Australia Fermented Superfoods Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

Australia Fermented Superfoods Market Overview:

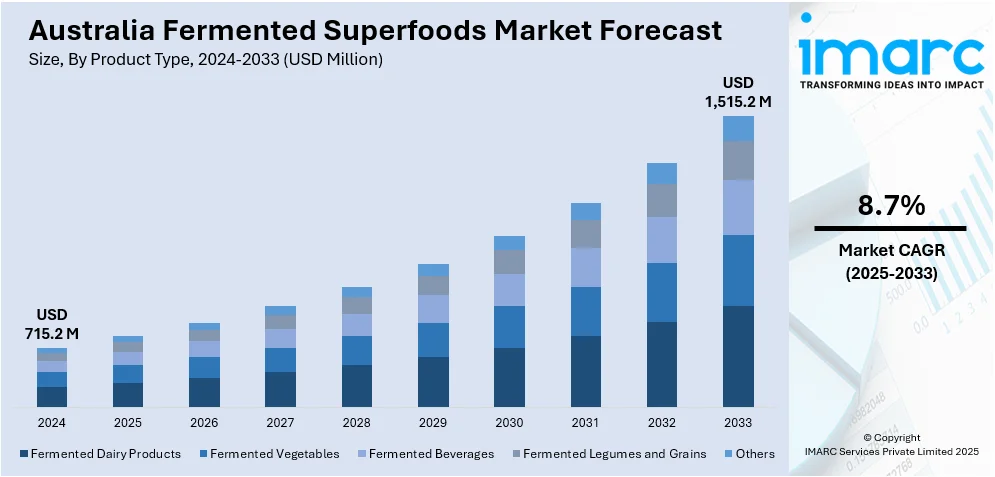

The Australia fermented superfoods market size reached USD 715.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,515.2 Million by 2033, exhibiting a growth rate (CAGR) of 8.7% during 2025-2033. The market is propelled by increasing consumer understanding of health benefits associated with gut health, amplifying demand for organic and locally grown ingredients, and ongoing product innovation in flavor and format. Health-aware Australians are looking for natural, functional foods that help maintain digestion and overall health. The need for sustainable, clean-label alternatives is speeding up with the support of lifestyle changes towards preventive nutrition. Moreover, these factors further the broadening reach and impact of the Australia fermented superfoods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 715.2 Million |

| Market Forecast in 2033 | USD 1,515.2 Million |

| Market Growth Rate (2025-2033) | 8.7% |

Australia Fermented Superfoods Market Trends:

Increasing Consumer Awareness of Gut Health

Nationwide throughout Australia, greater public awareness of the link between gut health and general well-being is driving demand for fermented superfoods. Such foods, filled with naturally occurring probiotics, enzymes, and beneficial bacteria, are being adopted by health-conscious consumers seeking to optimize digestion and immune function via dietary sources. The gut microbiome connection to mental acuity, mood stability, and levels of energy has become a topic of discussion not just among medical practitioners but also in mainstream media. With an increasing number of Australians moving towards preventive health practices, fermented superfoods are being incorporated into daily meals as part of overall wellness practices. This trend is not limited to niche groups; it cuts across multiple age groups and lifestyles. Ease of access to information via digital media and wellness influencers also speeds up adoption. Australia fermented superfoods market growth is being driven by the confluence of scientific advancements, heightening health education, and evolving consumer trends. For instance, in December 2023, Sacco System introduced a new website showcasing the advantages of rennet, lactic ferments, and probiotics, the major ingredients fueling innovation and expansion in Australia's fermented superfood industry.

To get more information on this market, Request Sample

Locally Sourced, Organic Ingredients Preference

One characteristic trend in Australia's fermented superfoods market is consumer demand for locally sourced organic ingredients-based products. Australians are becoming increasingly focused on food traceability, ethical production methods, and sustainability. This attitude is affecting consumer buying behavior, especially in the functional foods segment, where origin is seen as a quality and integrity indicator. Fermented foods made from organic vegetables, grains, and milk sourced locally are becoming popular due to their lower environmental footprint and perceived health advantages. Consumers are seeking guarantees that foods contain no artificial additives, pesticides, or genetically modified ingredients. This is also a response to a general trend of wanting to buy locally produced food and reduce dependency on imports. With consumers seeking cleaner labels and more transparency, companies are adapting by reformulating products. The trend reflects a changing food culture based on prioritizing nutrition, sustainability, and communal values in daily eating habits.

