Australia Fortified Baby Food Market Size, Share, Trends and Forecast by Product Type, Ingredients, Nutritional Additives, Distribution Channel, Age Group, and Region, 2025-2033

Australia Fortified Baby Food Market Overview:

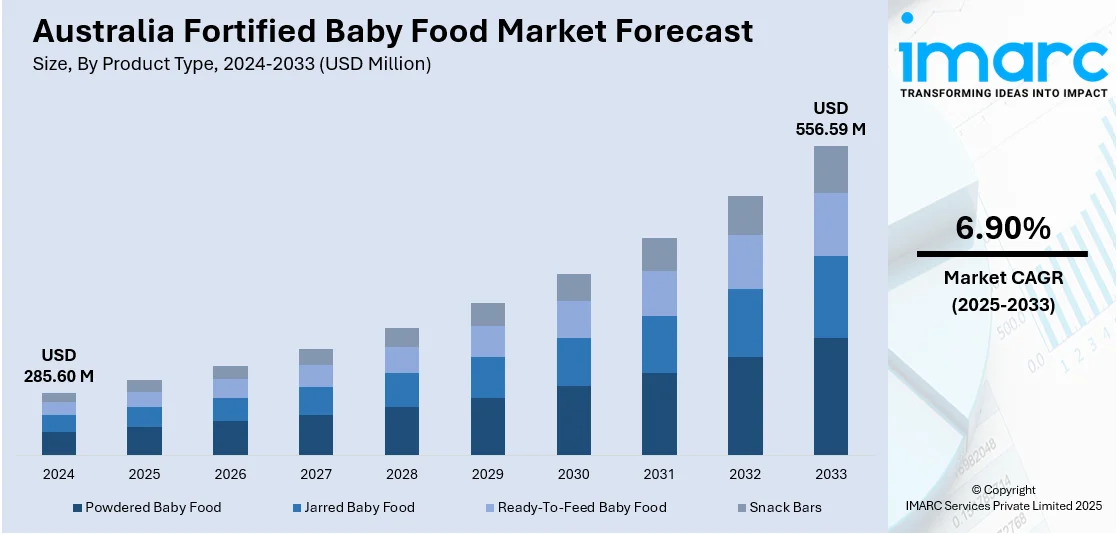

The Australia fortified baby food market size reached USD 285.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 556.59 Million by 2033, exhibiting a growth rate (CAGR) of 6.90% during 2025-2033. The market is driven by increasing health-conscious parenting and rise in working women seeking convenient, nutritious options. Parents prioritizing products free from artificial additives are boosting demand for organic and premium offerings. Product innovation, strong brand visibility, and adherence to stringent quality standards are some of the other factors further contributing to Australia fortified baby food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 285.60 Million |

| Market Forecast in 2033 | USD 556.59 Million |

| Market Growth Rate 2025-2033 | 6.90% |

Australia Fortified Baby Food Market Trends:

Rising Health Consciousness and Demand for Nutrient-Enriched Products

Australian parents are becoming increasingly aware of the vital role nutrition plays in their babies' early development. This awareness drives demand for fortified baby foods enriched with key nutrients like iron, calcium, DHA, and vitamins. Health organizations and pediatricians continue to advocate for balanced, nutrient-dense diets, reinforcing parental preferences for fortified options. These products support brain development, bone health, and immune function, especially during the critical first years of life. Additionally, rising exposure to health information via online platforms and parenting networks has increased consumer knowledge. In response, baby food manufacturers are investing in new formulations to meet growing expectations for science-backed, health-focused baby foods. This trend significantly fuels innovation and product variety in Australia’s fortified baby food market.

To get more information on this market, Request Sample

Increased Workforce Participation Among Parents

As more Australian parents return to work shortly after childbirth, convenience becomes a top priority in infant nutrition. This shift has increased reliance on ready-to-eat and easy-to-prepare baby foods that also deliver complete nutrition. Fortified baby foods offer an ideal solution, providing essential vitamins and minerals in portable, time-saving formats. Dual-income households often look for products that eliminate meal prep without compromising health. Online grocery services and growing retail availability further support accessibility for busy families. This lifestyle change has directly influenced demand for nutrient-enriched baby foods that match modern parenting routines. As more parents seek both efficiency and health benefits, manufacturers are expanding product lines to meet these evolving expectations, boosting the Mexico fortified baby food market growth.

Regulatory Oversight and Emphasis on Food Safety

Australia maintains strict regulations for infant nutrition, ensuring that baby foods are safe, high quality, and nutritionally adequate. Regulatory bodies like Food Standards Australia New Zealand (FSANZ) set standards for nutrient content, safety testing, and accurate labeling. These measures enhance parental trust in fortified products by assuring product reliability. Recent scrutiny of sugar and additive levels has also prompted reforms in how baby food is manufactured and marketed. Such regulation motivates companies to improve formulations, reduce unhealthy ingredients, and focus on evidence-based fortification. Consumers benefit from greater transparency, and brands gain credibility in a highly sensitive market. This commitment to health-driven regulation plays a major role in shaping innovation and consumer acceptance in Australia’s fortified baby food sector.

