Australia Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type and Region, 2026-2034

Australia Foreign Exchange Market Size and Share:

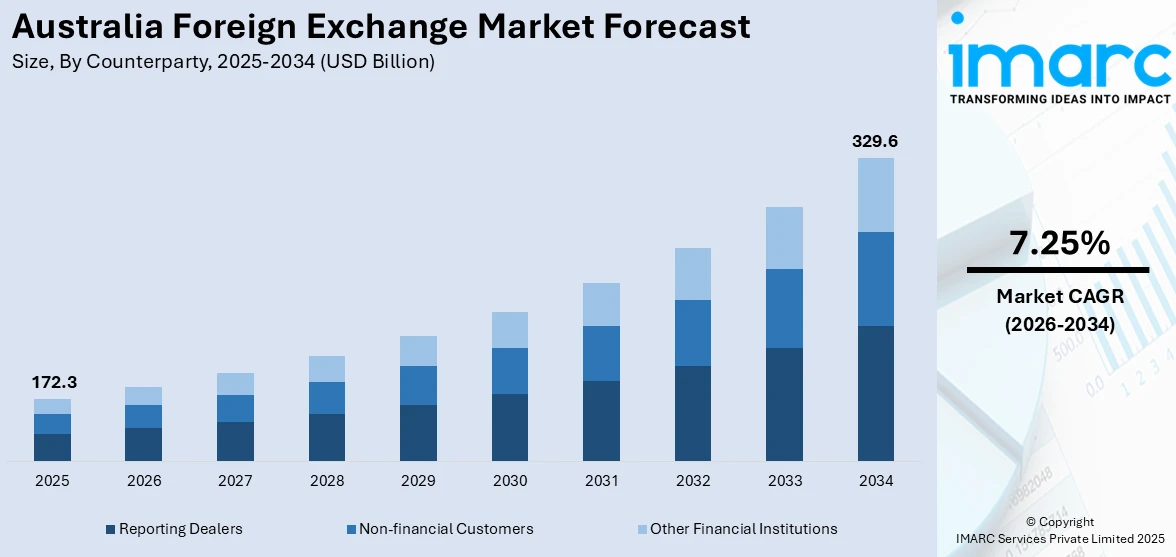

The Australia foreign exchange market size was valued at USD 172.3 Billion in 2025. Looking forward, the market is expected to reach USD 329.6 Billion by 2034, exhibiting a CAGR of 7.25% from 2026-2034. The Australian foreign exchange market share is characterized by robust liquidity, driven by institutional players, retail brokers, and increasing demand for hedging and speculative trading, supported by technological advancements, global trade relationships, and the country’s strong economic ties to the Asia-Pacific region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 172.3 Billion |

| Market Forecast in 2034 | USD 329.6 Billion |

| Market Growth Rate (2026-2034) | 7.25% |

One of the main drivers propelling the growth of the Australia foreign exchange market outlook is the country’s strong economic ties to Asia-Pacific, particularly with China. As one of Australia’s largest trading partners, China’s economic health directly impacts the demand for Australian exports like coal, iron ore, and natural gas. The ongoing trade relationships between Australia and China lead to consistent demand for the Australian dollar (AUD) in international markets. Moreover, the global demand for Australian commodities has attracted foreign investors, who are drawn to the stability of the country’s economy, offering relatively higher interest rates compared to other developed nations. This ongoing influx of capital has bolstered liquidity in the foreign exchange market, driving the trading volume of the Australian dollar. The symbiotic relationship between Australia’s resource-driven export economy and its foreign exchange market creates a continual cycle of demand and supply, further expanding the market.

To get more information of this market Request Sample

Another key driver is the regulatory environment, which has fostered a stable and well-regulated Australia foreign exchange market forecast. The Australian government and regulatory bodies like the Australian Securities and Investments Commission (ASIC) have implemented policies that prioritize transparency, investor protection, and market integrity, enhancing the attractiveness of Australia’s foreign exchange market for both domestic and international investors. As one of the world’s most transparent and reliable financial markets, Australia is observed as a low-risk environment for foreign exchange trading. The country’s regulatory framework aligns with international standards, providing a stable platform for currency trading. For instance, in July 2024, Westpac, in partnership with Optus, launched the SafeCall feature within its digital banking app to protect customers from scam calls, offering call verification and additional security measures. Furthermore, the Reserve Bank of Australia’s (RBA) monetary policy and interest rate decisions play a significant role in determining the value of the Australian dollar, influencing both short- and long-term forex market trends. These factors together create a favorable climate for investors, supporting the growth of the Australian foreign exchange market.

