Australia Forklift Trucks Market Size, Share, Trends and Forecast by Product Type, Technology, Class, Application, and Region, 2025-2033

Australia Forklift Trucks Market Overview:

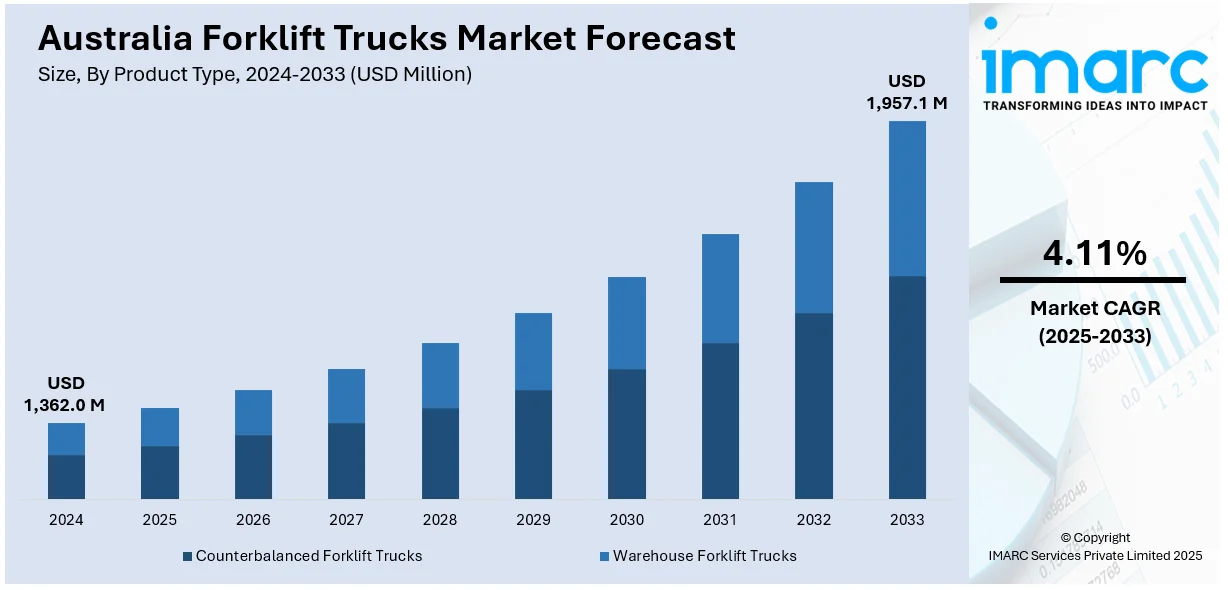

The Australia forklift trucks market size reached USD 1,362.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,957.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.11% during 2025-2033. Growing demand for electric and eco-friendly material handling solutions, growing warehouse automation, growing e-commerce industry, government incentives for low-emission vehicles, industrial and construction activity growth, and technological innovations in forklift design and performance are widening the Australia forklift trucks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,362.0 Million |

| Market Forecast in 2033 | USD 1,957.1 Million |

| Market Growth Rate 2025-2033 | 4.11% |

Australia Forklift Trucks Market Trends:

Increase in Electric Forklift Adoption Driven by Environmental Concerns

The Australia forklift truck market growth is primarily driven by a significant shift towards electric forklifts, propelled by heightened environmental awareness and stringent government regulations aimed at reducing carbon emissions. For instance, as per latest industry reports, Combilift has made large investments in electrification, with more than 90% of its forklift line now being all electric as a response to Australia’s electrification infrastructure development. Approximately 90% of the company's R&D investment over the last five years has gone into electric power equipment, highlighting the company's dedication to environmental responsibility and consumer wellness. Electric forklifts offer advantages such as zero tailpipe emissions, improved energy efficiency, and lower operating costs compared to their internal combustion counterparts. Government initiatives, including import duty concessions on battery-powered forklifts, have further incentivized businesses to transition to electric models. This trend is particularly evident in states like New South Wales and Victoria, where industrial activities are robust, and companies are keen to adopt sustainable practices. The growing emphasis on sustainability and the need to optimize operations have positioned electric forklifts as the preferred choice in the market.

To get more information on this market, Request Sample

Integration of Advanced Technologies Enhancing Operational Efficiency

Australian businesses are increasingly integrating advanced technologies such as automation, Internet of Things (IoT), and telematics into forklift operations to enhance productivity and safety. Equipping forklifts with sensors and cameras allow for real-time data collection, leading to improved decision-making, reduced human error, and minimized downtime. This technological evolution is driven by the need to streamline logistics and supply chain operations, especially in sectors like warehousing and distribution, which, in turn, is positively influencing Australia forklift trucks market outlook. The adoption of autonomous forklifts is on the rise, reflecting a broader trend towards automation in material handling. As companies seek to optimize their supply chains and improve operational efficiency, the demand for technologically advanced forklifts is projected to grow substantially, positioning Australia as a key market for innovative material handling solutions. For instance, according to a 2025 industry report, businesses with streamlined supply networks have three times faster cash-to-cash cycles, 50% fewer inventory, and up to 15% cheaper supply chain expenses than their counterparts. The research emphasizes how utilizing automation, real-time data, and predictive analytics improves end-to-end visibility, which helps boost profitability and customer satisfaction.

