Australia Functional Food for Elderly Market Size, Share, Trends and Forecast by Product Type, Form, Health Benefit, Distribution Channel, and Region, 2025-2033

Australia Functional Food for Elderly Market Overview:

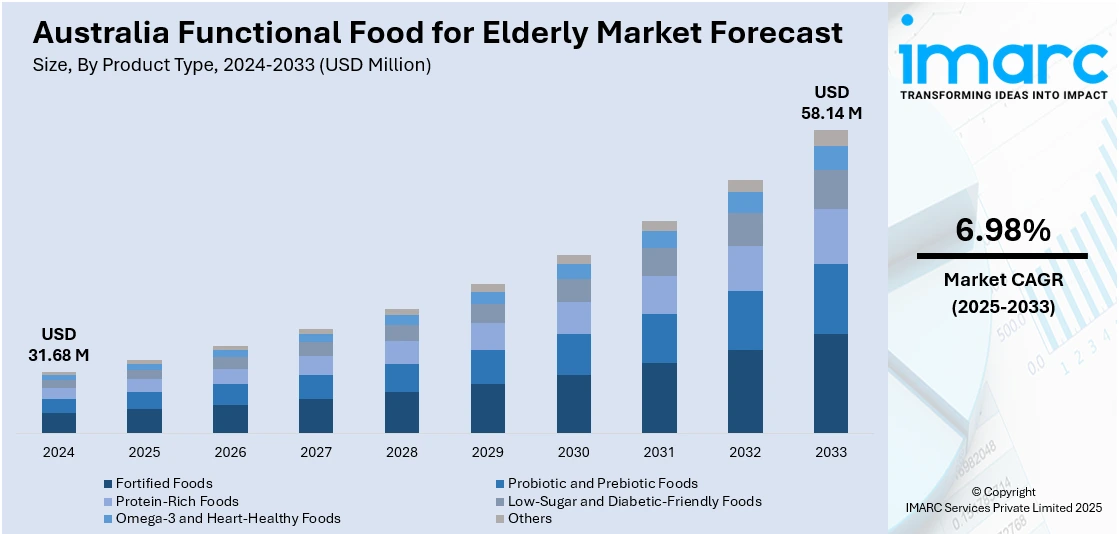

The Australia functional food for elderly market size reached USD 31.68 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 58.14 Million by 2033, exhibiting a growth rate (CAGR) of 6.98% during 2025-2033. The market is fueled by the country's aging population, rising need for chronic condition management, and overall preference for well-being. Consumers are increasingly adopting a health-conscious lifestyle and opting for food products that provide an added benefit. This is supplemented by advancements in food technology to develop functional foods fortified with bioactive components such as probiotics, omega-3 fatty acids, and antioxidants. Increased occurrence of chronic diseases in older adults is also propelling a shift toward preventive care, which is further fueling the Australia functional food for elderly market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 31.68 Million |

| Market Forecast in 2033 | USD 58.14 Million |

| Market Growth Rate 2025-2033 | 6.98% |

Australia Functional Food for Elderly Market Trends:

Personalized Nutrition and Customized Functional Foods

With Australia's aging population, there is an increasing trend toward individualized nutrition in functional foods. According to the IMARC Group, the Australia functional food market size reached USD 6.6 Billion in 2024, and is further expected to reach USD 10.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. Technological innovation, including artificial intelligence and data analysis, facilitates the creation of bespoke dietary solutions driven by consumer health profiles, genetic makeup, and lifestyles. The trend favors more precise and efficient nutritional intervention, targeting such specific issues as cognitive impairment, joint health, and gastrointestinal function. By providing products that address the specific needs of older adults, manufacturers can maximize the effectiveness of functional foods and ensure overall improved health and well-being for the elderly. This market approach responds to the increasing demand for personalized care and represents a larger trend toward precision nutrition and medicine in the aging population.

To get more information on this market, Request Sample

Focus on Gut and Immune Health

There is a rising awareness in Australia about gut and immune health's significance, especially among older adults. Studies show that good gut microbiome and healthy immune system play significant roles in overall health as an individual ages. Functional foods that are enriched with prebiotics, probiotics, and immune-boosting minerals are becoming increasingly popular among seniors looking to maximize their longevity and health. These foods are formulated to aid digestive health, promote nutrient utilization, and strengthen the body's defensive processes against infections and illness. The growing emphasis on gut and immune health indicates a comprehensive approach to aging, whereby nutrition is used to preserve vigor and ward off age-associated illness, which further contributes to the Australia functional food for the elderly market growth.

