Australia Feminine Hygiene Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Australia Feminine Hygiene Products Market Overview:

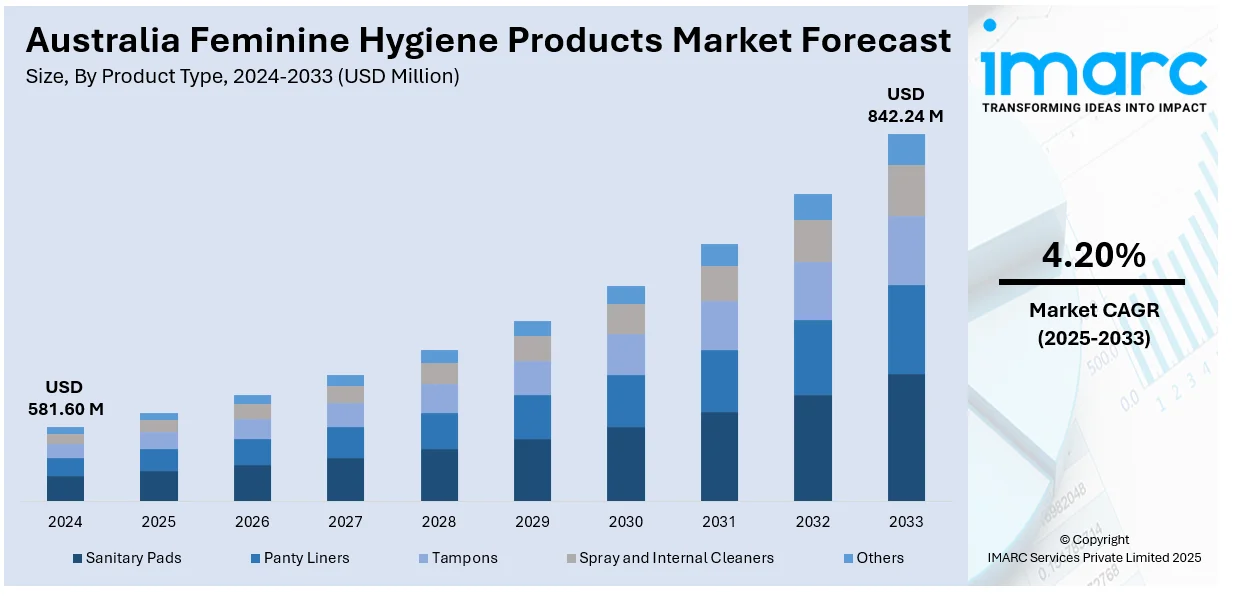

The Australia feminine hygiene products market size reached USD 581.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 842.24 Million by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The growing awareness about menstrual health, rising female workforce participation, increasing demand for sustainable products like organic pads and menstrual cups, and government efforts to combat period poverty and improve access are some of the major factors fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 581.60 Million |

| Market Forecast in 2033 | USD 842.24 Million |

| Market Growth Rate 2025-2033 | 4.20% |

Australia Feminine Hygiene Products Market Trends:

Rising Awareness and Menstrual Health Education

Awareness of menstrual health in Australia has grown significantly due to education programs, health campaigns, and increasing openness in public discourse. Schools, NGOs, and government bodies have contributed to breaking the stigma around menstruation, particularly among younger generations. This cultural shift has encouraged the adoption of feminine hygiene products across all age groups. Women are more informed about menstrual hygiene management, which boosts the demand for reliable, high-quality products, thus driving the Australia feminine hygiene products market growth. Increased educational efforts also mean consumers are better able to differentiate between types of products, such as disposable pads, tampons, and reusable alternatives, leading to more personalized, informed purchasing behavior. As education continues to expand, it plays a critical role in growing and diversifying the market. For instance, in December 2024, researchers at the University of Queensland introduced a menstrual health teaching guide for classrooms, collaboratively developed with Aboriginal and Torres Strait Islander students. Kaiwalagal, Umaii, and Kiwai woman Minnie King, who is an Adjunct Lecturer in UQ’s School of Public Health, initiated and directed the research to create ‘Mind Your Body’.

To get more information on this market, Request Sample

Increasing Female Workforce Participation and Active Lifestyles

Australia’s rising female workforce participation has created greater demand for convenient, discreet, and reliable feminine hygiene products. Women balancing work, school, fitness, and travel seek products that support active lifestyles, such as ultra-absorbent tampons, odor control features, or compact, on-the-go packaging. The need for long-lasting comfort and performance during extended periods of activity has driven product development and diversification, thus increasing the Australia feminine hygiene products market share. Recently, brands now market products specifically designed for athletic or high-movement scenarios. As more women engage in full-time employment and physical wellness, demand for hygienic, durable, and portable solutions continues to grow, influencing the type and quality of products available across the Australian market.

