Australia Food Flavors Market Size, Share, Trends and Forecast by Type, Form, End User, and Region, 2025-2033

Australia Food Flavors Market Overview:

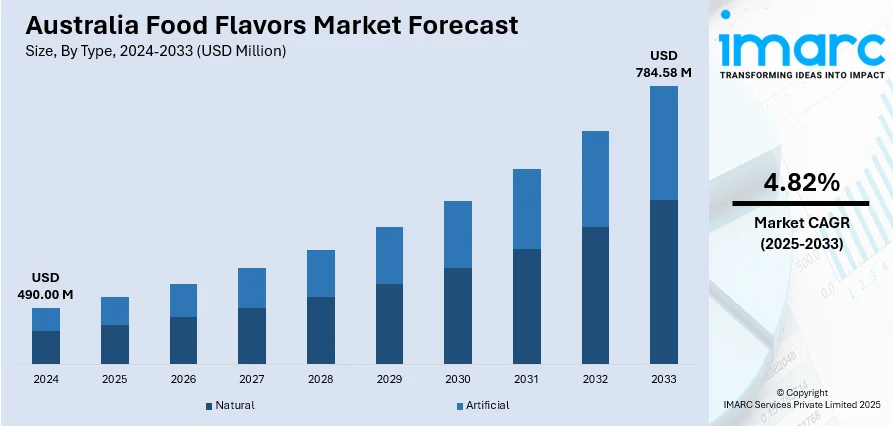

The Australia food flavors market size reached USD 490.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 784.58 Million by 2033, exhibiting a growth rate (CAGR) of 4.82% during 2025-2033. The health-conscious shift in Australia is driving flavor innovation, with a preference for clean-label, low-fat, and natural ingredients. Consumers are increasingly drawn to functional foods that provide health advantages like improved digestion and immunity. Moreover, the demand for unique, bold, and culturally diverse flavors is rising as people seek new, global taste experiences. Food producers are responding with creative, cross-cultural flavor combinations to meet consumer desires for authenticity, innovation, and wellness-driven options. These factors are contributing to the expansion of the Australia food flavors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 490.00 Million |

| Market Forecast in 2033 | USD 784.58 Million |

| Market Growth Rate 2025-2033 | 4.82% |

Australia Food Flavors Market Trends:

Health and Wellness Trends Influencing Flavor Choices

Australia's growing emphasis on health, wellness, and clean-label choices is transforming the flavor profile across food and beverage (F&B) sectors. Consumers are becoming more conscious of how their food choices affect their health and are actively looking for tastes that correspond with a healthier way of living. This encompasses a strong preference for items that are low in fat, devoid of artificial colors, flavors, and preservatives, and crafted with natural, identifiable ingredients. The increasing fascination with functional foods, which provides advantages beyond basic nutrition, like enhanced digestion, immunity, or mental clarity, is prompting brands to create flavor profiles that promote wellness while maintaining taste. As a result, producers are increasingly utilizing fruit-based, herbal, and nutrient-rich components to satisfy this need. A prime illustration of this change is the 2025 introduction of a limited-edition Mango & Cream flavored milk by Weis and Breaka in Queensland. Drawing inspiration from the classic Weis mango ice cream bar, this product honors local traditions while providing a low-fat, clean-label option to conventional flavored milks. Free from artificial colors and flavors, the drink appeals to nostalgic, locally influenced taste preferences while also meeting consumer demand for healthier, more transparent food options. The growing health consciousness among individuals is fostering flavor innovation that harmonizes indulgence with nutrition, making wellness a key factor in product development throughout the market.

