Australia Fruit Juice Market Size, Share, Trends and Forecast by Product Type, Flavor, Distribution Channel, and Region, 2026-2034

Australia Fruit Juice Market Size and Share:

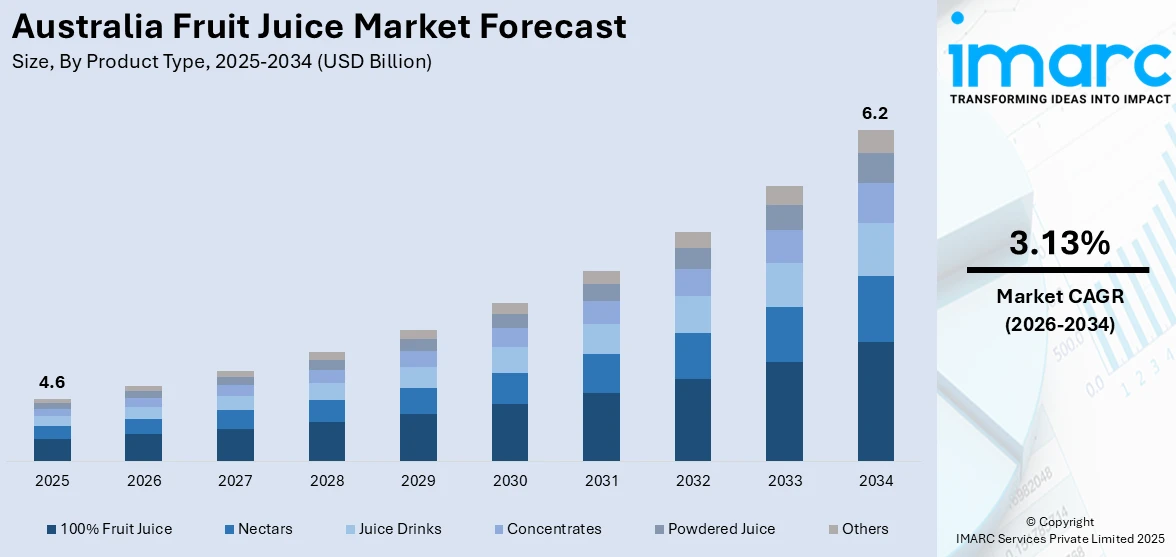

The Australia fruit juice market size reached USD 4.6 Billion in 2025. Looking forward, the market is projected to reach USD 6.2 Billion by 2034, exhibiting a growth rate (CAGR) of 3.13% during 2026-2034. Australia’s market is shaped by rising health awareness, a preference for natural ingredients, and a growing demand for functional beverages. The shift toward reduced-sugar options and premium cold-pressed juices is encouraging producers to focus on innovation and clean-label products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.6 Billion |

| Market Forecast in 2034 | USD 6.2 Billion |

| Market Growth Rate 2026-2034 | 3.13% |

Key Trends of Australia Fruit Juice Market:

Health-Conscious Choices Drive Sales

Australian consumers increasingly prefer healthier juices and have taken a considerable stake in the fruit juice market. This is mainly because of a growing health consciousness against added sugars and a demand for drinks with added functionality beyond just hydration. Moreover, consumers are paying closer attention to labels, checking for genuine fruit juices, no added sugar, and functional nutrients such as vitamins, antioxidants, or probiotics. This trend has led manufacturers to re-formulate products or launch new lines emphasizing health attributes. At the mid and lower end of the market, brands are launching vegetable-blended juices and low-calorie versions to address these demands. Retailers also are getting behind this trend by providing shelf space for organic, no-added-sugar, and fortified juices. In addition, local farmers are also paying attention to providing farm-fresh choices with little processing. As more Australians drop out of carbonated drinks and sugary sodas, the fruit juice market with a health-focused positioning is taking a bigger slice. These trends are affecting not only product development but also how products are marketed. With this trend ongoing, innovation in manufacturing methods and ingredients is likely to open up bigger market opportunities.