Key Trends of Australia Foreign Exchange Market:

Expansion of Algorithmic and High-Frequency Trading

Algorithmic trading and high-frequency trading (HFT) have dramatically transformed the Australian foreign exchange market. These techniques rely on sophisticated mathematical models and algorithms to analyze market data and execute trades in milliseconds, ensuring that traders capitalize on even the smallest price fluctuations. As a result, market participants particularly institutional investors have become more efficient in executing trades at high volumes, leading to improved liquidity and narrower spreads. For instance, in August 2023, ASIC extended transitional relief for foreign financial services providers (FFSPs), allowing them to provide services to Australian wholesale clients without an Australian financial services license

Moreover, with the rise of machine learning, algorithms are also becoming increasingly self-adaptive, allowing them to adjust their strategies based on market trends. This has opened the door for both larger institutions and retail investors to benefit from a more dynamic and faster-paced market environment. The significant increase in trade volumes, speed, and accuracy driven by these technologies has reshaped the Australian forex market, fostering greater competitiveness and market depth.

Rise of Sustainable and ESG Investing

The heightening importance of Environmental, Social, and Governance (ESG) factors is emerging as a key trend in the Australian foreign exchange market. As investors place greater emphasis on sustainability, currency markets are seeing growing interest in the Australian dollar, particularly in sectors aligned with ecofriendly energy, renewable resources, and sustainable development. Australia, with its vast natural resources and growing commitment to environmental protection, is becoming an attractive destination for foreign investors looking to align their portfolios with ESG goals. For example, in 2024, Airwallex introduced its Australian-first 'Yield' account, enabling businesses to earn up to 4.07% returns on USD and AUD balances, surpassing the big banks' rates, without any lock-up periods. Moreover, the integration of ESG considerations into forex trading is encouraging more socially responsible capital flows, with forex brokers offering ESG-based currency trading options. In turn, this shift influences the Australian economy, as foreign capital inflows into sectors such as clean technology and sustainable agriculture increase demand for the Australian dollar. As ESG investing continues to grow, it is likely to become a key driver for Australia’s forex market.

Integration of Cryptocurrencies in Forex Trading

As cryptocurrencies continue to gain acceptance and recognition in mainstream finance, integration into the Australian foreign exchange market is happening fast. More investors are using Bitcoin, Ethereum, and stablecoins for cross-border transactions and as an alternative investment class. Since cryptocurrencies allow fast, low-cost international transfers, they have emerged as a suitable choice for forex traders seeking diversification or hedging opportunities. In Australia, various forex brokers started providing cryptocurrency pairs next to other classic currency pairs and allow traders to be more easily sold the digital currencies. Moreover, because of advancement of technology and improved transparency and efficiency in securities management, among the technologies linked to cryptocurrencies-the most prominent blockchain are increasing legitimacy among traders that perceive cryptocurrencies as actual trading commodities. This trend introduces new opportunities for growth and innovation, with accelerating trading volumes actively reshaping global currency exchange markets along with increasing Australia foreign exchange market demand in the sector.

Growth Drivers of Australia Foreign Exchange Market:

Commodity-Driven Economic Influence

Australia's economy is heavily driven by its position as a prime commodity exporter, with the likes of iron ore, coal, natural gas, and agriculture being major exports. The fortunes of these industries have a lot to do with influencing their currency value, that of the Australian dollar (AUD), which is one of the most traded in the world. World demand for Australian exports, specifically from large trading partners such as China, India, and Japan, has direct impacts on currency movements and participation in the market. This close connection between commodity exports and currency valuation provides speculative and hedging opportunities for participants in the market. A standout feature of Australia is that its economy is small in scale but highly exposed to international commodity cycles, whereby foreign exchange activity tends to react quickly to shifts in market sentiment in international markets. This highly dynamic quality makes the AUD a draw for institutional traders and financial institutions seeking to profit from the currency's sensitivity to economic releases, commodity prices, and news surrounding trade-related geopolitics.

