Australia Food Packaging Market Size, Share, Trends and Forecast by Packaging Type, Application, and Region, 2025-2033

Australia Food Packaging Market Overview:

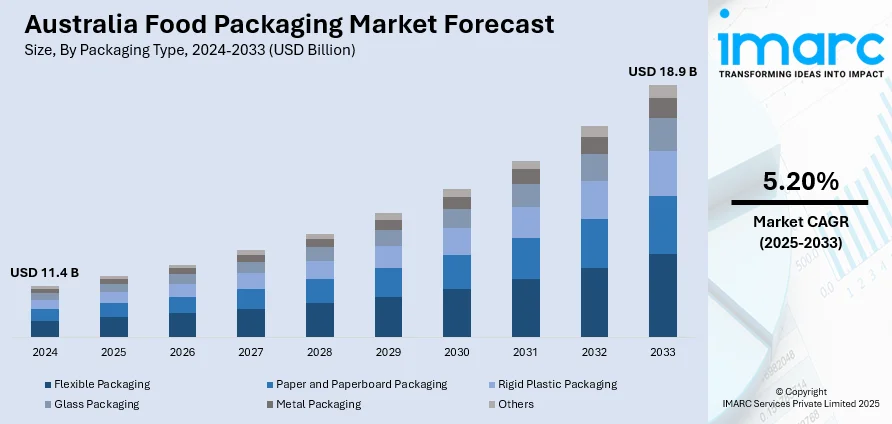

The Australia food packaging market size reached USD 11.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is fueled by increasing food use, changing dietary habits, and regulatory compliance, with a good emphasis on offering safe, good-quality, efficient packaging solutions over a wide range of domestic as well as worldwide food markets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.4 Billion |

| Market Forecast in 2033 | USD 18.9 Billion |

| Market Growth Rate 2025-2033 | 5.20% |

Australia food packaging Market Trends:

Sustainable Packaging Practices on the Rise

Sustainability is emerging as a fundamental pillar of Australia's food packaging industry, driven by environmentally conscious consumers seeking eco-friendly alternatives. Suppliers and manufacturers are adapting by switching to biodegradable, recyclable, or compostable packaging to minimize landfill waste and carbon footprint. This trend is being spurred not just by consumer attitudes but also by government support for lower plastic usage and better recycling facilities. According to the reports, in October 2024, the Australian Government launched packaging regulation reform, introducing national standards, chemical bans, and extended producer responsibility to enhance recyclability, with public consultation. Moreover, changes like plant-based films, molded pulp trays, and paper-based laminates are finding applications in every food category, ranging from fruits and vegetables to ready-to-eat (RTE) foods. Minimalist packages and lightweight packing are also becoming investments by the brands to lower resource utilization throughout production and distribution. With environmentally friendly solutions continuing to scale economically, their application is anticipated to gain pace faster. Australia food packaging market growth is being strongly influenced by this broad sustainability trend, indicating a future where sustainable design becomes mainstream and not a niche product.

To get more information on this market, Request Sample

Smart Packaging Integration Enhances Food Safety and Engagement

Emerging smart packaging technologies are transforming the way consumers engage with food products in Australia. Smart labels and interactive features are being introduced to improve safety, traceability, and user interaction. Traits such as time-temperature indicators, QR codes, and freshness sensors are increasingly popular across the broad range of perishable food products, providing real-time information about product quality and shelf life. These technologies do not only limit food waste but also enhance transparency in supply chains, which customers greatly appreciate. Moreover, intelligent packaging incorporating augmented reality (AR) and mobile-enabled content is increasingly utilized to enhance consumer engagement through storytelling, recipe suggestions, and product origin information. This trend is particularly prominent in health-aware and gourmet food categories where experience and consumer trust take precedence. Australian food packaging market share is growing through increasing adoption of such intelligent technologies, putting the market at the forefront of innovation-led consumer interaction in the international food packaging market.

