers are driven by ethical and environmental factors in their buying choices. There has been greater awareness about sustainability, animal welfare, and environmental consciousness, with a majority of customers looking for fast food brands to show responsibility in sourcing, packaging, and waste. This is especially prevalent among city-dwellers who are more exposed to environmental cause campaigns and local movements advocating for zero-waste. Consumers prefer brands that have recyclable or biodegradable packaging and espouse sustainable agricultural practices, e.g., buying free-range meat or selling to local produce suppliers. Ethical consumerism when it comes to fast food also extends to the practice of labor and the community, with consumers usually preferring companies that are upfront about decent working conditions. This evolution puts pressure on fast food chains to innovate product creation and supply chain management to address the increasing demands for environmental stewardship.

Effect of Social and Family Dynamics on Food Choices

Social and household dynamics are influential in determining fast food eating patterns among Australians. Fast food is usually a quick meal option for families with time constraints, with parents enjoying speedy, value-for-money foods that children and teenagers like. Family outings to fast food restaurants are also the norm, and child-oriented menus with staple foods such as nuggets, fries, and mini burgers are major contributors to frequent visits. Social gatherings, such as informal catchups and after-school encounters, also drive regular fast food purchases, particularly among young Australians. The growth of single-person households and the shift in family structures have also shaped demand for solo-sized portions and meal deals. Fast food chains that appeal both to family groups and solo diners through flexible meal options and friendly atmospheres are well placed to capture various customer segments in the Australian market.

Consumer Behavior of Australia Fast Food Market:

Convenience and Speed Preference

Australian fast-food consumers always choose convenience and speed, which significantly influence their buying behavior. The high-speed urban life in cities such as Sydney, Melbourne, and Brisbane have caused a rise in demand for swift meal alternatives that accommodate busy work schedules, commute times, and family routines. Drive-thru, takeaway, and delivery are especially favored formats since they make it possible for consumers to get meals without losing time. Australians also prefer longer operating hours, such as late nights and weekends, to meet varied work schedules and social activity. Additionally, customers increasingly order through mobile apps and websites, a sign of a technology-savvy population who demand convenient, efficient service. This is seen in the popularity of online loyalty schemes and promotions that reward frequent buyers, a sign that Australian consumers positively respond to convenience with value offerings. Generally, the need for convenience and speed in the fast food process is a leading motivator of consumer behavior.

Increasing Health Awareness and Dietary Tendencies

Even as convenience leads, Australian fast food customers increasingly demonstrate an awareness about health and nutrition that drives food choice and behavior. There is a distinct trend to demand healthier menu items that do not sacrifice taste or convenience. Most people would like to have fast food restaurants that have salads, grilled meats, and plant-based products, an indication of a growing national interest in health and diets that balance. The increased popularity of vegetarianism, veganism, and gluten-free diets in Australia has necessitated a diversification of menus by fast food companies to appeal to such customers. Also, there is greater emphasis on portion sizes, ingredients, and calories, with consumers tending to do their homework on nutritional facts before they buy. This health orientation is especially prevalent among young Australians and families that are more inclined to insist on transparency and sustainable food production methods. The fast food industry has responded by using locally produced ingredients and minimizing artificial additives, which comply with these new consumer demands.

Multiculturalism and Social Trends Influence

Multicultural society in Australia has a significant impact on consumer behavior within the fast food industry, fueling differences in tastes and dabbling in global foods. Australians are willing to test foreign fast food tastes, such as Asian, Middle Eastern, and Mediterranean-style foods, capturing the melting pot character of the nation. This openness prompts fast food chains to innovate and introduce ethnic flavors to their offerings to tap broader market segments. Social trends like increasing significance of social media and food culture also dominate consumer behavior. Australians, particularly youth segments, perceive food brands on Instagram and TikTok, looking for food that is both tasty and looks appetizing. Ethical and sustainable consumption is another social trend that is dictating purchasing decisions; whereby consumers are growing more aware of environmental consequences and ethical procurement. This blend of cultural diversity and socially led preferences renders the Australian fast food consumer distinctly dynamic and reactive to global and local influences alike.

