Australia Fisheries Infrastructure Market Size, Share, Trends and Forecast by Infrastructure Type, Sector, End-User, and Region, 2025-2033

Australia Fisheries Infrastructure Market Overview:

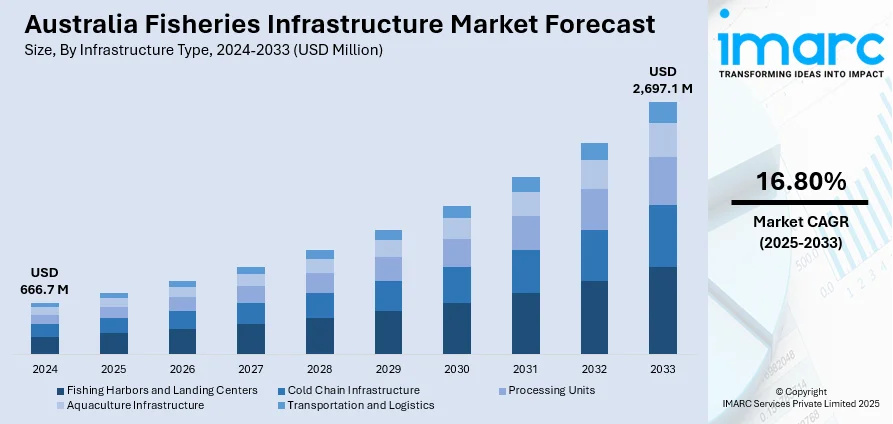

The Australia fisheries infrastructure market size reached USD 666.7 Million in 2024. Looking forward, the market is expected to reach USD 2,697.1 Million by 2033, exhibiting a growth rate (CAGR) of 16.80% during 2025-2033. The market is boosted by growing demand for seafood, advances in technology, and government initiatives. Growing exports to Asia and the use of sustainable aquaculture also help the market grow. Strategic investments in infrastructure are needed to fulfill these rising demands. All these factors together boost the Australia fisheries infrastructure market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 666.7 Million |

|

Market Forecast in 2033

|

USD 2,697.1 Million |

| Market Growth Rate 2025-2033 | 16.80% |

Key Trends of Australia Fisheries Infrastructure Market:

Emphasis on Sustainable Practices and Alternative Feeds

Sustainability is taking a core focus position in Australia's fisheries infrastructure development. The sector is increasingly embracing sustainable operations to address consumer desires as well as comply with regulations. One trend is the transition from traditional fishmeal dependency to insect meal and algae-based feed alternatives to minimize environmental footprint. Collaborations between companies, like the May 2024 partnership between Skretting and Goterra, aim to incorporate insect meal into aquafeeds, promoting a circular economy approach. This collaboration validates insect meal as a sustainable, low-cost protein source, supporting flexible raw material use and maintaining seafood nutritional quality. These initiatives not only enhance the sustainability of aquaculture operations but also contribute to the overall growth and resilience of the Australia fisheries infrastructure market.

To get more information on this market, Request Sample

Expansion of Export Markets and Infrastructure Enhancement

The Australian fisheries sector is experiencing a surge in export demand, particularly from Asian markets seeking high-quality seafood products. This growing demand necessitates significant investments in infrastructure to ensure efficient processing, storage, and transportation of seafood products. Developments in port facilities and cold-chain logistics are critical to maintaining product quality and meeting international standards. For example, the introduction of the NEXDOC system streamlines export documentation processes, facilitating smoother trade operations. These infrastructure enhancements are essential to support the expanding export market and are expected to play a pivotal role in the continued Australia fisheries infrastructure market growth.

