Australia Frozen Fruits and Vegetables Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Australia Frozen Fruits and Vegetables Market Overview:

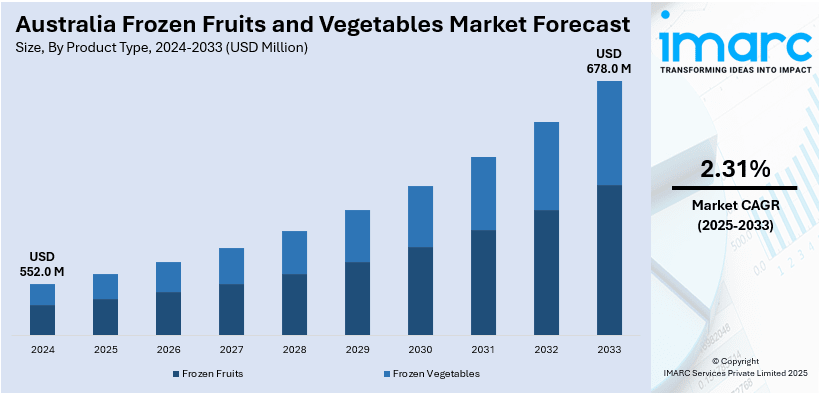

The Australia frozen fruits and vegetables market size reached USD 552.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 678.0 Million by 2033, exhibiting a growth rate (CAGR) of 2.31% during 2025-2033. The increasing consumer demand for convenient, time-saving food options; advancements in freezing technologies preserving nutritional value; expanding cold chain infrastructure; and the introduction of attractive, sustainable packaging solutions are some of the major factors fueling the market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 552.0 Million |

| Market Forecast in 2033 | USD 678.0 Million |

| Market Growth Rate 2025-2033 | 2.31% |

Australia Frozen Fruits and Vegetables Market Trends:

Changing Consumer Lifestyles and Demand for Convenience

Modern Australian consumers lead increasingly busy lives, resulting in a heightened demand for convenient, time-saving food options. Frozen fruits and vegetables cater to this need by offering pre-washed, pre-cut, and ready-to-cook products, significantly reducing meal preparation time. This convenience aligns with the growing preference for healthy eating without the extensive preparation associated with fresh produce. Additionally, frozen produce allows for portion control and reduces food waste, appealing to environmentally conscious consumers. The ability to store these products for extended periods without spoilage further enhances their attractiveness to households seeking both convenience and efficiency in meal planning. For instance, in September 2024, the Frozen foods brand Frosty Fruits introduced a lower-sugar variant of its top-selling flavor. The new Frosty Fruits Tropical has 50% less sugar, is crafted from actual fruit juice, and includes no artificial sweeteners, colors, or flavors. Andrea Hamori, marketing head at Peters Ice Cream, producer of Frosty Fruits, stated that the new product is designed for the increasing number of Australians aware of their sugar consumption yet still desiring a frozen dessert.

To get more information on this market, Request Sample

Expansion of Cold Chain Infrastructure

The development and enhancement of cold chain logistics have been pivotal in supporting the frozen fruits and vegetables market. Efficient refrigeration and transportation systems ensure that products remain frozen throughout the supply chain, preserving their quality from processing facilities to retail outlets. This infrastructure expansion has facilitated wider distribution, including to remote and rural areas, thereby creating a positive impact on the Australia frozen fruits and vegetables market outlook. The reliability of cold chain systems also minimizes spoilage and loss, contributing to cost-effectiveness for both suppliers and consumers.

Technological Advancements in Freezing and Packaging

Innovations in freezing technologies, such as flash freezing, have revolutionized the preservation of fruits and vegetables. These advancements ensure that the nutritional content, texture, and flavor of produce are maintained, making frozen options comparable to their fresh counterparts. Improved packaging solutions have also played a crucial role by extending shelf life and enhancing product appeal through sustainable and user-friendly designs. Such technological progress has bolstered consumer confidence in the quality of frozen produce, thereby driving the Australia frozen fruits and vegetables market growth.

Australia Frozen Fruits and Vegetables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, and distribution channel.

Product Type Insights:

- Frozen Fruits

- Frozen Vegetables

The report has provided a detailed breakup and analysis of the market based on the product type. This includes frozen fruits and frozen vegetables.

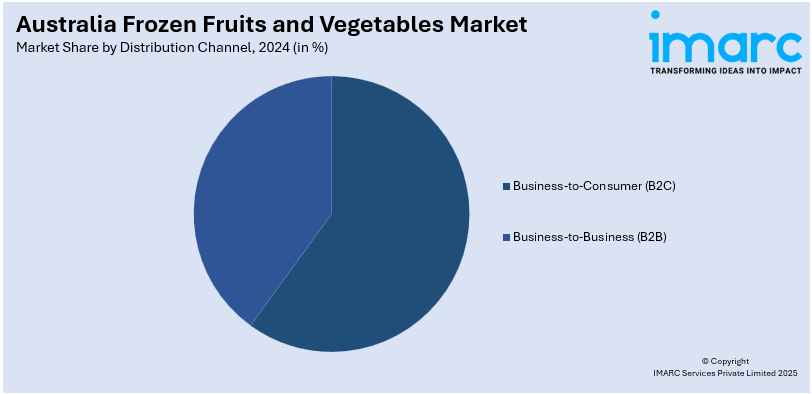

Distribution Channel Insights:

- Business-to-Consumer (B2C)

- Supermarkets/Hypermarkets

- Independent Retailers

- Convenience Stores

- Online

- Others

- Business-to-Business (B2B)

A detailed breakup and analysis of the market based on distribution channel have also been provided in the report. This includes business-to-consumer (B2C) (supermarkets/hypermarkets, independent retailers, convenience stores, online, and others) and business-to-business (B2B).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Frozen Fruits and Vegetables Market News:

- In January 2025, HyFun Foods, a prominent exporter of frozen potato items from India, collaborated with Woolworths, the largest retail chain in Australia. This partnership, worth more than Rs 25 crore ($2.91 million) for 2025, brings HyFun’s high-quality frozen potatoes to more than 1,000 Woolworths outlets throughout Australia. HyFun seeks to secure a double-digit market share within Australia’s frozen potato sector, which has an annual consumption of about 450,000 metric tons.

Australia Frozen Fruits and Vegetables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Frozen Fruits, Frozen Vegetables |

| Distribution Channels Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia frozen fruits and vegetables market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia frozen fruits and vegetables market on the basis of product type?

- What is the breakup of the Australia frozen fruits and vegetables market on the basis of distribution channel?

- What is the breakup of the Australia frozen fruits and vegetables market on the basis of region?

- What are the various stages in the value chain of the Australia frozen fruits and vegetables market?

- What are the key driving factors and challenges in the Australia frozen fruits and vegetables market?

- What is the structure of the Australia frozen fruits and vegetables market and who are the key players?

- What is the degree of competition in the Australia frozen fruits and vegetables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia frozen fruits and vegetables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia frozen fruits and vegetables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia frozen fruits and vegetables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)