Australia Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End-User, and Region, 2025-2033

Australia Fintech Market Size and Share:

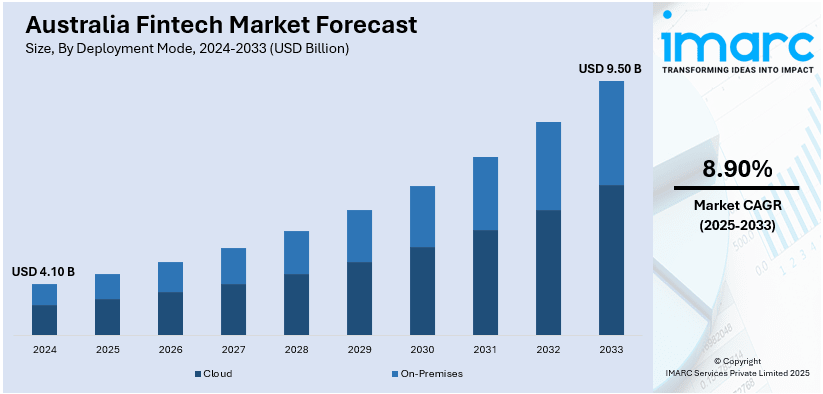

The Australia fintech market size was valued at USD 4.10 Billion in 2024. Looking forward, the market is projected to reach USD 9.50 Billion by 2033, exhibiting a CAGR of 8.90% during 2025-2033. New South Wales currently dominates the market, holding a significant market share of over 45.0% in 2024. The rising digital banking adoption, rising smartphone and internet penetration, favorable regulatory reforms, increasing demand for cashless transactions, expanding startup ecosystem, growing startup activity, investor confidence, and strong government support through initiatives are some of the major factors augmenting the fintech market share in Australia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.10 Billion |

|

Market Forecast in 2033

|

USD 9.50 Billion |

| Market Growth Rate 2025-2033 | 8.90% |

The market is primarily driven by the widespread adoption of digital payment platforms and mobile banking solutions. Moreover, the implementation of supportive government initiatives and regulatory reforms, such as the Consumer Data Right (CDR), is fostering innovation and competition in the market. Furthermore, the increasing demand for alternative lending solutions and robo-advisory platforms is reshaping the traditional financial services landscape, which is providing an impetus to the market. According to an industry report, there are nearly 175 open banking offerings live in Australia as of May 2024. The expansion of open banking is also enhancing data transparency and enabling the development of personalized financial products, thereby contributing to the growth of the market.

To get more information on this market, Request Sample

Additionally, the growing interest of institutional investors and venture capital in fintech startups is accelerating technological advancements, which is an emerging Australia fintech market trend. Besides this, high internet penetration and smartphone usage in the region are creating a conducive environment for digital finance solutions. In addition to this, the increasing focus on cybersecurity and compliance tools is also reinforcing trust among users and financial institutions, which is a significant growth-inducing factor for the market. According to an industry report, approximately 31% of Australian adults owned cryptocurrency as of April 2025, translating to around 6.2 million individuals based on national census data. This growing familiarity is fueling demand for crypto trading, blockchain payments, and decentralized finance solutions, further strengthening the market.

Key Trends of Australia Fintech Market:

Considerable growth in Digital Payment

The Australia fintech industry is experiencing significant growth in digital payments as consumers move away from cash towards digital transactions. The rise in popularity is caused by more smartphones being used, improvements in mobile banking, and the increase in use of contactless payment options. As per industry reports, In Australia, the number of mobile phone users has been steadily increasing. The number of smartphone users is expected to rise by 3.7 Million, from 19.9 Million in 2017 to 23.6 Million by 2026. Government endorsement for open banking and digital wallets is continuing to speed up this change. Payment platforms are placing emphasis on improved security and smooth integration to meet consumer expectations for ease and efficiency. As the digital payment industry grows, conventional banks are embracing fintech solutions to remain competitive, resulting in new partnerships and advancements in the field.

Increasing Need of Buy Now, Pay Later (BNPL) Services

BNPL services are gaining immense popularity among the masses, changing how consumers manage their expenditure, which is positively impacting fintech market outlook in Australia. Information gathered by the Reserve Bank of Australia from a cross-section of BNPL providers shows that BNPL transactions have shown ongoing growth in the past year. The volume of these transactions increased by about 13% in 2022/23, which was lower than the 37% growth seen in 2021/22. During 2022/23, BNPL transactions totaled approximately $19 Billion, representing about 2% of all cards purchases in Australia. Fintech firms are taking advantage of the trend among younger generations to prefer flexible payment options, meeting this demand with interest-free instalment plans, which is creating a positive Australia fintech market outlook. Major retailers and e-commerce platforms are currently integrating BNPL into their payment options because of its increasing popularity. The regulatory environment is changing, emphasizing responsible lending practices to support sustainable growth in the BNPL sector. Due to the growing competition, providers are broadening their service offerings to retain customers through loyalty programs and personalized financial products.