Growth Drivers of Australia Fisheries Infrastructure Market:

Aquaculture and Wild-Catch Support Infrastructure Expansion

One of the strongest drivers stimulating growth within Australia's fisheries infrastructure market is the growing aquaculture industry and ongoing investment in wild-catch fisheries support systems. In areas such as the Murray‑Darling Basin and the Northern Territory, freshwater aquaculture including Murray cod businesses are expanding, and supporting infrastructure for hatcheries, fingerling supply, and onboard processing is being improved. In coastal regions such as Port Lincoln on the Eyre Peninsula, extensive sea-cage aquaculture industries for southern bluefin tuna and yellowtail kingfish depend on specialist port facilities, cold chain processing factories, and biosecure feed supply chains. On the wild-catch side, new vessel fleets, such as the Darwin-based new FV Australia Bay, call for upgraded quay-side docking, refrigeration and offloading facilities, and servicing wharfs. These combined requirements for advanced hatcheries, landing wharfs, refrigerated storage, and onshore processing capacity fuel growth in investment, construction, and operations in both public and private fisheries infrastructure industries.

Technological Innovation and Integration of Smart Systems

Technological advancements are positively influencing Australia's fisheries infrastructure environment to promote growth through more intelligent systems and automation. Australia's Fisheries Research and Development Corporation (FRDC) funds research on how AI-based feeding controls, water quality analysis, and remote sensing can be incorporated into aquaculture farms. Facilitated by government-funded trials, most operations now utilize precision feeding systems, recirculating aquaculture systems (RAS), and digital tracking of fish to maximize yield and reduce environmental footprints. Infrastructure upgrades include shore-based water treatment systems, sensor-equipped tanks, and centralized data hubs that support multi-site monitoring and control. At ports, improving cold storage facilities, real‑time logistics tracking, and traceability platforms are enabling better handling of export-bound seafood. The convergence of digital infrastructure, ranging from automated feeding within ponds to blockchain-based traceability for supply chains, naturally intersects with investment in physical infrastructure, fueling demand for upgraded facilities that can host next-generation fisheries technologies.

Policy and Trade-Driven Modernization of Port Infrastructure

Policy regulations and trade patterns are yet another primary stimulus behind expansion of the Australia fisheries infrastructure market demand. With Australia's reputation for high-quality, sustainably produced seafood, there is federal and state government commissioning of port and supply-chain facilities custom-designed for fisheries export markets. Major ports like Darwin and Port Lincoln are increasing facilities to receive fishing boats, cold stores in containers, and value-added processing areas. Examples include Northern Territory investment in ship lift facilities and servicing capacity to back offshore fishing and pearling boats and commercial trawlers and reinforce Darwin as a hub for fisheries. Regional development planning in Queensland and South Australia targets infrastructure zoning in aquaculture farms and hatcheries for ease in logistics from sea to shore. Export-oriented species such as barramundi, prawns, and oysters need cold-chain ports with biosecurity zones, labelling stations, and processing lines. With trade agreements creating avenues to Asia-Pacific markets, demand for traceable, compliant, and efficient port infrastructure that is specifically designed to meet the needs of seafood export fuels ongoing growth and contemporary development of Australia's fisheries infrastructure.

Opportunities of Australia Fisheries Infrastructure Market:

Regional Aquaculture Zone Expansion

Australia offers vast opportunities in fisheries infrastructure in the form of regional aquaculture zone expansion, particularly on northern and coastal areas. Queensland, Western Australia, and the Northern Territory are all in the process of creating special aquaculture development areas to increase local economies and produce food. Such areas are normally found close to clean marine environments and are well suited to grow high-value species such as barramundi, prawns, and tropical rock oysters. The creation of these areas provides opportunities for investment in shore-based hatcheries, feed storage, biosecurity facilities, and marine cage systems. In addition, the ability to co-locate processing and packaging facilities creates logistical efficiencies and product traceability. As local authorities identify new locations and lease aquaculture in the long term, engineering companies and infrastructure developers are experiencing increasing demand for customized solutions, ranging from energy-efficient water supply systems to boat maintenance piers. These local projects generate employment, promote sustainable activity, and increase domestic seafood security, increasing the strategic significance of fisheries infrastructure in the more distant regions of the nation.