Convenience and Customization Lead Packaging Innovation

Changes in Australian consumer lifestyles are influencing a discernible trend toward convenience-focused and personalized packaging forms. The growth in single-person households, on-the-go eating, and online food shopping has stimulated demand for portion-controlled, easy-to-carry, and resealable packaging formats. For instance, in April 2023, Mars Wrigley Australia shifted to paper-based packaging for its chocolate bars, removing 360 tonnes of plastic, enabling a circular economy, and helping towards the 2025 national packaging targets. Furthermore, microwave-safe packaging’s, peelable film, and multi-compartment trays are increasingly employed in ready meals, snacks, and dairy items. At the same time, packaging tailored to specific eating habits such as clear allergen declarations and nutrition-focused design is gaining prominence, reflecting a growing emphasis on health and personalized consumer needs. Brands are also spending on visually unique packaging that resonates with consumer identity and lifestyle values, adding to greater shelf appeal. The convergence of functionality and personalization is transforming the way packaging addresses both functional and emotional requirements. Australia food packaging market outlook is supported by these consumer-driven innovations, as packaging that accommodates contemporary, hectic lifestyles continues to increase in urban and regional markets alike.

Australia Food Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on packaging type and application.

Packaging Type Insights:

- Flexible Packaging

- Paper and Paperboard Packaging

- Rigid Plastic Packaging

- Glass Packaging

- Metal Packaging

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes flexible packaging, paper and paperboard packaging, rigid plastic packaging, glass packaging, metal packaging, and others.

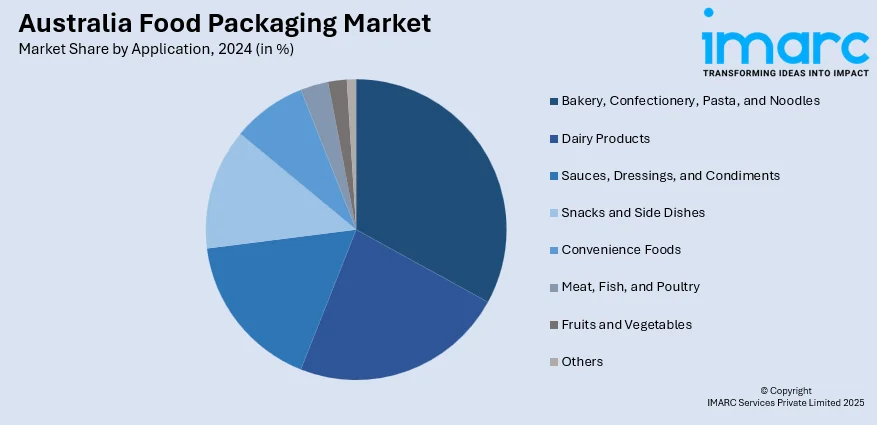

Application Insights:

- Bakery, Confectionery, Pasta, and Noodles

- Dairy Products

- Sauces, Dressings, and Condiments

- Snacks and Side Dishes

- Convenience Foods

- Meat, Fish, and Poultry

- Fruits and Vegetables

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery, confectionery, pasta, and noodles, dairy products, sauces, dressings, and condiments, snacks and side dishes, convenience foods, meat, fish, and poultry, fruits and vegetables, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Food Packaging Market News:

- In November 2024, MasterFoods, a Mars business, will test Australia's first paper-recyclable single-serve tomato sauce packs, cutting plastic by 58%. Available until April 2025, these packs are in line with Mars Australia's sustainability objectives, supporting circular economy efforts and helping National Packaging Targets.

- In September 2024, DoorDash joined forces with BioPak to provide restaurants and cafés in South and Western Australia with sustainable packaging options to meet the new single-use plastic ban by offering special pricing on compostable, eco-friendly packaging.

Australia Food Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Flexible Packaging, Paper and Paperboard Packaging, Rigid Plastic Packaging, Glass Packaging, Metal Packaging, Others |

| Applications Covered | Bakery, Confectionery, Pasta, and Noodles, Dairy Products, Sauces, Dressings, and Condiments, Snacks and Side Dishes, Convenience Foods, Meat, Fish, and Poultry, Fruits and Vegetables, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia food packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia food packaging market on the basis of packaging type?

- What is the breakup of the Australia food packaging market on the basis of application?

- What is the breakup of the Australia food packaging market on the basis of region?

- What are the various stages in the value chain of the Australia food packaging market?

- What are the key driving factors and challenges in the Australia food packaging?

- What is the structure of the Australia food packaging market and who are the key players?

- What is the degree of competition in the Australia food packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia food packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia food packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia food packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)