Australia Forged Steel Market Size, Share, Trends and Forecast by Component, Material Type, End Use Industry, and Region, 2025-2033

Australia Forged Steel Market Overview:

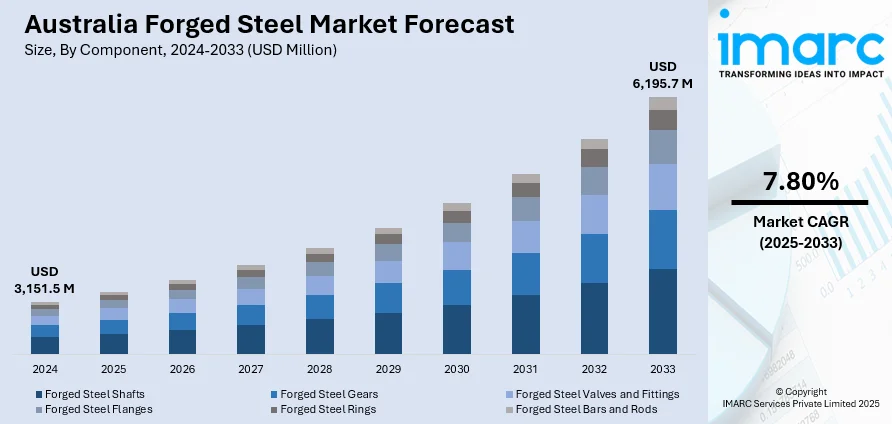

The Australia forged steel market size reached USD 3,151.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6,195.7 Million by 2033, exhibiting a growth rate (CAGR) of 7.80% during 2025-2033. The market is expanding, supported by rising demand from construction, mining, and infrastructure projects. Innovations in green steel and sustainable production are also helping to increase Australia forged steel market share by attracting investment and aligning with national decarbonization goals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3,151.5 Million |

|

Market Forecast in 2033

|

USD 6,195.7 Million |

| Market Growth Rate 2025-2033 | 7.80% |

Australia Forged Steel Market Trends:

Sustainable Production Driving New Demand

Australia’s forged steel sector is transforming through the adoption of sustainable production practices. Growing emphasis on reducing emissions in heavy industry has led to investments in cleaner steelmaking technologies and energy-efficient processes. This shift is not only lowering the environmental impact of steel manufacturing but also opening up new opportunities across public and private projects focused on sustainability. A notable example came in February 2025, when Future Forgeworks partnered with SMS group to install the country’s first Continuous Mill Technology (CMT® 350) mill at the Swanbank Green Steel Mill Project in Brisbane. This facility aims to produce rebar without the use of natural gas, cutting CO₂ emissions by up to 30%. The project reflects broader market trends where forged steel must meet both performance and environmental benchmarks. As the construction and infrastructure sectors seek low-carbon materials, producers that adopt greener forging methods are better positioned for long-term contracts. Government incentives and demand for certified sustainable materials are also boosting investment in domestic forging capacity. This trend is not only enhancing production efficiency but also helping to secure Australia’s position as a responsible supplier in the global forged steel market.

To get more information on this market, Request Sample

Infrastructure Growth Accelerates Market Output

The forged steel market in Australia continues to benefit from large-scale infrastructure programs aimed at improving transportation, energy, and public services. Government and private sector investments in highways, railways, airports, and energy grids are generating steady demand for high-strength forged components. These materials are essential for structural support, heavy machinery, and load-bearing systems across multiple sectors. In line with this, recent industrial projects are prioritizing locally produced steel to support national manufacturing and reduce dependency on imports. For instance, the Future Forgeworks Swanbank project announced in February 2025 aims to meet domestic demand for rebar and structural steel with reduced emissions and faster production cycles. By supplying forged steel tailored to project specifications, local producers are securing long-term contracts and building stronger partnerships with construction and engineering firms. The emphasis on quality, reliability, and timely delivery is pushing manufacturers to enhance capacity and adopt better-forging technologies. With many public works programs still in progress or planning stages, Australia forged steel market growth is expected to continue steadily over the next several years. These developments highlight the strategic role of forged steel in national infrastructure and its contribution to a resilient, locally driven supply chain.