Indigenous and Community-Based Enterprise Development

Part of the new opportunities in Australia's fisheries infrastructure industry is the expanding role of Indigenous and community-based business. In coastal and riverine communities, especially in the Northern Territory, Arnhem Land, and Far North Queensland, there is a growing interest in establishing culturally related and economically viable small-scale commercial fisheries and aquaculture ventures. Indigenous enterprises are also being joined by public and private partners in investing in localized fisheries infrastructure, such as fish processing sheds, cold storage facilities, transport boats, and onshore aquaculture systems. These initiatives offer particular opportunities for customized infrastructure that recognizes traditional knowledge and encourages stewardship of marine and freshwater ecosystems. Support from governments for Indigenous business development and co-management of the ocean further drives demand for infrastructure. Moreover, cultural tourism and seafood branding opportunities tied into Indigenous fisheries are generating new sources of revenue, which means infrastructure investment in these markets is socially valuable and financially viable.

Building Export Supply Chains and Biosecurity Compliance

According to the Australia fisheries infrastructure market analysis, the region’s reputation as a high-end seafood exporter generates huge opportunities to build fisheries on export supply chains and biosecurity compliance. With increased international demand for premium Australian seafood, including lobsters, abalone, and tuna, upgrading infrastructure to preserve freshness, adhere to traceability requirements, and meet strict international compliance is essential. Major ports such as Fremantle, Hobart, and Darwin are well placed for export activities, and their proximity to areas with rich fishing grounds makes them ideal candidates for expansion. There is a prospect for investment in chilled storage, fast inspection facilities, and automated handling systems that reduce product handling and maintain product quality. Also, as trading partners increasingly impose biosecurity and sustainability standards, Australia needs to further develop infrastructure facilitating real-time traceability, pathogen analysis, and product certification. These upgrades ensure smooth export processes and reinforce Australia's reputation as a supplier of safe, sustainably harvested seafood, positioning infrastructure development as a key enabler of global trade competitiveness.

Government Support of Australia Fisheries Infrastructure Market:

Strategic Investment Via Federal and State Programs

Government support is critical in determining the course of the fisheries infrastructure landscape in Australia, with federal and state governments regularly investing in the industry. Strategic funding programs prioritize the upgrade of key infrastructure such as port structures, aquaculture facilities, and cold chain logistics. For example, the national government has jointly funded regional fishing community infrastructure upgrades for increased seafood processing, boat maintenance, and onshore storage capacities. States such as Western Australia and the Northern Territory are also investing in special marine infrastructure areas, facilitating increases in aquaculture and wild-catch fisheries growth. These government initiatives seek to improve the efficiency and productivity of fisheries operations, particularly where infrastructure has previously been underdeveloped. The assistance frequently takes the forms of grants, long-term leases, or co-investment schemes, promoting private sector entry while guaranteeing infrastructure to have environmental and industry specifications. Such public support has facilitated Australia to become a forerunner in sustainable seafood production and readiness for export.

Indigenous and Remote Community Fisheries Support

One of the main areas of government assistance for Australia's fisheries infrastructure sector is the creation of Indigenous and remote community fisheries. Governments in places such as Arnhem Land, Cape York, and the Kimberley have initiated specialized programs to give local communities self-sufficiency through culturally appropriate fishing and aquaculture businesses. Infrastructure investment in these regions includes funding for small-scale processing plants, ice-making units, boat ramps, and transport gear that enhance access to markets and enhance economic participation. The assistance is intended not only to enhance regional development but also to maintain traditional fish knowledge and practices. Federal and state programs also offer capacity-building aid such as training in sustainable harvesting, biosecurity practices, and business planning. This type of integrated government assistance has led to infrastructure projects that both benefit business and community, achieving long-term economic viability while being environmentally and culturally sensitive to the local fisheries resources.