Australia Fortified Baby Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, ingredients, nutritional additives, distribution channel, and age group.

Product Type Insights:

- Powdered Baby Food

- Jarred Baby Food

- Ready-To-Feed Baby Food

- Snack Bars

The report has provided a detailed breakup and analysis of the market based on the product type. This includes powdered baby food, jarred baby food, ready-to-feed baby food, and snack bars.

Ingredients Insights:

- Fruits

- Vegetables

- Cereals

- Meats

- Dairy

A detailed breakup and analysis of the market based on the ingredients have also been provided in the report. This includes fruits, vegetables, cereals, meats, and dairy.

Nutritional Additives Insights:

- Vitamins

- Minerals

- Probiotics

- Omega-3 Fatty Acids

The report has provided a detailed breakup and analysis of the market based on the nutritional additives. This includes vitamins, minerals, probiotics, and omega-3 fatty acids.

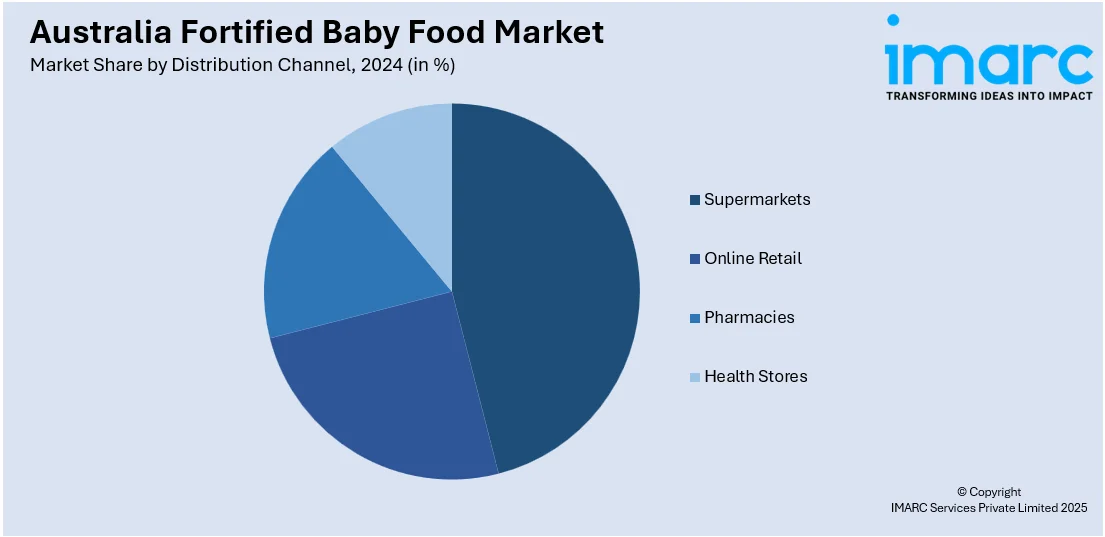

Distribution Channel Insights:

- Supermarkets

- Online Retail

- Pharmacies

- Health Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets, online retail, pharmacies, and health stores.

Age Group Insights:

- Infants

- Toddlers

- Preschoolers

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes infants, toddlers, and preschoolers.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fortified Baby Food Market News:

- In May 2025, Community Enterprise Queensland (CEQ), a not-for-profit remote store operator, reiterated its dedication to the health and wellbeing of families and children in remote First Nations communities through a significant enhancement of its infant and toddler food selection in all stores.

- In July 2023, in Australia and New Zealand, French dairy manufacturer Danone launched a dairy and plant milk powder blend for babies and young children. The dairy giant claims that the formula, which is a dairy and plant blend, includes 40% non-GMO soy protein and 60% dairy protein from whey and casein.

Australia Fortified Baby Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Powdered Baby Food, Jarred Baby Food, Ready-To-Feed Baby Food, Snack Bars |

| Ingredients Covered | Fruits, Vegetables, Cereals, Meats, Dairy |

| Nutritional Additives Covered | Vitamins, Minerals, Probiotics, Omega-3 Fatty Acids |

| Distribution Channels Covered | Supermarkets, Online Retail, Pharmacies, Health Stores |

| Age Groups Covered | Infants, Toddlers, Preschoolers |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia fortified baby food market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia fortified baby food market on the basis of product type?

- What is the breakup of the Australia fortified baby food market on the basis of ingredients?

- What is the breakup of the Australia fortified baby food market on the basis of nutritional additives?

- What is the breakup of the Australia fortified baby food market on the basis of distribution channel?

- What is the breakup of the Australia fortified baby food market on the basis of age group?

- What is the breakup of the Australia fortified baby food market on the basis of region?

- What are the various stages in the value chain of the Australia fortified baby food market?

- What are the key driving factors and challenges in the Australia fortified baby food market?

- What is the structure of the Australia fortified baby food market and who are the key players?

- What is the degree of competition in the Australia fortified baby food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fortified baby food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fortified baby food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fortified baby food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)