Liberalized Market Structure and Financial Infrastructure

Australia's foreign exchange market is facilitated by a liberalized and open financial system underpinned by well-developed infrastructure and robust institutional governance. A regime of floating exchange rates is in place, where market forces are relied upon to set the value of the Australian dollar without government intervention. Such openness presents fertile ground for domestic and international investors alike to participate in currency trading. The Reserve Bank of Australia (RBA), though not responsible for managing the currency per se, has a stabilizing influence on its value through its monetary policy and market operations communicated carefully and being adhered to worldwide. Moreover, Australia's location in the time zone positions it strategically between the close of the U.S. trading day and the beginning of Asia's, meaning Sydney is among the first markets to open every day. This positioning puts the Australian foreign exchange market in a special position to offer early price discovery and liquidity for global markets. With properly regulated financial institutions and access to sophisticated trading platforms, Australia provides a secure and desirable venue for foreign exchange activity.

Rising Foreign Investment and International Trade Relationships

According to the Australia foreign exchange market analysis, the growing international trade and investment links are some fundamental growth drivers of the region’s foreign exchange market. The nation's attractiveness as a foreign direct investment destination, especially in industries such as mining, education, and property, generates ongoing demand for Australian currency. Australia also has an array of free trade arrangements and bilateral economic pacts that make it easy to flow capital and promote cross-border transactions. These arrangements not only enhance trading volume but also enhance the demand for currency conversions, prompting forex transactions. Specifically, Australia's commercial relationship with the Asia-Pacific region is a constant source of FX market expansion, with the nation serving as a financial bridge between Western economies and fast-developing Asian nations. The increase in Australia's position as a destination for multinational companies and institutional investors also contributes to foreign exchange trading volumes, as these firms participate in hedging activities, profit repatriation, and portfolio rebalancing. With its strong legal framework and economic soundness, these elements make Australia a key hub in the global currency trading system.

Opportunities of Australia Foreign Exchange Market:

Asia-Pacific Gateway for Currency Trading

Australia's economic and geographical position as a linkage between Western markets and Asian markets presents special opportunities for the expansion of its foreign exchange (FX) industry. Located in a time zone that overlaps with both the close of North American markets and the open of major Asian economies, Australia's FX market is centrally involved in global liquidity and early indications of trading. This competitive edge enables Australian trading platforms and financial institutions to provide services to various international customers interested in access to Asian currency pairs or overnight response to global events. Sydney has become a major financial hub with growing connectivity to Singapore, Hong Kong, and Tokyo markets. As intra-Asia trade and capital flows expand, Australia is poised to gain as companies and investors place a greater demand for FX services on cross-border transactions, hedging, and arbitrage. Increased trading infrastructure and product offerings with a focus on this regional corridor could further establish Australia's position as an Asia-Pacific FX gateway.

Growth in Digital Trading and Fintech Innovation

Australia's robust regulatory climate and technologically advanced financial sector provide fertile ground for innovation in digital trading platforms and fintech solutions in the foreign exchange market. Australia's early move to adopt real-time payment systems such as the New Payments Platform (NPP) has paved the way for quicker and more transparent FX transactions, an urgent demand among contemporary traders and international companies. Sydney and Melbourne-based fintech companies are increasingly building algorithmic trading solutions, AI analytics, and blockchain-powered platforms to enhance currency conversion efficiency and security. These solutions not only serve retail investors but also institutional traders seeking sophisticated solutions in FX execution and risk management. Australia's emphasis on consumer protection and cybersecurity and the enforcement of regulatory bodies like ASIC further increases confidence in digital FX services. By promoting public-private collaborations and research and development incentives, Australia can be a leader in exporting fintech solutions, growing its own market, while also being a technologically driven provider of solutions to other FX centers globally.