Policy-Driven Emphasis on Sustainability and Compliance

Australian government assistance for fisheries infrastructure closely reflects its emphasis on sustainability and international compliance. Investments in infrastructure are regulated by rigorous environmental laws and fisheries management systems that promote the preservation of marine biodiversity and the long-term sustainability of resources. Governmental institutions frequently finance infrastructure that allows for better monitoring, reporting, and sustainability standard compliance, e.g., electronic logbooks, surveillance equipment, and waste treatment plants. Ports and processing facilities supported by government funding need to have high levels of traceability and export certification, especially for high-value seafood to be exported to international markets. This policy-induced infrastructure development makes Australian seafood competitive and reliable abroad. Public funds are also spent on climate adaptation efforts in fisheries infrastructure, such as flood-resistant port design, energy-efficient cold stores, and water recycling. These initiatives uphold the government's twin mandate of economic development and environmental stewardship, placing Australia's fisheries industry in a state of being both productive and ecologically progressive.

Challenges of Australia Fisheries Infrastructure Market:

Geographic Isolation and Logistical Complexity

One of the principal challenges confronting the fisheries infrastructure market in Australia is the geographic remoteness of major fishing areas. Virtually all productive fisheries are situated in the far reaches of northern Queensland, the Northern Territory, and Western Australia. These areas tend to have deficient road networks, stable power, or modern port facilities, which render the building and upkeep of fisheries infrastructure both challenging and expensive. The transportation of material, labor, and machinery to such places tends to be long distances away from fairly stable weather conditions, which can push projects forward and raise overall costs. Ensuring regular cold chains for seafood harvested from distant coastlines to urban markets or export terminals is also logistically challenging. Investments in infrastructure in these areas need to be extremely specialized and robust, frequently being dependent on government subsidy or partnership to be financially sustainable. Without innovative thinking and careful planning, remoteness makes geographic scale and cost efficiency a limitation to fisheries infrastructure initiatives nationwide.

Environmental Restraints and Regulatory Compliance

Australia's stringent environmental rules, though crucial for sustainability, can prove to be restrictions for fisheries infrastructure development as well. The construction of new ports, aquaculture farms, or processing plants demands extensive environmental impact statements, marine spatial planning, and permitting processes that are time-consuming and resource intensive. Fragile marine ecosystems, such as those in the vicinity of the Great Barrier Reef or in the temperate waters surrounding Tasmania, demand extra protection measures, which can restrict locations and the scale of infrastructure works. In addition, continued climate change and changing weather patterns add uncertainty to marine resource availability and operational schedule. Coastal erosion, sea level rise, and climatic extremes add stress on established infrastructure, necessitating upgrades or design changes. These environmental and regulatory issues, though critical for long-term resource sustainability, can postpone investment choices and lower the private sector's interest, particularly in high-risk or low-return regions. Balancing economic growth with ecological responsibility is a core tension in Australia's fisheries infrastructure sector.

High Capital Expenditure and Restricted Access to Funding

The high capital expenditure required for fisheries infrastructure investment is a major problem in Australia. Building advanced processing facilities, cold storage facilities, and dedicated port infrastructure demands huge initial investments, usually out of the reach of small to medium-sized enterprises. Even when government subsidies or grants are available, private investors might be reluctant to invest because of long return-on-investment horizons and subject to market fluctuation. Aquaculture, in addition to the fisheries sector, also encounters challenges in securing commercial financing based on perceived operational risks like outbreaks of disease, breaches in biosecurity, or uncertain harvests. In remote and regional communities, financial constraints are even more significant, with fewer local banks and smaller investor networks. While public-private partnerships and cooperative models are developing gradually, overall financial innovation and sectoral lending solutions remain underdeveloped. Meeting these capital needs is essential to maintaining infrastructure in step with increasing domestic and export demand, particularly as competition in international seafood markets grow.

Australia Fisheries Infrastructure Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on infrastructure type, sector, and end-user.