Rising Popularity of Regulatory Technology (RegTech) Advancements

There is a growing emphasis on the adoption of regulatory technology (Regtech) solutions to streamline compliance processes and reduce operational costs. As per the Australia fintech market forecast, fintech firms across the country are developing artificial intelligence (AI) and machine learning (ML) tools to automate activities such as fraud detection, reporting, and risk management in response to stringent regulations within the financial industry. Regulatory technology (RegTech) to help companies comply with regulations more efficiently, are being increasingly embraced by both traditional firms and new businesses in an effort to improve transparency and regulatory adherence. As a result, the rising demand for efficient, scalable solutions is positioning RegTech as a key driver in the market and is expected to continue.

Growth Drivers of Australia Fintech Market:

Financial Inclusion

A major factor propelling Australia fintech market demand is the increasing emphasis on financial inclusion. Fintech platforms are filling the gaps of individuals and businesses normally neglected by mainstream financial institutions by offering services such as online banking, micro-lending, and investment solutions. These products have a dramatic effect in rural and remote areas, where access to banking facilities is limited. Ease of access to fintech apps, combined with low entry costs and user-friendly interfaces, allows more users to manage their money smartly. From buy-now-pay-later to digital credit provision, or mobile banking, fintech is revolutionizing Australians' interactions with financial services. Such an inclusive model is important in driving the adoption of fintech among diverse user segments.

Tech-Savvy Consumers

The digitally savvy population of Australia particularly millennials and Gen Z is playing a significant role in boosting the growth of fintech services. These consumers prioritize convenience, efficiency, and transparency in their financial dealings, making app-based platforms highly attractive. From peer-to-peer payments to automated investments and immediate loan approvals, tech-oriented users are driving the demand for smarter, mobile-centered financial solutions. Their familiarity with technology fosters a willingness to explore innovative tools, compelling fintech companies to remain on the cutting edge. Moreover, the widespread use of smartphones and robust internet connectivity in the nation facilitates easy access to these digital offerings. As this younger demographic matures and their financial needs become more sophisticated, their preference for fintech solutions over traditional banks is likely to increase, influencing long-term market dynamics.

SMEs Turning to Fintech for Flexible Financial Solutions

Small and medium enterprises (SMEs) in Australia are increasingly turning to fintech services to adapt to their changing financial requirements. In contrast to conventional banks, fintech platforms provide quicker access to loans, real-time payment processing, automated accounting, and cash flow management tailored for smaller businesses. These solutions help alleviate administrative burdens and enhance operational efficiency. Fintech firms also deliver more personalized services with faster approval times, often bypassing the stringent credit criteria set by traditional lenders. As SMEs contend with tighter profit margins and intensifying competition, the flexibility and speed offered by fintech platforms become crucial. According to Australia fintech market analysis, this transition is a key driving force behind the expansion of fintech, with SMEs identified as a critical user segment for ongoing growth in the industry.

Australia Fintech Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia fintech market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on deployment mode, technology, application, and end-user.

Analysis by Deployment Mode:

- Cloud

- On-Premises

On-premises leads the market with around 70.7% of market share in 2024. On-premises deployment is significant for companies that value direct control over their infrastructure, particularly in domains dealing with sensitive financial information or under strict regulatory scrutiny. The model is attractive to large banks, payment processors, and financial institutions that aim to reduce data exposure risks and ensure compliance with data sovereignty regulations. On-premises solutions provide more customization, lower latency for certain high-frequency transactions, and more consistent performance irrespective of internet connection. Although cloud adoption is increasing, most Australian fintechs in risk-averse or highly regulated industries prefer hybrid approaches where core transaction systems are kept on-premises. This enables them to take advantage of the security and reliability of local hosting while progressively incorporating cloud-based tools for customer interaction and analytics. As fintech evolves in Australia, on-premises deployment remains an essential part of IT infrastructure choices, particularly for companies weighing innovation against regulatory compliance.