Convenience and Easy-to-Consume Functional Foods

As people grow older, most Australians encounter issues such as poor appetite, chewing difficulties, and swallowing problems. To cover this need, there is an upsurge in demand for easy-to-consume and convenient functional foods. Ready-to-drink shakes, dissolvable powders, and nutrient-dense snacks are some of the products that offer full nutritional support without heavy preparation or effort needed from the consumer. These new products address the individual requirements of older adults to provide them with proper nutrition despite their physical constraints. The focus on ease is an extension of the general movement towards effortless healthy consumption, which becomes simpler and more convenient for seniors. Focusing on ease of intake, companies are increasing the attractiveness and usability of functional foods for the elderly.

Australia Functional Food for Elderly Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, form, health benefit, and distribution channel.

Product Type Insights:

- Fortified Foods

- Probiotic and Prebiotic Foods

- Protein-Rich Foods

- Low-Sugar and Diabetic-Friendly Foods

- Omega-3 and Heart-Healthy Foods

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fortified foods, probiotic and prebiotic foods, protein-rich foods, low-sugar and diabetic-friendly foods, omega-3 and heart-healthy foods, and others.

Form Insights:

- Solid Foods

- Liquid Foods

- Powders and Supplements

A detailed breakup and analysis of the market based on the form has also been provided in the report. This includes solid foods, liquid foods, and powders and supplements.

Health Benefit Insights:

- Bone and Joint Health

- Digestive Health

- Cardiovascular Health

- Immune Support

- Cognitive Health

- Others

A detailed breakup and analysis of the market based on the health benefit has also been provided in the report. This includes bone and joint health, digestive health, cardiovascular health, immune support, cognitive health, and others.

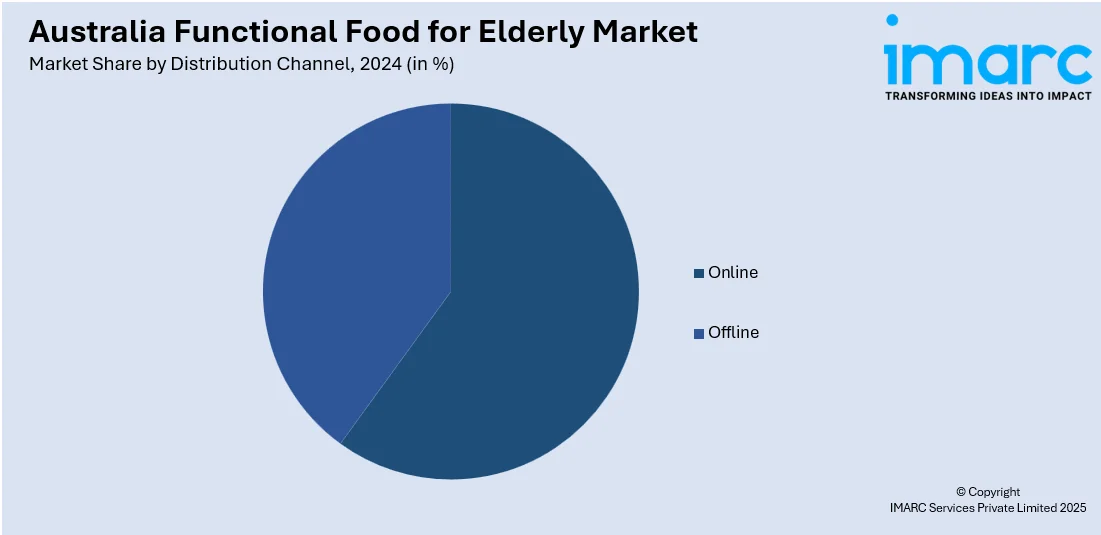

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Functional Food for Elderly Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fortified Foods, Probiotic and Prebiotic Foods, Protein-Rich Foods, Low-Sugar and Diabetic-Friendly Foods, Omega-3 and Heart-Healthy Foods, Others |

| Forms Covered | Solid Foods, Liquid Foods, Powders and Supplements |

| Health Benefits Covered | Bone and Joint Health, Digestive Health, Cardiovascular Health, Immune Support, Cognitive Health, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia functional food for elderly market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia functional food for elderly market on the basis of product type?

- What is the breakup of the Australia functional food for elderly market on the basis of form?

- What is the breakup of the Australia functional food for elderly market on the basis of health benefit?

- What is the breakup of the Australia functional food for elderly market on the basis of distribution channel?

- What is the breakup of the Australia functional food for elderly market on the basis of region?

- What are the various stages in the value chain of the Australia functional food for elderly market?

- What are the key driving factors and challenges in the Australia functional food for elderly market?

- What is the structure of the Australia functional food for elderly market and who are the key players?

- What is the degree of competition in the Australia functional food for elderly market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia functional food for elderly market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia functional food for elderly market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia functional food for elderly industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)