Innovation in Flavor Profiles and Formats

Australian fermented superfoods are more and more defined by innovation, with manufacturers diversifying flavor profiles and formats in order to address changing consumer demand. Older staples like sauerkraut and kefir are being brought back to life with the addition of indigenous botanicals, foreign fruits, and international spice blends appealing to a broader palate. This has resulted in gourmet-style fermented foods that both provide functionality and culinary flair. Further, innovation is driven by convenience, leading to innovation in ready-to-eat and on-the-go products like fermented snacks, drinks, and meal enhancers. These new formats meet busy lifestyles while maintaining the fundamental health benefits of fermentation. Through maturity in the Australian market, innovation is also increasing in plant-based and allergen-free categories, accelerating accessibility. For example, in June 2023, one Australian precision fermentation company said it will introduce its initial precision-fermented dairy protein product in Singapore by end-2024, focusing on APAC, Middle East, and US markets with clean, high-quality alternatives. Furthermore, the blending of ancient fermentation methods with modern food trends is transforming the category, making fermented superfoods each day, versatile staples in the contemporary diet.

Australia Fermented Superfoods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Fermented Dairy Products

- Yogurt

- Kefir

- Buttermilk

- Fermented Vegetables

- Kimchi

- Sauerkraut

- Pickles

- Fermented Beverages

- Kombucha

- Kanji

- Fermented Teas

- Fermented Legumes and Grains

- Idli

- Dosa

- Dhokla

- Tempeh

- Miso

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fermented dairy products (yogurt, kefir, and buttermilk), fermented vegetables (kimchi, sauerkraut, and pickles), fermented beverages (kombucha, kanji, and fermented teas), fermented legumes and grains (idli, dosa, dhokla, tempeh, and miso), and others.

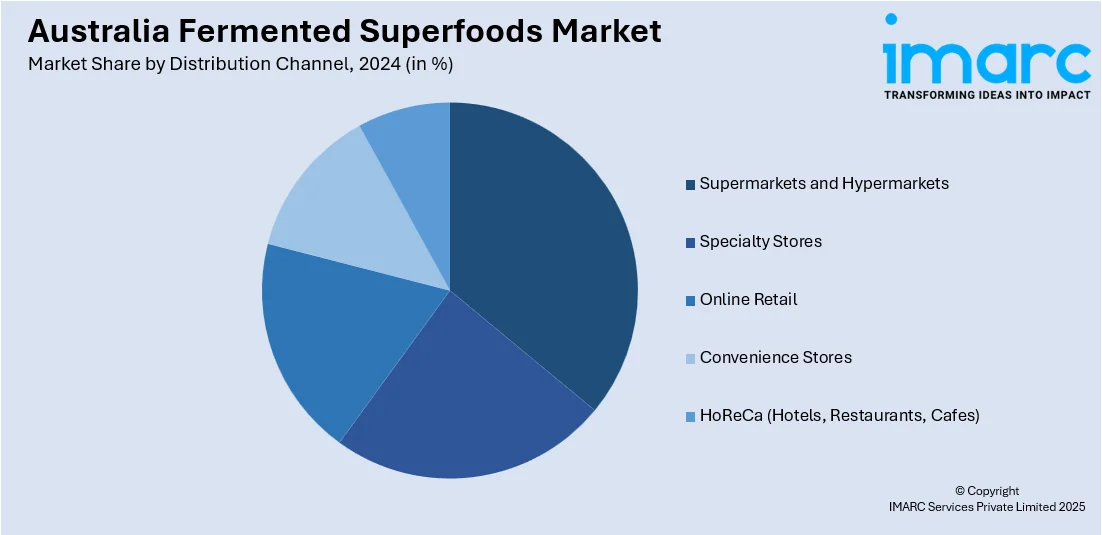

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail

- Convenience Stores

- HoReCa (Hotels, Restaurants, Cafes)

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes Supermarkets and hypermarkets, specialty stores, online retail, convenience stores, and HoReCa (hotels, restaurants, cafes).

End User Insights:

- Households

- Food Service Industry

- Health and Wellness Industry

The report has provided a detailed breakup and analysis of the market based on the end user. This includes households, food service industry, and health and wellness industry.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fermented Superfoods Market News:

- In February 2024, Kommunity Brew added to its product range with the launch of a zero-sugar iced tea and probiotic drink. The announcement follows a wider trend in the fermented superfoods market in Australia that focuses on flavor and format innovation to address rising consumer demand for natural, health-based functional beverages.

Australia Fermented Superfoods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Retail, Convenience Stores, HoReCa (Hotels, Restaurants, Cafés) |

| End Users Covered | Households, Food Service Industry, Health and Wellness Industry |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia fermented superfoods market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia fermented superfoods market on the basis of product type?

- What is the breakup of the Australia fermented superfoods market on the basis of distribution channel?

- What is the breakup of the Australia fermented superfoods market on the basis of end user?

- What is the breakup of the Australia fermented superfoods market on the basis of region?

- What are the various stages in the value chain of the Australia fermented superfoods market?

- What are the key driving factors and challenges in the Australia fermented superfoods?

- What is the structure of the Australia fermented superfoods market and who are the key players?

- What is the degree of competition in the Australia fermented superfoods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fermented superfoods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fermented superfoods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fermented superfoods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)