To get more information on this market Request Sample

Premiumization and Product Innovation

Australia's fruit juice market is witnessing an evident shift towards premium and innovative products. Consumers are paying a premium for products that guarantee higher quality, fresher flavor, and value-added. This trend is especially evident among the youth who perceive premium juices as a lifestyle related to wellness. Cold-pressed and raw juices, usually sold in refrigerated parts of supermarkets or specialty shops, are increasing in popularity because they are seen as fresh and healthy. Toward the end of this trend, exotic fruits, superfoods, and innovative combinations have become popular. Brands are introducing seasonal offerings, limited-time combinations, and functional juices that enhance immunity, energy, or digestion. These features allow brands to stand out in a crowded category. Packaging has also changed, with green bottles and streamlined presentations attracting environmentally sensitive consumers. Direct-to-consumer channels are being increasingly utilized for distributing such specialist products. There is a quest for transparency by consumers, and products that emphasize sourcing, production practices, and manufacturing are gaining preference. Therefore, manufacturers are investing in clean-label claims as well as traceability attributes for establishing trust as well as differentiating.

Sustainability and Local Sourcing

Sustainability is now one of the key drivers in the Australia fruit juice market, as consumers increasingly focus on green practices. More consumers are becoming aware of locally available ingredients, as Australians are more willing to invest in local agriculture and minimize their carbon footprint. This trend is driving consumers towards juices with Australian-grown fruits, emphasizing freshness and sustainability. Moreover, packaging is important as consumers prefer products that incorporate recyclable or biodegradable packaging to reduce their impact on the environment. As consumers become increasingly interested in more ethical and environmentally friendly products, juice companies are responding by implementing sustainable sourcing methodologies and green-packaging initiatives. This transformation toward sustainability is redefining the market, as it aligns with consumers' overall interest in products with a positive environmental impact. Australia fruit juice market analysis illustrates that this trend will persist and influence the market trends in the future years.

Growth Drivers of Australia Fruit Juice Market:

Rise in Convenient On-the-Go Products

The market for ready-to-drink (RTD) fruit juices in Australia has experienced tremendous growth with the rising number of consumers adopting fast-paced, on-the-go lifestyles. As the day gets busier, people look for easy and handy beverage solutions that can be easily consumed and digested without scarifying nutrients. RTD fruit juices fulfil this demand, providing a healthy and refreshing alternative to sugary sodas or other drinks. Moreover, the ease of single-serve packaging makes these products perfect for office goers, fitness enthusiasts, and commuters. With consumer preference focusing on products that cater to their busy lifestyles, the Australia fruit juice market demand is likely to keep growing for easy-to-use, ready-to-drink juice products.

E-commerce Growth

E-commerce growth has tremendously altered the Australian fruit juice industry by opening up products to more people. As the online shopping platforms keep growing, consumers can now comfortably order fruit juices from their homes without going through the conventional retail systems. The trend has specially favored niche and premium brands that may not have extensive physical retail networks. E-commerce also provides home delivery convenience to customers, enabling them to buy in bulk or have regular shipments of juice delivered to their homes. Mobile shopping apps have become increasingly popular, giving shoppers more flexibility to buy their preferred juices at any time. The growth of e-commerce in the Australian marketplace has therefore promoted consumer convenience and increased market coverage for fruit juice companies.

Growing Demand for Functional Beverages

The demand for functional beverages, particularly fruit juices offering added health benefits, is rapidly growing in Australia. Consumers are increasingly seeking juices that provide more than just hydration, opting for products that support detoxification, boost immunity, and promote digestive health. Ingredients like ginger, turmeric, probiotics, and antioxidants are being integrated into fruit juices to meet these wellness needs. This shift toward health-focused beverages is reshaping the Australian fruit juice market, as more brands innovate to provide functional products that align with consumers’ health-conscious lifestyles. As the demand for such specialized products rises, it is contributing significantly to the Australia fruit juice market share, with functional juices capturing a larger portion of the overall market due to their appeal to health-focused consumers.

Australia Fruit Juice Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, flavor, and distribution channel.

Product Type Insights:

- 100% Fruit Juice

- Nectars

- Juice Drinks

- Concentrates

- Powdered Juice

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes 100% fruit juice, nectars, juice drinks, concentrates, powdered juice, and others.

