Australia Functional Food Market Size, Share, Trends and Forecast by Product Type, Ingredient, Distribution Channel, Application, and Region, 2025-2033

Australia Functional Food Market Overview:

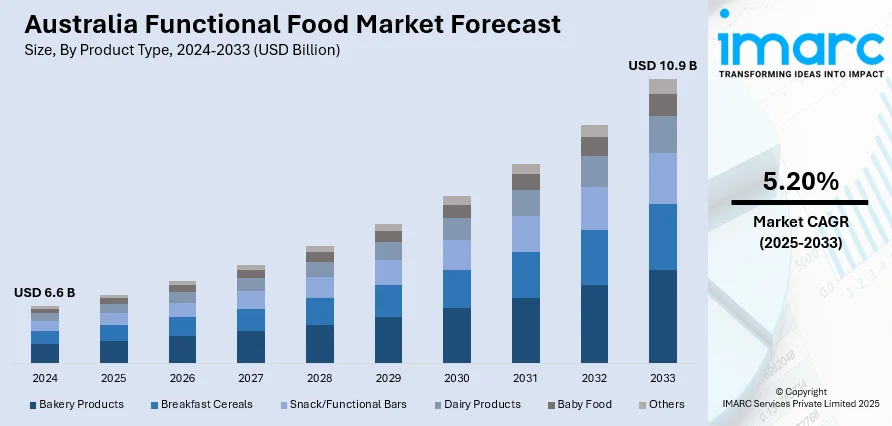

The Australia functional food market size reached USD 6.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is driven by the growing health awareness, rising demand for plant-based and clean-label products, and increasing preference for personalized nutrition. Government initiatives promoting preventive healthcare and the expansion of e-commerce further accelerate growth in this sector. Additionally, lifestyle-related health issues, digital health advancements, and sustainability concerns are expanding the Australia functional food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.6 Billion |

| Market Forecast in 2033 | USD 10.9 Billion |

| Market Growth Rate 2025-2033 | 5.20% |

Australia Functional Food Market Trends:

Rising Demand for Plant-Based Functional Foods

The market is experiencing a rise in demand for plant-based products, driven by increasing health consciousness and environmental concerns. Consumers are actively seeking functional foods that combine nutritional benefits with sustainable sourcing, such as protein-fortified plant milks, probiotic-rich fermented foods, and superfood snacks. Brands are responding by innovating with ingredients including pea protein, quinoa, and hemp, catering to vegan, vegetarian, and flexitarian diets. Additionally, the growing prevalence of lactose intolerance and dairy allergies is accelerating this shift. Market research indicates that over 30% of Australians are reducing animal-based product consumption, further fueling growth in plant-based functional foods. Australia's plant-based meat sector has grown, with sales rising 47% between 2020 and 2023 and per-capita consumption increasing by 28%. The growth can be seen to be driven by the rise in popularity of veganism and increased demand in the food service industry. Beyond substituting in customers' minds for classic products such as burgers, the wholesale market has grown 59% in the past year. With increasing price equivalence (local products are currently USD 3.72 per kilogram cheaper than imports), the sector is well-positioned for wider integration into Australian food service menus. Companies are also leveraging clean-label trends, emphasizing natural, non-GMO, and organic certifications to attract health-conscious buyers. As plant-based diets gain mainstream acceptance, this segment is expanding significantly, favoring the Australia functional food market growth.

To get more information on this market, Request Sample

Personalized Nutrition and Digital Health Integration

Another key trend in the market is the rise of personalized nutrition, supported by advancements in digital health technologies. Consumers are increasingly turning to tailored functional foods that address specific health needs, such as gut health, immunity, or energy enhancement. Companies are utilizing AI-driven platforms, DNA testing, and wearable health data to develop customized supplements and fortified foods. For instance, probiotic blends targeting individual microbiome profiles and protein bars with personalized macronutrient ratios are gaining traction. Besides this, the integration of telehealth and nutrition apps further enhances accessibility, allowing consumers to receive real-time dietary recommendations. Recently, Australia's digital health industry has grown, delivering 118.2 million telehealth services to 18 million patients. This expansion has allowed greater access to health care via applications, electronic prescriptions, and My Health Record services. This trend aligns with Australia’s growing focus on preventive healthcare, with numerous consumers willing to pay a premium for personalized functional foods. Industry leaders predict that digital health collaborations will drive innovation, creating a positive Australia functional food market outlook.