Sustainable Finance and ESG-Conscious Currency Strategies

The future opportunity for Australia's foreign exchange market lies where currency trading intersects with environmental, social, and governance (ESG) principles. With a high national emphasis on sustainable development, such as carbon neutrality and clean energy initiatives, there is increased potential for Australia to be at the forefront of developing ESG-aligned currency products and hedging strategies. Corporates and investors with green mandates are now starting to think about the sustainability profile of countries in which they are investing, and currencies such as the Australian dollar can form part of ESG-screened portfolios. Australia's leadership in responsible mining, the expansion of renewable energy, and Indigenous peoples' participation in economic growth offers a distinct national narrative that can be embedded in sustainable finance products. Banks and other financial institutions may take advantage of this by creating green FX indices, ESG-thematic derivatives, or sustainability-linked hedging products. These innovations would appeal to eco-friendly investors and place Australia at the forefront of progressive, forward-thinking FX markets that are shaping the future of international FX.

Government Support of Australia Foreign Exchange Market:

Sensible Regulatory Oversight and Stability

The Australian government offers underpinning support to the foreign exchange market through a strong and transparent regulatory system that encourages stability, justice, and global confidence. The Australian Securities and Investments Commission (ASIC) oversees the supervision of financial markets, including forex trading sites and brokers, that they maintain high operational and disclosure standards. This supervision assists in ensuring market integrity, discourages financial abuse, and protects institutional and retail players. In Australia is a holistic licensing and compliance method that not only targets domestic entities but foreign-based brokers dealing within its borders as well. This environment of discipline renders the Australian forex market one of the most respectable in the world. Moreover, the Reserve Bank of Australia (RBA) indirectly facilitates the forex market by having a clear and consistent monetary policy, facilitating a stable macroeconomic environment. These initiatives altogether provide a reliable environment for forex players, further enhancing Australia's attractiveness as an international trading center.

Infrastructure Support and Technological Innovation

The Australian government proactively encourages technological innovation and infrastructure development in its financial markets, including the foreign exchange market. Through government investment in digital infrastructure and schemes such as the New Payments Platform (NPP), which facilitates real-time settlements, the nation is increasing the speed of transactions and transparency—two key ingredients for contemporary FX trade. Government partnership with financial technology districts in Sydney and Melbourne facilitates the development of fintech startups that focus on automated trading systems, data analytics, and blockchain-based solutions for currency markets. These initiatives are complemented by grants and R&D incentives that challenge the private sector to innovate within financial services. Australia's position in the international time zone cycle also has government agencies spending on early-morning trading capability and connectivity upgrades to consolidate its role in global FX liquidity. This investment in digital transformation makes the Australian FX market competitive and well-entrenched in the global trading infrastructure.

International Market Integration and Trade Agreements

The foreign exchange market is promoted by the Australian government through boosting international financial and trade integration through strategic partnerships and agreements. Australia has a broad system of free trade agreements with nations in Asia, North America, and Europe, making cross-border financial transactions easy and currency exchange flows strengthened. These agreements, including those with China, Japan, and ASEAN countries, open greater opportunity for FX services through enhanced trade volume and multinational investment. In addition, government-sponsored programs like Austrade help Australian financial service firms go global and reach overseas investors, many of whom have active currency conversion and hedging needs. Australia's regulatory cooperation and commitment to transparency also enable its financial system to be in conformity with international standards, making it more convenient for global trading firms and banks to do business in its jurisdiction. The government facilitates the forex market to extend its outreach and deepen its involvement in the global financial system through these economic and diplomatic avenues.

Australia Foreign Exchange Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia foreign exchange market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on counterparty and type.

Analysis by Counterparty:

- Reporting Dealers

- Non-financial Customers

- Other Financial Institutions

Reporting dealers are an integral part of the Australian foreign exchange market. They are the middlemen between financial institutions, central banks, and other participants in the market. They make large transactions possible and ensure that liquidity is available. Their function in market-making and price discovery is indispensable for the smooth working of the forex market and stability.

The non-financial customers of the forex market are businesses, governments, and corporations that engage in foreign exchange to facilitate international trade or manage currency risk. Hence, they are usually using this market for hedging purposes, such as protecting from fluctuations in foreign exchange rates when dealing with foreign suppliers or customers in terms of ensuring financial stability.