Growing Demand for Sustainable and Innovative Products

Australian consumers are increasingly prioritizing sustainability and innovation when it comes to feminine hygiene. This trend is driving demand for eco-friendly alternatives like biodegradable sanitary pads, reusable menstrual cups, and washable period underwear. Many women are concerned about the environmental impact and chemical content of conventional products, leading them to seek out organic, plastic-free, or cruelty-free options. Brands that highlight transparency, ethical sourcing, and green manufacturing practices are seeing increased market share. Additionally, innovations such as leak-proof designs, improved absorbency, and discreet packaging are influencing consumer preferences. As environmental consciousness continues to rise, these sustainable and innovative offerings are creating a positive impact on the Australia feminine hygiene products market outlook.

Australia Feminine Hygiene Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Sanitary Pads

- Panty Liners

- Tampons

- Spray and Internal Cleaners

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sanitary pads, panty liners, tampons, spray and internal cleaners, and others.

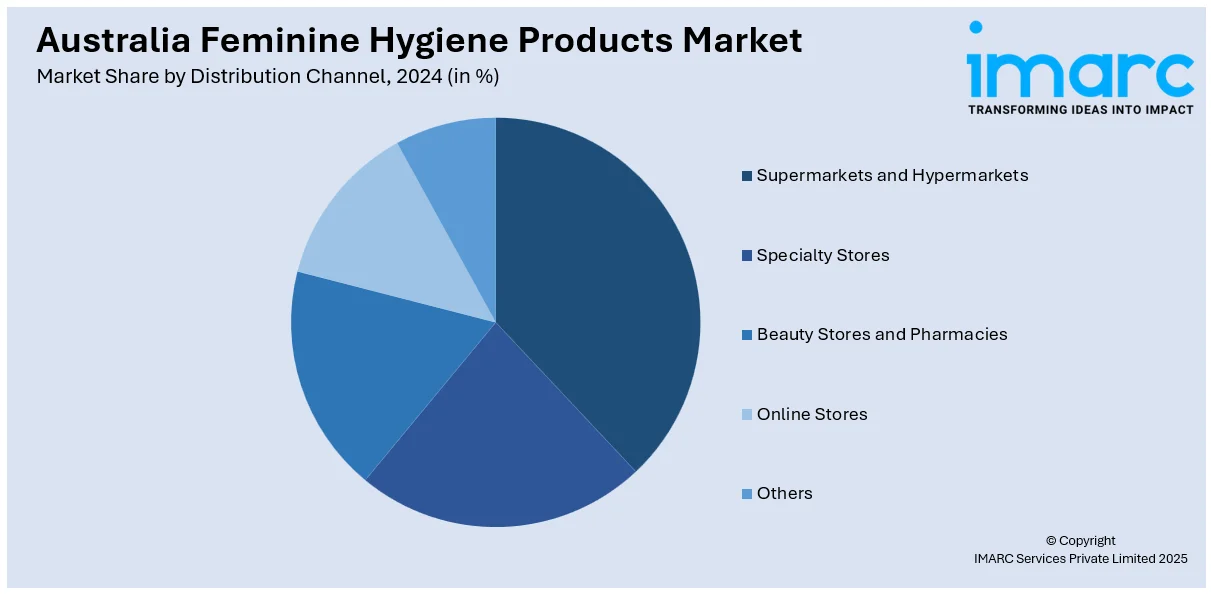

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Beauty Stores and Pharmacies

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, beauty stores and pharmacies, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Feminine Hygiene Products Market News:

- In May 2024, Taboo, a social enterprise and supplier of sanitary products, established a charitable foundation to eradicate period poverty in Australia by the year 2030. Taboo has provided more than 5500 boxes of menstrual products through their Pad it Forward initiative, enabling individuals to buy items for those facing period poverty.

Australia Feminine Hygiene Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sanitary Pads, Panty Liners, Tampons, Spray and Internal Cleaners, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Beauty Stores and Pharmacies, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia feminine hygiene products market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia feminine hygiene products market on the basis of product type?

- What is the breakup of the Australia feminine hygiene products market on the basis of distribution channel?

- What is the breakup of the Australia feminine hygiene products market on the basis of region?

- What are the various stages in the value chain of the Australia feminine hygiene products market?

- What are the key driving factors and challenges in the Australia feminine hygiene products market?

- What is the structure of the Australia feminine hygiene products market and who are the key players?

- What is the degree of competition in the Australia feminine hygiene products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia feminine hygiene products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia feminine hygiene products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia feminine hygiene products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)