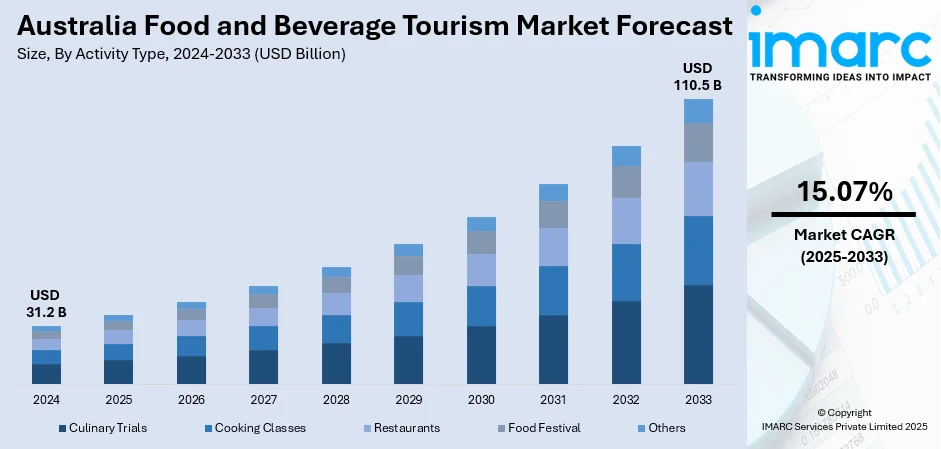

Australia Food and Beverage Tourism Market Report by Activity Type (Culinary Trials, Cooking Classes, Restaurants, Food Festival, and Others), Mode of Booking (Online Travel Agencies (OTA), Tour Operators, Direct Travel), Tour (Domestic, International), and Region 2025-2033

Australia Food and Beverage Tourism Market Overview:

The Australia food and beverage tourism market size reached USD 31.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 110.5 Billion by 2033, exhibiting a growth rate (CAGR) of 15.07% during 2025-2033. The market is propelled by growing interest in culinary experiences and local cuisines, increasing promotion of regional food festivals and events, rising demand for farm-to-table and organic food experiences, and expanding wine tourism in key regions such as South Australia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 31.2 Billion |

| Market Forecast in 2033 | USD 110.5 Billion |

| Market Growth Rate 2025-2033 | 15.07% |

Australia Food and Beverage Tourism Market Trends:

Growing Demand for Culinary Experiences

The increasing global and domestic demand for immersive culinary experiences significantly influences the food and beverage tourism market in Australia. Instead of just sightseeing, travelers today want to experience the local culture of the places they visit through food. Australia possesses a very rich and diverse culinary landscape and offers tourists the chance to explore indigenous ingredients, modern fusion cuisine, and internationally acclaimed restaurants. Cities such as Melbourne and Sydney have become major gastronomic destinations, with a wide variety of dining experiences ranging from Michelin-starred restaurants to street food markets. Additionally, the growing interest in food festivals and events, such as the Melbourne Food and Wine Festival, attracts tourists seeking to indulge in authentic and innovative culinary experiences. The focus on local and fresh ingredients, including seafood, bush tucker, and a variety of unique fruits and vegetables, further enhances the appeal of Australia as a food tourism destination. Moreover, the rise of culinary tours and cooking classes also adds to the experiential dimension, allowing tourists to engage with food beyond just eating, learning about the preparation and history of local dishes. This demand for curated food experiences is steadily rising, making it a significant driver of the market.

To get more information on this market, Request Sample

Expanding Wine and Beverage Tourism

Australia is acclaimed globally for its wine production regions, such as Barossa Valley, Margaret River, and Hunter Valley, which produce some of the finest wines in the world. Tourists are drawn to these places for wine tasting, vineyard tours, winemaking classes, and food-pairing experiences. As a result, wine tourism is a major component of food and beverage tourism. In fact, with 42% of average consumption, wine was the most popular choice in beverages in 2019-2020, as per the Australian Institute of Health and Welfare. The wine making regions in Australia have a unique climate and geography. This helps in producing many different types of wines, making the country more alluring to wine enthusiasts, and generating traffic. Also, the craft beer and spirits industries in Australia are becoming popular in the tourism market. The region of Tasmania, in particular, is receiving more attention because of its high-quality whiskey that adds another diverse option to the overall beverage tourism scene. The popularity of these beverages is expanding opportunities for food tourism as well, facilitating overall market growth.

