Australia Fortified Foods Market Size, Share, Trends and Forecast by Raw Material, Micronutrient, Application, Technology, Sales Channel, and Region, 2025-2033

Australia Fortified Foods Market Overview:

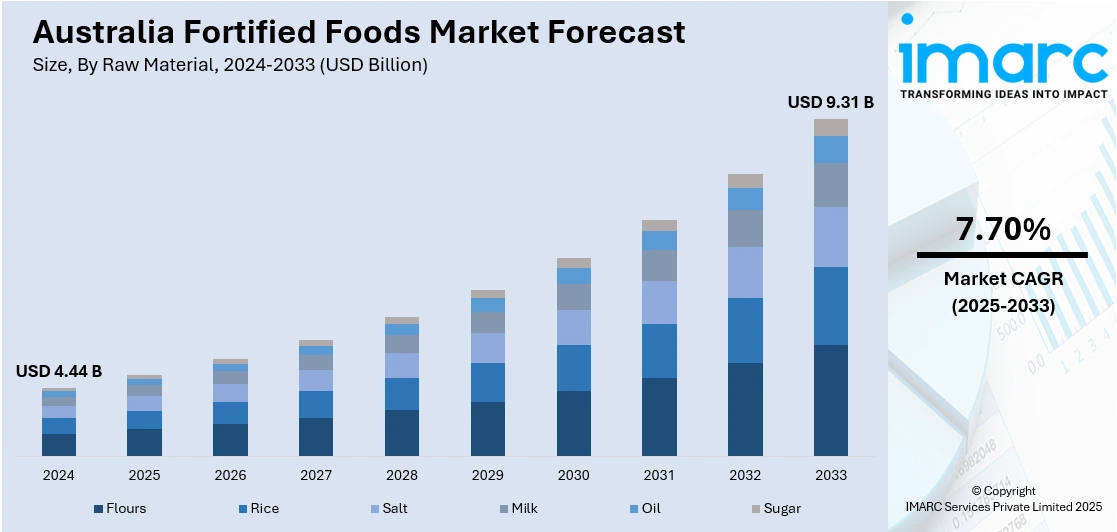

The Australia fortified foods market size reached USD 4.44 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.31 Billion by 2033, exhibiting a growth rate (CAGR) of 7.70% during 2025-2033. The market is experiencing growth driven by increasing health consciousness, demand for functional nutrition, and regulatory support for nutrient enrichment. Consumers becoming aware about the importance of nutrition for long-term health are also seeking fortified products. Manufacturers innovating with clean-label and plant-based options are further enhancing market diversity and collectively strengthening the Australia fortified foods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.44 Billion |

| Market Forecast in 2033 | USD 9.31 Billion |

| Market Growth Rate 2025-2033 | 7.70% |

Australia Fortified Foods Market Trends:

Rising Health Consciousness and Preventive Nutrition

Australian consumers are increasingly health-aware, looking for means to avoid chronic conditions like diabetes, cardiovascular disease, and obesity through better nutrition. The benefit of fortified foods is that it is a direct method of providing necessary vitamins and minerals in common products like milk, cereals, and juices. Consumers are particularly attracted to items that benefit their immune system, energy levels, and mental health. This is supported by increasing awareness about the importance of nutrition for long-term health, particularly among old Australians and young families. The COVID-19 pandemic also contributed to this shift by intensifying the focus on disease prevention through diet. As a result, demand for convenient, nutrient-dense options continues to rise, driving both innovation and sales within the fortified foods market in Australia.

To get more information on this market, Request Sample

Government Regulations and Public Health Initiatives

Government-initiated nutrition policies are a leading factor in the strength of Australia's fortified foods industry. Compulsory fortification of wheat flour with folic acid and salt with iodine has been instrumental in reducing neural tube defects and iodine deficiency disorders. Aside from regulation, public health campaigns remind consumers of the value of healthy diets and the advantages of fortified foods. The Health Star Rating scheme also ensures transparency and facilitates communication of healthier options at point of purchase. These combined efforts not only create a supportive environment for manufacturers but also guide consumer behavior toward nutrient-enhanced food options. Regulatory stability and clear fortification guidelines give brands the confidence to invest in new products, further boosting the availability and diversity of fortified foods in the market.

Innovation in Functional Ingredients and Clean Label Demand

Innovation is a key force propelling Australia fortified foods market growth, particularly through the integration of functional ingredients like probiotics, omega-3s, and plant-based nutrients. Consumers today demand more than just nutrition—they seek transparency and simplicity, fueling the clean label trend. As a result, food manufacturers are developing fortified products free from artificial additives, preservatives, and allergens. This demand has led to creative use of natural sources, such as chia, flaxseed, and marine extracts, to deliver essential nutrients. Categories like fortified plant-based milks, snack bars, and cereals have gained popularity among health-aware consumers. Continuous product development and reformulation efforts to meet clean label expectations ensure that fortified foods remain relevant and attractive in the eyes of Australia’s discerning shoppers.