Flavor Insights:

- Orange

- Apple

- Mango

- Mixed Fruit

- Others

A detailed breakup and analysis of the market based on the flavor have also been provided in the report. This includes orange, apple, mango, mixed fruit, and others.

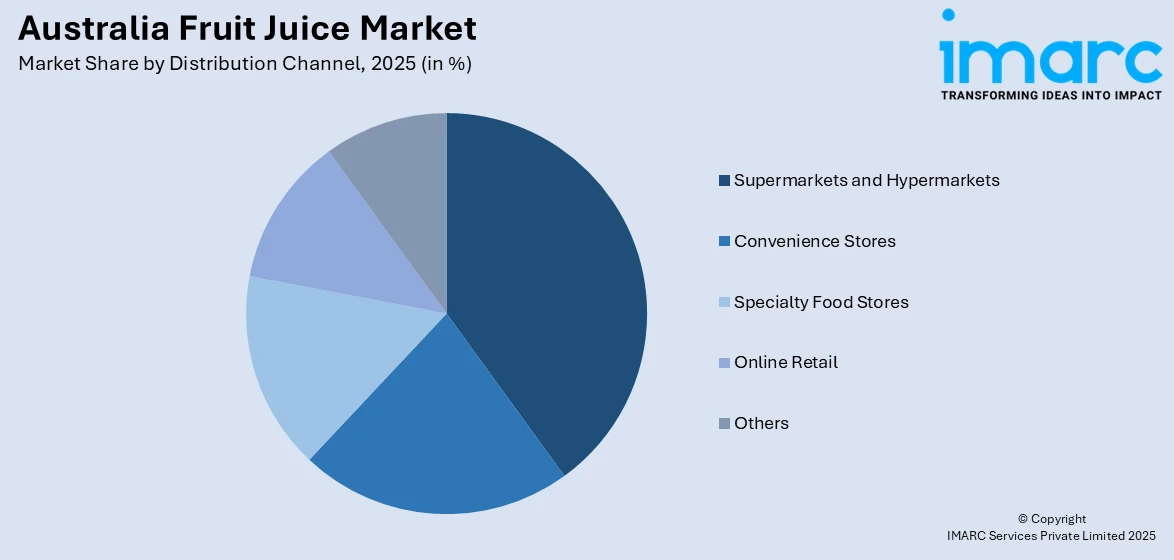

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Retail

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty food stores, online retail, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fruit Juice Market News:

- October 2024: Original Juice Company announced a merger with SPC and Nature One Dairy. This strategic move aimed to strengthen domestic manufacturing and expand fruit juice production. It positively impacted Australia’s fruit juice industry by boosting local processing capacity and ensuring long-term industry stability.

- September 2024: Bickford’s launched its Peach & Strawberry Premium Juice to mark its 150th anniversary. Enriched with Vitamin C, fiber, and calcium, the new flavor expanded its premium range. This launch boosted product diversity and reinforced innovation in Australia’s fruit juice segment.

Australia Fruit Juice Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | 100% Fruit Juice, Nectars, Juice Drinks, Concentrates, Powdered Juice, Others |

| Flavors Covered | Orange, Apple, Mango, Mixed Fruit, Others |

| Distribution Channels Covered | Supermarkets, Hypermarkets, Convenience Stores, Specialty Food Stores, Online Retail, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fruit juice market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fruit juice market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fruit juice industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fruit juice market in the Australia was valued at USD 4.6 Billion in 2025.

The Australia fruit juice market is projected to exhibit a compound annual growth rate (CAGR) of 3.13% during 2026-2034.

The Australia fruit juice market is expected to reach a value of USD 6.2 Billion by 2034.

Growth drivers in the Australia fruit juice market include increasing consumer awareness about health and wellness, leading to a preference for natural, sugar-free juices. The rise of e-commerce platforms, along with the demand for on-the-go beverages, further boosts the market. Sustainability and local sourcing are also key factors driving growth.

Key trends in the Australia fruit juice market are driven by health-conscious choices, with consumers seeking juices that offer added nutritional benefits like probiotics and vitamins. There is also a rise in premium, cold-pressed products, along with growing demand for locally sourced, eco-friendly packaging and convenient, ready-to-drink options.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)