Australia Forged Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on component, material type, and end use industry.

Component Insights:

- Forged Steel Shafts

- Forged Steel Gears

- Forged Steel Valves and Fittings

- Forged Steel Flanges

- Forged Steel Rings

- Forged Steel Bars and Rods

The report has provided a detailed breakup and analysis of the market based on the component. This includes forged steel shafts, forged steel gears, forged steel valves and fittings, forged steel flanges, forged steel rings, and forged steel bars and rods.

Material Type Insights:

- Carbon Steel

- Alloy Steel

- Stainless Steel

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, alloy steel, and stainless steel.

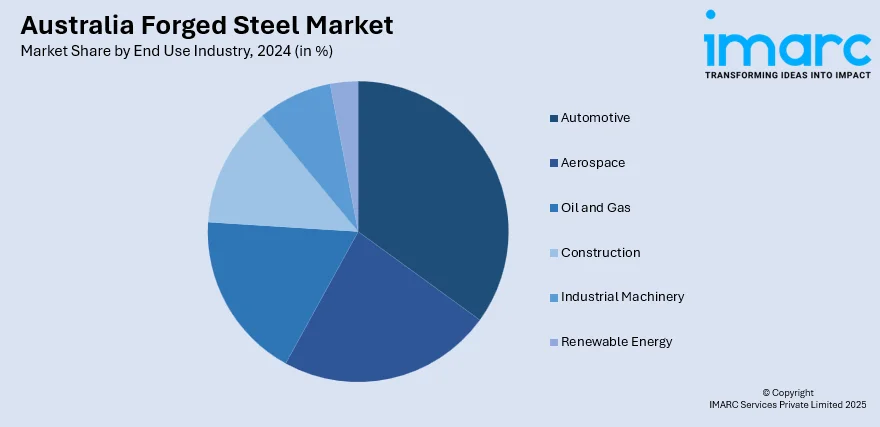

End Use Industry Insights:

- Automotive

- Aerospace

- Oil and Gas

- Construction

- Industrial Machinery

- Renewable Energy

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, aerospace, oil and gas, construction, industrial machinery, and renewable energy.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Forged Steel Market News:

- February 2025: The Australian and South Australian governments announced a USD 2.4 Billion rescue and investment package for Whyalla Steelworks. The funding aimed to stabilize operations and support green steel initiatives, strengthening Australia’s forged steel capabilities and ensuring long-term supply chain resilience and job preservation.

- February 2025: Future Forgeworks partnered with SMS group to install Australia’s first CMT 350 mill in Brisbane. This green steel project aimed to reduce CO₂ emissions by up to 30%, boosting sustainable forged steel production and advancing Australia’s low-carbon construction material capabilities.

Australia Forged Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Forged Steel Shafts, Forged Steel Gears, Forged Steel Valves and Fittings, Forged Steel Flanges, Forged Steel Rings, Forged Steel Bars and Rods |

| Material Types Covered | Carbon Steel, Alloy Steel, Stainless Steel |

| End Use Industries Covered | Automotive, Aerospace, Oil and Gas, Construction, Industrial Machinery, Renewable Energy |

| Region Covered | Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia forged steel market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia forged steel market on the basis of component?

- What is the breakup of the Australia forged steel market on the basis of material type?

- What is the breakup of the Australia forged steel market on the basis of end use industry?

- What is the breakup of the Australia forged steel market on the basis of region?

- What are the various stages in the value chain of the Australia forged steel market?

- What are the key driving factors and challenges in the Australia forged steel market?

- What is the structure of the Australia forged steel market and who are the key players?

- What is the degree of competition in the Australia forged steel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia forged steel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia forged steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia forged steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)