Australia Fortified Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on raw material, micronutrient, application, technology, and sales channel.

Raw Material Insights:

- Flours

- Rice Flour

- Wheat Flour

- Corn Flour

- Rice

- Salt

- Milk

- Oil

- Sugar

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes flours (rice flour, wheat flour, and corn flour), rice, salt, milk, oil, and sugar.

Micronutrient Insights:

- Vitamins

- Vitamin A

- Vitamin B

- Vitamin C

- Vitamin D

- Others

- Minerals

- Calcium

- Iron

- Zinc

- Iodine

- Others

- Other Fortifying Nutrients

A detailed breakup and analysis of the market based on the micronutrient have also been provided in the report. This includes vitamins (Vitamin A, Vitamin B, Vitamin C, Vitamin D, and others), minerals (calcium, iron, zinc, iodine, and others), and other fortifying nutrients.

Application Insights:

- Basic Food

- Cheese

- Butter

- Yogurt

- Others

- Processed Food

- Extruded Products

- Powdered Products

- Value Added Food

- Condiments

- Juice

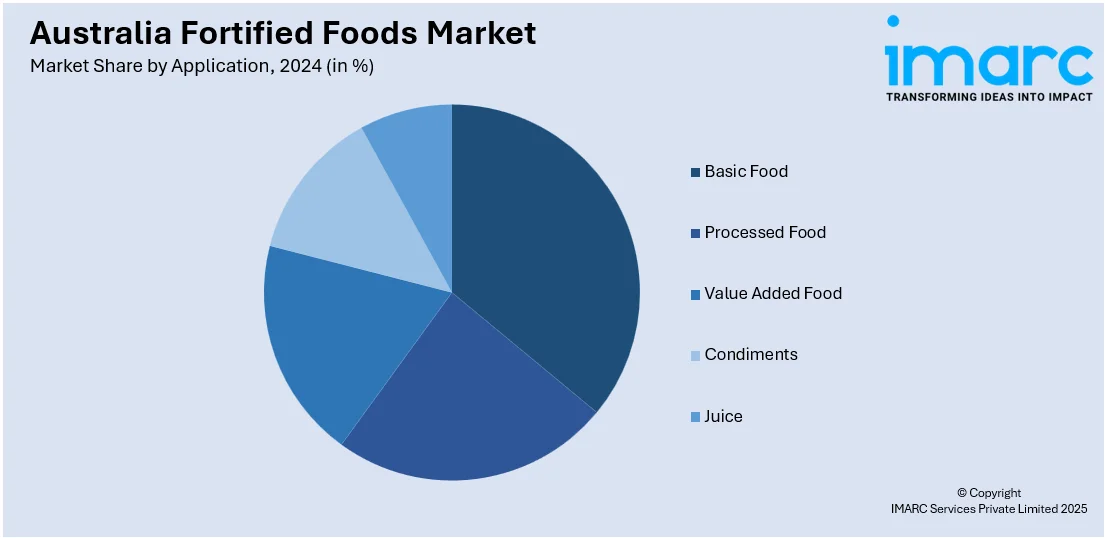

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes basic food (cheese, butter, yogurt, and others), processed food (extruded products, powdered products), value added food, condiments, and juice.

Technology Insights:

- Drying

- Oven Drying

- Drum Drying

- Spray Drying

- Extrusion

- Coating and Encapsulation

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes drying (oven drying, drum drying, and spray drying), extrusion, coating and encapsulation, and others.

Sales Channel Insights:

- Modern Trade

- Online Sales

- Neighborhood Stores

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes modern trade, online sales, neighborhood stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fortified Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered |

|

| Micronutrients Covered |

|

| Applications Covered |

|

| Technologies Covered |

|

| Sales Channels Covered | Modern Trade, Online Sales, Neighborhood Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia fortified foods market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia fortified foods market on the basis of raw material?

- What is the breakup of the Australia fortified foods market on the basis of micronutrient?

- What is the breakup of the Australia fortified foods market on the basis of application?

- What is the breakup of the Australia fortified foods market on the basis of technology?

- What is the breakup of the Australia fortified foods market on the basis of sales channel?

- What is the breakup of the Australia fortified foods market on the basis of region?

- What are the various stages in the value chain of the Australia fortified foods market?

- What are the key driving factors and challenges in the Australia fortified foods market?

- What is the structure of the Australia fortified foods market and who are the key players?

- What is the degree of competition in the Australia fortified foods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fortified foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fortified foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fortified foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)