Analysis by Technology:

- Application Programming Interface (API)

- Artificial Intelligence (AI)

- Blockchain

- Data Analytics

- Robotic Process Automation (RPA)

- Others

Data analytics lead the market in 2024. Data analytics drives innovation in lending, payments, wealth management, and insurance platforms. Fintech companies increasingly turn to real-time analytics to determine credit risk, identify fraud, tailor customer experiences, and maximize operational efficiency. With increasing digital uptake, customer and transaction volumes of data have accelerated, which is prompting fintech firms to spend on advanced analytics platforms to make more profound behavior insights and intelligent decisions. In lending, analytics assists in alternative credit scores that facilitate better inclusion for the underbanked. In payments and advisory financials, analytics optimizes user experiences and product solutions to enhance retention and satisfaction. Regulatory technology (RegTech) products also employ analytics in order to automate compliance monitoring and reporting. As competition stiffens and customer demands increase, the capacity to effectively utilize data is a strong differentiator in the market, making analytics a central driver of market leadership and long-term growth.

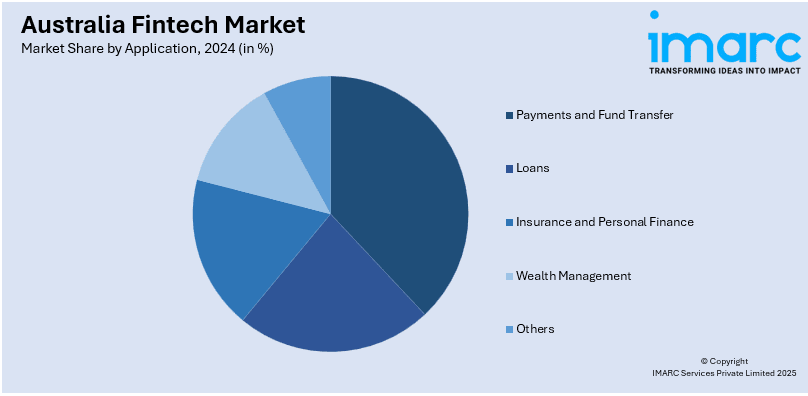

Analysis by Application:

- Payments and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

Payments and fund transfer leads the market with around 43.2% of market share in 2024. FinTech companies are revolutionizing how people and enterprises transfer money, fueled by enhanced consumer demands for convenience and quickness. Real-time payments, digital payment wallets, and peer-to-peer transfer apps are widely adopted with the rise in mobile banking and online commerce. The New Payments Platform (NPP) launched in Australia has facilitated instant, 24/7 bank transfers, providing a solid foundation for fintech growth in this arena. Startups and established players alike are employing API-based offerings to provide hassle-free and secure transactions, many times at cheaper rates than banks. Cross-border fund transfer products are also transforming, providing remittances and global trade at competitive rates with quicker processing. Payments and fund transfer continue to be crucial to customer interaction and financial inclusion and are thus a primary growth driver for fintech in Australia.

Analysis by End-User:

- Banking

- Insurance

- Securities

- Others

Banking leads the market with around 55.3% of market share in 2024. Banking plays an important role in the adoption and scaling of new financial technologies. Traditional banks are increasingly collaborating with fintech companies or developing in-house expertise to boost digital offerings, customer experience, and backend efficiencies. From AI-powered chatbots and tailored financial products to real-time fraud prevention and compliance automation, fintech is transforming the way bank's function and engage with customers. Challenger banks and neobanks have also emerged, delivering mobile-centric banking services that cater to technology-aware customers who want transparency, speed, and convenience. The introduction of open banking regulations propelling Australia fintech market growth, allowing safe data sharing and promoting competitiveness. As banks continue to digitalize their infrastructure, fintech continues to play a key role in assisting them in cutting costs, meeting new regulations, and competing in a rapidly changing financial ecosystem.

States Analysis:

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Tasmania

- Others

In 2024, New South Wales accounted for the largest market share of over 45.0%. Sydney, the capital of NSW, is home to a dense concentration of fintech startups, global financial institutions, incubators, and innovation labs. The region benefits from a strong financial services ecosystem, robust infrastructure, and proximity to regulatory bodies and key investors, making it an attractive location for fintech development and partnerships. New South Wales (NSW) also receives strong government support through programs such as Investment NSW and the Sydney Startup Hub, which offer funding, networking, and policy support to drive fintech development. The state dominates areas like digital payments, RegTech, wealth tech, and blockchain, while there is increasing interest in AI and data-led financial services. Its strategic role in driving innovation, employment, and global collaboration cements NSW’s position as a central region in Australian fintech landscape.

Competitive Landscape:

The Australian fintech market is characterized by fast-paced innovation, favorable regulation, and high demand for digital financial services. Competition is growing across segments such as payments, lending, wealth management, and blockchain use cases, with startups and incumbent institutions driving digital products. The open banking architecture and real-time payments infrastructure have driven new product development and customer acquisition. Venture capital interest is steady, with a growing emphasis on embedded finance and regtech solutions. Fintech players are also using partnerships with legacy banks to expand distribution with the added ease of navigating licensing requirements and compliance standards. Entry barriers in the market are moderate, although customer trust, data security, and price differentiation remain battleground areas. As digital adoption increases across demographics, firms are competing on user experience, personalization, and ecosystem integration to win market share. Regulatory oversight continues to evolve, defining competitive dynamics and long-term scalability for new business models.