Other financial institutions have a big involvement in the FX market through their speculative trading activities or management of foreign exchange exposure in portfolios. They participate in influencing markets and their corresponding liquidity levels where they position, often taking those positions based upon macroeconomic prognostications and geopolitical developments.

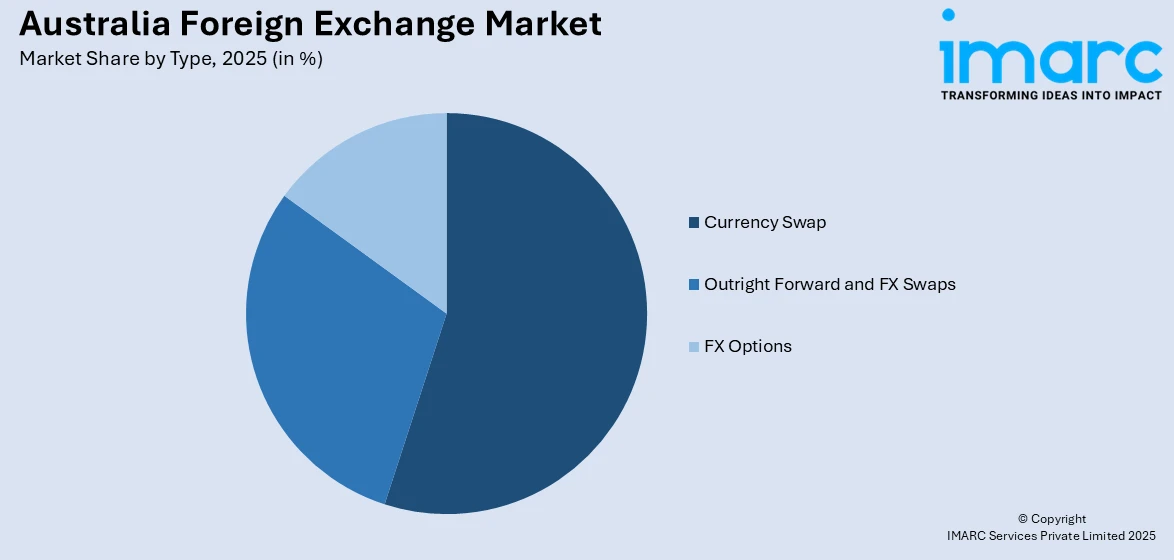

Analysis by Type:

Access the comprehensive market breakdown Request Sample

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

Currency swaps refer to financial tools through which parties can exchange the cash flows from different currencies with each other over some specified period of time. Typically, these agreements are used by institutions to lock in long-term foreign exchange exposure or to avail foreign currency funding under favorable terms and conditions. When two parties make a currency swap, they manage to hedge changes in the fluctuating exchange rate or adjust the funding position abroad.

Outright forwards and FX swaps are vital instruments for managing currency risk. An outright forward contract enables two parties to lock in a predetermined exchange rate for a specified amount of currency at a future date, commonly utilized to mitigate exposure in international transactions. FX swaps, on the other hand, involve the exchange of currencies at one point in time, with a reverse exchange agreed upon at a later date. These instruments are heavily utilized by corporates, banks, and other financial institutions for managing short-term currency risk and ensuring liquidity.

Options in the foreign exchange allow traders to purchase a currency at an agreed price on or before an expiration date. The FX option is basically utilized for hedging purposes as well as giving some flexibility regarding fluctuating rates. Market participants use FX options to limit potential losses while maintaining the possibility of benefiting from favorable market movements. The popularity of FX options has grown as they allow for more tailored risk management strategies and are increasingly used in both speculative and corporate settings.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales is the central point of the country's foreign exchange activity, where Sydney is its financial capital. In this region are major financial institutions, investment banks, and forex brokers, whose activities significantly impact the liquidity and volume of the forex transactions. This area is also at a favorable time zone for conducting international transactions in Australia, particularly with Asia-Pacific markets. With a concentration of financial services and a robust economic base, it is definitely a player in the Australian forex market.