Australia Functional Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, ingredient, distribution channel , and application.

Product Type Insights:

- Bakery Products

- Breakfast Cereals

- Snack/Functional Bars

- Dairy Products

- Baby Food

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes bakery products, breakfast cereals, snack/functional bars, dairy products, baby food, and others.

Ingredient Insights:

- Probiotics

- Minerals

- Proteins and Amino Acids

- Prebiotics and Dietary Fiber

- Vitamins

- Others

A detailed breakup and analysis of the market based on the ingredient have also been provided in the report. This includes probiotics, minerals, proteins and amino acids, prebiotics and dietary fiber, vitamins, and others.

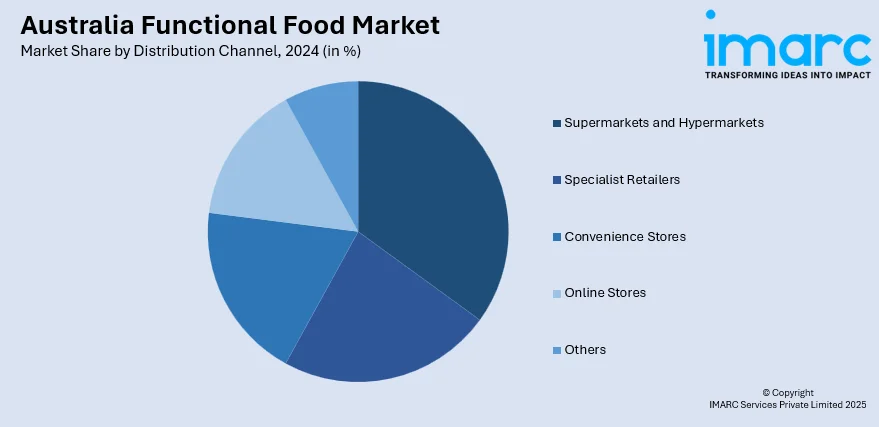

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialist Retailers

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialist retailers, convenience stores, online stores, and others.

Application Insights:

- Sports Nutrition

- Weight Management

- Clinical Nutrition

- Cardio Health

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes sports nutrition, weight management, clinical nutrition, cardio health, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Functional Food Market News:

- November 8, 2024: Fulfill launched its vitamin and protein bars in Australia, selling only at Woolworths for $ 6 each. Each low-sugar bar is fortified with nine extra vitamins and comes in flavors such as Chocolate Hazelnut Whip and Salted Caramel. This program is in keeping with Australia's growing functional food market, giving consumers a practical and tasty means to obtain their daily nutritional supplement.

- October 01, 2024: Kinoko-Tech partnered with Metaphor Foods to launch mycelium-based functional foods by 2025 in Australia. This product line includes high-in-protein sausages, muesli bars, and chips made of food waste. The project hopes to drive annual production from 24 to over 700 tonnes, offering a fungi-based portfolio of zero-waste, clean-label, high-fibre products targeting health-conscious eaters in Australia. This undertaking addresses the increasing demand for a range of sustainable and nutritious meat freedom innovations in the functional food market across the country.

Australia Functional Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Bakery Products, Breakfast Cereals, Snack/Functional Bars, Dairy Products, Baby Food, Others |

| Ingredients Covered | Probiotics, Minerals, Proteins and Amino Acids, Prebiotics and Dietary Fiber, Vitamins, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialist Retailers, Convenience Stores, Online Stores, Others |

| Applications Covered | Sports Nutrition, Weight Management, Clinical Nutrition, Cardio Health, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia functional food market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia functional food market on the basis of product type?

- What is the breakup of the Australia functional food market on the basis of ingredient?

- What is the breakup of the Australia functional food market on the basis of distribution channel?

- What is the breakup of the Australia functional food market on the basis of application?

- What is the breakup of the Australia functional food market on the basis of region?

- What are the various stages in the value chain of the Australia functional food market?

- What are the key driving factors and challenges in the Australia functional food market?

- What is the structure of the Australia functional food market and who are the key players?

- What is the degree of competition in the Australia functional food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia functional food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia functional food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia functional food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)