The report provides a comprehensive analysis of the competitive landscape in the market with detailed profiles of top fintech companies in Australia.

- Afterpay

- Airwallex Pty Ltd

- Athena Mortgage Pty Ltd

- Divipay Pty Ltd

- Judo Bank Pty Ltd (Judo Capital Holdings)

- mx51 Pty Ltd

- PTRN Pty Ltd

- Stripe Inc.

- Wise Australia Pty Ltd

- Zeller Australia Pty Ltd.

Latest News and Developments:

- February 2025: Digital private equity manager Moonfare launched its operations in Australia as part of its global expansion. Since 2016, the firm had grown rapidly across Europe, North America, and Asia-Pacific. It offered eligible Australian investors access to top-tier private equity funds like KKR, EQT, and Carlyle Group. Moonfare aimed to address limited local access to global private equity by introducing its digital platform and proprietary strategies.

- February 2025: Australia's AMP unveiled a new online bank targeted at side hustlers, solopreneurs, and tiny and micro enterprises. The Engine platform from Starling Bank, which AMP chose in 2023, powered the business, which was called AMP Bank. With sophisticated accounting and cash flow management features, it catered to underserved markets. Moreover, the bank provided fee-free foreign exchange conversions, comprehensive transaction insights, and spending limits.

- January 2025: AMP Bank partnered with Mastercard to launch Australia’s first numberless debit card for small businesses. The initiative supported the debut of AMP’s digital bank, tailored for micro and small enterprises. Mastercard enabled global payment access and ATM use for AMP customers. The numberless design enhanced transaction security and reduced fraud risks.

- October 2024: Lockton launched Lockton Pulse, a digital insurance platform for SMEs and individuals in Australia. The initiative addressed rising demand for faster, more convenient insurance services. It replaced traditional systems with a more agile, tech-driven approach. Powered by Kanopi’s InsurTech, the platform allowed users to get quotes and buy insurance online.

- July 2024: MoEngage launched its MoEngage for Financial Services platform to support Australian financial institutions in addressing consumer expectations and improving campaign execution. The platform offered features such as direct data warehouse integration, PII protection, and AI-driven analytics. It supported omnichannel engagement, including push notifications and in-app messages, to enhance digital customer experiences.

Australia Fintech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Deployment Modes Covered | Cloud, On-Premises |

| Technologies Covered | Application Programming Interface (API), Artificial Intelligence (AI), Blockchain, Data Analytics, Robotic Process Automation (RPA), Others |

| Applications Covered | Payments and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End-Users Covered | Banking, Insurance, Securities, Others |

| States Covered | New South Wales, Victoria, Queensland, Western Australia, South Australia, Tasmania, Others |

| Companies Covered | Afterpay, Airwallex Pty Ltd, Athena Mortgage Pty Ltd, Divipay Pty Ltd, Judo Bank Pty Ltd (Judo Capital Holdings), mx51 Pty Ltd, PTRN Pty Ltd, Stripe Inc., Wise Australia Pty Ltd , Zeller Australia Pty Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fintech market from 2019-2033.

- The Australia fintech market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fintech market in Australia was valued at USD 4.10 Billion in 2024.

The growth of the Australia fintech market is driven by high smartphone and internet penetration, supportive regulatory initiatives like the Consumer Data Right (CDR), and increasing digital adoption by financial institutions. Rising demand for contactless payments, peer-to-peer lending, and personalized financial services, alongside strong investment inflows in fintech startups, is also accelerating market expansion.

The fintech market in Australia is projected to exhibit a CAGR of 8.90% during 2025-2033, reaching a value of USD 9.50 Billion by 2033.

Banking holds the largest share in Australia fintech market due to strong demand for digital banking services, early adoption of mobile and online platforms, and increasing investment in AI-driven financial solutions. Banks are actively collaborating with fintechs to enhance customer experience, streamline operations, and stay competitive in the evolving financial services landscape.

Some of the major players in the Australia fintech market include Afterpay, Airwallex Pty Ltd, Athena Mortgage Pty Ltd, Divipay Pty Ltd, Judo Bank Pty Ltd (Judo Capital Holdings), mx51 Pty Ltd, PTRN Pty Ltd, Stripe Inc., Wise Australia Pty Ltd and Zeller Australia Pty Ltd. among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)