Australia Frozen Dessert Market Size, Share, Trends and Forecast by Product Type, Category, Distribution Channel, and Region, 2025-2033

Australia Frozen Dessert Market Overview:

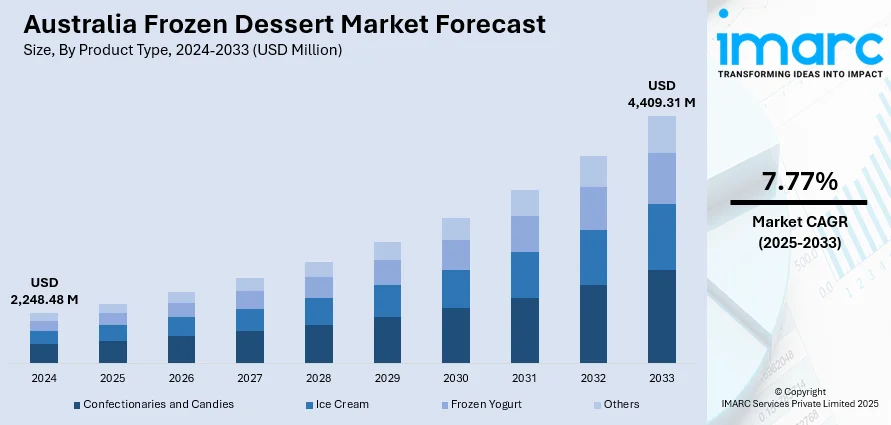

The Australia frozen dessert market size reached USD 2,248.48 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,409.31 Million by 2033, exhibiting a growth rate (CAGR) of 7.77% during 2025-2033. Consumers’ growing preference for premium and artisanal offerings made with natural, locally sourced ingredients, rising health consciousness that is driving demand for low-sugar, dairy-free, and functional options, surging disposable incomes and urbanization, and year-round consumption supported by changing lifestyles are among the primary factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,248.48 Million |

| Market Forecast in 2033 | USD 4,409.31 Million |

| Market Growth Rate 2025-2033 | 7.77% |

Australia Frozen Dessert Market Trends:

Rise of Plant-Based and Functional Frozen Desserts

Australia’s growing focus on health and sustainability is driving a surge in demand for plant-based and functional frozen desserts, combining indulgence with clean-label appeal. This trend is fueled by rising lactose intolerance, affecting nearly 44% of Australians, and a broader shift toward a flexitarian diet, with an increasing number of adults actively reducing dairy consumption for health or environmental reasons. As a result, vegan alternatives made with almond, oat, and coconut bases are gaining ground in frozen aisles. Manufacturers are enhancing these offerings with protein isolates, probiotics, and functional botanicals such as turmeric and matcha to support gut health and immunity. This fusion of dairy-alternative innovation and nutraceutical benefits is encouraging partnerships across both sectors, further propelling market expansion. Additionally, the rise of vegan-friendly product lines in hypermarkets and online grocery platforms has prompted major players like Nestlé and Unilever’s Ben & Jerry’s to develop dedicated plant-based sub-brands, while artisanal startups turn to crowdfunding to scale their operations and meet rising demand.

To get more information on this market, Request Sample

Expansion of Omnichannel and E-commerce Distribution

Changing consumer lifestyles and rapid digital adoption are reshaping frozen-dessert retailing in Australia, with year-round demand now driven by online, direct-to-consumer (D2C), and convenience channels. The e-commerce sales of ice creams and other desserts are expected to rise over the near-term, fueled by innovations like home delivery, subscription-based ‘dessert boxes,’ and click-and-collect services that appeal particularly to younger urban consumers. Impulse purchases remain a dominant force, largely driven by convenience stores and petrol-forecourt outlets. Supermarket chains are responding by installing self-checkout kiosks in frozen sections and leveraging mobile-app promotions to encourage on-the-go purchases, expanding consumption beyond the traditional summer peak. As online and D2C channels gain traction, legacy brands are adapting by collaborating with last-mile logistics startups and experimenting with refrigerated vending machines in central business district (CBD) locations, further enhancing accessibility and convenience.

Australia Frozen Dessert Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, category, distribution channel, and region.

Product Type Insights:

- Confectionaries and Candies

- Ice Cream

- Frozen Yogurt

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes confectionaries and candies, ice cream, frozen yogurt, and others.

Category Insights:

- Conventional

- Sugar-free

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes conventional and sugar-free.

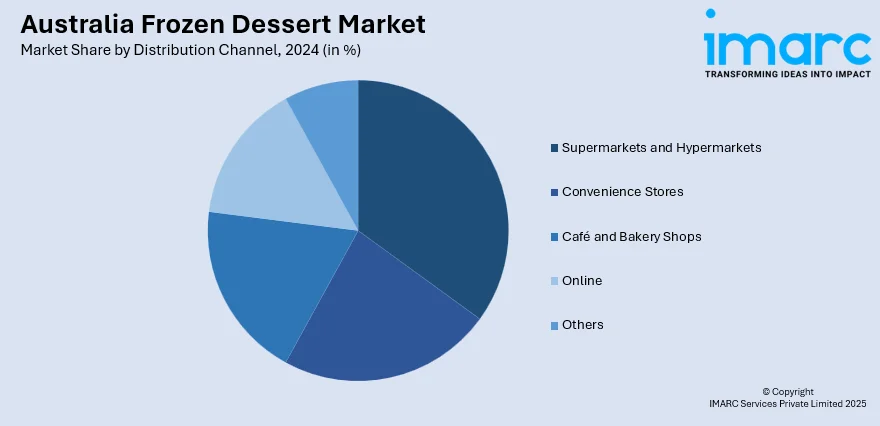

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Café and Bakery Shops

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, café and bakery shops, online, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Frozen Dessert Market News:

- February 2025: Bulla teamed up with Hershey’s to launch two new one-liter ice cream tubs in Cookies n Creme and Chocolate Mint Ripple flavors. The collaboration blends Australian ice cream expertise with a beloved American chocolate brand, expanding Bulla’s innovative frozen dessert offerings in the market.

- September 2024: Victoria-based Peters Ice Cream launched a new reduced-sugar tropical flavor under its popular Frosty Fruits line. With 50% less sugar, the new treat caters to evolving consumer preferences and targets health-conscious individuals.

Australia Frozen Dessert Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Confectionaries and Candies, Ice Cream, Frozen Yogurt, Others |

| Categories Covered | Conventional, Sugar-free |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Café and Bakery Shops, Online, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia frozen dessert market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia frozen dessert market on the basis of product type?

- What is the breakup of the Australia frozen dessert market on the basis of category?

- What is the breakup of the Australia frozen dessert market on the basis of distribution channel?

- What is the breakup of the Australia frozen dessert market on the basis of region?

- What are the various stages in the value chain of the Australia frozen dessert market?

- What are the key driving factors and challenges in the Australia frozen dessert market?

- What is the structure of the Australia frozen dessert market and who are the key players?

- What is the degree of competition in the Australia frozen dessert market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia frozen dessert market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia frozen dessert market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia frozen dessert industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)