Rise of Sustainable and Farm-to-Table Practices

A significant driver of the Australia food and beverage tourism industry is the trend of sustainability. Since tourists want to see for themselves where their food is sourced from and how it is produced, farm-to-table experiences are becoming more popular. Many domestic restaurants in Australia are also advocating for sustainable farming practices and emphasizing the use of locally sourced, organic ingredients. As per a study by the Australian Department of Agriculture, Water, and the Environment, most of the organic goods’ sales are domestic, with 60% of farmers supplying to retailers and 58% selling organic products directly to consumers. This broadens the appeal of such foods to a wider audience. For instance, tourists who are more eco-conscious are attracted to such ethical dining options. Moreover, agritourism also contributes to the expansion of the food and beverage tourism in Australia. Tourists are very interested in visiting farms, orchards, and fisheries. These places provide opportunities to learn about the production of food, allow visitors to indulge in fresh products, and even include them in harvesting activities, all of which are novel experiences for many people. This connection between agriculture and tourism enhances the appeal of food and beverage offerings in Australia, as tourists are seeking authentic and immersive experiences that support local communities and the environment.

Australia Food and Beverage Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on activity type, mode of booking, and tour.

Activity Type Insights:

- Culinary Trials

- Cooking Classes

- Restaurants

- Food Festival

- Others

The report has provided a detailed breakup and analysis of the market based on the activity type. This includes culinary trials, cooking classes, restaurants, food festival, and others.

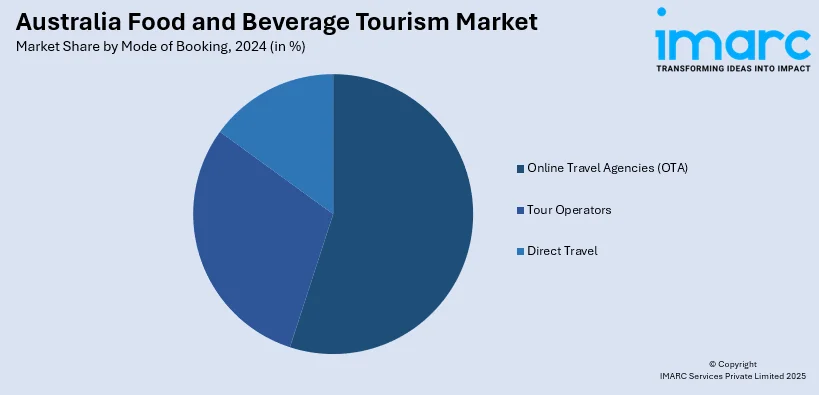

Mode of Booking Insights:

- Online Travel Agencies (OTA)

- Tour Operators

- Direct Travel

A detailed breakup and analysis of the market based on the mode of booking have also been provided in the report. This includes online travel agencies (OTA), tour operators, and direct travel.

Tour Insights:

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the tour. This includes domestic, and international.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Food and Beverage Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Activity Types Covered | Culinary Trials, Cooking Classes, Restaurants, Food Festival, Others |

| Mode of Bookings Covered | Online Travel Agencies (OTA), Tour Operators, Direct Travel |

| Tours Covered | Domestic, International |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia food and beverage tourism market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Australia food and beverage tourism market?

- What is the breakup of the Australia food and beverage tourism market on the basis of activity type?

- What is the breakup of the Australia food and beverage tourism market on the basis of mode of booking?

- What is the breakup of the Australia food and beverage tourism market on the basis of tour?

- What are the various stages in the value chain of the Australia food and beverage tourism market?

- What are the key driving factors and challenges in the Australia food and beverage tourism?

- What is the structure of the Australia food and beverage tourism market and who are the key players?

- What is the degree of competition in the Australia food and beverage tourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia food and beverage tourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia food and beverage tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia food and beverage tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)