Australia Forklift Trucks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, technology, class, and application.

Product Type Insights:

- Counterbalanced Forklift Trucks

- Warehouse Forklift Trucks

The report has provided a detailed breakup and analysis of the market based on the product type. This includes counterbalanced forklift trucks and warehouse forklift trucks.

Technology Insights:

- Electricity Powered

- Internal Combustion Engine Powered

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes electricity powered and internal combustion engine powered.

Class Insights:

- Class I

- Class II

- Class III

- Class IV

- Class V

The report has provided a detailed breakup and analysis of the market based on the class. This includes class I, class II, class III, class IV, and class V.

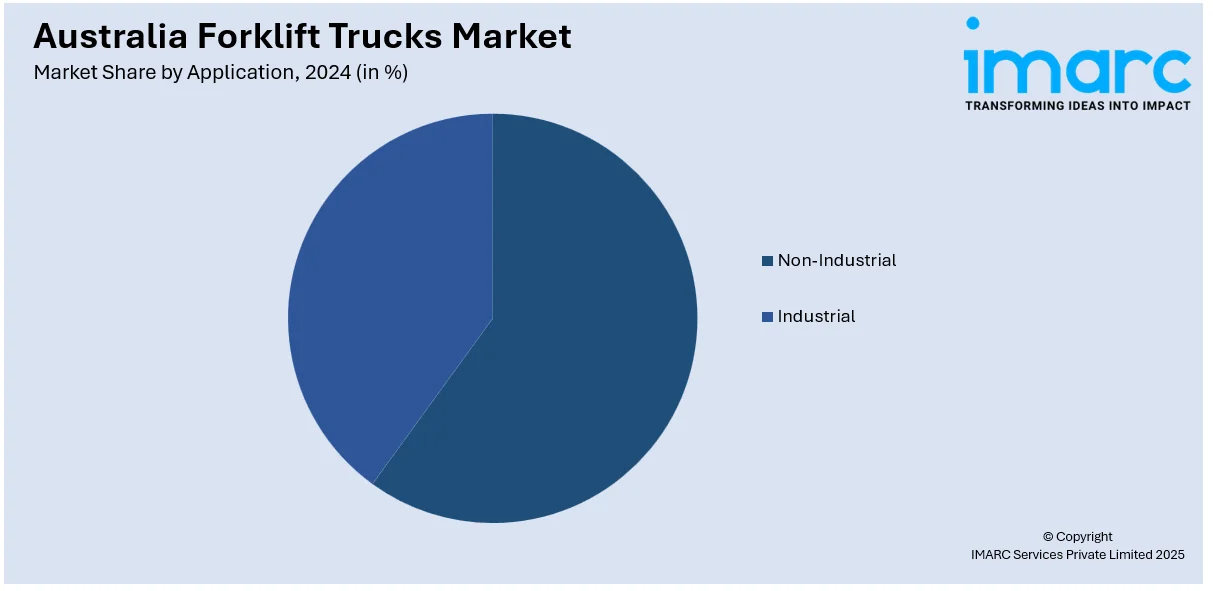

Application Insights:

- Non-Industrial

- Warehouse and Distribution Centers

- Construction Sites

- Dockyards

- Snow Plows

- Industrial

- Manufacturing

- Recycling Operations

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes non-industrial (warehouse and distribution centers, construction sites, dockyards, and snow plows) and industrial (manufacturing and recycling operations).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Forklift Trucks Market News:

- On April 3, 2025, Australia's first electric tire handler was unveiled by United Forklift and Access Solutions. It is a specially designed 17-ton forklift with a tire handling attachment that can securely handle tires up to 8,500 kg in weight. This invention was created for the mining corporation Fortescue and includes sophisticated safety features like magnetic wireless cameras, a light sequence safety system, pedestrian detection, and a wireless clamp pressure monitor.

- On October 7, 2024, Kalmar Corporation has secured a deal to provide Australian steel producer, BlueScope, with 13 forklift trucks for its Western Port steel processing facility under a fully maintained rental contract. The order includes Kalmar's light electric forklift trucks equipped with lithium-ion battery technology, supporting BlueScope's commitment to reduce emissions and achieve net zero greenhouse gas emissions by 2050.

Australia Forklift Trucks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Counterbalanced Forklift Trucks, Warehouse Forklift Trucks |

| Technologies Covered | Electricity Powered, Internal Combustion Engine Powered |

| Classes Covered | Class I, Class II, Class III, Class IV, Class V |

| Applications Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia forklift trucks market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia forklift trucks market on the basis of product type?

- What is the breakup of the Australia forklift trucks market on the basis of technology?

- What is the breakup of the Australia forklift trucks market on the basis of class?

- What is the breakup of the Australia forklift trucks market on the basis of application?

- What is the breakup of the Australia forklift trucks market on the basis of region?

- What are the various stages in the value chain of the Australia forklift trucks market?

- What are the key driving factors and challenges in the Australia forklift trucks?

- What is the structure of the Australia forklift trucks market and who are the key players?

- What is the degree of competition in the Australia forklift trucks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia forklift trucks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia forklift trucks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia forklift trucks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)