To get more information on this market, Request Sample

Increasing Consumer Demand for Unique and Authentic Flavors

Australia’s increasingly multicultural society and its growing fascination with global cuisines are key drivers behind the evolving demand for bold, exotic, and innovative food flavors. Consumers are no longer content with traditional products and are actively looking for distinctive taste experiences that embody global culinary trends and various cultural influences. This change is driven by a craving for genuine experiences and exploration in cuisine, alongside exposure to diverse global tastes via travel, migration, and digital platforms. As people become more adventurous with their tastes, food producers are adopting intricate and unconventional flavor combinations to remain competitive and pertinent. A notable instance of this trend is the 2025 introduction of Nongshim’s Toomba-flavored Shin Ramyun in Woolworths Australia, after its successful launch in Korea, where it has sold more than 25 million units since September 2024. Drawing inspiration from spicy cream pasta, a blend of Western and Korean flavors, the product addresses the Australian craving for hybrid, globally influenced tastes. The launch of this flavor not only piques consumer interest in global cuisines but also showcases how brands are utilizing cross-cultural inspirations to develop items that appeal to contemporary, flavor-centric buyers. As international food trends increasingly influence local tastes, the F&B sector is adapting with vibrant flavor options that blend authenticity, innovation, and cultural richness.

Australia Food Flavors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, form, and end user.

Type Insights:

- Natural

- Artificial

The report has provided a detailed breakup and analysis of the market based on the type. This includes natural and artificial.

Form Insights:

- Dry

- Liquid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes dry and liquid.

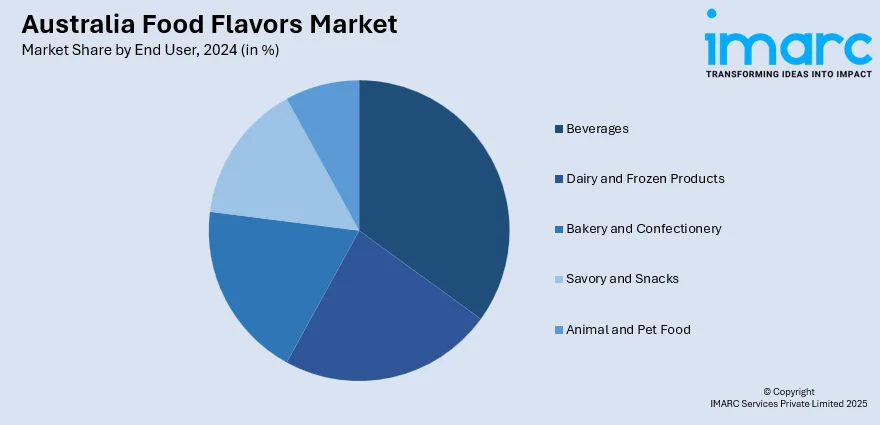

End User Insights:

- Beverages

- Dairy and Frozen Products

- Bakery and Confectionery

- Savory and Snacks

- Animal and Pet Food

The report has provided a detailed breakup and analysis of the market based on the end user. This includes beverages, dairy and frozen products, bakery and confectionery, savory and snacks, and animal and pet food.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Food Flavors Market News:

- In December 2024, Twisties announced a limited-edition "Caviar" flavor, available only through social media giveaways from November 18–27. The campaign, led by VaynerMedia and Mango Communications, received a positive response and reached over 155 million people. It followed other unique flavors like Spicy Ramen and Donut King.

- In December 2024, Norco Co-operative launched a new range of Minecraft-themed flavored milks in Australia. The four flavors, including Choc Charger, Lime Lightning, Strawberry Slam, and Caramel Chug, were lactose-free, with no added sugar and a four-star health rating.

Australia Food Flavors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural, Artificial |

| Forms Covered | Dry, Liquid |

| End Users Covered | Beverages, Dairy and Frozen Products, Bakery and Confectionery, Savory and Snacks, Animal and Pet Food |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia food flavors market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia food flavors market on the basis of type?

- What is the breakup of the Australia food flavors market on the basis of form?

- What is the breakup of the Australia food flavors market on the basis of end user?

- What is the breakup of the Australia food flavors market on the basis of region?

- What are the various stages in the value chain of the Australia food flavors market?

- What are the key driving factors and challenges in the Australia food flavors market?

- What is the structure of the Australia food flavors market and who are the key players?

- What is the degree of competition in the Australia food flavors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia food flavors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia food flavors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia food flavors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)