Australia Fast Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Pizza/Pasta

- Burger/Sandwich

- Chicken

- Asian/Latin American Food

- Seafood

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes pizza/pasta, burger/sandwich, chicken, Asian/Latin American food, seafood, and others.

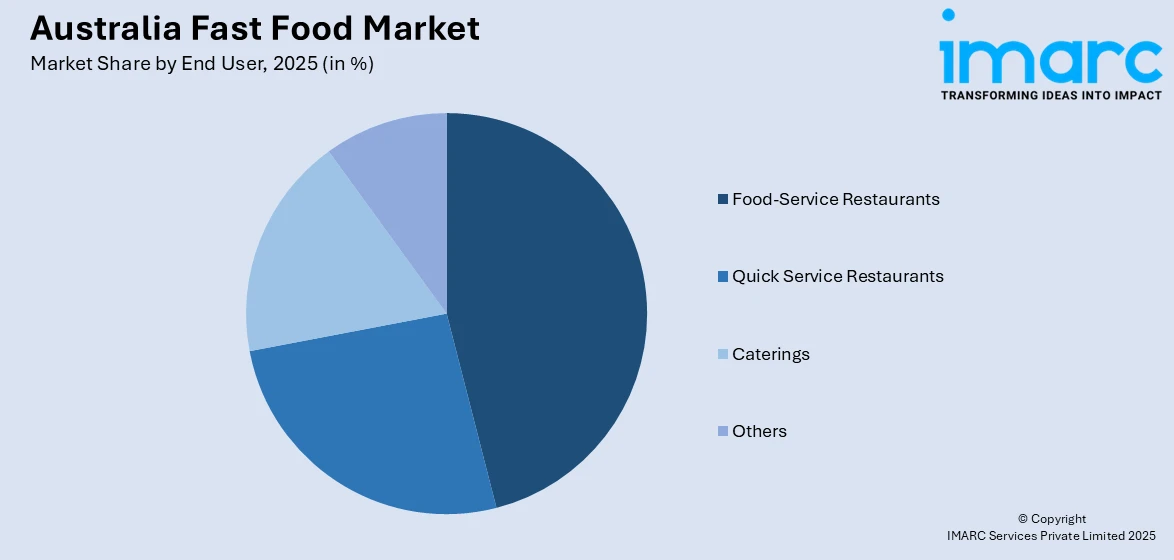

End User Insights:

Access the comprehensive market breakdown Request Sample

- Food-Service Restaurants

- Quick Service Restaurants

- Caterings

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food-service restaurants, quick service restaurants, caterings, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fast Food Market News:

- In March 2025, Australian chain Bubba Pizza introduced a ham-and-orange pizza, which caused national controversy. Priced as a variation on the pineapple debate, the new flavor is a response to growing consumer demand for unusual, globally inspired fast-food innovations. Social media responses were divided, from curiosity to outright dismissal.

- In October 2024, Australia's high-end burger chain Burgertory announced its foray into India through a strategic alliance with FranGlobal, the global subsidiary of Franchise India. The strategy involves opening 100 stores in key Indian cities within five years, combining Australian favorites with Indian burger innovations.

Australia Fast Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Pizza/Pasta, Burger/Sandwich, Chicken, Asian/Latin American Food, Seafood, Others |

| End Users Covered | Food-Service Restaurants, Quick Service Restaurants, Caterings, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fast food market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fast food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fast food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia fast food market was valued at USD 18.8 Billion in 2025.

The Australia fast food market is projected to exhibit a CAGR of 3.80% during 2026-2034.

The Australia fast food market is expected to reach a value of USD 26.5 Billion by 2034.

The Australia fast food market trends include heightened demand for plant-based options and healthier menu items, reflecting growing health awareness. There is also widespread adoption of digital ordering, loyalty apps, and contactless payment systems. Meanwhile, delivery and ghost kitchen models are also expanding rapidly to serve urban and regional markets seeking convenience and variety.

The Australia fast food market is driven by urbanization, busy lifestyles, and increasing demand for convenient meal options. Rising digital ordering, delivery services, and menu innovation, such as healthier and multicultural choices, further boost growth. Consumer preference for quick, affordable dining continues to shape the expansion of fast food across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)