Victoria & Tasmania are seeing an active growth spurt in the volume of forex, mainly underpinned by the presence of Melbourne as a financial center. In terms of trade infrastructure, the region has a well-developed infrastructure for international trade, especially manufacturing and agriculture, which often involve cross-border transactions that need foreign exchange. A smaller economy is being increasingly pulled into international markets, particularly natural resources and tourism, with Tasmania experiencing a growing demand for foreign exchange services.

Queensland is a major player in Australia's forex market due to its diversified economy, such as mining, agriculture, and tourism. Brisbane, being the capital of the state, has become a financial services hub that also encompasses forex trading and investment management. The export market of the state, especially to Asia, contributes to currency exchange, making Queensland a key player in the Australian forex scene. Additionally, international trade relations are increasing, along with the infrastructure projects undertaken by the state, that increases the demand for foreign exchange services.

Northern Territory & South Australia are smaller players in terms of forex activity, but they add to the overall Australian market, given their engagement in resource extraction activities, including energy and minerals. The Northern Territory benefits from being close to Southeast Asia, hence the demand for foreign exchange arises in trade and investment. South Australia, through the strong agricultural exports and emerging defense industries, also needs foreign exchange for its international transactions. Although these areas have a smaller percentage of the market share, they are vital for specialized forex services linked to their industries.

West Australia is an enormous contributor to Australia's foreign exchange market because the state boasts of a resource-driven economy. The state is one of the leading mining and natural resources producers worldwide, exporting commodities like iron ore, gold, and natural gas. This drives enormous demand for foreign exchange services, especially for currency conversion related to international trade. Perth, as the state capital, is a financial center for the mining and energy sectors, and its economic ties with Asia-Pacific markets further increase the region's role in forex transactions. Western Australia’s strong export economy makes it one of the most active regions in the Australian foreign exchange market.

Competitive Landscape:

The competitive landscape of the Australian foreign exchange market is composed of a high heterogeneous mix of both institutional players, retail brokers, and market makers striving for a larger share of the market. Institutional over-the-counter operations exist with big financial groups engaging in forex services such as trading, hedging, and investment solutions for their corporate clients as well as governments. Retail brokers are catering to individual investors by offering easy-to-use online platforms and competitive spreads, thereby democratizing forex trading. The competition is based on technology, speed of execution, and customer service. The market is also characterized by the growing number of fintech firms that are utilizing advanced technologies like artificial intelligence and blockchain to provide more efficient, secure, and transparent trading solutions. This constant innovation, coupled with regulatory changes and market liquidity, produces a highly dynamic and competitive environment in which the participants must adapt constantly to outpace others.

The report provides a comprehensive analysis of the competitive landscape in the Australia foreign exchange market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, Melbourne-based forex and CFD broker Pepperstone partnered with the Aston Martin Aramco Formula One® Team as their Global Forex and Trading Partner. The multi-year collaboration will debut Pepperstone’s branding on the AMR25, aligning two leaders in innovation, precision, and performance ahead of the 2025 F1 season.

- In July 2024, CMC Markets partnered with HPE GreenLake to modernize Australian operations, enhancing trading platforms with scalable cloud infrastructure. The collaboration aims to boost agility, performance, and customer experience.

- In January 2024, OANDA Global Corporation launched the OANDA Prop Trader program, providing self-directed traders with profit-sharing opportunities. The program allows traders to access global markets, tools, and educational resources, sharing profits generated from virtual funds while enhancing their trading skills.

Australia Foreign Exchange Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Non-financial Customers, Other Financial Institutions |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia foreign exchange market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia foreign exchange market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia foreign exchange market was valued at USD 172.3 Billion in 2025.

IMARC Group estimates the market to reach USD 329.6 Billion by 2034, exhibiting a CAGR of 7.25% from 2026-2034.

The growth of the Australian foreign exchange market is driven by Australia’s strong economic ties with Asia, particularly China, boosting trade and investment flows. Additionally, technological advancements in trading platforms, rising retail investor participation, favorable interest rates, and a stable regulatory environment contribute to increased forex activity, creating a dynamic and competitive market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)