Infrastructure Type Insights:

- Fishing Harbors and Landing Centers

- Cold Chain Infrastructure

- Cold Storage

- Ice Plants

- Processing Units

- Fish Processing Plants

- Packaging Units

- Aquaculture Infrastructure

- Hatcheries

- Feed Plants

- Transportation and Logistics

- Refrigerated Vehicles

- Supply Chain

The report has provided a detailed breakup and analysis of the market based on the infrastructure type. This includes fishing harbors and landing centers, cold chain infrastructure (cold storage and ice plants), processing units (fish processing plants and packaging units), aquaculture infrastructure (hatcheries and feed plants), and transportation and logistics (refrigerated vehicles and supply chain).

Sector Insights:

- Marine Fisheries

- Inland Fisheries

- Aquaculture

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes marine fisheries, inland fisheries, and aquaculture.

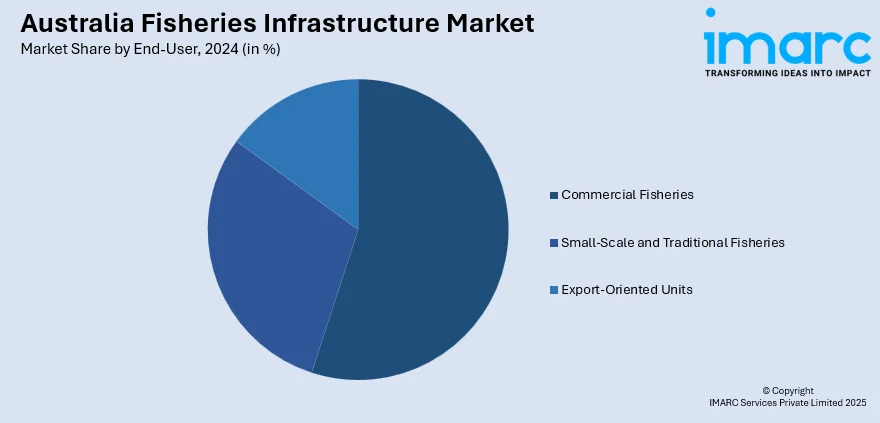

End-User Insights:

- Commercial Fisheries

- Small-Scale and Traditional Fisheries

- Export-Oriented Units

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes commercial fisheries, small-scale and traditional fisheries, and export-oriented units.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fisheries Infrastructure Market News:

- In November 2024, Charles Sturt University, in partnership with the Australian Centre for International Agricultural Research (ACIAR), introduced the FishTech project. Backed by over AUD 8.5 million, this Australian-led initiative aims to integrate technical fisheries solutions into river development programs across Southeast Asia. Drawing on Australia’s extensive research background, the project seeks to improve fish migration systems affected by irrigation and hydropower infrastructure. Collaborating with key regional institutions in Cambodia, Indonesia, Laos, and Myanmar, FishTech leverages Australian expertise to drive innovation in fishway technology, strengthen policy development, and build institutional capacity to support sustainable fisheries and food security in the Indo-Pacific region.

Australia Fisheries Infrastructure Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Infrastructure Types Covered |

|

| Sectors Covered | Marine Fisheries, Inland Fisheries, Aquaculture |

| End-Users Covered | Commercial Fisheries, Small-Scale and Traditional Fisheries, Export-Oriented Units |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fisheries infrastructure market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fisheries infrastructure market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fisheries infrastructure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia fisheries infrastructure market was valued at USD 666.7 Million in 2024.

The Australia fisheries infrastructure market is projected to exhibit a CAGR of 16.80% during 2025-2033.

The Australia fisheries infrastructure market is expected to reach a value of USD 2,697.1 Million by 2033.

The Australia fisheries infrastructure market trends include growing adoption of sustainable aquaculture practices, expansion of export-oriented cold chain and processing facilities, and increasing use of advanced technologies like automated feeding and water quality monitoring. These trends enhance productivity, environmental stewardship, and global competitiveness in the Australian seafood sector.

The Australia fisheries infrastructure market is driven by expanding aquaculture zones, rising seafood export demand, and government-backed regional development. Investment in cold chain logistics, sustainable harvesting technologies, and indigenous enterprise support further propels growth. These drivers collectively enhance productivity, sustainability, and competitiveness across both remote and coastal fisheries operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)